What is an Index? The Foundation of Index Trading

A stock index is a mathematical computation that tracks a selected stock group's performance.

Indices typically represent:

Entire national economies

Specific industrial sectors

Broad market performance indicators

Comprehensive snapshots of economic health

The primary purpose of an index is to provide a standardized measurement of market movements and economic trends.

Historical Evolution of Index Trading

Charles Dow pioneered index tracking in 1896 with the Dow Jones Industrial Average.

The original index comprised just 12 companies, starkly contrasting today's comprehensive market representations.

Modern indices like the S&P 500 now encompass hundreds of companies, reflecting complex economic ecosystems.

Index Trading Advantages: Diversification Made Simple

Index trading offers instant exposure to multiple companies within a single transaction.

Investors can mitigate individual stock risks through broad market representation.

Lower volatility compared to individual stock trading provides more stable investment opportunities.

Flexible Trading Strategies in Index Trading

Multiple trading timeframes accommodate different investor preferences:

Short-term scalping

Day trading

Swing trading

Long-term investment approaches

Index trading allows both long and short-positioning strategies.

Lower transaction costs make index trading an attractive option for cost-conscious investors.

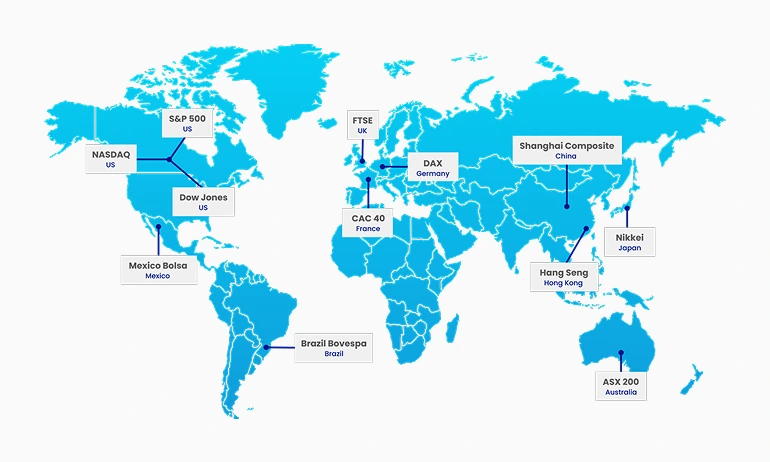

Global Indices: A World of Opportunities

United States Market Indices

Dow Jones Industrial Average: Represents 30 largest US companies

S&P 500: Tracks 500 leading corporate performers

Nasdaq 100: Focuses on technology sector leaders

European Market Indices

FTSE 100: United Kingdom's top corporate performers

DAX 30: German market leadership representation

CAC 40: French blue-chip stock performance

Euro Stoxx 50: Comprehensive Eurozone economic indicator

Asia-Pacific Market Indices

Nikkei 225: Japanese market performance tracker

ASX 200: Australian market comprehensive view

HSI 50: Hong Kong market representation

SSE Composite: Chinese market economic indicator

Index Trading Strategies: Selecting Your Approach

Scalping Strategy

Trades are completed within minutes

Requires rapid decision-making and market understanding

Potential for multiple small profit opportunities

Day Trading Approach

Index trading completed within a single market session

Requires active market monitoring

Suits traders with real-time availability

Swing Trading Method

Index trading spanning multiple days to weeks

Less intensive market management

Ideal for fundamental analysis enthusiasts

Risk Management in Index Trading

Implement consistent stop-loss strategies

Understand leverage implications thoroughly

Diversify across multiple indices

Stay continuously informed about global economic developments

Commit to ongoing financial education

Embarking on Your Index Trading Journey

Index trading is a strategic approach to understanding global economic movements.

It gives investors a comprehensive view of market performance beyond individual stock analysis.

Successful index trading requires continuous learning, market understanding, and strategic planning.

Steps to Develop Index Trading Skills

Research and Education

Understand the fundamentals of index trading.

Study market dynamics and economic indicators.

Learn about different trading strategies and risk management.

Platform Selection

Choose a reliable trading platform with comprehensive index offerings.

Evaluate the trading tools, resources, and support that are available.

Consider a demo account for practical learning.

Practical Application

Start with conservative trading approaches.

Monitor and analyze market performance.

Continuously refine your trading strategy.

Manage risks through diversification and informed decision-making.

TMGM: Comprehensive Index Trading Platform

Available Indices for Trading

TMGM provides access to a diverse range of indices across global markets.

Includes key indices from US, European, and Asia-Pacific markets.

Offers traders the opportunity to explore multiple market segments.

Supports trading on major indices:

US Stock Indices: DJ30, S&P 500, Nasdaq 100

European Indices: FTSE 100, GER 40, CAC 40

Asia-Pacific Indices: Nikkei 225, ASX 200

Index trading offers a structured approach to participating in global financial markets. By developing skills, understanding market dynamics, and maintaining a disciplined approach, traders can effectively navigate the complexities of index trading.

Whether you're a beginner seeking to understand market dynamics or an experienced trader looking to expand your portfolio, TMGM's platform provides the resources, tools, and support necessary to achieve your investment goals.