ประเด็นสำคัญ

คริปโตคือสินทรัพย์ดิจิทัลแบบกระจายศูนย์ที่สร้างขึ้นบนเทคโนโลยีบล็อกเชน ช่วยให้สามารถทำธุรกรรมแบบเพียร์ทูเพียร์ได้อย่างปลอดภัย

การเทรดคริปโตสามารถทำได้ผ่าน CFDs หรือที่เรียกว่า การเทรด Crypto CFD หรือผ่านแพลตฟอร์มแลกเปลี่ยนแบบรวมศูนย์ ซึ่งแต่ละแบบมีข้อดีที่แตกต่างกัน

แนวคิดหลักประกอบด้วย เลเวอเรจ, การเทรดมาร์จิ้นล็อต, พิพส์ และสเปรด

การบริหารความเสี่ยงเป็นสิ่งสำคัญในการเทรดคริปโตเนื่องจากความผันผวนของตลาด

การกำเนิดของสกุลเงินดิจิทัล

สกุลเงินดิจิทัลเริ่มต้นจากการสร้าง บิตคอยน์ ในปี 2009 หลังจากวิกฤตการณ์ทางการเงินโลก ในเดือนตุลาคม 2008 บุคคลหรือกลุ่มนิรนามที่ใช้ชื่อแฝงว่า ซาโตชิ นากาโมโตะ ได้เผยแพร่เอกสารไวท์เปเปอร์ชื่อ "Bitcoin: A Peer-to-Peer Electronic Cash System" ซึ่งอธิบายแนวคิดของสกุลเงินดิจิทัลแบบกระจายศูนย์ที่ทำงานโดยไม่มีตัวกลางอย่างธนาคาร

บล็อกบิตคอยน์แรกที่เรียกว่า "บล็อกกำเนิด (genesis block)" ถูกขุดขึ้นเมื่อวันที่ 3 มกราคม 2009 ซึ่งเป็นการเปิดตัวสกุลเงินดิจิทัลแรกของโลกอย่างเป็นทางการ ในช่วงปีแรก ๆ บิตคอยน์ถูกใช้โดยกลุ่มผู้สนใจเทคโนโลยีและผู้สนับสนุนความเป็นส่วนตัว หนึ่งในการทำธุรกรรมที่มีชื่อเสียงในปี 2010 คือการซื้อพิซซ่าสองถาดด้วยบิตคอยน์ 10,000 เหรียญ (มูลค่าหลายพันล้านดอลลาร์ในราคาปัจจุบัน)

หลังจากการสร้างบิตคอยน์' สกุลเงินดิจิทัลอื่น ๆ ก็เริ่มปรากฏขึ้น:

รูปที่ 1: แสดงสกุลเงินดิจิทัลอื่น ๆ

ไลต์คอยน์ (2011) – สร้างขึ้นเป็นทางเลือกที่ "เบากว่า" บิตคอยน์ พร้อมเวลาทำธุรกรรมที่เร็วขึ้น

ริปเปิล (2012) – พัฒนาสำหรับระบบชำระเงินของสถาบัน

อีเธอเรียม (2015)– แนะนำสมาร์ตคอนแทรกต์และแอปพลิเคชันแบบกระจายศูนย์

มีสกุลเงินดิจิทัลอีกหลายพันสกุลตามมา โดยแต่ละสกุลมีคุณสมบัติและวัตถุประสงค์ที่แตกต่างกัน

ลักษณะสำคัญของสกุลเงินดิจิทัล

สกุลเงินดิจิทัลเป็นสินทรัพย์ดิจิทัลที่ออกแบบมาเพื่อทำหน้าที่เป็นสื่อกลางในการแลกเปลี่ยนโดยไม่ต้องพึ่งพาหน่วยงานกลาง เช่น รัฐบาลหรือธนาคาร พวกมันทำงานบนเครือข่ายแบบกระจายศูนย์และได้รับการปกป้องด้วยเทคนิคการเข้ารหัสขั้นสูง เพื่อความปลอดภัยและป้องกันการปลอมแปลง แตกต่างจากสกุลเงินฟิอทแบบดั้งเดิม สกุลเงินดิจิทัลมีอยู่ในรูปแบบดิจิทัลล้วน ๆ ไม่มีตัวตนทางกายภาพ

