Key Takeaways

CFDs enable you to speculate on price fluctuations without owning the underlying asset, offering opportunities in both bullish and bearish markets.

Leverage permits control of larger positions with a small margin deposit, magnifying both potential profits and losses.

Trading costs comprise the spread or commission and, for rolling (cash) CFDs, overnight financing fees; futures CFDs generally embed higher costs within the spread and avoid daily funding charges.

A single trading platform can provide access to equities, indices, forex, commodities, cryptocurrencies, bonds, and ETFs, facilitating broad portfolio diversification.

Effective risk management is crucial—utilize position sizing, stop-loss and take-profit orders, and closely monitor leveraged positions.

Key Features of CFD Trading

Leverage and Margin Trading

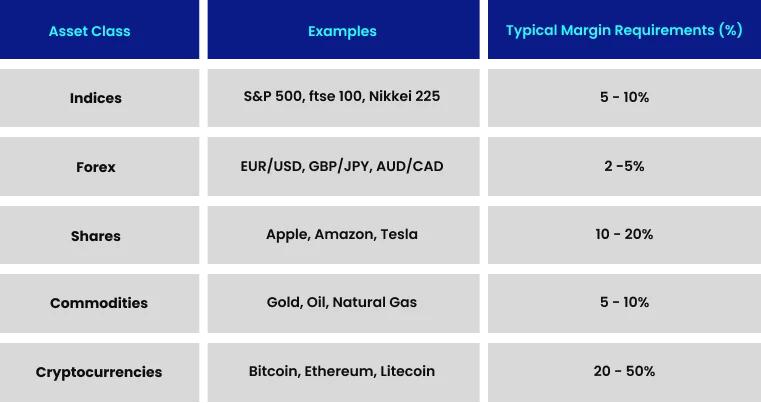

One of the most powerful features of CFD trading is leverage. This allows you to gain market exposure with only a fraction of the capital typically required:

Enhanced Market Exposure: Control larger positions with a relatively small margin deposit

Capital Efficiency: Preserve capital for diversification across multiple markets

Amplified Potential: Both gains and losses are calculated on the full position size

For example, with a 5% margin requirement on the S&P 500 index, a $1,000 margin deposit could control a $20,000 position. However, this leverage effect applies both ways—increasing potential profits and losses.

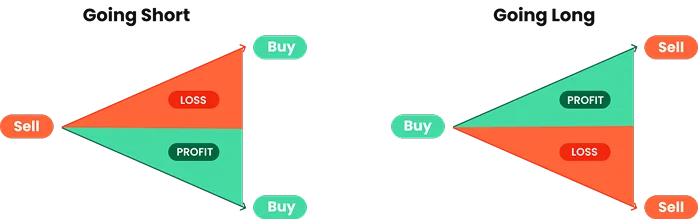

Going Long or Short

Unlike traditional investing, which primarily profits from rising markets, CFDs offer the flexibility to profit in both bullish and bearish conditions:

Long Positions (Buy): Profit from upward price movements by opening a buy position

Short Positions (Sell): Profit from downward price movements by opening a sell position

This bidirectional trading capability is particularly advantageous during market downturns or periods of economic uncertainty, where traditional buy-and-hold strategies may underperform.

Diverse Market Access

CFD trading offers access to thousands of financial markets via a single platform:

With over 18,000 markets available, traders can diversify portfolios and capitalize on opportunities across various sectors and regions.

How CFD Trading Works: A Practical Overview

Position Sizing and Contract Values

CFD positions are quantified in contracts or lots, each market having a specific contract value:

Shares CFDs: Typically, one contract represents one share

Index CFDs: Contract values are usually expressed as a currency amount per index point (e.g., $10 per point)

Forex CFDs: Standard lot sizes (standard lot = 100,000 units of base currency)

Understanding contract values is essential for calculating potential profits, losses, and position sizing according to your risk tolerance.

