Day Trading Guide for Beginners: The Basics & How to Get Started

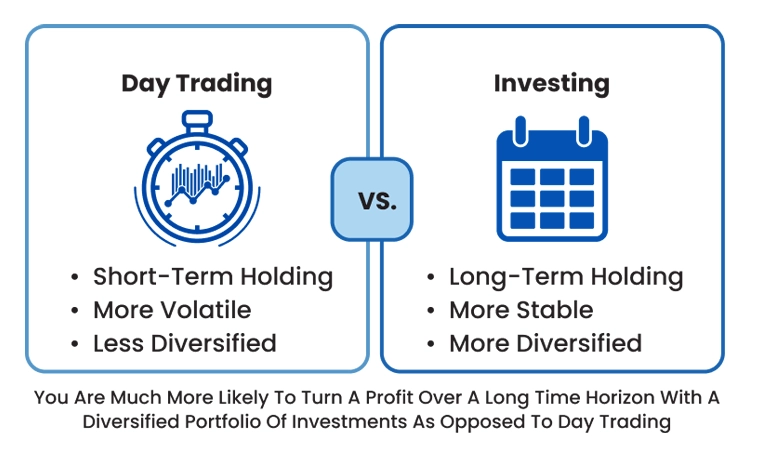

Day trading is a fast-paced form of investing in which individuals buy and sell financial instruments within the same trading day, aiming to profit from short-term price movements. Understanding day trading strategie and how to get started with day trading can be challenging for any novice trader, so here is a primer on how to get started with day trading. Unlike long-term investors, day traders focus on capitalizing on intraday market fluctuations rather than the fundamental value of assets. This comprehensive guide delves into day trading basics and provides insights on how to get started in this high-stakes financial arena.

Day Trading Basics: Understanding the Fundamentals

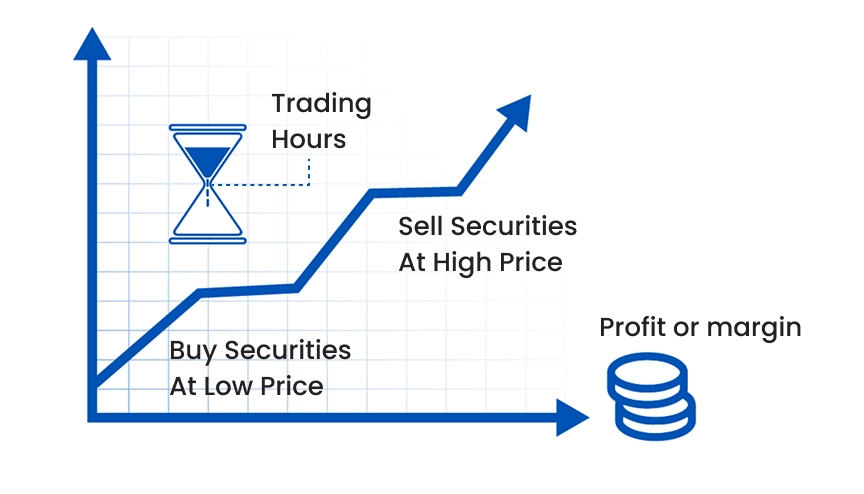

Day trading involves rapidly buying and selling securities — such as stocks, options, currencies, or futures — within a single trading day. The objective is to leverage small price movements to accumulate profits over time. This approach contrasts with traditional "buy and hold" strategies, where investments are held for extended periods to appreciate value.

Figure 1: What is Day Trading

Characteristics of Day Trading

Minor And Exotic Pairs

Short-Term Focus: Day traders close all positions before the market closes to avoid overnight risks associated with price gaps.

High Frequency of Trades: Multiple trades are executed daily to exploit market inefficiencies.

Leverage Utilization: Many day traders use borrowed funds to amplify potential returns, increasing potential losses.

Technical Analysis: Decisions are primarily based on technical indicators and chart patterns rather than long-term fundamentals.

Figure 1: Day Trading Vs. Investing

Potential Rewards and Risks

The allure of day trading lies in the potential for substantial profits within short periods. However, this potential is accompanied by significant risks:

Market Volatility: Rapid price movements can lead to substantial gains or losses in a short time.

Emotional Stress: The fast-paced nature of day trading can be mentally taxing, leading to impulsive decisions.