สกุลเงินดิจิทัลหลายสกุล เช่น บิตคอยน์ มีจำนวนจำกัด โดยมีการกำหนดจำนวนสูงสุดไว้ล่วงหน้า (เช่น บิตคอยน์มีขีดจำกัดที่ 21 ล้านเหรียญ) ซึ่งช่วยสร้างความขาดแคลนและมีผลต่อมูลค่าในระยะยาว

การเทรดสกุลเงินดิจิทัลคืออะไร?

การเทรดสกุลเงินดิจิทัลเกี่ยวข้องกับการเก็งกำไรจากการเคลื่อนไหวของราคาผ่านบัญชีเทรด CFD หรือการซื้อขายเหรียญจริงผ่านแพลตฟอร์มแลกเปลี่ยน กิจกรรมนี้ช่วยให้นักเทรดสามารถทำกำไรจากความผันผวนของตลาดคริปโตได้

นักเทรดมักใช้กลยุทธ์ที่แตกต่างกันขึ้นอยู่กับเป้าหมายและความเสี่ยงที่ยอมรับได้ การเทรดรายวัน เน้นการเคลื่อนไหวระยะสั้น โดยเปิดและปิดสถานะภายในวันเดียวกัน การเทรดสวิง เกี่ยวข้องกับการถือสถานะเป็นเวลาหลายวันหรือหลายสัปดาห์เพื่อจับการเคลื่อนไหวของราคาในวงกว้าง ขณะที่ การเทรดสปอต หมายถึงการซื้อขายสกุลเงินดิจิทัลในราคาตลาดปัจจุบันเพื่อเป็นเจ้าของโดยตรงโดยไม่ใช้เลเวอเรจ วิธีการแต่ละแบบมีความเสี่ยงและข้อดีของตัวเอง การเลือกกลยุทธ์ที่เหมาะสมขึ้นอยู่กับสไตล์และมุมมองของนักเทรด

สองวิธีหลักในการเทรดคริปโต

#1 เทรด Crypto CFDs กับ TMGM

Crypto CFDs (สัญญาสำหรับความแตกต่าง) เป็นตราสารอนุพันธ์ของสกุลเงินดิจิทัลที่ช่วยให้คุณเก็งกำไรจากการเคลื่อนไหวของราคาโดยไม่ต้องเป็นเจ้าของเหรียญจริง ด้วย Crypto CFDs ของ TMGM':

คุณสามารถเปิดสถานะซื้อ ('long') หากคิดว่าราคาคริปโตจะเพิ่มขึ้น

คุณสามารถเปิดสถานะขาย ('short') หากคิดว่าราคาคริปโตจะลดลง

ทั้งสองวิธีใช้ผลิตภัณฑ์ที่มีเลเวอเรจ หมายความว่าคุณต้องวางเงินมัดจำเพียงเล็กน้อย—เรียกว่ามาร์จิ้น—เพื่อเปิดรับความเสี่ยงเต็มรูปแบบในตลาด

กำไรหรือขาดทุนของคุณจะคำนวณจากขนาดเต็มของสถานะ

เลเวอเรจจะช่วยเพิ่มทั้งกำไรและขาดทุนที่อาจเกิดขึ้น

#2 การซื้อขายสกุลเงินดิจิทัลผ่าน แพลตฟอร์มแลกเปลี่ยนแบบรวมศูนย์

เมื่อคุณซื้อคริปโตผ่านแพลตฟอร์มแลกเปลี่ยน:

