热门文章

- Cardano rises by over 2% as prices across the cryptocurrency market react to softer-than-expected US inflation.

- ADA holds above the 50 and 100 EMAs on the 4-hour chart, with bulls eyeing a short-term breakout above $0.42.

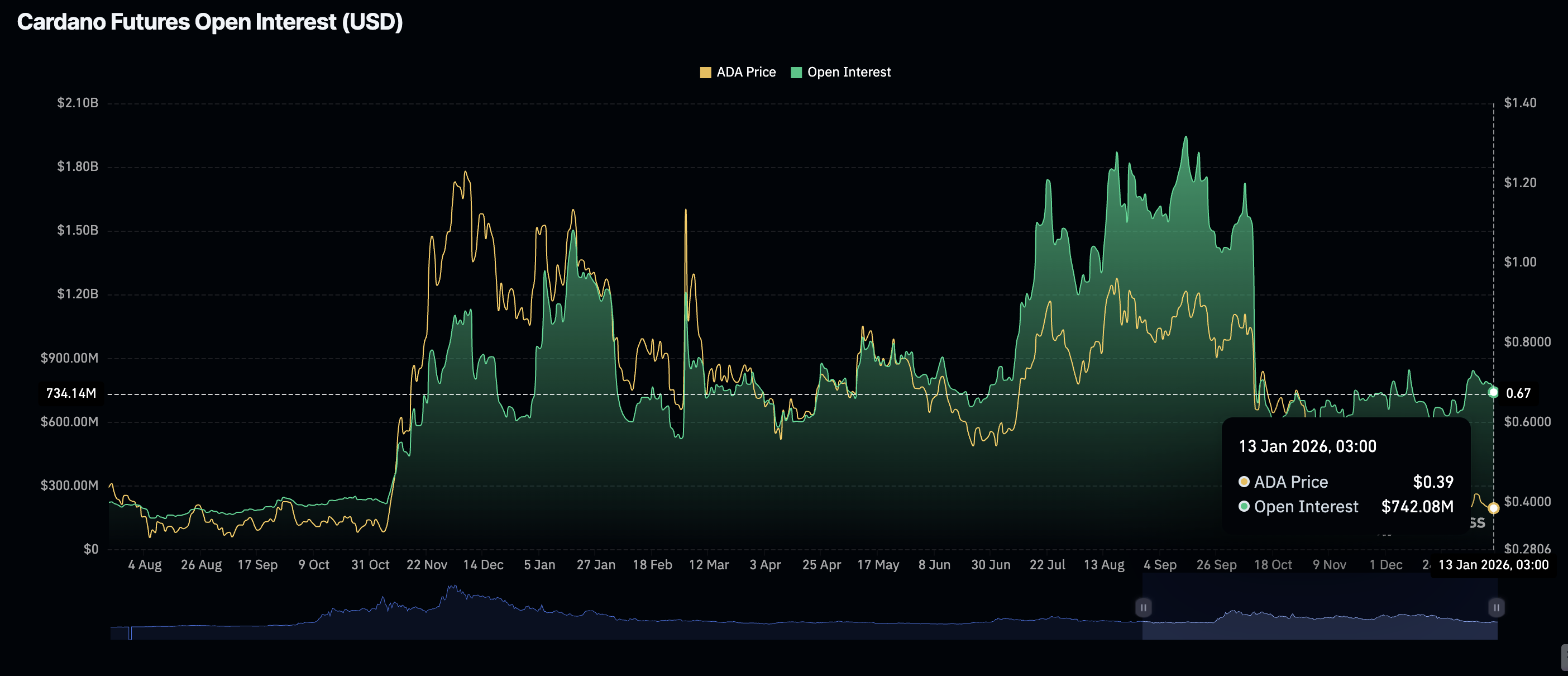

- Retail interest in ADA remains low, as reflected by futures Open Interest declining to $742 million.

Cardano (ADA) is edging up above $0.40 at the time of writing on Tuesday, reflecting improving sentiment across the crypto market. ADA’s rebound from an intraday low of $0.38 has been fueled by improving optimism, following softer-than-expected core inflation in the United States (US).

Cardano rises, driven by softer US inflation

The US Consumer Price Index (CPI) report shows that headline inflation increased by 2.7% annually in December, in line with forecasts.

The Bureau of Labor Statistics (BLS) report highlighted that core inflation rose 2.6%, softer than the expected 2.7%, indicating mild cooling in underlying price pressures excluding food and energy.

