POPULAR ARTICLES

- XRP slips nearly 3% on Thursday, but holds the 50-day EMA as fear grips the broader cryptocurrency market.

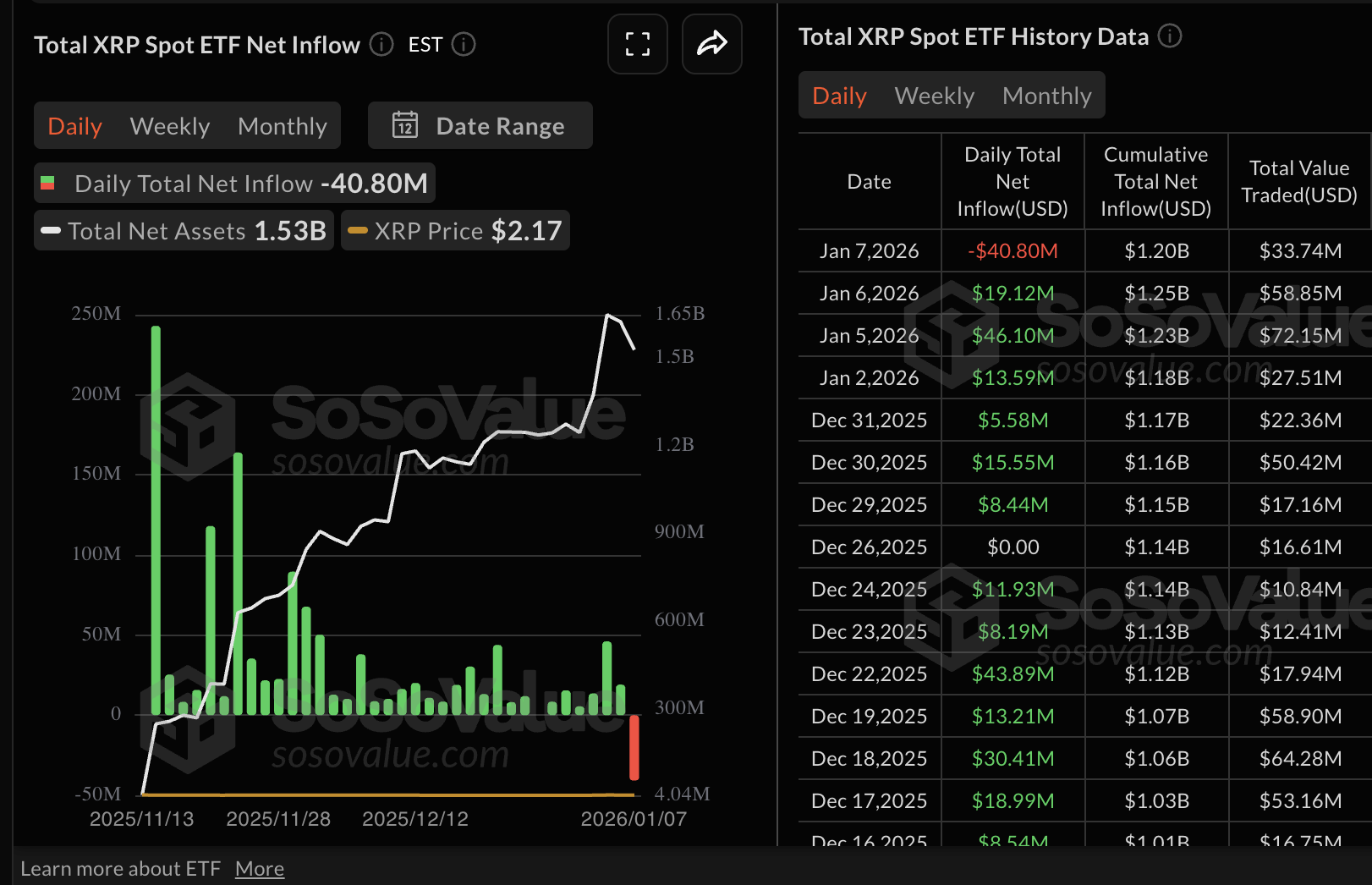

- Institutional demand falters, with XRP ETFs registering their first outflow since their launch.