Profit and Loss Mechanics

CFD profit and loss calculations follow a straightforward formula:

For long positions (buy): Profit/Loss = (Closing Price - Opening Price) × Number of Contracts × Contract Value

For short positions (sell): Profit/Loss = (Opening Price - Closing Price) × Number of Contracts × Contract Value

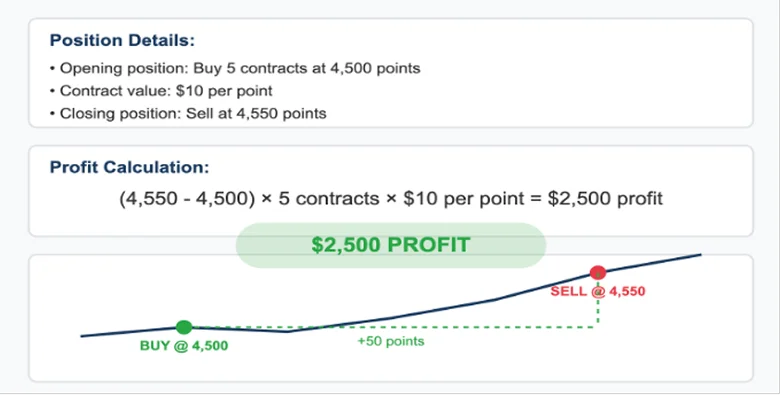

Example: Long Position on S&P 500 Index

Opening position: Buy 5 contracts at 4,500 (contract value: $10 per point)

Closing position: Sell at 4,550

Calculation: (4,550 - 4,500) × 5 × $10 = $2,500 profit

Example: Short Position on S&P 500 Index

Opening position: Sell 5 contracts at 4,500 (contract value: $10 per point)

Closing position: Buy at 4,450

Calculation: (4,500 - 4,450) × 5 × $10 = $2,500 profit

Please note these examples exclude costs such as overnight financing, spreads, or commissions.

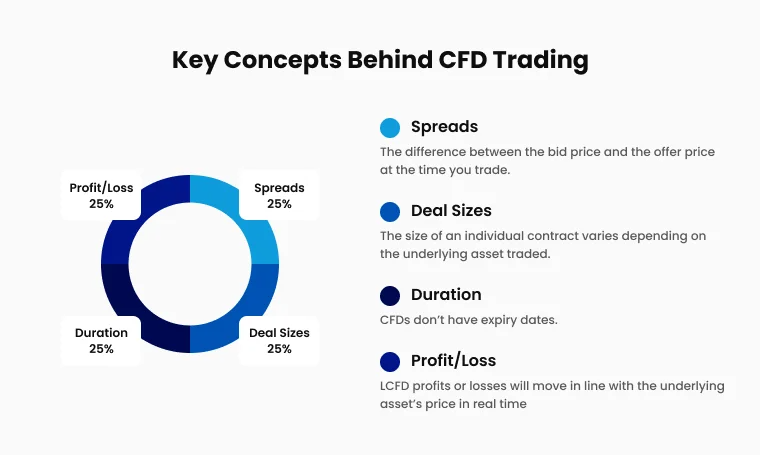

Understanding the Spread

The spread is the difference between the buy (ask) and sell (bid) prices. This represents a primary cost in CFD trading:

For most markets (indices, forex, commodities), trading costs are incorporated into the spread

For share CFDs, many brokers charge a commission instead of widening the spread

Tighter spreads are generally preferred as they reduce the price movement needed to break even on a trade.

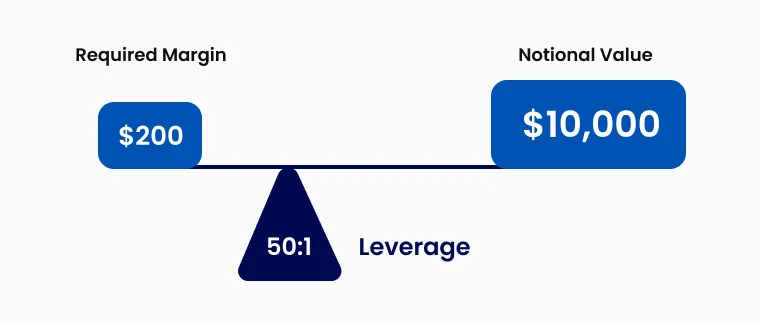

Margin and Leverage Calculations

To calculate the margin required for a position:

Margin Requirement = Position Size × Margin Percentage

For example, to open a $10,000 position with a 10% margin requirement: $10,000 × 10% = $1,000 initial margin required.

