What Is the US Dollar Index?

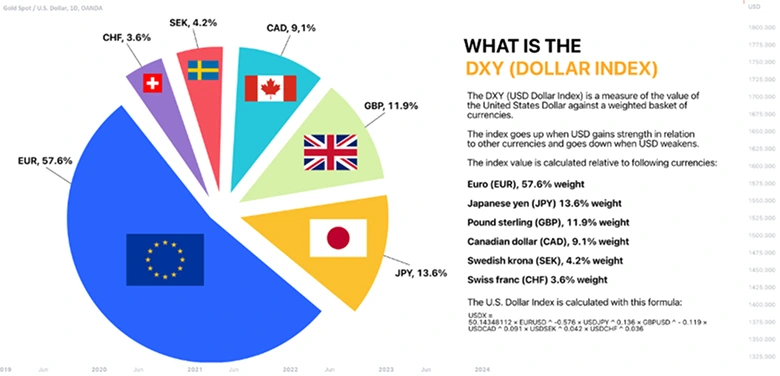

The US Dollar Index measures the performance of the US dollar against six major currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

Introduced 1973 by the Intercontinental Exchange (ICE), the index uses a weighted geometric mean formula.

The euro holds the largest weight in the index at nearly 57.6%, making it the most influential currency in the basket.

USDX values are scaled to 100, with a baseline set in 1973. A reading above 100 indicates a stronger dollar, while below 100 signals weakness.

Why Traders Focus on the US Dollar Index

Global Indicator: The US Dollar Index is a benchmark for gauging the dollar’s relative strength on the global stage.

Influences on Commodity Prices: Commodities like gold and oil are typically priced in USD. A strong dollar can pressure commodity prices lower, while a weaker dollar can boost them.

Correlation with Forex Pairs: USDX can signal trends for major currency pairs, offering insights into the forex market.

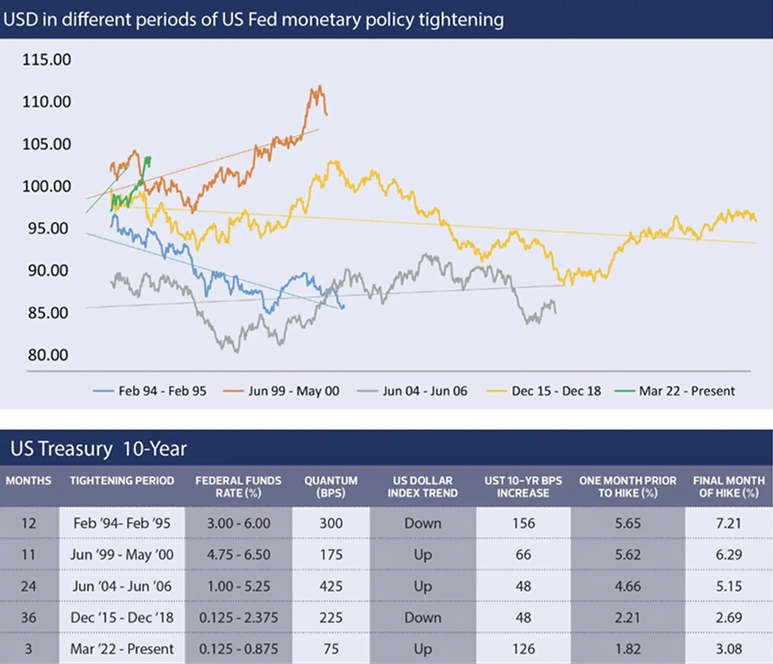

Economic Sentiment: Fluctuations in the index often reflect market reactions to US economic data, Federal Reserve policies, and geopolitical events.

How to Trade the US Dollar Index with TMGM

Access Multiple Markets: TMGM provides seamless access to the US Dollar Index through CFDs (Contracts for Difference), allowing traders to speculate on rising and falling markets.

Leverage Powerful Tools: TMGM’s trading platform includes advanced charting tools, technical indicators, and market insights tailored for index trading.

Flexible Trading Hours: The US Dollar Index is traded almost 24 hours daily, allowing you to trade around your schedule.

Risk Management Features: TMGM equips traders with stop-loss orders, margin monitoring, and other tools to manage risks effectively.

Key Strategies for Trading the US Dollar Index

Trend Following: Identify long-term trends using moving averages or other trend indicators. The USDX often displays prolonged trends due to economic cycles.

Range Trading: When the index moves within a defined range, use support and resistance levels to buy at lows and sell at highs.

News-Driven Trades: Attention to economic reports like US GDP, employment data, and Federal Reserve announcements, as these events can cause significant USDX movements.

Correlation Analysis: Study the USDX alongside commodity and forex markets to spot profitable opportunities. For example, a rising USDX might coincide with falling gold prices.

Benefits of Trading Indices with TMGM

Low Costs: Competitive spreads and transparent pricing ensure cost-effective trading.

Wide Asset Coverage: TMGM offers access to global indices beyond the US Dollar Index, providing diversification opportunities.

Education and Support: TMGM’s learning hub features webinars, tutorials, and market analysis to enhance your trading skills.

Scalable Accounts: Whether you’re a beginner or an advanced trader, TMGM’s account options cater to various experience levels.

Why the US Dollar Index Matters Now

Economic Shifts: With central banks globally adjusting monetary policies, the USDX is a barometer for market sentiment.

Inflation Concerns: As inflation remains a key issue, the index provides insights into how the market perceives the Federal Reserve’s actions.

Geopolitical Uncertainty: In times of crisis, the US dollar often strengthens as a safe-haven currency, making the USDX an essential tool for understanding market flows.

Take Your Trading to the Next Level

The US Dollar Index is more than a number; it’s a dynamic tool that reflects global economic realities and offers lucrative trading opportunities. By trading indices on TMGM’s robust platform, you can gain an edge with comprehensive tools, market access, and educational resources.

Start your journey today and explore the potential of the US Dollar Index with TMGM.

Visit TMGM for more resources, strategies, and tools to elevate your trading experience.