คุณซื้อเหรียญจริง

คุณต้องสร้างบัญชีแลกเปลี่ยน

คุณต้องวางเงินเต็มจำนวนของสินทรัพย์เพื่อเปิดสถานะ

คุณต้องเก็บเหรียญคริปโตไว้ในกระเป๋าเงินดิจิทัลจนกว่าคุณ'จะพร้อมขาย

การเทรดผ่านแพลตฟอร์มแลกเปลี่ยนมีความท้าทาย:

เส้นทางการเรียนรู้ที่สูงเพื่อเข้าใจเทคโนโลยี

ความยากในการตีความข้อมูลตลาด

ข้อจำกัดในการฝากเงินบนหลายแพลตฟอร์ม

ค่าใช้จ่ายในการดูแลบัญชีที่อาจสูง

ความกังวลด้านความปลอดภัยในการจัดการกระเป๋าเงิน

ตลาดสกุลเงินดิจิทัลทำงานอย่างไร?

ตลาดสกุลเงินดิจิทัลดำเนินการบนพื้นฐานที่แตกต่างจากตลาดการเงินแบบดั้งเดิม:

โครงสร้างเครือข่ายแบบกระจายศูนย์

ตลาดสกุลเงินดิจิทัลเป็นแบบกระจายศูนย์ หมายความว่าไม่ได้ถูกออกหรือรับรองโดยหน่วยงานกลาง เช่น รัฐบาล แต่ทำงานผ่านเครือข่ายคอมพิวเตอร์ แม้จะเป็นแบบกระจายศูนย์ แต่สกุลเงินดิจิทัลสามารถซื้อขายผ่านแพลตฟอร์มแลกเปลี่ยนและเก็บไว้ใน 'กระเป๋าเงินดิจิทัล'

บันทึกความเป็นเจ้าของสินทรัพย์ดิจิทัล

แตกต่างจากสกุลเงินทั่วไป สกุลเงินดิจิทัล มีอยู่ในรูปแบบบันทึกดิจิทัลที่แชร์ร่วมกันบนบล็อกเชน เมื่อผู้ใช้ต้องการส่งหน่วยคริปโตไปยังผู้ใช้อื่น จะส่งไปยังกระเป๋าเงินดิจิทัลของผู้รับ การทำธุรกรรมจะไม่ถือว่าสมบูรณ์จนกว่าจะได้รับการตรวจสอบและบันทึกลงในบล็อกเชนผ่านกระบวนการขุด นี่คือวิธีที่เหรียญคริปโตใหม่ส่วนใหญ่ถูกสร้างขึ้น

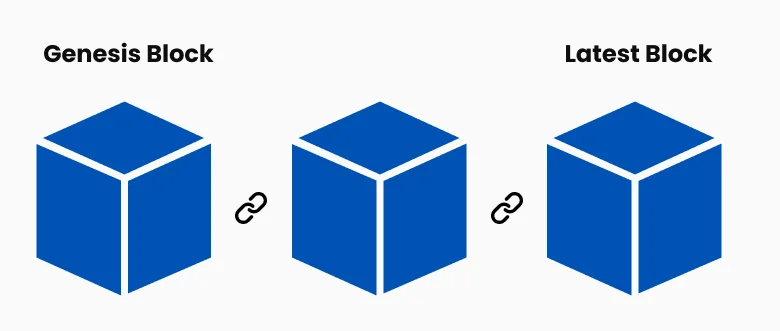

เทคโนโลยีบล็อกเชนคืออะไร?

บล็อกเชนคือสมุดบันทึกดิจิทัลที่แชร์ร่วมกันของข้อมูลที่บันทึกไว้ สำหรับสกุลเงินดิจิทัล นี่คือประวัติการทำธุรกรรมของทุกหน่วยคริปโตที่แสดงการเปลี่ยนแปลงความเป็นเจ้าของตลอดเวลา บล็อกเชนทำงานโดยการบันทึกธุรกรรมใน 'บล็อก' และเพิ่มบล็อกใหม่ที่ส่วนหน้าของโซ่