Effective leverage is calculated as: Effective Leverage = Position Size ÷ Margin Requirement.

In this example, effective leverage equals 10:1 ($10,000 ÷ $1,000).

Advanced CFD Trading Concepts

Hedging with CFDs

CFDs can be used to hedge existing investments against adverse market movements:

Portfolio Protection: If you hold a traditional equity portfolio valued at $50,000, you could open a short CFD position of equivalent value. If the market declines, profits from the CFD position can offset losses in your portfolio.

Sector Hedging: Mitigate sector-specific risks by taking offsetting positions in related markets.

Currency Risk Management: Hedge currency exposure in international investments.

This hedging functionality makes CFDs valuable risk management tools, particularly in volatile markets.

Rolling Contracts vs. Futures CFDs

CFD providers typically offer two contract types: Cash (Rolling) CFDs and Futures CFDs, each with distinct features suited to different trading approaches.

Cash or Rolling CFDs

Rolling CFDs have no fixed expiry, allowing indefinite position holding. However, they incur overnight funding fees that accumulate over time. They are ideal for short to medium-term trading, where traders focus on price movements without contract expiration concerns.

Futures CFDs

Futures CFDs have a fixed expiry date and close automatically at a predetermined time. Unlike rolling CFDs, they do not incur overnight funding charges, as costs are embedded in the spread. This structure suits medium to long-term positions aiming to avoid daily financing fees.

Choosing between rolling and futures CFDs depends on your trading horizon and strategy. Short-term traders may prefer rolling CFDs for flexibility, while longer-term traders may benefit from futures CFDs’ cost structure.

Order Types and Risk Management

Successful CFD trading depends on effective order execution and risk management tools:

Market Orders: Execute immediately at current market price

Limit Orders: Set a specific entry price

Stop Orders: Automatically open positions when markets reach specified levels

Stop-Loss Orders: Close positions to limit losses

Guaranteed Stops: Guarantee execution at exact price levels (usually for an additional fee)

Trailing Stops: Dynamic stop-loss orders that adjust with favorable price movements

A comprehensive risk management approach using these tools is essential for sustainable trading.

Is CFD Trading Suitable for You?

Advantages of CFD Trading

Market Versatility: Trade multiple asset classes from a single platform

Leverage Benefits: Control larger positions with smaller capital outlay

Short Selling Capability: Profit from declining markets without borrowing securities

No Stamp Duty: In certain jurisdictions, CFDs are exempt from stamp duty applicable to share purchases

Extended Trading Hours: Access to out-of-hours trading on major indices

Hedging Opportunities: Protect existing investments against market downturns

Risks and Considerations

Magnified Losses: Leverage can amplify losses, potentially exceeding your initial margin deposit

Overnight Financing Costs: Long-term positions incur daily funding charges

Market Volatility: Rapid price changes can trigger stop-loss orders or margin calls

Counterparty Risk: Dependence on the CFD provider'’s financial stability

Complexity: Requires understanding of multiple financial concepts and markets

CFD trading is best suited for:

Individuals with a solid understanding of financial markets who can dedicate time to analyzing price movements and monitoring positions. Successful CFD traders typically employ disciplined risk management strategies to mitigate losses and optimize returns. Since CFDs involve leverage, traders must have sufficient financial resources to withstand market volatility without forced position liquidation.

Additionally, a thorough understanding of leverage’s impact on profits and losses is essential for effective risk management. Traders comfortable with these aspects and maintaining a structured trading approach may find CFD trading a viable market participation method.