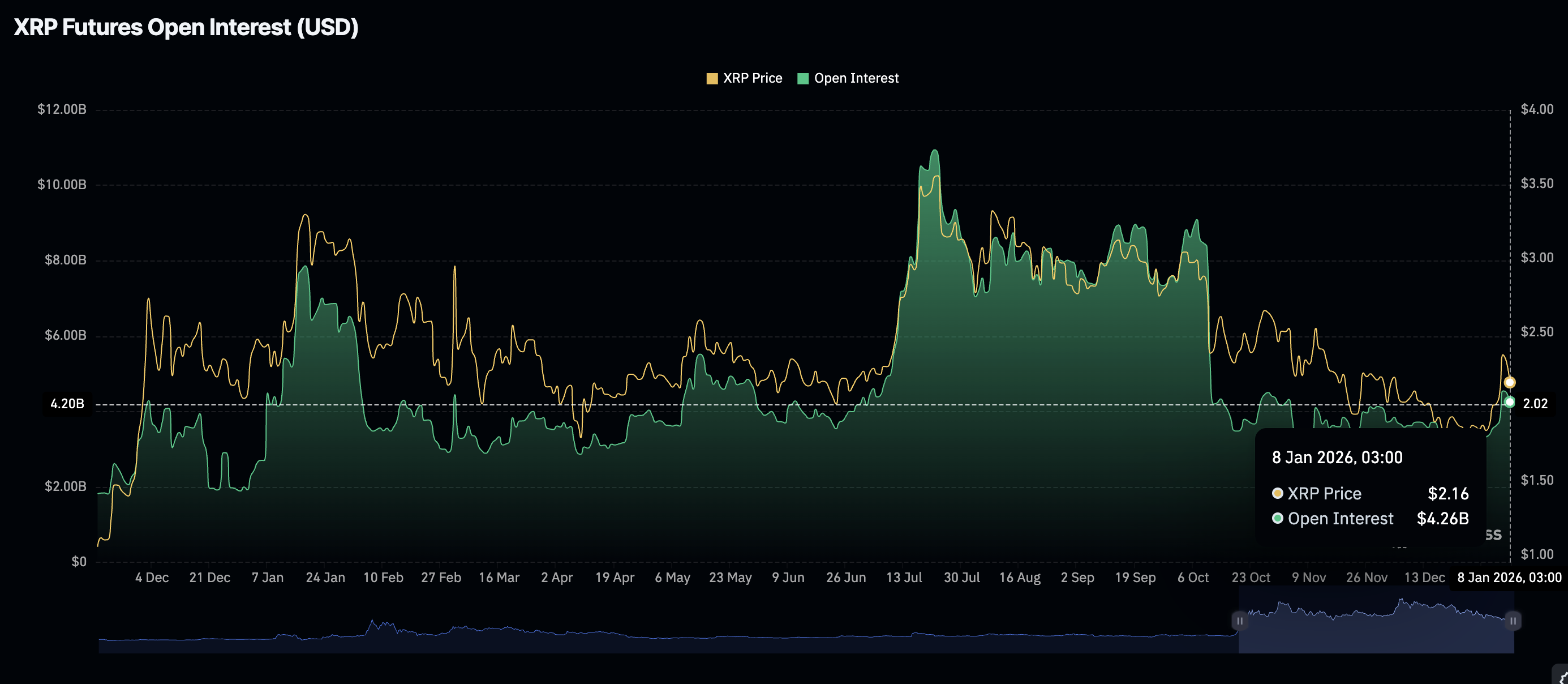

- XRP derivatives market faces declining retail interest as futures Open Interest falls to $4.26 billion.

Ripple (XRP) is trading down for the third consecutive day on Thursday amid escalating volatility in the cyrptocurrency market. After peaking at $2.41 on Tuesday, its highest print since November 14 amid the early-year rally, XRP has quickly ran into aggressive profit-taking.

Sellers have since taken control, with the cross-border payments token attempting to stabilize just above the psychological $2.00 handle. The broader crypto outlook has also deteriorated, with Bitcoin (BTC) briefly sliding below $90,000.

Market sentiment has also flipped decisively into fear, with the Crypto Fear & Greed Index by Alternative sliding to 28 after failing to sustain a move above 42 on Wednesday. Its sudden reversal underscores the loss of bullish momentum.

If $2.00 gives way, downside risks may intensify, with the November support at $1.77 and the April low near $1.61 emerging as the next key demand zones.

XRP risks extending decline as retail and institutional demand softens

XRP spot Exchange Traded Funds (ETFs) recorded nearly $41 million in outflows on Wednesday after maintaining stellar performance since their debut in November. The cumulative inflow now stands at $1.2 billion while net assets average $1.53 billion, according to SoSoValue data.

Softening demand for ETFs can be attributed to deteriorating sentiment, which often hinders price increases, as investors prioritise risk aversion. The next few days could provide insight into the overall trend, especially given XRP’s technical structure's weakness.

The derivatives market has also mirrored the risk-off sentiment that has been thawing in the broader cryptocurrency market. CoinGlass data shows that futures Open Interest (OI) has fallen sharply to $4.26 billion on Thursday from $5.51 billion the previous day and $4.55 billion on Tuesday.

A declining OI indicates that retail is losing confidence in XRP, which leaves prices at risk of rising selling pressure.

Technical outlook: XRP testing critical support

XRP holds above the rising 50-day Exponential Moving Average (EMA) at $2.07, but remains capped below the 100-day EMA at $2.22 and the 200-day EMA at $2.34. The Relative Strength Index (RSI) has declined to 54 from overbought territory on the daily chart, suggesting easing bullish momentum.

The Moving Average Convergence Divergence (MACD) on the same chart stands above the signal line and the zero line, yet the positive histogram is contracting, which aligns with the broader corrective trend in the crypto market.

Looking up, a daily close above $2.22 (100-day EMA) would open the path toward $2.33 (200-day EMA), while a break through the descending trend line near $2.40 would strengthen the medium-term bullish case.

On the downside, initial support sits at the 50-day EMA at $2.07. A break below this level would put the recovery at risk. Overall, XRP remains in a choppy range amid a weakening technical structure that could pave the way for losses toward the November trough at $1.77 and April's low of $1.62.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

(The technical analysis of this story was written with the help of an AI tool)