热门文章

- Solana price trades lower on Thursday after rejecting the upper trendline of its falling wedge pattern.

- The Federal Reserve’s cautious, hawkish rate cut in December weighs on risk assets, such as SOL.

- On-chain data signals bearish momentum, with Spot Taker CVD showing clear sell-side dominance and rising retail activity.

Solana (SOL) price is trading below $130 at the time of writing on Thursday, after being rejected at the upper boundary of its falling wedge pattern. The broader market weakness following the Federal Reserve’s hawkish rate cut has added to downside momentum. Additionally, SOL's on-chain data suggest further downside, with rising sell-side dominance.

Fed’s cautious rate cut weighs on riskier assets

The broader crypto market softened after the Federal Open Market Committee (FOMC) meeting on Wednesday. In a widely expected move, the US Federal Reserve (Fed) lowered interest rates by 25 basis points to 3.50%-3.75% at the end of its two-day policy meeting but signaled a likely pause in January.

Adding to the cautious tone, policymakers projected only a one-quarter-percentage-point cut in 2026, the same outlook as in September, which tempered market expectations and contributed to short-term pressure on risk assets. This hawkish rate cut and the Fed’s cautious stance triggered a slight risk-off sentiment, weighing on riskier assets, with major cryptocurrencies such as Bitcoin, Ethereum, Ripple, and Solana trading lower as of Thursday.

On-chain data shows bearish signs

CryptoQuant data, as shown in the graph below, highlights selling pressure on Solana. The Taker CVD (Cumulative Volume Delta) for SOL turned negative on Wednesday. This indicator measures the cumulative difference between market buy and sell volumes over three months. When the 90-day CVD is positive and increasing, it suggests the Taker Buy Dominant Phase, while a negative and decreasing value indicates the Taker Sell Dominant Phase.

(2)-1765430722962-1765430722964.png)

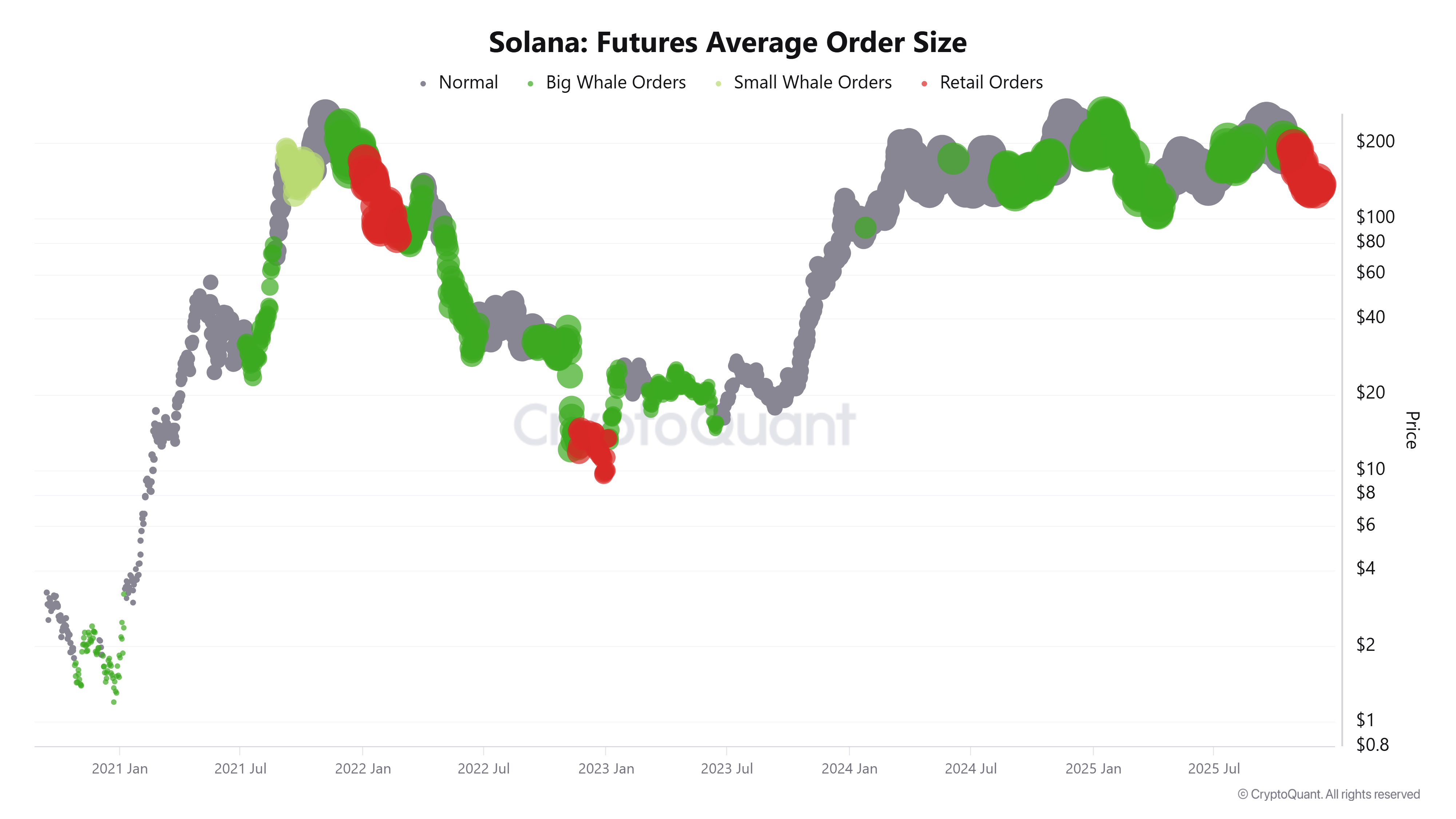

CryptoQuant’s Futures Average Order Size indicator — which tracks the average size of executed SOL futures trades — shows a rise in smaller order sizes, signaling increased retail activity in the market that does not bode well with the SOL price.

Solana Price Forecast: SOL faces rejection from key level

Solana price faced rejection from the upper trendline boundary of the falling wedge pattern (drawn ) on Wednesday. As of Thursday, SOL is down 3.87% to around $130.99.

If SOL continues its downward trend, it could extend the decline toward the November 21 low of $121.66.

The Relative Strength Index (RSI) on the daily reads 40, below its neutral level of 50 and pointing downward, indicating bearish momentum.

However, if SOL recovers, it could extend the recovery toward the 50-day EMA at $151.60.