POPULAR ARTICLES

- Cryptomarket trades in red on Wednesday after facing a pullback on the previous day.

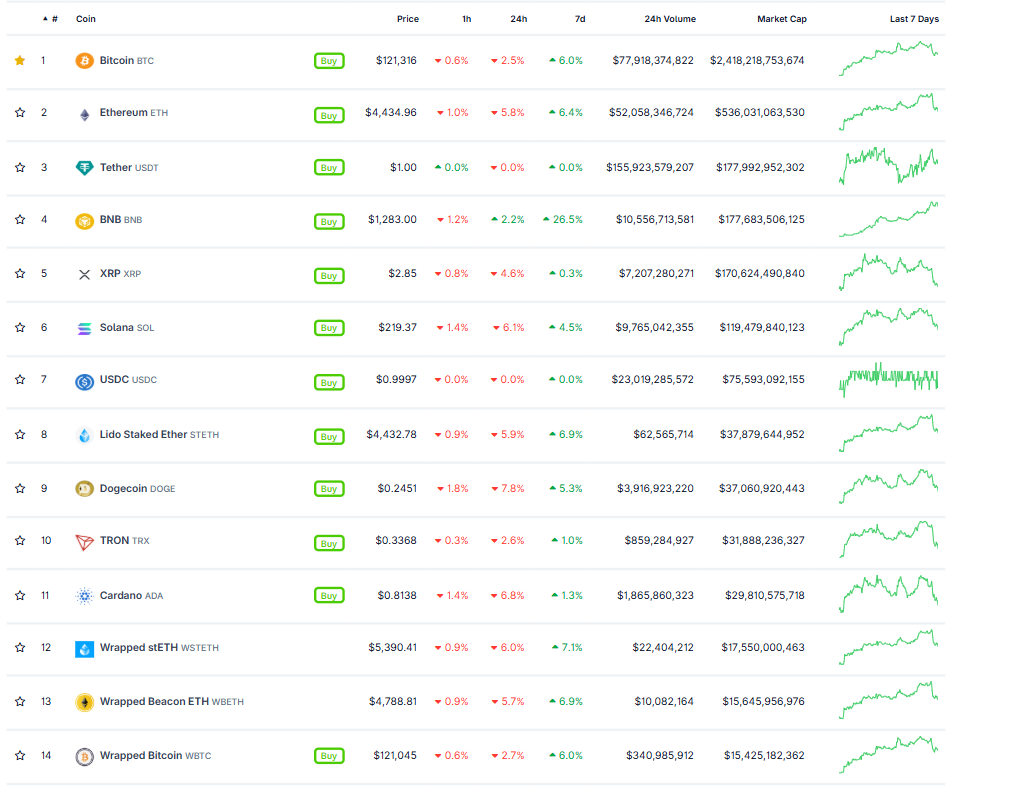

- Major tokens, including BTC, ETH, XRP, ADA, and popular memecoins, face notable price declines.

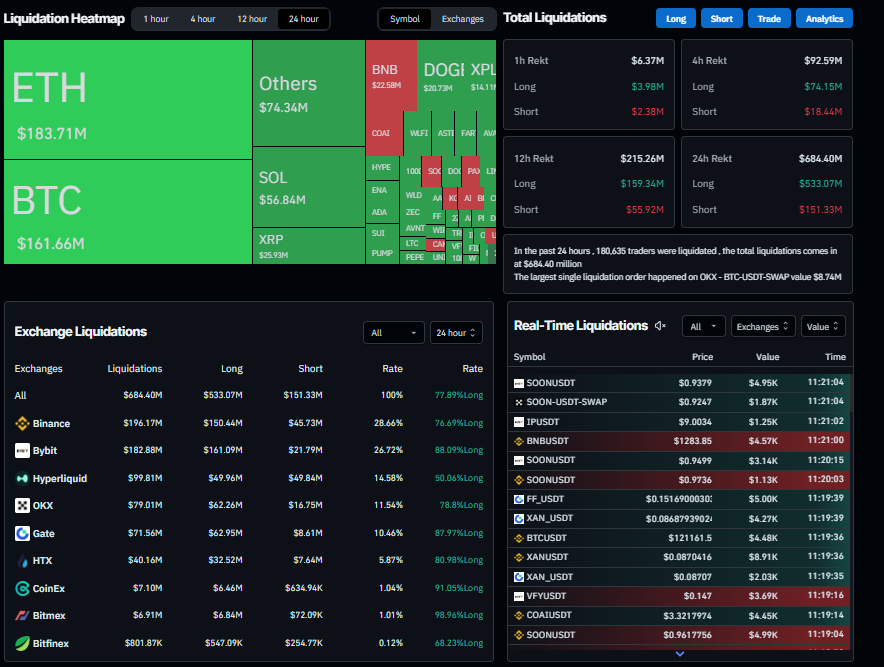

- CoinGlass data show that over $680 million in leveraged positions were wiped out across crypto markets in the past 24 hours.

