Introduction to Crypto Staking

Crypto staking has become a popular method for both cryptocurrency traders and holders to generate passive income while supporting blockchain networks. By locking their assets into the network, participants assist in transaction validation, enhance blockchain security, and receive rewards in return. This guide will cover the fundamentals of crypto staking, its operational mechanics, benefits, and associated risks. Although TMGM specializes in CFD trading, gaining an understanding of staking can provide valuable insights into the wider cryptocurrency market and support more informed trading decisions.

What is Crypto Staking?

Definition of Crypto Staking

Crypto staking is the process whereby cryptocurrency holders lock their assets to support a blockchain network and validate transactions. It is a transaction validation method employed by cryptocurrencies utilizing the proof-of-stake consensus protocol.

How Crypto Staking Works

The Crypto Staking Process Explained

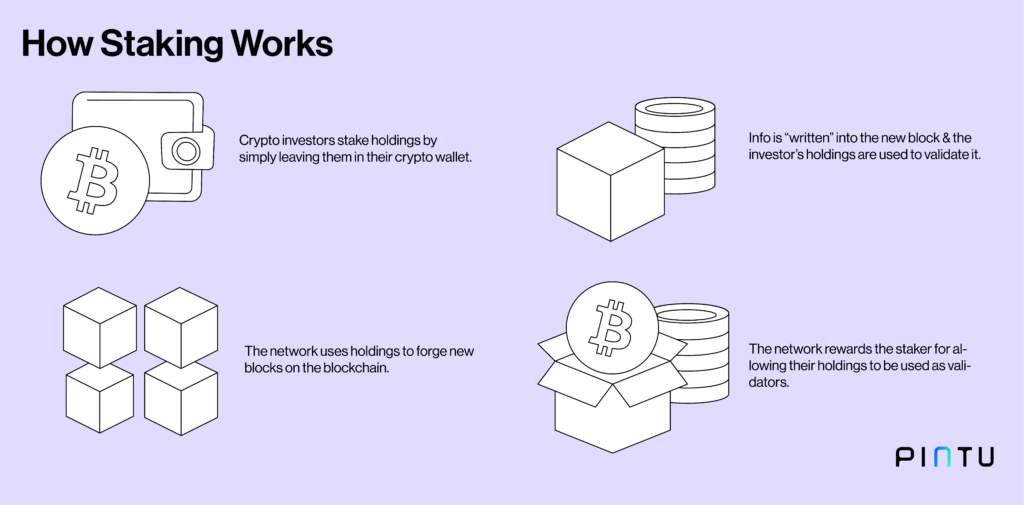

Users lock a portion of their cryptocurrency holdings in a staking wallet.

This staked amount serves as collateral to participate in transaction validation.

Validator Node Selection in Staking Networks

The network selects validators (nodes) based on the amount of cryptocurrency staked.

Typically, the larger the stake, the higher the probability of being chosen to validate transactions.

Transaction Validation in Crypto Staking

Selected validators confirm new transactions.

Upon successful validation, a new block is appended to the blockchain.

Reward Distribution in Staking Systems

Validators earn rewards in the form of additional cryptocurrency tokens.

These rewards are generally proportional to the amount staked.

TMGM Perspective: While TMGM does not provide direct staking services, understanding this mechanism can assist traders in anticipating price movements in proof-of-stake cryptocurrencies.

Proof-of-Stake vs. Proof-of-Work

Proof-of-Stake (PoS) in Crypto Staking

Utilizes staking to validate transactions

More energy-efficient consensus mechanism

Typically offers faster transaction confirmation times

Proof-of-Work (PoW) vs Crypto Staking

Relies on computational power to solve complex cryptographic puzzles

More energy-intensive process

Used by cryptocurrencies such as Bitcoin

TMGM Offering: TMGM offers CFD trading on both PoS and PoW cryptocurrencies, enabling traders to capitalize on price fluctuations regardless of the underlying consensus algorithm.