Financial Losses: Without proper risk management, traders can incur losses that exceed their initial investments, especially when using leverage.

Essential Tools and Resources for Day Traders

To navigate the complexities of day trading, having the right tools and resources is crucial:

Advanced Trading Platforms

A robust trading platform provides real-time data, advanced charting tools, and swift execution capabilities. Features include customizable interfaces, access to various markets, and integration with analytical tools.

High-Speed Internet Connection

A reliable, high-speed internet connection ensures timely trade execution and access to real-time market information, minimizing the risk of delays that could impact trading outcomes.

Real-Time Market Data and News Feeds

Access to up-to-the-minute market data and news is essential for making informed trading decisions. Subscriptions to reputable financial news services and data providers can offer insights into market-moving events.

Analytical Software

Specialized software can help identify technical patterns, perform strategy backtesting, and integrate directly with brokerage accounts for seamless trade execution.

How to Get Started with Day Trading

Embarking on a day trading journey requires meticulous preparation and a clear understanding of the market dynamics. Here's a step-by-step guide on how to get started:

Acquire Comprehensive Market Knowledge

Education is the foundation of successful day trading. Aspiring traders should immerse themselves in learning:

Technical Analysis: Understanding chart patterns, indicators, and market trends is crucial.

Market Fundamentals: Grasping economic indicators, earnings reports, and other factors influencing market movements.

Risk Management: Learning to protect capital by setting stop-loss orders and position sizing.

Resources such as books, online courses, webinars, and reputable financial websites can provide valuable information. Engaging with trading communities and forums can also offer practical insights and experiences from seasoned traders.

Ensure Adequate Capital

Sufficient capital is vital for day trading, not only to meet regulatory requirements but also to absorb potential losses:

Regulatory Minimums: In the U.S., pattern day traders must maintain a minimum account balance of $25,000.

Risk Capital: Only trade with money you can afford to lose without affecting your financial stability.

Leverage Considerations: While leverage can amplify gains, it equally magnifies losses. Ensure you have enough capital to meet margin requirements and cushion against adverse market movements.

Develop and Test a Trading Strategy

A well-defined day trading strategy is essential for consistency and discipline:

Define Your Edge: Identify specific market conditions or setups where you have a higher probability of success.

Backtesting: Apply your strategy to historical data to evaluate its effectiveness.

Paper Trading: Simulate trades in real time without risking actual capital to refine your approach.

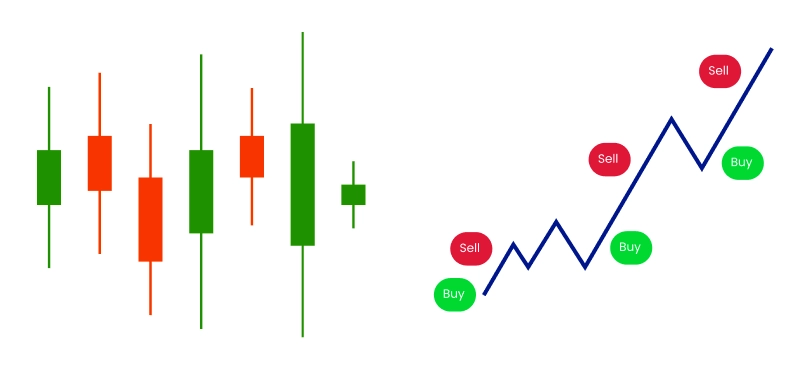

Common day trading strategies include:

Scalping: Aiming for numerous small profits on minor daily price changes.

Momentum Trading: Capitalizing on strong price movements in a particular direction.

Range Trading: Identifying support and resistance levels to make buy and sell decisions.

Figure 2: Day trading strategies

Start Small and Focused

When transitioning to live trading:

Limit Your Scope: Focus on one or two securities to avoid information overload.

Control Position Sizes: Keep trades small relative to your overall capital to manage risk effectively.

Set Realistic Goals: Aim for consistent, modest gains rather than seeking large profits initially.

Implement Strict Risk Management

Protecting your capital is paramount:

Risk Per Trade: Do not risk more than 1-2% of your trading capital on a single trade.

Use Stop-Loss Orders: Predetermine stop-loss levels to exit losing trades before they become unmanageable automatically.

Maintain a Favorable Risk-Reward Ratio: A typical goal is to aim for a profit at least twice the size of potential losses (e.g., risking $100 to potentially make $200).