The cryptocurrency market remains in the red at the time of writing on Wednesday, following a downturn the previous day. The price correction has triggered a wave of liquidation worth over $680 million in the past 24 hours, with 77% of positions being long, highlighting the bullish overexposure among traders.

Market dips amid profit-taking and rising uncertainty

The week began positively for the cryptocurrency market, with prices climbing as Bitcoin (BTC) reached a new all-time high of $126,199 on Monday, followed by major altcoins rising in tandem with BTC. However, the cryptocurrency market’s gains faded on Tuesday as profit-taking sent BTC down more than 2.5% to close below $121,500. Moreover, fears of a prolonged US government shutdown, now in its second week, heighten economic uncertainty and weigh on risk assets.

At the time of writing on Wednesday, the cryptocurrency market remains in the red, with major tokens, including Ethereum (ETH), Ripple (XRP), Cardano (ADA), and popular memecoins, experiencing notable price declines, as shown in the image below.

This sudden drop in prices has triggered a wave of liquidations across the market, with over $680 million in leveraged positions wiped out, according to Coinglass data shown below. Notably, 77% were long positions, underscoring the market’s overly bullish positioning. The largest single liquidation occurred on the OKK exchange, where a BTC-USDT-SWAP position worth $8.74 million was liquidated.

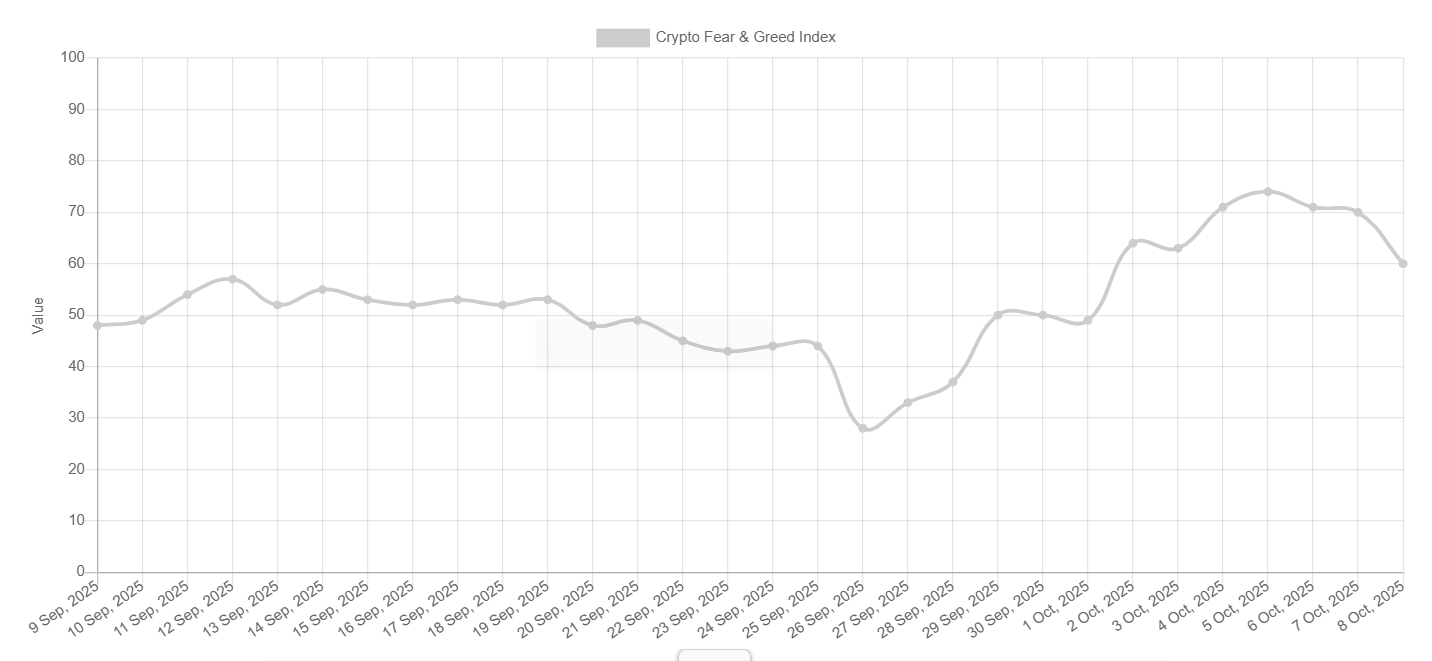

The Fear and Greed Index drops to 60 on Wednesday from Sunday’s high of 74, signaling a cooling of investor sentiment and a shift from strong greed toward a more cautious outlook.

The market participants’ focus now shifts to the release of the Federal Open Market Committee (FOMC) meeting Minutes, due later on Wednesday. Apart from this, Federal Reserve (Fed) Chair Jerome Powell’s appearance on Thursday will be closely watched for more cues about the interest rate cut path. This, in turn, will drive the US Dollar (USD) and provide a fresh impetus to riskier assets such as Bitcoin.