热门文章

Bank of Japan Governor Kazuo Ueda has strongly suggested that the December 19 meeting could mark the end of the long pause in rate hikes, reinforcing expectations of a policy move driven by persistent inflation and fresh fiscal stimulus. Markets now assign an 80%+ probability to a December increase, propelling the Japanese Yen (JPY) higher and potentially laying the groundwork for a stronger JPY through 2026, Commerzbank's FX analyst Antje Praefcke notes.

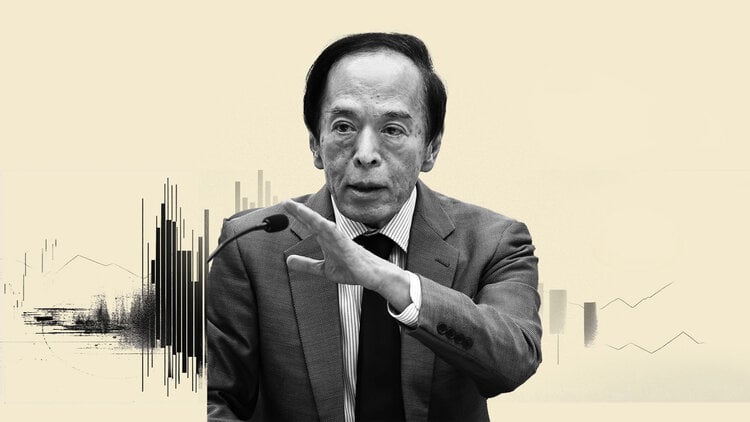

Ueda delivers his clearest hint yet

"We have long expected the Bank of Japan (BoJ) to raise its key interest rate again in December, as we considered this necessary in view of persistently high inflation (driven primarily by food prices). Now, the new government's fiscal package, which is likely to have an inflationary effect, is also coming into play. As a result, market expectations for December interest rates had already risen slightly."

"Yesterday, Bank of Japan Governor Kazuo Ueda finally gave the clearest indication yet that the long pause in interest rate hikes is likely to end at the December meeting and that the BoJ could raise interest rates on December 19. In a speech in Nagoya, he said: 'At the MPM, the Bank will examine and discuss economic activity and prices at home and abroad as well as developments in financial and capital markets, including the point I just mentioned, based on various data and information, and will consider the pros and cons of raising the policy interest rate and make decisions as appropriate'."

"The market immediately adjusted its interest rate expectations, causing the yen to rise significantly against the dollar yesterday. The market now expects an interest rate hike in December with a probability of over 80%, or January at the latest. The new government appears to be giving the BoJ a free hand, as Finance Minister Satsuki Katayami hinted this morning. The imminent rate hike could ultimately be the starting signal for a better year for the yen in 2026, as we expect."