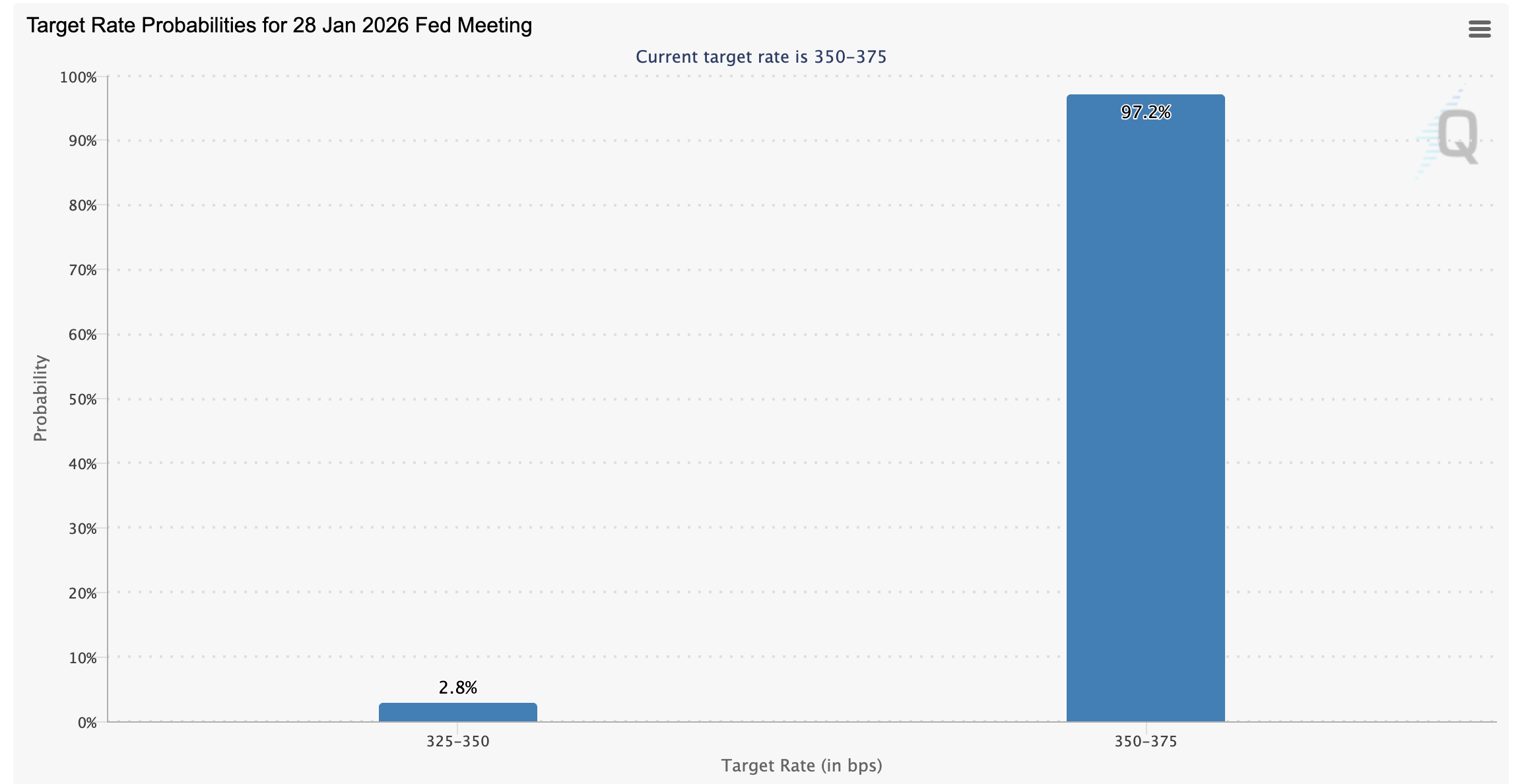

Cryptocurrency prices rose slightly after the CPI report, with ADA rising above $0.40. If the rebound steadies, interest in crypto assets could pick up ahead of the Federal Reserve (Fed) policy meeting at the end of the month; however, the market has partly priced in the possibility that the Fed will leave rates unchanged in the 3.50%-3.75% range.

Meanwhile, retail interest in Cardano has remained significantly low since the October 10 flash crash, with recovery attempts quickly snuffed out. CoinGlass data shows futures Open Interest (OI) averaging $742 million on Tuesday, down from $780 million on Monday and $844 million on January 5.

The ADA futures OI averaged $1.51 billion on October 10, after peaking at a record $1.95 billion in mid-September. If the downtrend persists, it suggests that traders are losing confidence in the token’s ability to rebound and maintain an uptrend. A steady increase in OI is required to support price increases, encouraging investors to lean more into risk.

Technical outlook: Cardano reclaims key support

Cardano rises above $0.40 at the time of writing on Tuesday, supported by positive sentiment driven by softer US inflation. The token also holds above the 100 and 50 Exponential Moving Averages (EMAs), which are poised to provide short-term support around $0.39.

Based on the Relative Strength Index (RSI), which is rising to 54 on the 4-hour chart, the path of least resistance is upward, with higher RSI readings likely to boost recovery momentum.

The Moving Average Convergence Divergence (MACD) indicator on the same chart highlights slight positive divergence. Traders would be prompted to increase their risk exposure if the histogram above the mean line continues to expand.

A close above the 200-day EMA at $0.39 would reinforce a short-term bullish grip and possibly increase the odds of an extended breakout above $0.42. ADA should increase by almost 10% to reach its January high of $0.437.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.