Track Performance: Keep a detailed trading journal to analyze successful and unsuccessful trades, refining your strategy over time.

Understanding the Reality of Day Trading

While the potential for financial success in day trading is appealing, the reality is that most traders struggle to achieve consistent profitability.

Success Rate and Challenges

Low Long-Term Profitability: Only 10-15% of active day traders consistently make money. Many traders fail due to poor risk management, emotional trading, or lack of strategy.

Emotional and Psychological Pressures: Constant decision-making under market pressure can lead to stress, impulsive trading, and burnout.

Hidden Costs: Even if a trader makes profitable trades, transaction fees, software costs, margin interest, and taxes can significantly erode earnings.

Market Competition: Institutional traders and algorithmic trading programs often have an edge over individual traders due to superior technology, faster execution, and access to greater capital.

Figure 3: Day trading

The Day Trading Lifestyle: Is It Right for You?

Successful day traders treat trading as a business, requiring full dedication and discipline. Consider these factors before pursuing a career in day trading:

Time Commitment: Active monitoring of the market during trading hours is essential. Day trading is not a passive activity.

Personality Fit: A strong ability to stay calm under pressure and make rational decisions without emotion is critical.

Continuous Learning: Markets evolve, and strategies that work today may become obsolete. Keeping up with financial news, refining strategies, and adapting to market trends are ongoing requirements.

Practical Example of a Day Trade

To illustrate how a day trade unfolds, let’s examine this scenario:

Market Research: A trader identifies a tech stock showing strong momentum pre-market due to positive earnings.

Entry Point: After confirming a bullish pattern using technical indicators, the trader buys 500 shares at $100 each.

Risk Management: The trader sets a stop-loss at $98 to cap potential losses at $1,000 and a take-profit target at $105.

Trade Execution: The stock moves in the trader’s favor, hitting $105, triggering an automatic sell order.

Profit Calculation: With a $5 per share gain on 500 shares, the trader makes a gross profit of $2,500 before deducting fees.

How to Get Started Day Trading: Next Steps

Figure 4: Effective Day Trading Strategy

If you’re ready to take the plunge into day trading, follow these structured steps:

1. Education & Preparation

Building a strong knowledge foundation is crucial before diving into trading. Enroll in trading courses, read books, and follow market experts to understand strategies, risk management, and market behavior. Practice with a demo account to gain hands-on experience without risking real capital.

2. Choose the Right Brokerage

Selecting a reliable broker is essential for seamless trading. Look for a platform that offers low commissions, fast execution speeds, and access to advanced trading tools to enhance your decision-making process.

3. Develop a Trading Plan

Success in trading requires discipline and structure. Before entering the market, define your trading strategies, risk parameters, and daily profit/loss limits. A solid plan helps maintain consistency and avoid emotional decision-making.

4. Start Small and Scale Gradually

Beginners should start with limited capital and small trade sizes to manage risk effectively. Only increase exposure once consistent profitability is achieved, ensuring a steady and sustainable growth path.

5. Review and Improve

Continuous improvement is key to long-term success. Maintain a trading journal to track performance, analyze mistakes, and refine strategies based on past results. Regular self-assessment helps traders adapt to changing market conditions and improve efficiency.

Familiarizing oneself with day trading basics and how to get started requires a structured, disciplined approach. While the potential rewards are enticing, the risks are equally high. Aspiring traders must invest in education, practice in simulated environments, and develop robust risk management strategies before risking any sizable capital.

Success in day trading isn’t about making quick money — it’s about consistent learning, adapting, and managing risk effectively. If approached with patience and a clear strategy, day trading can be viable for those with the right mindset and dedication.

Master Day Trading with TMGM: Precision, Speed, and Control

Start your day trading journey with TMGM, a trusted platform offering advanced trading tools, real-time market data, and a seamless trading experience. With competitive spreads, lightning-fast execution, and risk management features, TMGM empowers traders to make informed decisions. Open a demo account today and refine your strategy in a risk-free environment before trading live markets.

Using a demo account like TMGM’s is a crucial step for beginners learning day trading basics and how to get started. It provides a risk-free environment to master strategies, understand market behavior, and build confidence before transitioning to live trading.

Fai trading in modo più intelligente oggi

Conto Reale

Conto

Subito