POPULAR ARTICLES

- BIT Mining announced plans to raise $300 million for a SOL reserve.

- The company intends to convert its current crypto holdings to SOL to strengthen its new reserve.

- SOL could rally to $183 if it validates an inverted H&S pattern.

Solana (SOL) rose 4% on Thursday after crypto mining company BIT Mining (BTCM) announced a treasury shift to Solana worth up to $300 million.

Solana sees gains as BIT Mining shares interest in SOL treasury

NYSE-listed BIT Mining announced plans to raise between $200 million and $300 million in different phases to establish a Solana treasury.

The company aims to convert its current crypto holdings into Solana as part of its new shift, but it did not specify how much it currently holds in its reserves.

"We are excited to take this bold step into what we believe is one of the most dynamic and promising ecosystems in the blockchain space," said Xianfeng Yang, CEO of BIT Mining, in a press release on Thursday.

BIT Mining claims it aims to leverage Solana's infrastructure and growing developer community to "drive innovation, enhance ecosystem integration, and create sustainable shareholder value." It also shared its intentions of operating validator nodes to support the Solana network and earn staking rewards.

The move places BIT Mining alongside other firms that have shifted their treasury plan towards SOL, mirroring Strategy's (formerly MicroStrategy) treasury accumulation approach with Bitcoin. Companies that have established a Solana treasury in recent months include Classover Holdings, SOL Strategies, DeFi Development Corporation and Upexi.

BIT Mining's stock skyrocketed over 150% on Thursday following the announcement before seeing a 14% decline in after-hours trading.

Solana Price Forecast: SOL could rally to $183 if it validates inverted H&S pattern

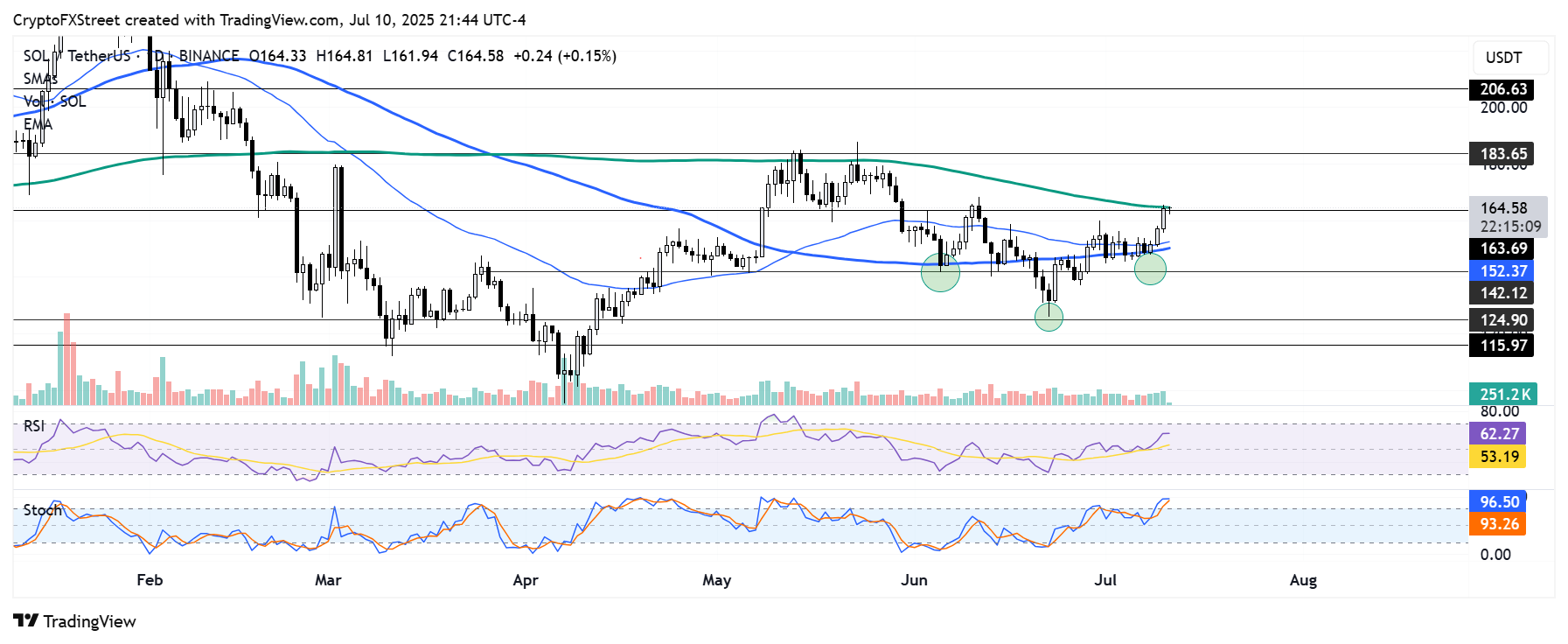

SOL climbed above the 100-day Simple Moving Average (SMA) and the 50-day Exponential Moving Average (EMA), rising toward the $163 resistance, which the 200-day SMA strengthens.

SOL/USDT daily

A move above $163 will see it validate an inverted Head-and-Shoulders (H&S) pattern, which could stretch its price over 12% toward the next key resistance level at $183. A rejection at $163 could see it decline back toward $142.

The Relative Strength Index (RSI) is above its neutral level, while the Stochastic Oscillator (Stoch) is in the overbought region. This indicates a dominant bullish momentum but with potential for a short-term pullback due to overbought conditions in the Stoch.

A daily candlestick close below the 100-day SMA will invalidate the bullish thesis.