POPULAR ARTICLES

- XRP eyes a short-term breakout above $2.50, supported by improving sentiment in the broader crypto market.

- Wallets holding between 10 million and 100 million XRP are accumulating tokens, signaling an increasing risk appetite.

- Retail demand for XRP remains significantly subdued, with the Open Interest falling to $3.67 billion.

Ripple (XRP) is trading slightly below $2.50 at the time of writing on Thursday, after marking an intraday high at $2.52 buoyed by positive sentiment in the broader cryptocurrency market.

Bullish sentiment is poised to recover after United States (US) President Donald Trump signed legislation that ended the longest government shutdown in the country's history.

Trump said that the US "can never let this happen again," adding, "This is no way to run a country." XRP, Bitcoin (BTC), Ethereum (ETH), and other risk assets are edging higher as investors respond positively to the news.

Whales increase exposure, bolstering XRP's bullish outlook

Large volume holders of XRP have, since the October 10 deleveraging event, which wiped out over $19 billion in crypto assets in a single day, increased their risk appetite.

Santiment data shows that wallets holding between 10 million XRP and 100 million XRP have grown to account for 13.43% of the total supply from 12.25% on October 10.

The steady accumulation suggests that investors are confident in XRP's ability to recover, while the larger ecosystem expands through adoption. Higher demand predisposes XRP for a steady uptrend as available supply shrinks.

[14-1763040373954-1763040373955.45.44, 13 Nov, 2025].png)

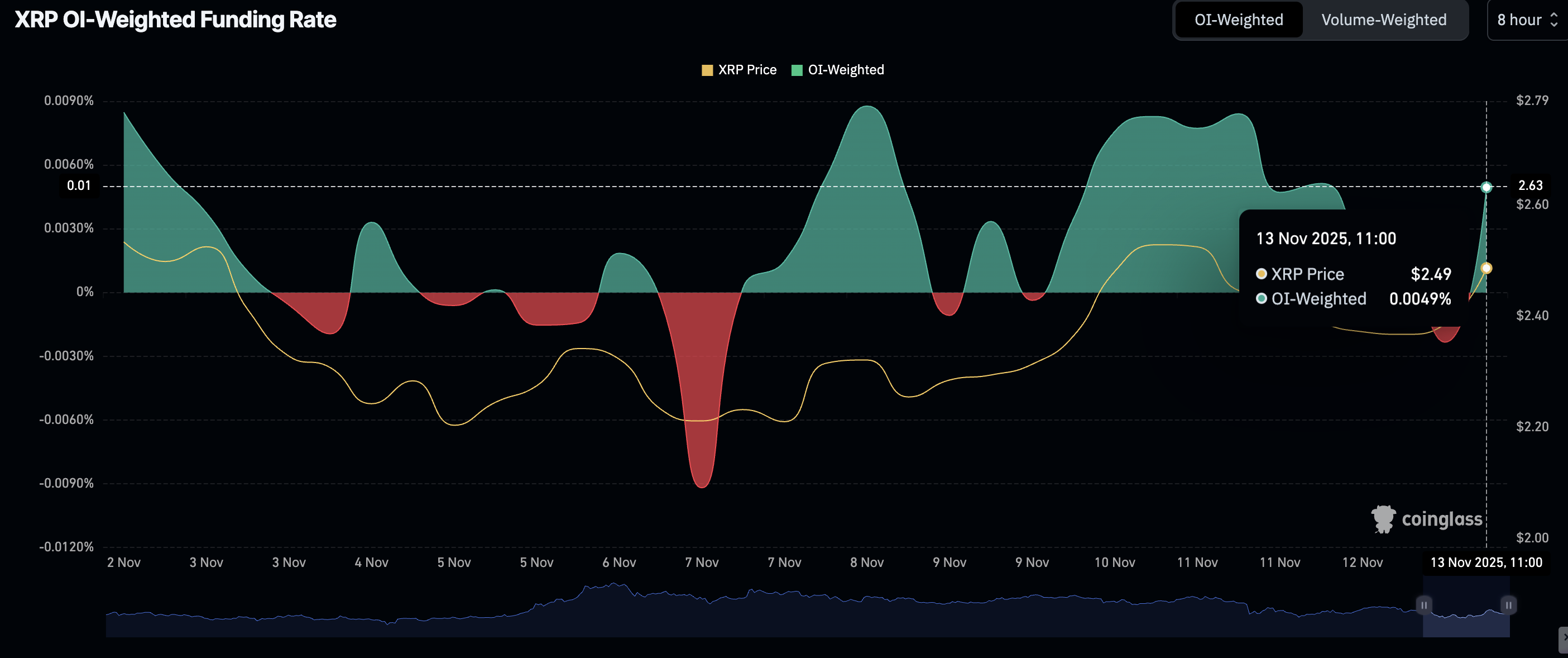

However, retail demand for XRP has not recovered since mid-October, characterised by a weak derivatives market. CoinGlass data shows the futures Open Interest (OI) averaging $3.67 billion on Thursday, down from $3.95 billion on Wednesday and $4.11 billion on Tuesday.

A steady increase in OI is required to support XRP's short-term recovery, indicating that investors have confidence in the token and the ecosystem and are willing to increase their risk exposure.

However, the OI-Weighted Funding Rate metric is at 0.0049%, up from -0.0023% earlier in the day, suggesting that traders are starting to pile into long positions amid emerging opportunities.

Technical outlook: XRP eyes recovery momentum in the short-term

XRP is trading above $2.40 at the time of writing on Thursday, supported by steady demand from large-volume holders and improving sentiment in the broader cryptocurrency market.

A buy signal maintained by the Moving Average Convergence Divergence (MACD) indicator since Monday underpins XRP's short-term bullish outlook. If the blue MACD line holds above the red signal line as the indicator generally rises, risk appetite will increase, driving risk exposure.

The Relative Strength Index (RSI) is at 51, indicating a bullish signal and an increased likelihood of a sustained uptrend. Key areas of interest for traders include the 50-day Exponential Moving Average (EMA) at $2.54, the 200-day EMA at $2.57 and the 100-day EMA at $2.64, all of which highlight vital resistance levels.

Still, the SuperTrend indicator remains above XRP's price, pointing to persistent overhead pressure. This tool uses the Average True Range (ATR) to measure market volatility; a sell signal prompts investors to cut exposure, further adding to selling pressure. Early profit-taking may dampen the uptrend, triggering a sell-off toward $2.24, a support tested on Sunday, and $2.07, tested on November 4.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.