This guide covers coca cola stock (KO) ownership, investment steps, and CFD trading considerations for 2025.

Who Owns Coca-Cola (KO)?

Based on recent public filings, here are the largest shareholders:

Largest Institutional Shareholders:

- Berkshire Hathaway Inc. (Warren Buffett's holding company): Historically, one of the single largest shareholders. Its stake is a famous, long-held position, signaling confidence in the company's long-term stability and cash flow.

- The Vanguard Group Inc.: One of the largest asset managers globally. Its ownership is primarily through its vast array of index funds (like the Total Stock Market Index Fund or S&P 500 ETFs), which are required to hold Coca-Cola stock because it's a major component of those market indices.

- BlackRock, Inc.: Another major asset manager, similar to Vanguard, whose substantial ownership comes largely from managing numerous index funds and ETFs that track broad markets— index trading explained .

- State Street Corporation: Holds a large stake, mainly through its index-tracking funds (like the SPDR series), which follow similar passive investment mandates.

Largest Individual Shareholders:

- James Quincey (CEO and Chairman): His holdings are typically the largest among active company executives, comprising shares accumulated through performance awards, stock options, and compensation plans, directly aligning his financial interests with long-term shareholder returns.

- Coca-Cola Directors and Executives: Current and former members of the board and senior leadership collectively hold significant equity. Their ownership is an expected part of executive compensation designed to ensure commitment to the company's success.

- Members of the Candler Family: Descendants of Asa Griggs Candler, who purchased and built the modern Coca-Cola Company, maintain notable legacy stakes. While their individual percentages are small compared to the institutional giants, their holdings reflect the company's deep history and generational wealth.

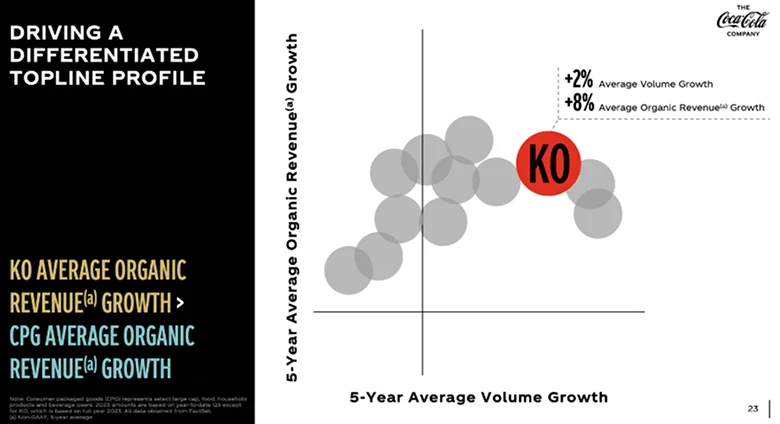

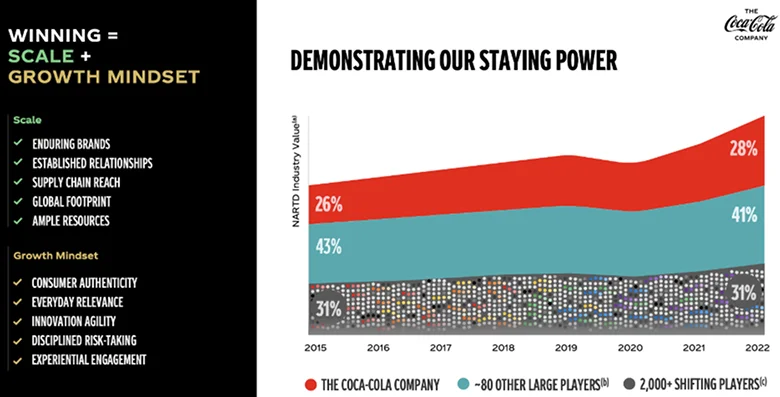

Why Coca-Cola Stock Remains a Strong Investment

Established Brand with Global Reach : Coca-Cola operates in over 200 countries, offering an unmatched market footprint. Its diverse product portfolio and marketing prowess keep the brand relevant across demographics.

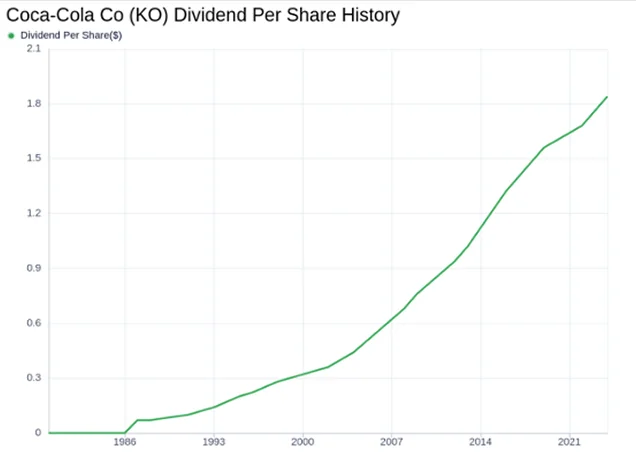

Resilient Dividend Payouts : As an S&P 500 Dividend Aristocrat, Coca-Cola has consistently increased its dividends, making it a reliable source of passive income. Explore dividend stocks .