รูปที่ 2: แสดงภาพบล็อกเชน

คุณสมบัติด้านความปลอดภัยขั้นสูงของคริปโตและบล็อกเชนคุณสมบัติความปลอดภัยเฉพาะตัว

เทคโนโลยีบล็อกเชนมีคุณสมบัติด้านความปลอดภัยที่ไม่เหมือนกับไฟล์คอมพิวเตอร์ทั่วไป:

กลไกฉันทามติในเครือข่ายคริปโต

ไฟล์บล็อกเชนจะถูกเก็บไว้บนคอมพิวเตอร์หลายเครื่องในเครือข่าย – แทนที่จะเก็บไว้ในที่เดียว – และมักจะเปิดให้ทุกคนในเครือข่ายอ่านได้ ซึ่งทำให้โปร่งใสและยากต่อการแก้ไข โดยไม่มีจุดอ่อนเดียวที่เสี่ยงต่อการถูกแฮ็กหรือเกิดข้อผิดพลาดจากมนุษย์หรือซอฟต์แวร์

พื้นฐานการเข้ารหัสของคริปโต

บล็อกถูกเชื่อมโยงกันด้วยการเข้ารหัส – คณิตศาสตร์และวิทยาการคอมพิวเตอร์ขั้นสูง ความพยายามใด ๆ ที่จะเปลี่ยนแปลงข้อมูลจะทำให้การเชื่อมโยงเข้ารหัสระหว่างบล็อกเสียหายและสามารถถูกตรวจจับได้อย่างรวดเร็วว่าเป็นการปลอมแปลงโดยคอมพิวเตอร์ในเครือข่าย

การขุดสกุลเงินดิจิทัลคืออะไร?

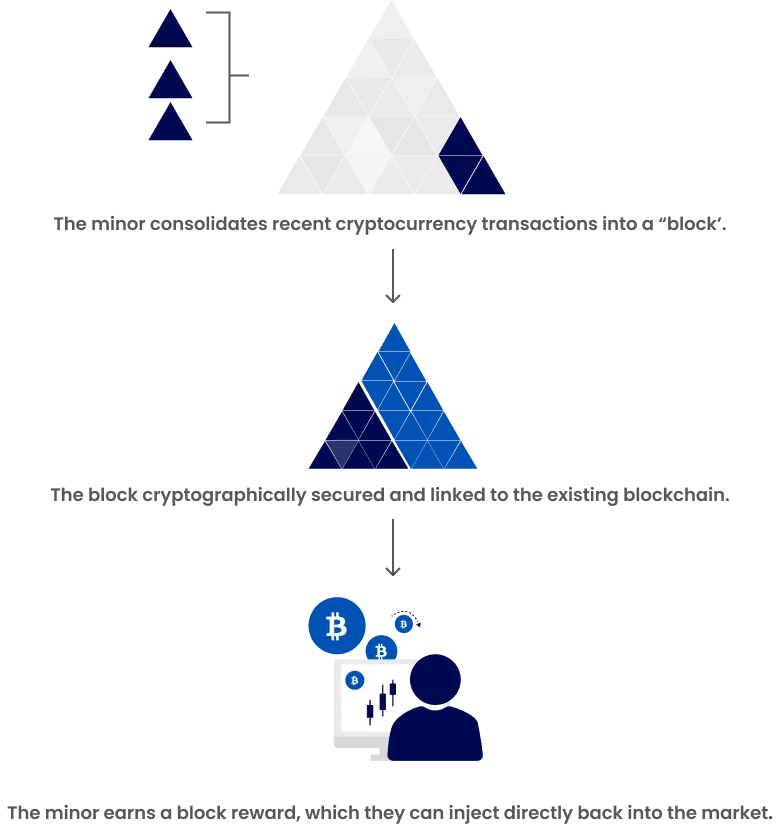

การขุดคริปโตคือการตรวจสอบธุรกรรมล่าสุดและเพิ่มบล็อกใหม่ลงในบล็อกเชน

วิธีการตรวจสอบธุรกรรมบนบล็อกเชน

การตรวจสอบธุรกรรม: คอมพิวเตอร์ขุดจะเลือกธุรกรรมที่รอดำเนินการจากกลุ่มและตรวจสอบให้แน่ใจว่าผู้ส่งมีเงินเพียงพอสำหรับทำธุรกรรมนั้น โดยตรวจสอบรายละเอียดธุรกรรมกับประวัติธุรกรรมที่เก็บไว้ในบล็อกเชน การตรวจสอบครั้งที่สองยืนยันว่าผู้ส่งอนุญาตให้โอนเงินโดยใช้กุญแจส่วนตัวของตน

