Key Takeaways

CFDs are derivative instruments used to speculate on price fluctuations without owning the underlying asset, whereas stocks represent direct equity ownership, often including voting rights and dividend entitlements.

Leverage is commonly applied in CFD trading, amplifying both potential profits and losses, while stocks are generally purchased outright without leverage, requiring full payment.

Cost structures vary by product: CFDs may incur spreads, commissions, and overnight financing charges, whereas stock trading typically involves broker and exchange fees without holding costs.

The investment horizon often influences the choice: CFDs are suited for short-term trading strategies, while stocks align better with long-term investing and dividend income.

Investor protections differ: shareholders benefit from regulatory protections under exchange rules, whereas CFD trading protections depend on the broker and jurisdictional regulations, making risk management crucial.

What Are CFDs and Stocks?

CFDs (Contracts for Difference)

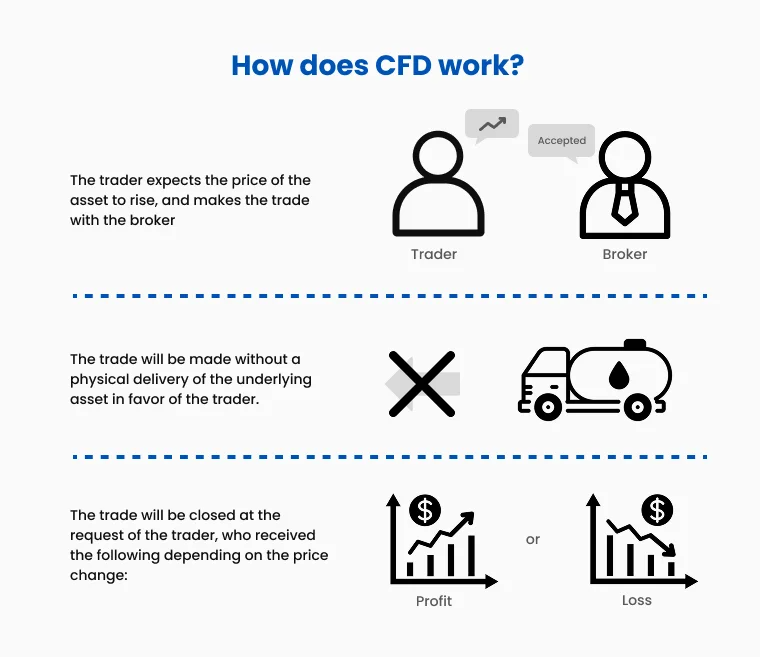

are derivative products that enable traders to speculate on price movements of various underlying assets without owning them.

They are used to trade equities, commodities, foreign exchange (forex), and indices.

Profit or loss is determined by the difference between the opening and closing prices of the CFD contract.

Stocks

represent partial ownership in a corporation, granting shareholders rights to company assets and profits.

They are traded on stock exchanges such as the NYSE, NASDAQ, and LSE.

Investors gain through capital appreciation and dividend distributions over time.

Key Similarities Between CFDs and Stocks

Market Access: Both CFDs and stocks provide exposure to equity markets, enabling speculation on corporate performance.

Price Movements: Both are influenced by earnings announcements, economic data, and geopolitical events.

Trading Platforms: Both instruments can be traded via online platforms, offering global accessibility and convenience.

Risk and Reward: Both carry inherent market risks, including volatility, but also present opportunities for profit when managed strategically.

Major Differences Between CFDs and Stocks

Ownership

CFDs: Do not confer ownership of the underlying asset; purely speculative instruments.

Stocks: Provide direct ownership, including voting rights and dividend entitlements.

Leverage

CFDs: Typically traded with leverage allowing position sizes larger than the margin deposited, amplifying gains and losses.

Stocks: Generally traded without leverage, requiring full payment of the share price upfront.

Cost Structure

CFDs: May involve spreads, overnight financing (swap) fees, and commissions.

Stocks: Typically incur broker commissions and exchange fees, with no overnight holding costs.

Time Horizon

CFDs: Best suited for short-term trading due to leveraged exposure and overnight financing costs.

