On Friday night, gold prices saw a sharp correction after Federal Reserve officials once again delivered hawkish policy signals.

Policy divisions within the Fed have become increasingly pronounced. Several officials explicitly opposed a rate cut in December, stressing the need to stay alert to inflation risks. In contrast, Governor Milan maintained a dovish stance, arguing that the data still supports further rate cuts. This inconsistency in policy signals has intensified market volatility.

Worth noting, former President Trump claimed that the United States would conduct a nuclear test, pushing geopolitical risks higher once again. However, officials at the Department of Energy are reportedly planning to dissuade such a move, and the subsequent developments remain to be seen.

Hawkish Fed rhetoric has dampened expectations for rate cuts, while the equity market sell-off and associated margin calls have also put short-term pressure on gold. At the same time, physical gold demand across major Asian markets has been soft, as elevated prices have curbed buying interest. In India, the discount on gold relative to international prices has widened to its highest level in five months.

Gold prices continue to find support from the cautious sentiment that is widespread across financial markets. However, the lack of fresh economic data has deepened doubts over a potential Fed rate cut in December, which in turn is capping the upside for gold.

After a record 43-day government shutdown, the U.S. government has reopened. The shutdown disrupted the release of key economic indicators. The White House has played down hopes for a clearer outlook, stating that the October unemployment report may not be published.

That said, as the economic costs of the shutdown become more evident and additional spending programs gradually roll out, the combination of inflation and growth uncertainty is likely to benefit precious metals. Non-yielding gold typically performs well during periods of economic uncertainty and low interest rates.

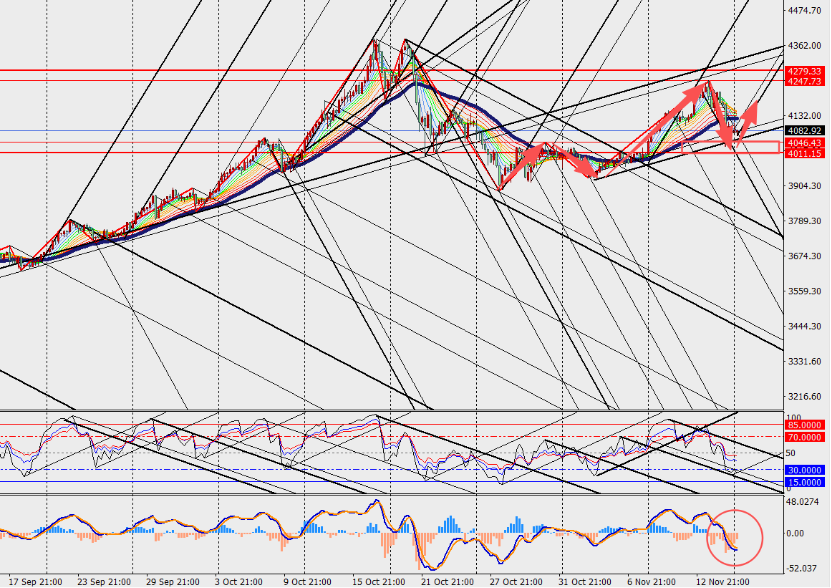

Market analysis:

On the 4-hour chart, gold has pulled back from recent highs, while the MACD lines and histogram are starting to converge below the zero line. Although prices have dropped from last month’s record high above $4,380 per ounce, gold is still up nearly 60% year-to-date and is on track for its best annual performance since 1979.