การสร้างบล็อกใหม่: คอมพิวเตอร์ขุดจะรวบรวมธุรกรรมที่ถูกต้องเป็นบล็อกใหม่และพยายามสร้างการเชื่อมโยงเข้ารหัสกับบล็อกก่อนหน้าโดยแก้สมการที่ซับซ้อน เมื่อคอมพิวเตอร์เครื่องใดประสบความสำเร็จในการสร้างการเชื่อมโยงนี้ จะเพิ่มบล็อกลงในเวอร์ชันบล็อกเชนของตนและกระจายการอัปเดตไปทั่วเครือข่าย

รูปที่ 3: แสดงภาพการขุดสกุลเงินดิจิทัล

อะไรเป็นตัวขับเคลื่อนตลาดคริปโต?

ตลาดคริปโตเคลื่อนไหวตามอุปสงค์และอุปทาน อย่างไรก็ตาม เนื่องจากเป็นแบบกระจายศูนย์ จึงไม่ถูกควบคุมโดยปัจจัยทางเศรษฐกิจและการเมืองหลายอย่างที่ส่งผลต่อตลาดสกุลเงินทั่วไป

ปัจจัยสำคัญที่มีผลต่อราคาคริปโต

แม้ว่ายังมีความไม่แน่นอนมากเกี่ยวกับคริปโต แต่ปัจจัยต่อไปนี้สามารถส่งผลกระทบอย่างมีนัยสำคัญต่อราคา:

อุปทาน: จำนวนเหรียญทั้งหมดและอัตราการปล่อย ทำลาย หรือสูญหาย

มูลค่าตลาด: มูลค่าของเหรียญทั้งหมดที่มีอยู่และการรับรู้ของผู้ใช้เกี่ยวกับการพัฒนา

การรายงานข่าว: วิธีที่คริปโตถูกนำเสนอในสื่อและปริมาณการรายงานข่าว

การบูรณาการ: ระดับที่คริปโตสามารถผสานเข้ากับโครงสร้างพื้นฐานที่มีอยู่ เช่น ระบบชำระเงินอีคอมเมิร์ซ

เหตุการณ์สำคัญ: เหตุการณ์ใหญ่ เช่น การอัปเดตกฎระเบียบ การละเมิดความปลอดภัย และปัญหาเศรษฐกิจ

การเทรดคริปโตกับ TMGM ทำงานอย่างไร

กับ TMGM คุณสามารถเทรดคริปโตผ่านบัญชี CFD – ผลิตภัณฑ์อนุพันธ์ที่ช่วยให้คุณเก็งกำไรว่าคริปโตที่คุณเลือกจะขึ้นหรือลง ราคาจะอ้างอิงในสกุลเงินทั่วไป เช่น ดอลลาร์สหรัฐ และคุณจะไม่เป็นเจ้าของคริปโตจริง

CFD เป็นผลิตภัณฑ์ที่ใช้เลเวอเรจ หมายความว่าคุณสามารถเปิดสถานะด้วยเงินเพียงส่วนหนึ่งของมูลค่าการเทรดทั้งหมด แม้เลเวอเรจจะช่วยเพิ่มกำไร แต่ก็สามารถเพิ่มขาดทุนได้หากตลาดเคลื่อนไหวสวนทางกับคุณ

