热门文章

Ethereum price today: $3,050

- Ethereum could post its first weekly gain in five weeks, as buying pressure has begun to outweigh selling.

- Ethereum open interest remained stable, with short liquidations slightly dominating long liquidations.

- ETH is testing the $3,100 resistance after reclaiming the $2,850 key level.

Ethereum (ETH) is on track to mark its first weekly gain since October after showing signs of recovery this week.

The weekly average of ETH exchange netflow plunged to its lowest level in over a month. The trend accelerated on Friday, with outflows on the day outweighing inflows by nearly 180K ETH.

- All Exchanges (12)-1764363091239-1764363091245.png)

Exchange net outflows indicate investors are increasingly withdrawing assets from exchanges to private wallets for potential long-term holding.

Institutional investors also joined in the buying activity as ETH exchange-traded funds (ETFs) have seen four consecutive days of net inflows totalling $292 million, per SoSoValue data. The products are on track to record their first weekly inflow in November after ending an eight-day outflow streak last Friday.

On-chain activity is also returning, as Ethereum active addresses have begun trending upward. Notably, the metric spiked above 601,000 on Thursday, its highest level in 2025. The rise shows that investors may be returning to using DeFi protocols and other on-chain platforms.

-1764363128463-1764363128465.png)

Derivatives and on-chain data signal a bearish exhaustion

On the derivatives side, Ethereum's futures open interest remained fairly stable, rising slightly to 12.1 million ETH on Friday, per Coinglass data. Liquidations slowed down considerably in the week, with liquidated short positions outweighing longs — a stark contrast from previous weeks. This suggests potential exhaustion among bearish traders.

From an on-chain perspective, the risk-off trend paused after ETH fell to the realized price or average cost basis of accumulation addresses — wallets with no record of selling activity — around $2,750-$2,850.

-1764363149808-1764363149809.png)

The same price range marks the average cost basis of whales within the 10K-100K ETH cohort.

Ethereum Price Forecast: ETH tackles $3,100 resistance

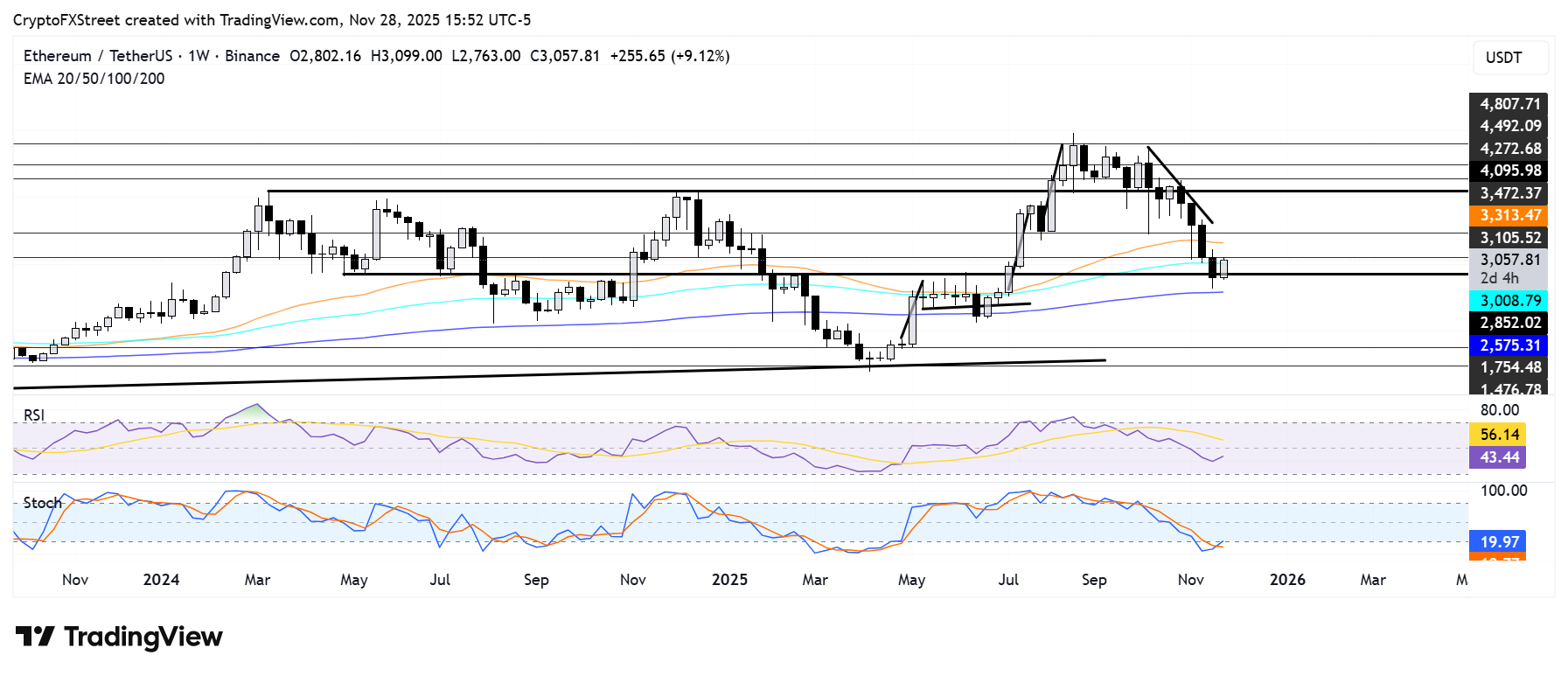

On the weekly chart, Ethereum could post its first weekly gains in five weeks after bouncing off the 200-week Exponential Moving Average (EMA) and reclaiming the $2,850 support.

The top altcoin is now facing resistance at $3,100, near the 100-week EMA. A firm rise above $3,100 could see ETH test the $3,470 level, but it has to clear the 50-week EMA on the way up.

The Relative Strength Index (RSI) has paused its downtrend while the Stochastic Oscillator (Stoch) is on the verge of crossing from oversold territory, signaling a decline in dominant bearish momentum.