热门文章

- Uniswap rises by more than 7% on Thursday, as sentiment around the token improves ahead of the network’s vote.

- Uniswap’s community votes on a unification proposal that would burn 100 million UNI.

- The proposal, if passed, will pave the way for Uniswap Lab’s alignment with Uniswap governance amid protocol fee rollout.

Uniswap (UNI) is trending up above $5.00 at the time of writing on Thursday, as sentiment surrounding the native Decentralised Exchange (DEX) token improves ahead of a much-awaited proposal vote.

Uniswap votes to burn 100 million UNI and governance unification

Uniswap Labs and the Uniswap Foundation's joint governance proposal, seeking to turn on protocol fees and align incentives across the ecosystem, has advanced to the final governance vote.

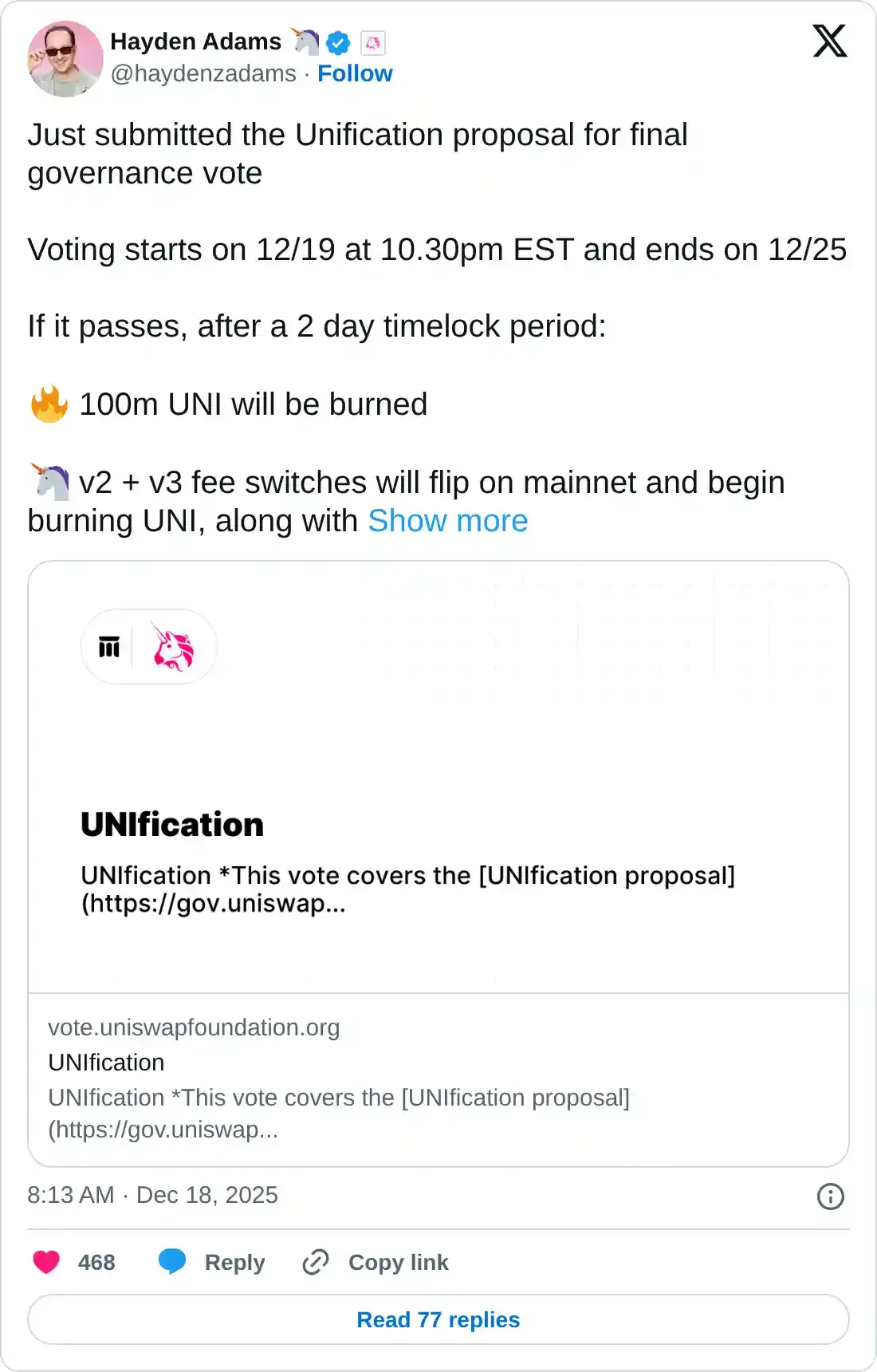

Hayden Adams, the co-founder of Uniswap, stated via X that the voting process, which starts on Friday and ends on December 25, could pave the way for a raft of changes on the network, including the burning of 100 million UNI.

The proposal would establish a long-term model for managing the Uniswap ecosystem, including protocol usage, UNI token burns, and Uniswap Labs and how they contribute to network development and growth. If passed, the proposal will lay the groundwork to turn on Uniswap protocol fees, which will then be used to burn UNI.

The proposal focuses on “driving protocol development and growth, including turning off our interface, wallet, and API fees… Move ecosystem teams from the Foundation to Labs, with a shared goal of protocol success, with growth and development funded from the treasury,” as stated in a blog post.

Under the new unification model, the proposal will pave the way for Foundation teams to transition to Labs as the network builds toward becoming “the default exchange for all tokenized value, funded through a growth budget from the treasury.”

“With the approval of this proposal, Labs will take on operational functions historically managed by the Foundation, including ecosystem support and funding, governance support, and developer relations," the blog post explained.

Technical outlook: Uniswap rises amid bearish conditions

Uniswap is trading above $5.00 at the time of writing on Thursday, as crypto prices across the market rebound slightly despite the overall bearish outlook in December.

The DEX token sits below downtrending moving averages, including the 50-day Exponential Moving Average (EMA) at $6.10, the 100-day EMA at $6.75 and the 200-day EMA at $7.38, which highlight the bearish thesis.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart has maintained a sell signal since November 21, prompting traders to reduce exposure.

However, UNI’s price increase could gain momentum if the blue MACD line crosses and settles above the red signal line.

The Relative Strength Index (RSI) on the same chart has risen to 41 as buyers return, pushing the price higher. Still, the RSI remains within the bearish region, which may cap rebounds until it crosses above the 50 midline. A close above the 50-day EMA at $6.10 could boost the uptrend toward the 200-day EMA at $7.38.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.