POPULAR ARTICLES

- Dogecoin trades near $0.17000 after a 5% drop on Tuesday, erasing the gains made in the two previous sessions.

- On-chain data shows an increase in supply inflows held for 365 days to two years, signaling an offloading phase.

- Derivatives data suggest a consistent decline in futures Open Interest, suggesting risk-off sentiment.

Dogecoin (DOGE) approaches the $0.17000 round figure on Wednesday, after a 5% loss on the previous day. In the third consecutive week of losses, DOGE risks further correction as on-chain data suggests old supply reentering circulation, indicating profit-taking by investors. Derivatives data indicate a steady decline in DOGE futures as risk-off sentiment persists among traders.

Investors' risk appetite declines for Dogecoin

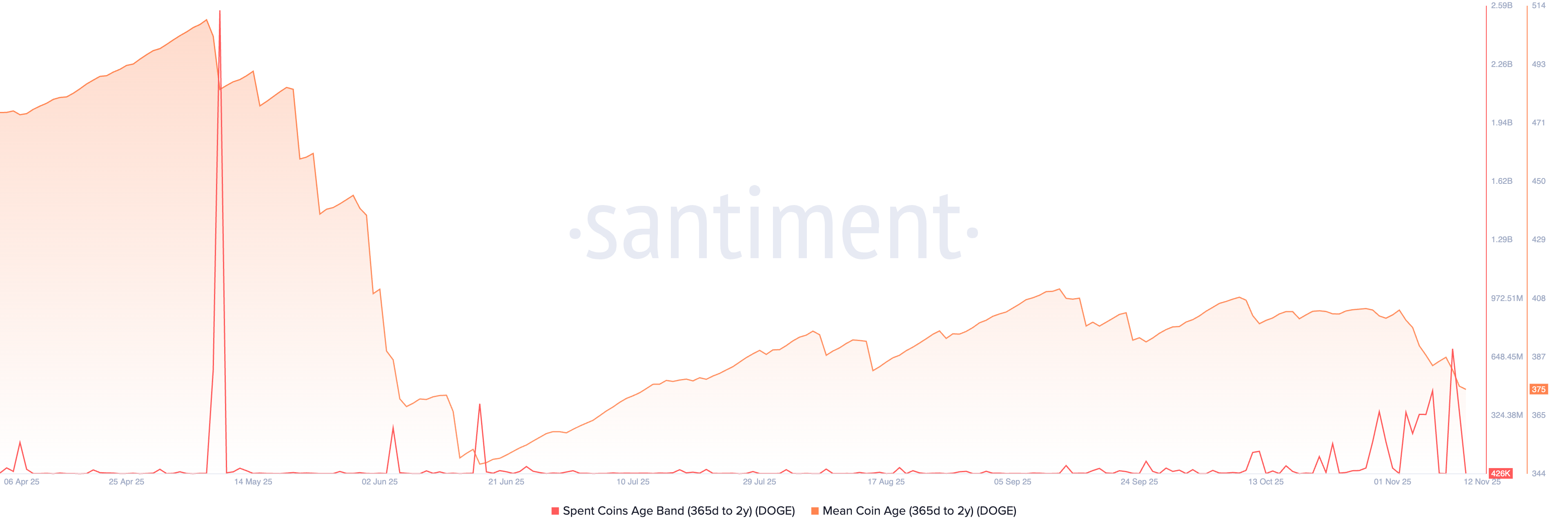

Dogecoin, the largest meme coin by market capitalization, is losing investors' confidence as supply held for over a year re-enters circulation. Santiment data reveals that the Mean Coin Age, which represents the average age of all tokens, ranging from 365 days to two years, is standing at 375 days, down from 404 days on November 2. This indicates a shift in the older dormant supply to new wallets, suggesting that previous holders are offloading.

The Spent Coins Age Band, spanning 365 days to two years, which refers to the daily spending by this holding age group of investors, confirms a recent sell-off. The successive spikes in November reached 693.07 million DOGE on Monday, the largest single-day selling after the 2.56 billion spent on May 9.

The activation of dormant supply reduces the mean age of coins held, which could be analogous to the canary in a coal mine, forecasting a potential correction phase.

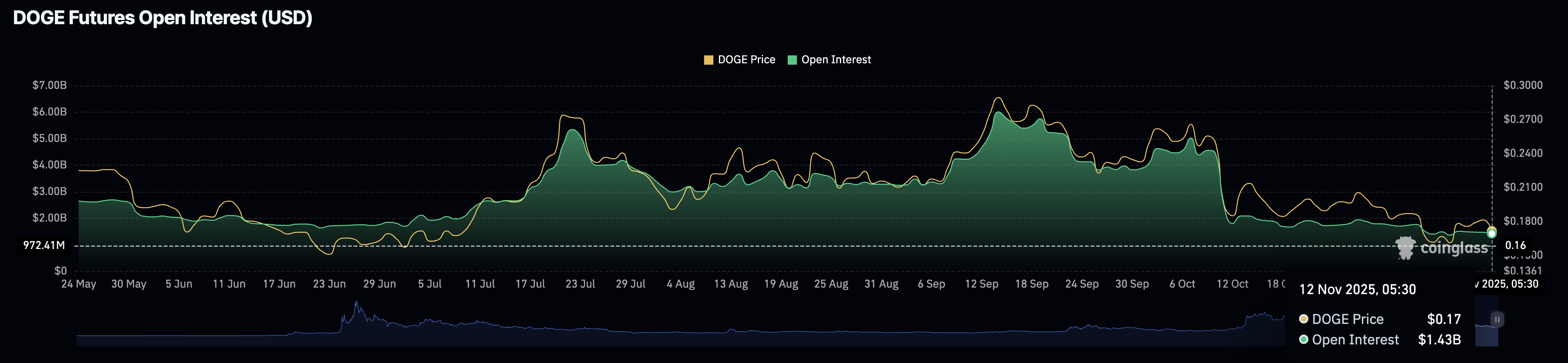

Meanwhile, the retail interest in Dogecoin also suffers from a reduction in risk appetite among investors. CoinGlass data indicates a declining trend in DOGE futures Open Interest (OI), which has reached $1.43 billion, down from $1.48 billion on Tuesday. A contraction in OI indicates a reduced number of outstanding long positions, signaling a risk-off sentiment.

Dogecoin risks a steeper correction as sellers regain strength

Dogecoin failed to surpass the supply zone near the $0.18527 close from October 11, resulting in a 5% pullback on Tuesday. At the time of writing, DOGE struggles to hold above $0.17000 as bears target the $0.15704 support level marked by the low of June 27.

If the investors fail to regain confidence in the meme coin, the pullback phase could extend to the $0.12896 level marked by the April 7 low.

Adding to the risk, the momentum indicators signal a resurgence in selling pressure as the Relative Strength Index (RSI) reads 40 on the daily chart, reversing from near midline.

At the same time, the Moving Average Convergence Divergence (MACD) reverses towards the signal line, risking a crossover that would signal a renewed bearish momentum.

However, if DOGE surfaces above $0.18527, it could extend the recovery to the 50-day Exponential Moving Average (EMA) at $0.19914.