What is the Risk-Reward Ratio (RRR)

The Risk-Reward Ratio (RRR) is a core trading concept that helps to weigh potential profits against potential losses. This ratio is a crucial part of risk management, guiding traders on whether a trade is worth taking based on its potential reward relative to its risk. Analyzing trades through the RRR enables traders to set clear targets, control risk exposure, and make more calculated trading decisions.

What is the Risk-Reward Ratio (RRR)?

The Risk-Reward Ratio (RRR) measures the proportional relationship between the profit expected from a trade and the amount at risk if the trade loses.

It allows traders to set realistic profit targets, define stop-loss levels and is essential in implementing risk management.

Understanding Reward

In trading, a reward represents the expected profit from an investment. This potential gain motivates traders to pursue trades, but rewards are only one part of the equation. The reward is calculated based on target prices or potential profit traders aim to achieve.

Evaluating rewards involves technical analysis, such as exit indicators, and understanding market factors to identify realistic profit targets.

Understanding Risk

Risk in trading is the chance that a trade may not achieve the expected outcome: when the price moves in the other direction and results in a financial loss. This potential loss, also called a “drawdown", can be substantial, especially in volatile markets with frequent price swings. Risks can include factors from market dynamics to liquidity and leverage. For effective risk management, traders need to identify sources of risk and implement strategies to limit exposure.

Risk calculation in Forex trading can involve a variety of metrics, from the probability of potential outcomes to the magnitude of loss. In Forex, calculating risk often focuses on the maximum potential loss a trade could incur, factoring in leverage and margin requirements.

For example, if a trader places a leveraged trade with a maximum loss level (stop-loss) at a specific price, the risk is the difference between the entry and stop-loss prices.

Example of RRR Calculation

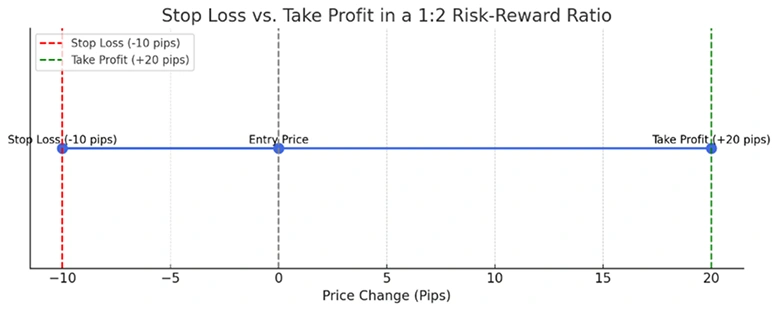

The following chart illustrates the stop loss versus take profit strategy with a one-to-two (1:2) RRR setup. The maximum risk is at -10 pips, while the maximum reward is at +20 pips.

To calculate the RRR, follow the following simple steps:

1) Determine the Risk: Find the difference between the entry price and the stop-loss level.

2) Determine the Reward: Calculate the difference between the target and entry prices.

3) Calculate the Ratio: Divide the reward by the risk to find the RRR.

Example Calculation:

Entry Price: 1.2000

Target Price: 1.2200 (Reward of 200 pips)

Stop-Loss Price: 1.1900 (Risk of 100 pips)

In this example, the RRR is 200 pips (reward) / 100 pips (risk) = 2:1. The trader aims to make $2 for every $1 risk.

How Are Risk and Reward Related?

There’s a fundamental rule in trading: higher rewards often come with higher risks. This relationship is evident in asset classes, with “safe” assets like government bonds generally offering lower returns, while riskier assets like equities or alternative investments offer potentially higher gains.

Examples of Asset Classes by Risk Level:

Low Risk: Treasuries, Cash

Moderate Risk: Government Bonds, Corporate Bonds

Higher Risk: Junk Bonds, Large-Cap Equities

High Risk & Volatile: Small-Cap Equities, Alternative Investments (like commodities and cryptocurrencies)

With TMGM as your trusted broker, you can access a wide range of markets and asset types across the risk spectrum and trade the instruments you prefer.

What is Considered a Good RRR?

A good RRR is different for every trader, and depends on factors such as risk tolerance, trading style, and market conditions.

An RRR of 2:1 or higher is desirable for aggressive traders, meaning the potential profit is twice as high as the potential loss.

For more conservative traders, a lower RRR may be appropriate if the goal is to achieve incremental gains and protect the starting capital.

The RRR should be aligned with a trader’s overall strategy. It is often beneficial to aim for consistent ratios that suit the trader’s style and goals. Regardless of the ratio chosen, maintaining discipline and sticking to a predetermined RRR helps traders manage their risk.

When to Use the RRR While Trading?

Set Specific RRR Targets: Before each trade, define an RRR based on personal preferences and market conditions. Setting targets makes it easier to assess whether a trade aligns with risk management goals.

Analyze Trades Based on the RRR: Assess whether the RRR makes the trade worthwhile. Even high-probability trades with poor RRRs may not be suitable if the potential reward does not justify the risk.

Understand RRR Limitations: While RRR is a valuable tool, it doesn’t account for probability or win rates. Traders should combine RRR with win/loss analysis, technical analysis, and other research to fully understand potential outcomes.

Common Sources of Risk in Forex Trading

While the drawdown potential and risk are quantifiable, many sources of risk might not be priced in. As such, being aware of these potential sources of risk is essential to a successful trading strategy. Examples of common sources of risk in Forex trading include, but are not limited to, the following:

Market Risk

Liquidity Risk

Leverage Risk

Currency (Forex) Risk

Interest Rate Risk

Counterparty Risk

Behavioral Risk

Event Risk

Learn more with TMGM

Take your risk management skills to the next level with TMGM’s extensive educational resources, including trading guides, market research, and expert insights. Discover the broad range of markets available to trade, and learn more about Contracts For Difference (CFDs). All are available here at TMGM.com.

Start building a resilient trading strategy alongside TMGM as your trusted partner!

Sign up now and gain access to global markets in under 3 minutes.

Trade Smarter Today

Account

Account

Instantly