5 Steps to Becoming a Successful CFD Trader

1. Build a Strong Knowledge Base

Before placing your first trade, develop a comprehensive understanding of key trading concepts. This includes CFD mechanics and pricing, technical and fundamental analysis, risk management principles, and trading psychology. Many reputable brokers provide educational resources such as webinars, tutorials, articles, and demo accounts to help traders acquire essential knowledge before entering live markets.

2. Develop a Detailed Trading Plan

A structured trading plan is vital for maintaining discipline and consistency. Your plan should specify clear entry and exit criteria, position sizing rules, and risk parameters, including maximum allowable losses per trade, day, or month.

Additionally, define the markets and timeframes you will trade, establish a trading schedule, and implement a review process to monitor performance. Documenting and adhering to your plan—especially during emotionally challenging market conditions—helps ensure long-term trading success.

3. Practice Using a Demo Account

A demo account allows traders to gain practical experience in a risk-free environment. It helps familiarize with the trading platform, test various strategies, and practice position sizing and risk management techniques.

Demo trading builds confidence and refines skills before transitioning to live trading with real capital.

Most established brokers offer demo accounts with virtual funds and real-time market data.

4. Start Small and Scale Gradually

When moving to live trading:

Begin with minimal position sizes

Use conservative leverage levels

Focus initially on one or two markets

Increase position sizes only after consistent performance

This gradual approach helps adapt to psychological differences between demo and live trading.

5. Continuously Review and Improve

Sustainable success requires ongoing evaluation and refinement:

Maintain a detailed trading journal

Regularly analyze performance metrics

Identify patterns in winning and losing trades

Adjust your strategy to evolving market conditions

Stay informed with market news and developments

Understanding CFD Costs and Fees

Understanding trading costs is essential for effective risk management. Key cost components include spreads, commissions, overnight financing, and guaranteed stop premiums.

Spreads

The spread is the difference between an asset'’s buy (ask) and sell (bid) prices and is often the primary cost when trading indices, forex, and commodity CFDs. Spreads are variable and fluctuate with market conditions and volatility, widening during major economic events or low liquidity periods.

Commissions

For share CFDs, brokers typically charge a commission instead of a spread. This fee is usually a percentage of the trade value and may include a minimum charge to cover broker costs on smaller trades.

Overnight Financing

Positions held beyond the daily cut-off incur overnight financing charges (swap rates), based on interbank rates plus broker markup. Long positions typically incur charges, while short positions may receive credits, depending on interest rate differentials.

Guaranteed Stop Premiums

Guaranteed stop-loss orders (GSLOs) ensure trades close at specified prices regardless of market gaps. This protection carries an additional cost, the stop premium, which is refunded if the stop-loss is not triggered.

Understanding these costs enables traders to make informed decisions and manage overall trading expenses effectively.