คำศัพท์สำคัญในการเทรดคริปโต

ทำความเข้าใจสเปรดของ Crypto CFD

สเปรดคือความแตกต่างระหว่างราคาซื้อและราคาขายที่เสนอสำหรับคริปโต เหมือนกับตลาดการเงินหลายแห่ง เมื่อคุณเปิดสถานะในตลาดคริปโต คุณจะเห็นราคาสองราคา:

เพื่อเปิดสถานะซื้อ คุณจะเทรดที่ราคาซื้อ ซึ่งสูงกว่าราคาตลาดเล็กน้อย

เพื่อเปิดสถานะขาย คุณจะเทรดที่ราคาขาย ซึ่งต่ำกว่าราคาตลาดเล็กน้อย

ล็อตในการเทรดคริปโตคืออะไร?

คริปโตมักถูกเทรดเป็นล็อต –ชุดของโทเค็นคริปโตที่ใช้มาตรฐานขนาดการเทรด เนื่องจากคริปโตมีความผันผวนสูง ล็อตมักจะมีขนาดเล็ก ส่วนใหญ่เป็นเพียงหนึ่งหน่วยของคริปโตหลัก อย่างไรก็ตาม บางสกุลถูกเทรดในล็อตที่ใหญ่กว่า

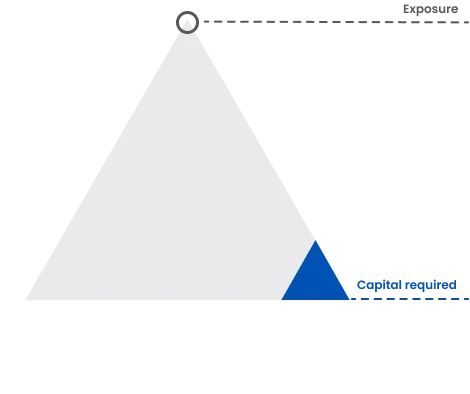

เลเวอเรจทำงานอย่างไรในการเทรดคริปโต

เลเวอเรจคือวิธีการเปิดรับความเสี่ยงในสกุลเงินดิจิทัลจำนวนมากโดยไม่ต้องจ่ายมูลค่าการเทรดเต็มจำนวนล่วงหน้า คุณเพียงวางเงินมัดจำเล็กน้อยที่เรียกว่ามาร์จิ้น เมื่อคุณปิดสถานะที่ใช้เลเวอเรจ กำไรหรือขาดทุนจะคำนวณจากขนาดเต็มของการเทรด

แม้เลเวอเรจจะช่วยเพิ่มกำไร แต่ก็เพิ่มความเสี่ยงของขาดทุนที่สูงขึ้น—รวมถึงขาดทุนที่อาจเกินมาร์จิ้นของคุณในแต่ละการเทรด ดังนั้นการเรียนรู้วิธีบริหารความเสี่ยงในการเทรดที่ใช้เลเวอเรจจึงสำคัญมาก

รูปที่ 3: แสดงภาพเลเวอเรจ

อธิบายมาร์จิ้นคริปโต

มาร์จิ้นเป็นส่วนสำคัญของการเทรดที่ใช้เลเวอเรจ คือเงินมัดจำเริ่มต้นที่คุณวางเพื่อเปิดและรักษาสถานะที่ใช้เลเวอเรจ เมื่อเทรดคริปโตด้วยมาร์จิ้น ความต้องการมาร์จิ้นจะเปลี่ยนแปลงตามโบรกเกอร์และขนาดการเทรด

มาร์จิ้นมักแสดงเป็นเปอร์เซ็นต์ของขนาดเต็มของสถานะ เช่น การเทรดบิตคอยน์ (BTC) อาจต้องวางเงินมาร์จิ้น 10% ของมูลค่าทั้งหมดเพื่อเปิดสถานะ แทนที่จะต้องวางเงิน 5,000 ดอลลาร์ คุณเพียงวางเงิน 500 ดอลลาร์

