POPULAR ARTICLES

The Commodity Futures Trading Commission (CFTC) data for the week ending September 2 indicate that FX markets remained attentive to the Federal Reserve’s evolving outlook, particularly regarding its upcoming rate decisions and the question of who will succeed Chief Powell. At the same time, growing concerns about a potential economic slowdown have started to resurface.

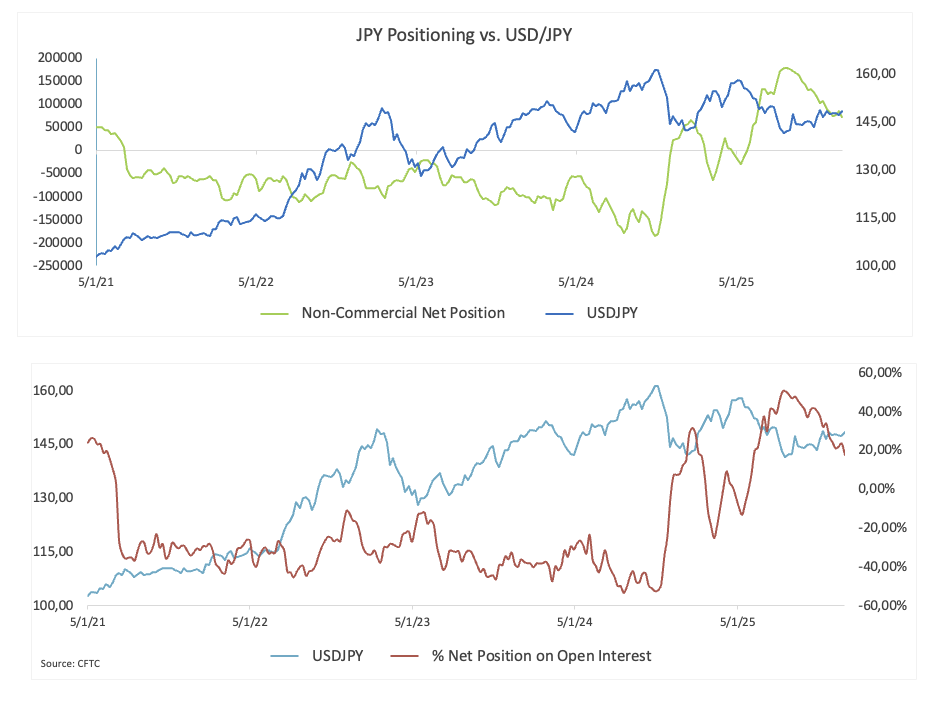

Non-commercial players have been cutting back their bullish bets on the Japanese Yen (JPY), with net longs slipping to about 73K contracts, the lightest since mid-February. In addition, institutional investors trimmed their bearish exposure, bringing net shorts down to a three-week low near 76K contracts. Trading activity picked up, with open interest posting its sharpest rise since March at just over 414K contracts. Still, the spot market didn’t break stride: USD/JPY stayed locked in its familiar range of 146.00 to 149.00.

Speculators trimmed their net short positions on the US Dollar (USD) to just over 5K contracts, marking a five-week low. On the flip side, open interest increased further, reaching a five-week peak of nearly 31.5K contracts. The US Dollar Index (DXY) traded on the back foot, approaching the bottom of its multi-week trading range near the mid-97.00s.

Speculative net longs in the Euro (EUR) dropped to two-week lows near 119.6K contracts. At the same time, non-commercial traders moderated their bearish exposure, bringing short positions down to their lowest point in recent weeks at approximately 171.3K contracts. Open interest continued its upward trajectory for the fourth consecutive week, approaching 846K contracts. In this context, EUR/USD has begun a gradual ascent, with the immediate focus on the 1.1700 region.

Non-commercial net short positions in the British Pound (GBP) climbed to their highest levels in three weeks, reaching approximately 33.1K contracts. In tandem, open interest extended their move higher, approaching 226.5K contracts, the highest level since early June. That said, GBP/USD fell from weekly highs near 1.3550 to as low as the 1.3340 zone.

Speculators scaled back their bearish positions on the Australian Dollar (AUD), with net short dropping to five-week lows near 82.7K contracts. In the same line, open interest went down to its lowest level in three weeks to just over 185K contracts. In this context, AUD/USD extended its upward momentum, managing to break above the 0.6500 barrier.

Non-commercial net longs in Gold continued their upward momentum, hitting six-week highs just below 250K contracts. This increase was accompanied by a strong rebound in open interest, rising to nearly 493K contracts for the first time since April. During the period, Gold prices kept their rally well and sound, climbing to record highs above their key $3,500 mark per troy ounce.