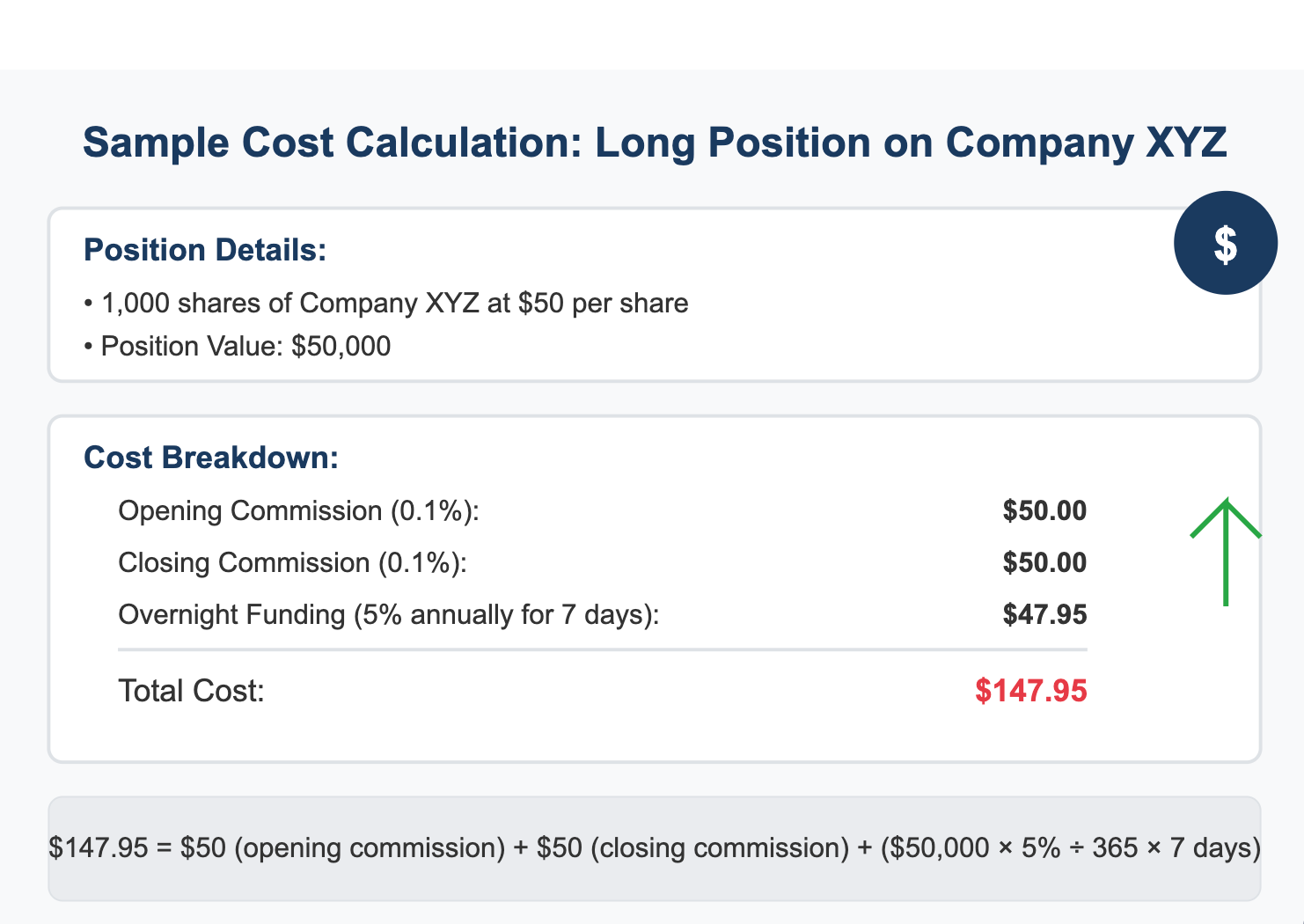

Sample Cost Calculation

For a long position on 1,000 shares of Company XYZ at $50 per share with a 0.1% commission:

Position value: $50,000

Opening commission: $50 (0.1% of $50,000)

Closing commission: $50 (assuming the same price)

Overnight financing at 5% annually: Approximately $6.85 per day ($50,000 × 5% ÷ 365)

Total cost of holding the position for 7 days would be approximately $147.95 ($50 + $50 + $6.85 × 7).

Trading with TMGM

TMGM offers tight spreads starting from 0.0 pips on major currency pairs with competitive commission rates. Traders can access leverage up to 1:1000, benefiting from deep liquidity sourced from multiple tier-1 providers for efficient trade execution. The platform delivers fast execution speeds, averaging under 30 milliseconds, minimizing slippage and enhancing trading efficiency.

TMGM supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop, web, and mobile devices, catering to diverse trading preferences. The broker provides educational resources including a Trading Academy, live webinars, daily market analysis, trading guides, and a real-time trading calendar to keep traders informed. Clients also benefit from multilingual support, dedicated account managers, and efficient withdrawal processing, ensuring a seamless trading experience.

Free CFD Trading Courses and Resources

Becoming a successful CFD trader requires skill, knowledge, and practice. TMGM provides comprehensive free trading courses and webinars. It also offers a free demo account with US$100,000 in virtual funds to build confidence in a risk-free environment.

We also supply trading strategy insights, market analysis, and news articles for all experience levels— so whether you’re a complete beginner or an experienced trader, TMGM has resources tailored for you.