Benefits of Crypto Staking

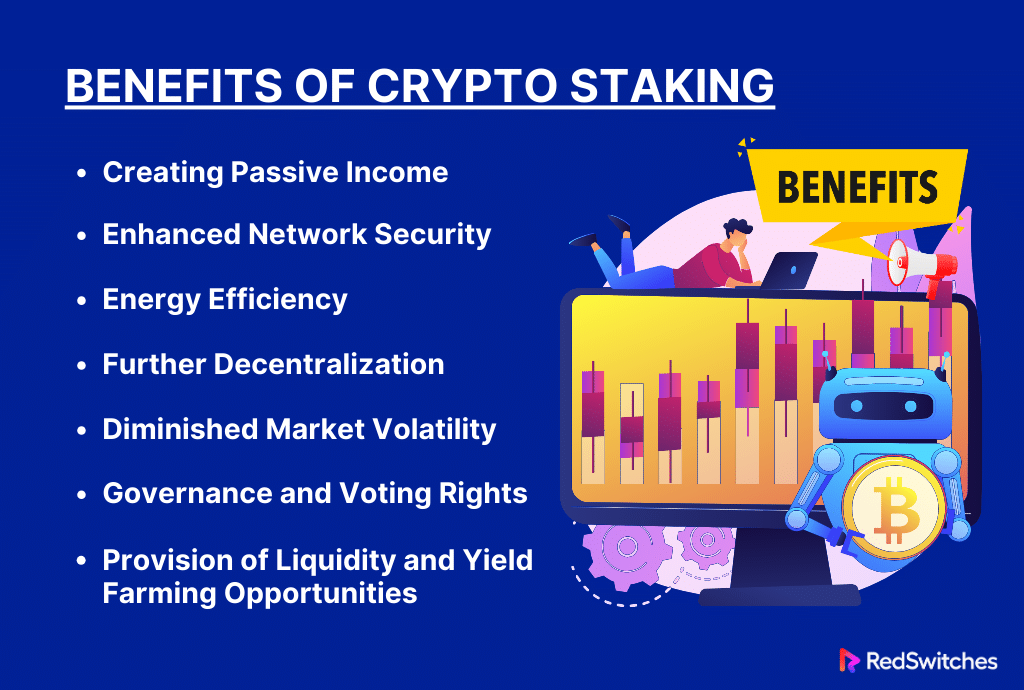

Generating Passive Income through Crypto Staking

Staking allows investors to earn passive income by locking digital assets within a blockchain network. Unlike active strategies such as day trading, staking provides rewards without the need to time the market or execute frequent trades.

How Crypto Staking Enhances Network Security

Staking is essential for securing proof-of-stake blockchains. By incentivizing validators to act honestly, the network preserves its integrity. This long-term incentive contrasts with spot trading, which targets short-term price movements and immediate asset ownership.

Energy Efficiency: Crypto Staking vs Mining

Proof-of-stake networks consume significantly less energy compared to proof-of-work mining operations.

Potential for Appreciation in Staked Assets

While assets are staked, they may still appreciate in value. Traders often assess growth potential using technical analysis tools such as Fibonacci retracement, particularly when evaluating staking-related tokens for long-term investment.

TMGM Alternative:

Although TMGM does not provide direct staking, traders can benefit from price movements of staking-related cryptocurrencies through CFD trading.

Risks and Considerations in Crypto Staking

Volatility Risk in Staking

The market value of staked assets and earned rewards can experience significant fluctuations.

Liquidity Risk in Staking Platforms

Staked assets are often locked for a fixed period, limiting liquidity.

Technical Risks in Staking Systems

There is a risk of losing staked assets due to system failures or bugs

Risk of forfeiting stake if the validator node is offline when required

Regulatory Risks in Crypto Staking

Changing regulations may affect staking platform operations or the taxation of staking rewards. Staying informed about regulatory developments is crucial to avoid unexpected impacts on earnings or compliance.

TMGM Risk Management:

When trading crypto CFDs on TMGM, utilize stop-loss orders and appropriate position sizing to mitigate risks associated with cryptocurrency volatility.

Popular Cryptocurrencies for Staking

Ethereum 2.0 and the Evolution of Crypto Staking

Transition from proof-of-work to proof-of-stake consensus.

Staking Cardano (ADA) for Passive Rewards

Built on a proof-of-stake system from inception.

Staking Polkadot (DOT) via Proof-of-Stake

Employs a nominated proof-of-stake (NPoS) mechanism.

Staking Tezos (XTZ) on Blockchain Networks

Introduced the concept of "liquid proof-of-stake".

TMGM Trading Opportunities: TMGM offers CFD trading on a range of cryptocurrencies, including those utilizing proof-of-stake protocols.

Crypto Staking vs. Other Crypto Strategies

Staking vs. Mining in Crypto Explained

Staking: Holding and "locking" coins to validate transactions

Mining: Utilizing computational power to solve cryptographic puzzles

Staking vs. Yield Farming: Key Differences

Staking: Generally simpler with typically lower returns

Yield Farming: More complex, potentially higher returns but with increased risk

Staking vs. Traditional Crypto Trading

Staking: Passive income strategy requiring minimal active management

Trading: Active approach involving market analysis and frequent decision-making

TMGM Trading: While TMGM does not offer direct staking or yield farming, it provides a robust platform for actively trading cryptocurrency CFDs.

How to Get Started with Crypto Staking

Select a Proof-of-Stake Cryptocurrency to Stake

Conduct research on various PoS cryptocurrencies and their staking requirements.

Acquire the Selected Cryptocurrency for Staking

Purchase the cryptocurrency via a reputable exchange.

Choose a Staking Method That Fits Your Needs

Options include:

Exchange-based staking

Wallet staking

Participating in a staking pool

Stake Your Cryptocurrency and Begin Earning Rewards

Follow the specific procedures for your chosen method and cryptocurrency.TMGM Alternative

: If you prefer to profit from cryptocurrency price fluctuations without engaging in staking complexities, consider trading crypto CFDs on TMGM's platform.

Future of Crypto Staking

Increasing Adoption of Crypto Staking

A growing number of cryptocurrencies are transitioning to PoS consensus mechanisms.

Rising Institutional Interest in Staking Cryptocurrencies

More institutional investors are engaging in staking activities.

Regulatory Developments Affecting Crypto Staking

Evolving regulatory frameworks may influence the staking ecosystem.TMGM Commitment

TMGM remains committed to monitoring developments in the cryptocurrency market to deliver timely trading opportunities and insights.