Adaptation to Market Trends : After many starts and stops, Coca-Cola has successfully diversified into low-sugar and sustainable beverage options, aligning with shifting consumer preferences.

Stability Amid Economic Volatility : The company’s essential goods positioning ensures steady demand, even in uncertain economic climates.

Key Steps to Invest in Coca-Cola Stock

Choose Your Investment Method : Decide whether to buy Coca-Cola shares outright or trade via CFDs . Direct shares offer ownership, while CFDs allow you to speculate on price movements with leveraged positions.

Select a Reliable Trading Platform : Use a regulated broker like TMGM to access user-friendly platforms , research tools , and real-time data .

Analyze Market Conditions : Study Coca-Cola’s financial reports, industry trends, and macroeconomic indicators before investing.

Set a Clear Investment Plan : Define your objectives, risk tolerance , and holding period. Short-term traders prefer CFDs for flexibility , while long-term investors focus on direct share ownership.

Coca-Cola Investor Revenue Overview 2Q24

Coca-Cola Investor Revenue Overview 2Q24

Advantages of Trading Coca-Cola Shares with CFDs

Leverage for Greater Exposure : CFDs enable traders to control larger positions with a smaller capital outlay, amplifying potential gains (and risks). Learn more about leverage .

Flexibility in Market Conditions : CFDs allow you to profit from rising and falling Coca-Cola share prices by going long or short .

Access to Global Markets : CFD trading platforms often provide additional tools and insights into related markets, like the broader consumer goods sector.

No Ownership Hassles : Unlike traditional shares, CFDs do not involve physical ownership, making them more straightforward for active traders .

Tips for Investing in Coca-Cola Stock in 2025

Monitor Industry Trends : Monitor the beverage industry’s transition toward sustainability, healthy products, and emerging markets. Coca-Cola’s strategic initiatives in these areas can influence its stock performance.

Leverage Technical Analysis : technical indicators such as moving averages (e.g., MACD ) for more precise entry and exit points using TMGM’s platforms.

Diversify Your Portfolio : To balance risk, avoid overexposure by combining Coca-Cola shares or CFDs with other sectors—see TMGM’s range of markets .

Stay Updated on Dividend Announcements : Coca-Cola’s dividend history is a key attraction—track payout schedules alongside news and events to inform your coca cola stock forecast and watch out for corporate actions like a potential stock split.

Risks to Consider When Trading Coca-Cola Shares

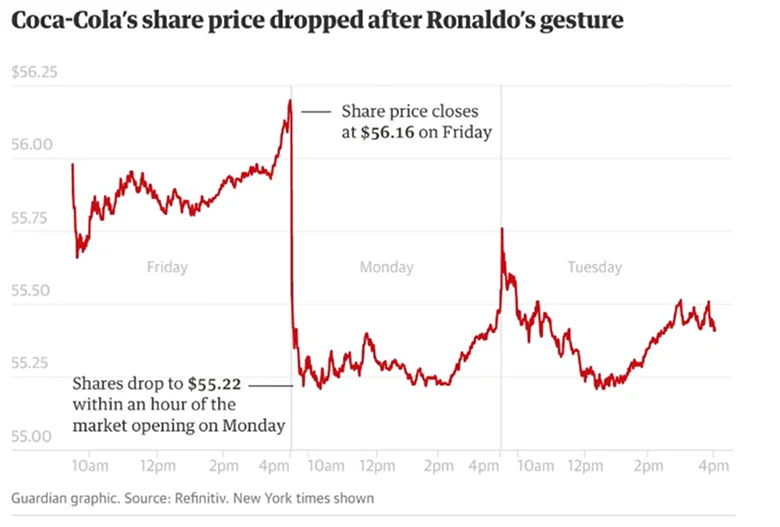

Market Volatility : Economic events, interest rate changes, and geopolitical factors can impact Coca-Cola’s share prices . In 2020, for example, an incident involving Cristiano Ronaldo moving Coke bottles from a press conference table sent Coca-Cola share prices tumbling.

Leverage Risks with CFDs : While leverage magnifies gains , it also increases losses. Use tools like a margin and profit calculator to size positions appropriately.

Industry Competition : Although Coca-Cola is a leader, rivals like PepsiCo and emerging brands can challenge its market share.

Currency Exchange Risks : Coca-Cola’s global operations expose it to foreign exchange fluctuations—understand the forex market , which can influence profitability.

Why 2025 Could Be a Pivotal Year for Coca-Cola Stock

Coca-Cola investors have exciting potential in 2025 as the company focuses on innovation and sustainability. Strategic expansions in emerging markets and its commitment to reducing plastic waste are likely to strengthen its market position.

Additionally, as inflation stabilizes, consumer spending on non-alcoholic beverages is expected to rise, benefiting Coca-Cola’s revenue streams and informing any coca cola stock price outlook.

Make Coca-Cola Part of Your 2025 Strategy

Investing in Coca-Cola shares and CFDs provides stability and opportunity in a fluctuating market. Understanding the dynamics of Coca-Cola’s business model, market trends, and trading methods can be essential for seasoned traders and novice investors.

Ready to take the next step? Explore TMGM's cutting-edge digital platform : access advanced tools, educational resources, and expert insights to master trading Coca-Cola shares and CFDs. Don’t miss the chance to elevate your trading journey in 2025!