POPULAR ARTICLES

- Ethereum struggles to hold $3,500 as risk-off sentiment and fear grip the broader crypto market.

- ETF outflows and shrinking retail demand drag Ethereum down, as the sell-off continues.

- Ethereum's recovery could be an uphill task considering the downtrending RSI and the MACD sell signal.

Ethereum (ETH) remains largely in bearish hands, trading marginally above $3,500 on Tuesday. The leading smart contracts token has extended its decline for the second consecutive day, reflecting the negative sentiment in the wider crypto market.

A weak derivatives market aligns with the risk-off sentiment, as traders increasingly retreat to the sidelines amid extreme volatility.

Ethereum recovery elusive as institutional and retail demand dwindles

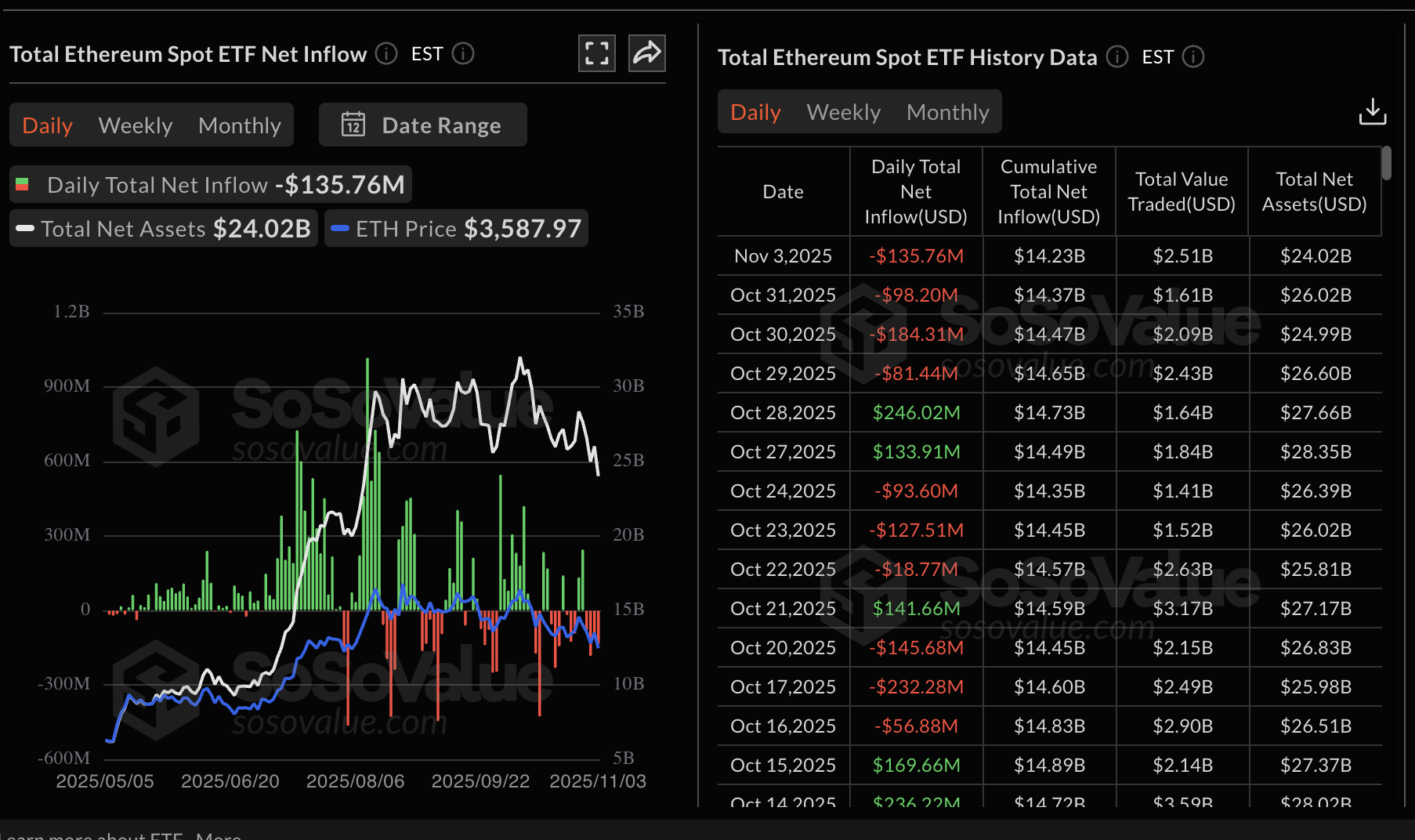

Institutional investors have taken a step back from seeking exposure to Ethereum spot Exchange Traded Funds (ETFs). According to SoSoValue, US-listed ETFs experienced outflows of $136 million on Monday, bringing the cumulative net inflows to $14.23 billion and net assets to approximately $24 billion.

