POPULAR ARTICLES

- Bitcoin trades in green on Wednesday, after finding support around the 50-day EMA the previous day.

- BTC closed September with a 5.16% gain above $114,000, bringing Q3 returns to 6.31%.

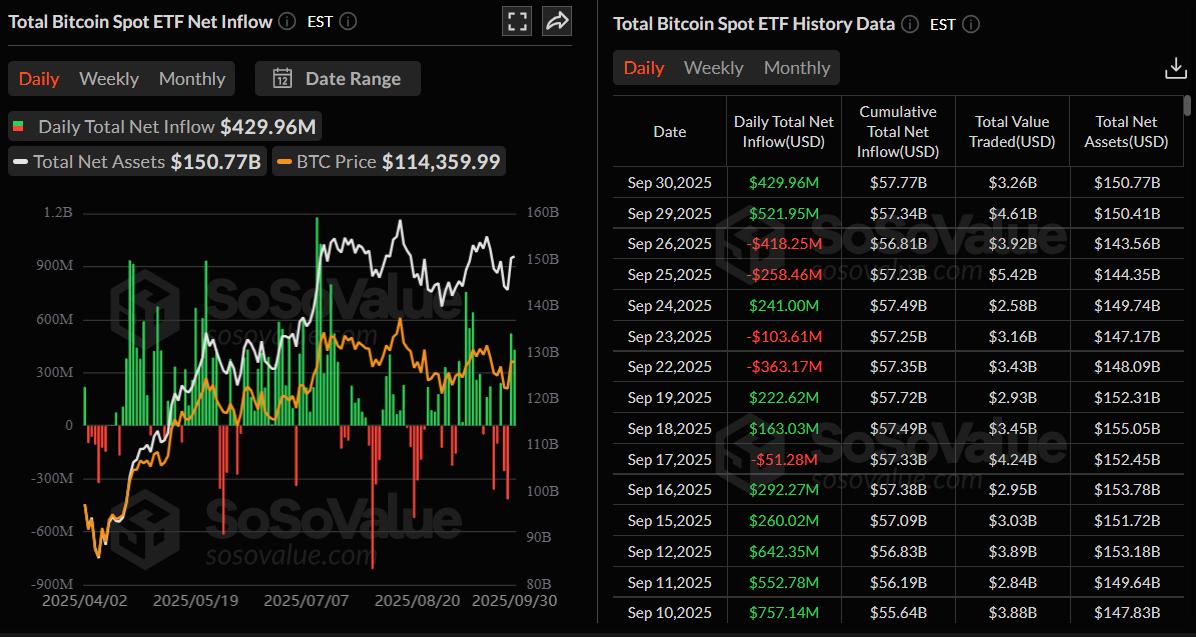

- US-listed spot ETFs recorded a second consecutive day of inflows on Tuesday.

Bitcoin (BTC) trades in green above $114,000 on Wednesday, rebounding from its key support level the previous day. The largest cryptocurrency by market capitalization closed September with a 5.16% gain, bringing Q3 returns to 6.31%. Meanwhile, the institutional demand continues to strengthen this week as it records a second consecutive day of inflow.

