POPULAR ARTICLES

- Dogecoin recovers by over 1% on Wednesday, preparing its first positive candle of the week.

- The retail demand for Dogecoin has dropped to an early April level, risking a surge in bearish speculations.

- On-chain data shows an increase in older DOGE spent during this week’s sell-off, suggesting a decline in holders' confidence.

Dogecoin (DOGE) edges higher by over 1% at press time on Wednesday, holding ground above the $0.15704 support level. Despite a bounce back from the $0.15456 low earlier on the day, both the on-chain and derivatives data suggest weak sentiment among retail and long-term holders.

Waning demand among Dogecoin holders, traders

Dogecoin, the largest meme coin by market capitalization, remains a speculative asset in the cryptocurrency market, primarily due to its community-driven nature. A decline in the interest of traders and long-term investors could cause the DOGE market value to plummet.

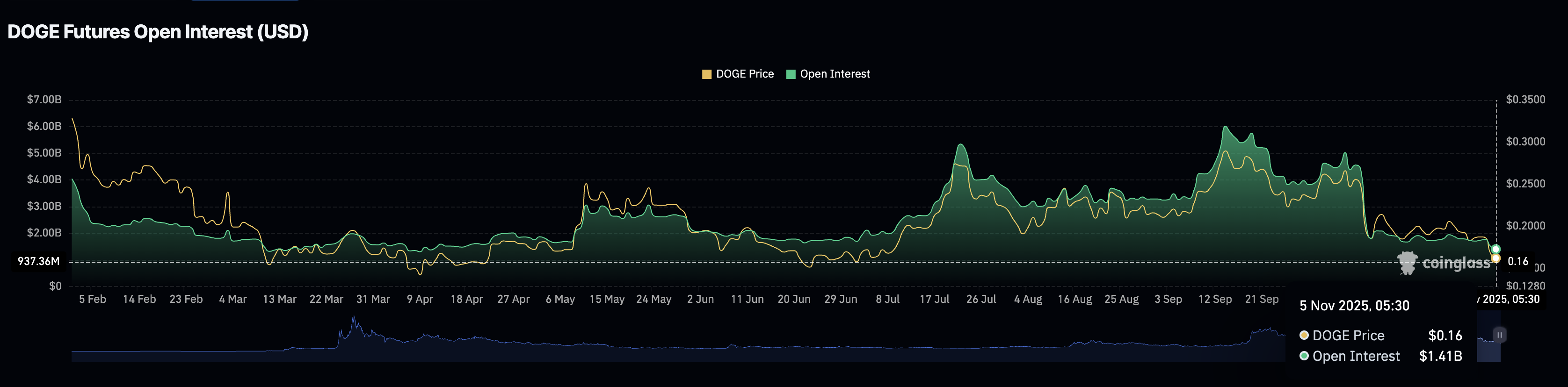

In the same line, a steady decline in Dogecoin futures Open Interest (OI) suggests a loss of interest among retail traders. CoinGlass data shows that the DOGE futures OI has dropped to $1.41 billion, marking a 7-month low.

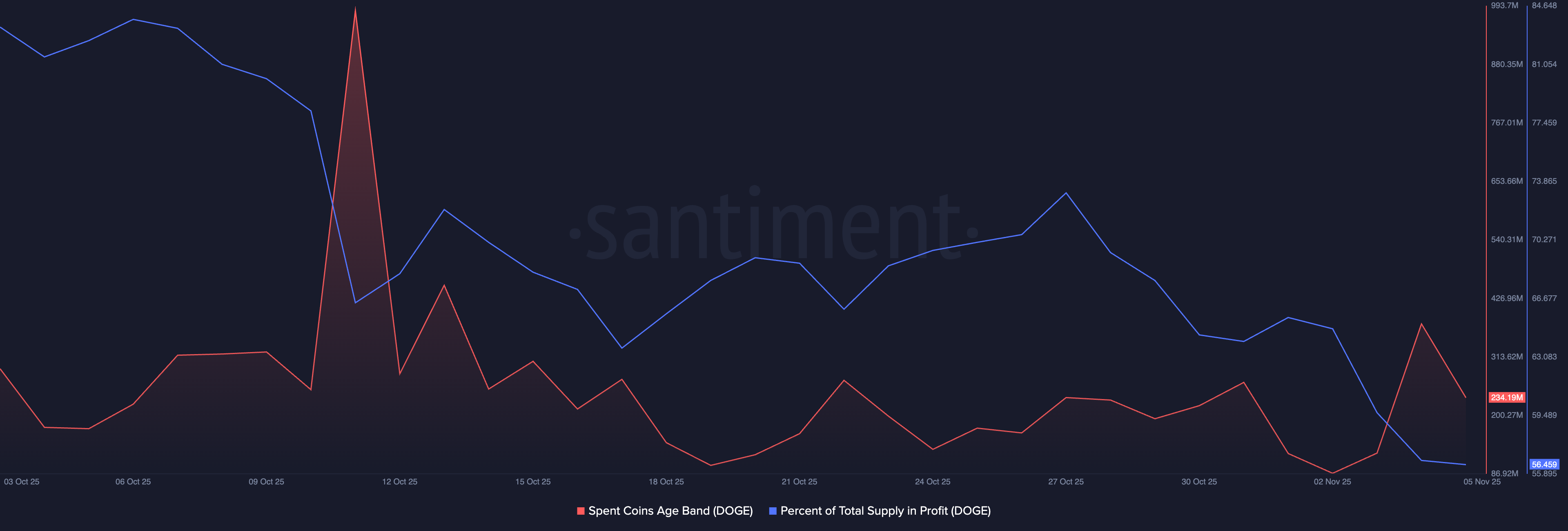

On a more negative note, a spike in the Spent Coins Age Band – daily coins spent by their holding age – to 377 million on Tuesday, from 126 million on Monday, indicates a sell-off of previously dormant DOGE tokens. This profit booking by long-term holders aligns with a decline in the percentage of DOGE supply held in profit, forcing them to offload.

Santiment data shows that only 56.459% of DOGE has been acquired at a price lower than the market price, compared to 83.81% on October 3. As the Supply in Profit declines, weak hands are likely to move to the sidelines.

Bearish technical signals warn of downside risk in Dogecoin

Dogecoin trades above $0.16000 at the time of writing on Wednesday, as moving averages flash a sell signal. The 100-day Exponential Moving Average (EMA) crossed below the 200-day EMA on Tuesday, flashing a Death Cross pattern and completing a bearish alignment with the 50-day EMA. This indicates a strong bearish trend in motion.

If the DOGE price slips below $0.15704 support level, marked by the June 27 low, the June 22 and April 7 lows at $0.14270 and $0.12986, respectively, could attempt to absorb the supply surge.

The technical indicators on the daily chart corroborate the bearish signals as the Moving Average Convergence Divergence (MACD) extends the downward trend below the signal line. Furthermore, the Relative Strength Index (RSI) at 32 moves slightly above the oversold zone, indicating heightened overhead pressure.

To reinforce an uptrend, the intraday recovery in DOGE should reclaim the October 11 low at $0.17816.