None of the nine ETH ETFs recorded net inflows. BlackRock's ETHA led the outflows at $82 million, followed by Fidelity's FETH with $25 million.

Ethereum ETF stats | Source: SoSoValue

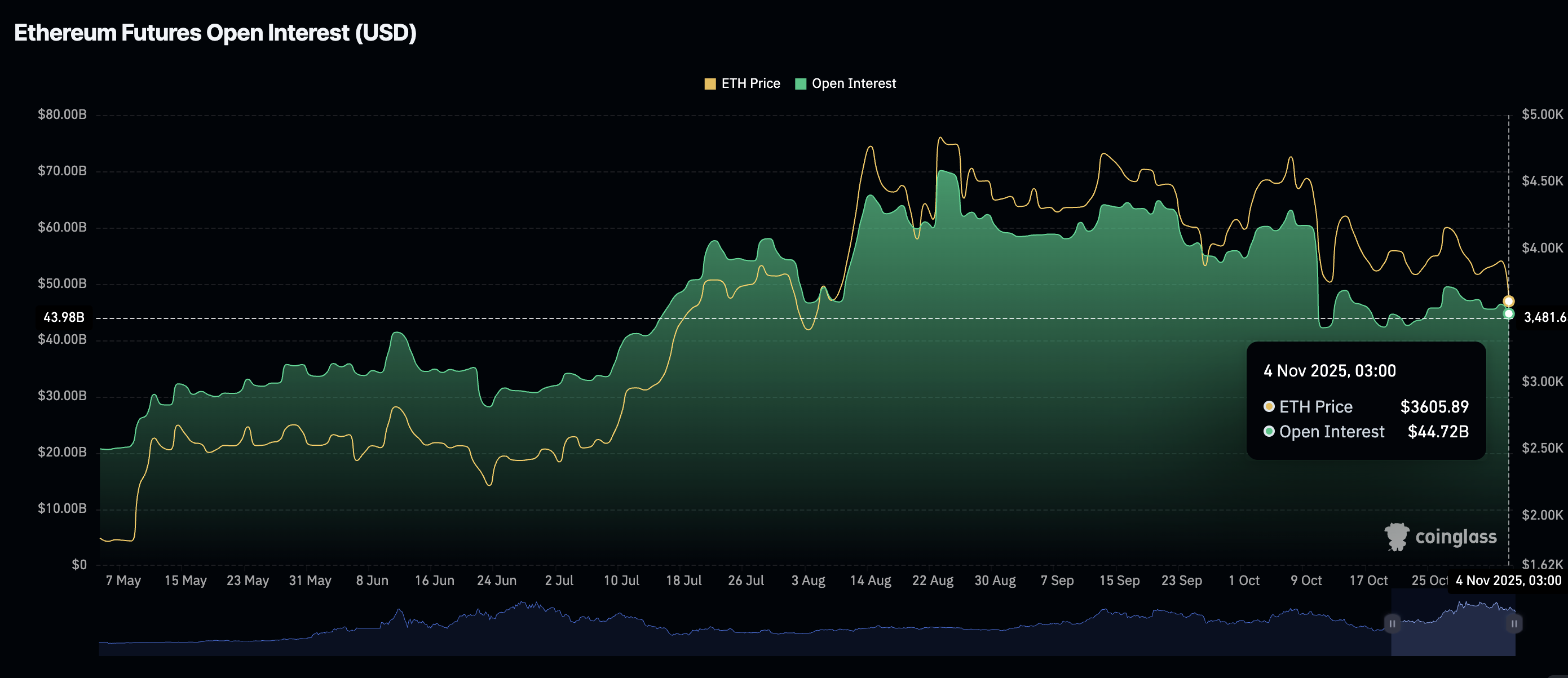

Retail demand for Ethereum has also taken a significant back foot, with the futures Open Interest (OI) falling to $44.72 billion from the October peak of approximately $63 billion.

OI refers to the notional value of outstanding futures contracts, which helps gauge interest and investor confidence in the asset. A persistent decline indicates that traders are closing their long positions in favor of short positions, contributing to selling pressure.