Bitcoin 'Uptober' soon

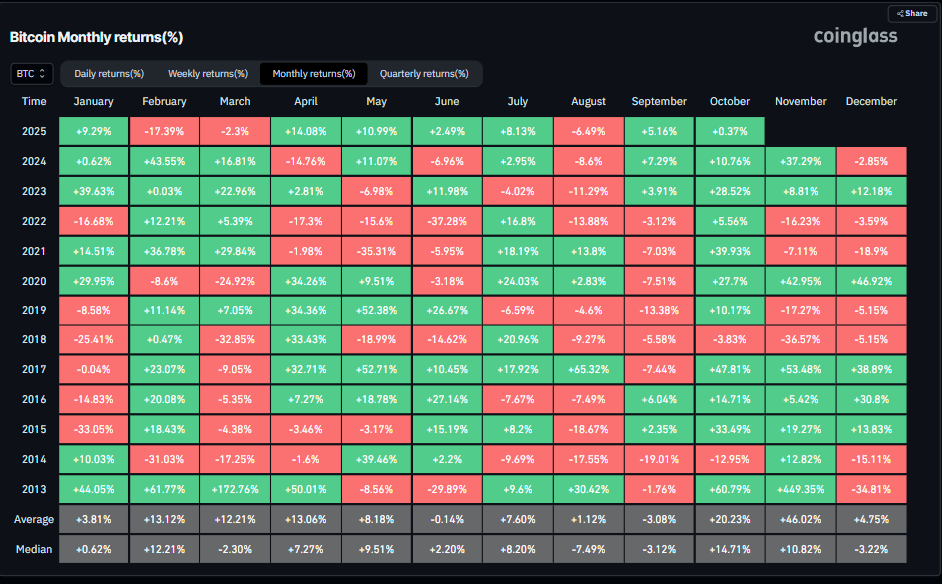

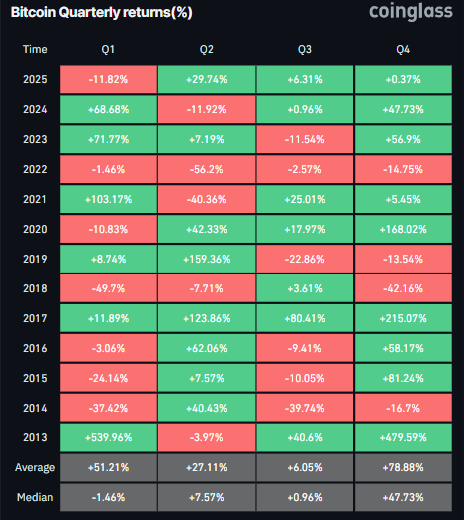

Bitcoin closed September with a 5.16% gain, finishing above $114,000, while the third quarter as a whole delivered a modest 6.31% gain, as shown in the Coinglass charts below.

Historical data for Bitcoin looks bullish as the monthly return for October has generally delivered a positive return for the cryptocurrency, averaging 20.23%, with the market terming it as ‘Uptober’ rally.

Adding to this optimism, the fourth quarter (Q4) has been the best quarter for BTC in general, with an average of 78.88%, which could push BTC to new highs by the end of the year.

Bitcoin Monthly returns chart. Source: Coinglass

Bitcoin Quarterly returns chart. Source: Coinglass

Bitcoin institutional demand continues to strengthen

Bitcoin’s ongoing recovery is further supported by institutional demand this week. SoSoValue data shows that Bitcoin spot ETFs recorded a second consecutive day of inflow worth $429.96 million on Tuesday. If these inflows continue and intensify, the BTC price could further recover.

Total Bitcoin Spot ETF Net Inflow chart

Several altcoin ETFs to launch in October

With many spot altcoin ETFs expected to launch within the next few weeks, if approved, they could further fuel the ‘Uptober’ narrative for the cryptocurrency markets.

Additionally, the US Securities and Exchange Commission (SEC) has recently approved generic listing standards to streamline ETF approvals, setting the stage for prompt approvals.

A K33 Research report released on Tuesday stated that ETFs are a potential catalyst for altering crypto sentiment.

The analyst writing the report continued that many altcoins are expected to see ETF launches throughout October, which may reinvigorate bullish demand. Following the undeniable success of BTC ETFs, Vanguard is reportedly exploring offering crypto ETFs to its brokerage clients, a meaningful development after nearly two years of repeated skepticism.

However, the analyst concluded that the week still faces elevated uncertainties due to the partial shutdown of the US government, which might impact liquidity, delay economic data releases and even altcoin ETF approvals. Alongside the shutdown, major Asian markets are entering banking holidays, which may further soften liquidity in the near term.

Bitcoin Price Forecast: BTC bulls aim for $116,000 mark

Bitcoin price started the week on a positive note, rallying nearly 2% on Monday and closing above the 50-day Exponential Moving Average (EMA) at $113,403. On Tuesday, BTC edged slightly down and found support around the 50-day EMA. At the time of writing on Wednesday, it trades slightly higher at around $114,300.

If the 50-day EMA at $113,403 continues to hold as support, BTC could extend the recovery toward the daily resistance at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 53, which is above its neutral level of 50, indicating that bullish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) is showing a bullish crossover on Wednesday, providing a buy signal and suggesting the start of an upward trend ahead.

BTC/USDT daily chart

However, if BTC fails to find support around the 50-day EMA and closes below it, BTC could extend the decline toward the daily support at $107,245.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.