Stocks: More appropriate for long-term investment strategies, benefiting from potential capital appreciation and dividend income.

| Feature | CFD Trading | Stock Trading |

|---|---|---|

| Ownership | No ownership; you speculate solely on price movements. | Direct ownership; you hold the actual shares with voting rights. |

| Leverage | High leverage available. Trade with a small margin deposit, magnifying profits and losses. | None. Requires full payment of the asset price upfront. |

| Profit Direction | Ability to trade both rising (long) and falling (short) markets easily. | Primarily profit from rising prices (unless engaging in complex short-selling strategies). |

| Costs | Spreads, commissions, and overnight financing (swap) fees. | Broker commissions and exchange fees; no overnight holding costs. |

| Best For | Short-term trading, hedging, and day trading. | Long-term investing, "buy-and-hold strategies", and dividend income. |

CFD Example vs Stock Example

To clarify the financial differences between these two approaches, let's examine a practical example comparing the same trade executed via stocks versus CFDs. This illustrates how leverage affects initial capital requirements.

Stock Example

Assume you purchase 50 shares of NVIDIA (NVDA) at $140 each, investing a total of $7,000. If the share price rises to $150, your holdings are worth $7,500, yielding a $500 profit. Conversely, if the price drops to $130, your investment value falls to $6,500, resulting in a $500 loss.

CFD Example

Instead of purchasing the shares outright, you trade a CFD on NVIDIA. With 10:1 leverage, you only need $700 margin to control a position equivalent to $7,000 in stock. A price increase to $150 still yields a $500 profit, but a drop to $130 results in a $500 loss. Since you are trading on margin, this loss represents a significantly higher percentage of your initial $700 deposit.

Risks of CFDs vs Stocks

#1 CFD Risks

Leverage can amplify losses beyond the initial margin deposit.

Overnight financing fees can erode profits on longer-term positions.

Requires continuous monitoring due to higher volatility and rapid price movements.

#2 Stock Risks

Market volatility can lead to capital losses.

Lower liquidity in smaller-cap stocks may pose trading challenges.

Long-term holdings are exposed to macroeconomic and company-specific risks.

Still unsure which instrument suits your trading style? Here is a summary of the key advantages and disadvantages of both.

Advantages and Disadvantages of CFDs

✅ Advantages

- Leverage: Control large positions with limited capital outlay.

- Short Selling: Easily profit from declining markets.

- Global Access: Trade thousands of markets including indices, cryptocurrencies, and forex from a single account.

❌ Disadvantages

- High Risk: Leverage can rapidly magnify losses.

- No Ownership: No shareholder rights or dividends.

- Overnight Fees: Swap rates can reduce long-term profitability.

Interested in learning more? Explore the comprehensive list of benefits of CFD trading in our detailed guide here

Advantages and Disadvantages of Stocks

✅ Advantages

- Ownership: Direct ownership with voting rights.

- Dividends: Receive regular income payments, beneficial for compounding returns.

- Lower Risk: Absence of leverage means losses are limited to invested capital.

❌ Disadvantages

- High Capital Requirement: Full payment of share price is required upfront.

- Limited Short Selling: Profiting from price declines is complex and less accessible.

- Restricted Trading Hours: Trading is limited to exchange operating hours.

Which Instrument Suits You?

Choose CFDs if:

You seek short-term speculative opportunities.

You want to trade on margin to optimize capital efficiency.

You’ aim to diversify across multiple asset classes such as forex or commodities.

Choose Stocks if:

You focus on long-term wealth accumulation and value investing.

You prefer the security and rights associated with direct asset ownership.

Dividend income is a significant component of your investment approach.

Final Thoughts: CFDs vs Stocks

The primary distinction between CFDs and stocks lies in their trading mechanics and the flexibility they provide. Understanding these differences enables you to align your trading strategy with your financial objectives.

While CFDs offer enhanced flexibility and access to a broad spectrum of markets, stocks deliver long-term stability and ownership benefits. Regardless of your choice, a well-informed and disciplined approach is essential.

Ready to trade?

TMGM is a leading, regulated CFD broker renowned for its ultra-fast execution and deep liquidity. With access to over 12,000 markets across Forex, Equities, Indices, and Commodities, TMGM equips traders with competitive spreads and advanced trading tools. Whether you are a scalper or day trader, our technology infrastructure is designed to provide a professional edge.

For those interested in exploring CFD trading, it is recommended to test strategies first using a TMGM demo account. Once familiar with the platform and trading mechanics, you can open a live trading account with TMGM, utilizing the TMGM Mobile App or desktop platform.