Ethereum futures Open Interest | Source: CoinGlass

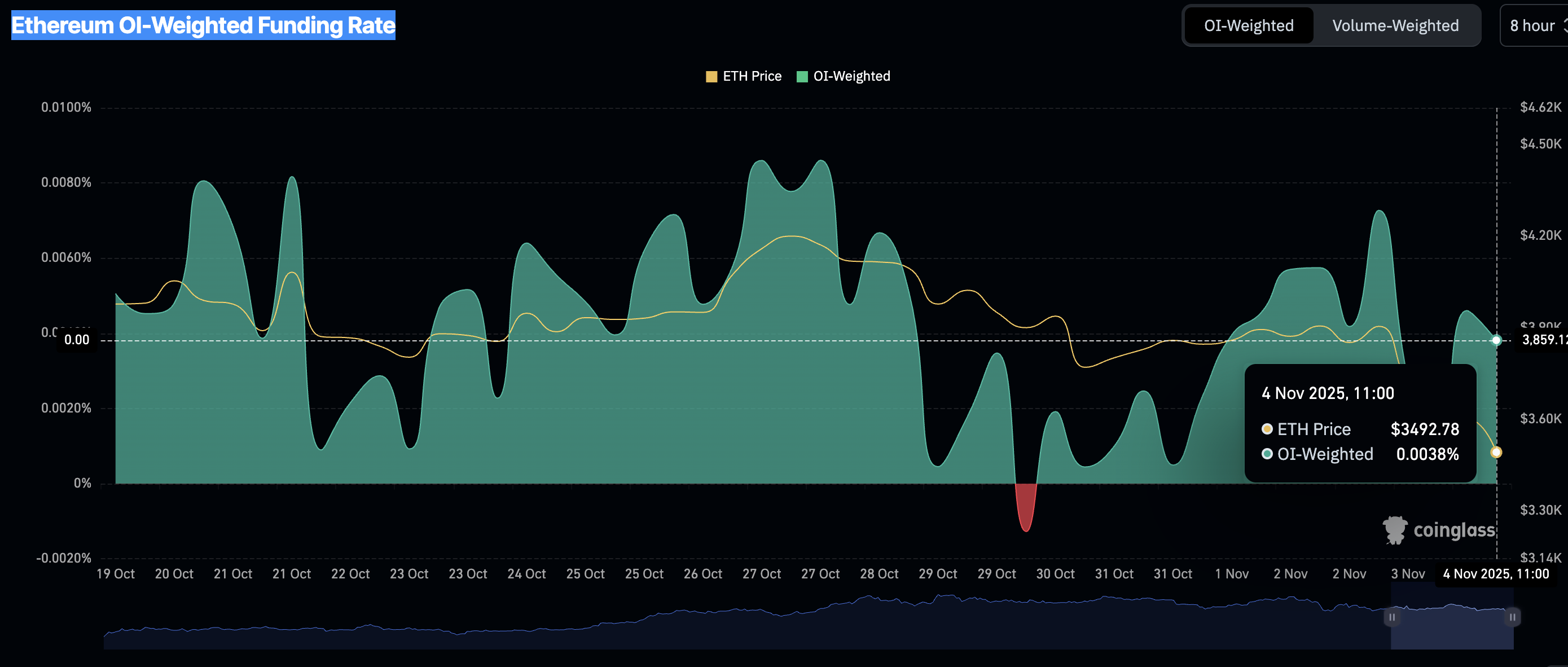

The OI-weighted funding rate, which averages 0.0038% on Tuesday, supports the risk-off sentiment surrounding Ethereum. As traders increasingly pile into short positions, it becomes difficult to sustain recovery. The significantly suppressed OI-weighted funding rate could explain the steady price drop since the October 10 sell-off.

Ethereum OI-Weighted Funding Rate | Source: CoinGlass

Technical outlook: Ethereum sell-off lingers amid bearish signals

Ethereum is trading around $3,500 at the time of writing on Tuesday, largely weighed down by a weak retail market, low institutional demand, and a lack of price catalysts to sustain the recovery.

Technical indicators, including the Moving Average Convergence Divergence (MACD), signal a bearish trend on the daily chart. The MACD has maintained a sell signal since Monday, with the blue line remaining below the red line, suggesting investors reduce their exposure in favor of short positions.

The Relative Strength Index (RSI) is at 33 and falling toward oversold territory within the same daily time frame, suggesting that bearish momentum could persist in the short term.

ETH/USDT daily chart

If Ethereum closes the day below the round-number support at $3,500, a 4% drop to $3,350 may follow. This is a support area previously tested in early August. Still, a knee-jerk reversal could occur if bulls buy the dip, further strengthening the tailwind to push ETH above the 200-day Exponential Moving Average (EMA) at $3,606.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.