การวัดการเคลื่อนไหวของราคาคริปโตด้วยพิพส์

พิพส์คือหน่วยที่ใช้วัดการเคลื่อนไหวของราคาคริปโต หมายถึงการเคลื่อนไหวหนึ่งหลักในราคาที่ระดับที่กำหนด โดยทั่วไปคริปโตที่มีมูลค่าสูงจะเทรดในระดับ 'ดอลลาร์' เช่น การเคลื่อนไหวจากราคา 190.00 ดอลลาร์เป็น 191.00 ดอลลาร์ จะถือว่าเป็นการเคลื่อนไหวหนึ่งพิพส์ อย่างไรก็ตามคริปโตที่มีมูลค่าต่ำกว่าจะเทรดในสเกลที่แตกต่างกัน ซึ่งพิพส์อาจหมายถึงเซนต์หรือเศษส่วนของเซนต์

ก่อนเปิดการเทรด ควรอ่านรายละเอียดบนแพลตฟอร์มเทรดของ TMGM' เพื่อให้เข้าใจระดับที่ใช้วัดการเคลื่อนไหวของราคา

เริ่มต้นกับการเทรด Crypto CFD ของ TMGM'

เปิดบัญชี: ลงทะเบียนกับ TMGM และทำการยืนยันตัวตน

ฝากเงิน: เติมเงินในบัญชีของคุณด้วยวิธีการชำระเงินที่ปลอดภัย

เลือกสกุลเงินดิจิทัล: เลือกจาก Crypto CFDs ที่มีให้

วิเคราะห์ตลาด: ใช้เครื่องมือของ TMGM' เพื่อประเมินโอกาสการเทรด

กำหนดขนาดสถานะ: กำหนดเลเวอเรจและความต้องการมาร์จิ้นของคุณ

บริหารความเสี่ยง: ตั้งระดับหยุดขาดทุนและทำกำไร

ดำเนินการเทรด: เปิดสถานะซื้อหรือขายตามมุมมองตลาดของคุณ

ติดตามและปิดสถานะ: ติดตามสถานะและปิดเมื่อเหมาะสม

การบริหารความเสี่ยงในการเทรดคริปโต

ธรรมชาติที่ผันผวนของตลาดคริปโตทำให้การบริหารความเสี่ยงเป็นสิ่งจำเป็น:

ใช้คำสั่งหยุดขาดทุนเพื่อจำกัดการขาดทุนที่อาจเกิดขึ้น

พิจารณาใช้คำสั่งหยุดแบบรับประกันเพื่อป้องกันเพิ่มเติมในช่วงเหตุการณ์ตลาดสำคัญ

รักษาระดับเลเวอเรจให้อยู่ในระดับเหมาะสมเพื่อหลีกเลี่ยงการเปิดรับความเสี่ยงเกินควร

กระจายการลงทุนในคริปโตและสินทรัพย์ประเภทอื่น

อย่าเสี่ยงเกินกว่าที่คุณจะรับได้

ติดตามข่าวสารและพัฒนาการของตลาดอย่างสม่ำเสมอ

คอร์สและเครื่องมือเรียนรู้การเทรดคริปโตฟรี

การเป็นนักเทรดที่ประสบความสำเร็จต้องใช้ทักษะ ความรู้ และการฝึกฝน TMGM มีทุกอย่างที่คุณต้องการเพื่อไปถึงจุดนั้น พร้อมคอร์สและสัมมนาออนไลน์ฟรีมากมาย นอกจากนี้ยังมี บัญชีทดลองฟรี ที่มีเงินเสมือนจริง 100,000 ดอลลาร์สหรัฐ เพื่อช่วยสร้างความมั่นใจในสภาพแวดล้อมที่ไม่มีความเสี่ยง

เรายังมีข้อมูลเชิงลึกเกี่ยวกับกลยุทธ์การเทรด การวิเคราะห์ตลาด, และบทความข่าวสำหรับทุกระดับประสบการณ์— ดังนั้นไม่ว่าคุณจะเป็นมือใหม่หรือเทรดเดอร์มืออาชีพ TMGM มีสิ่งที่เหมาะกับคุณ