POPULAR ARTICLES

- Ethena leads gains among major cryptocurrencies on Monday, trading above its $0.60 support.

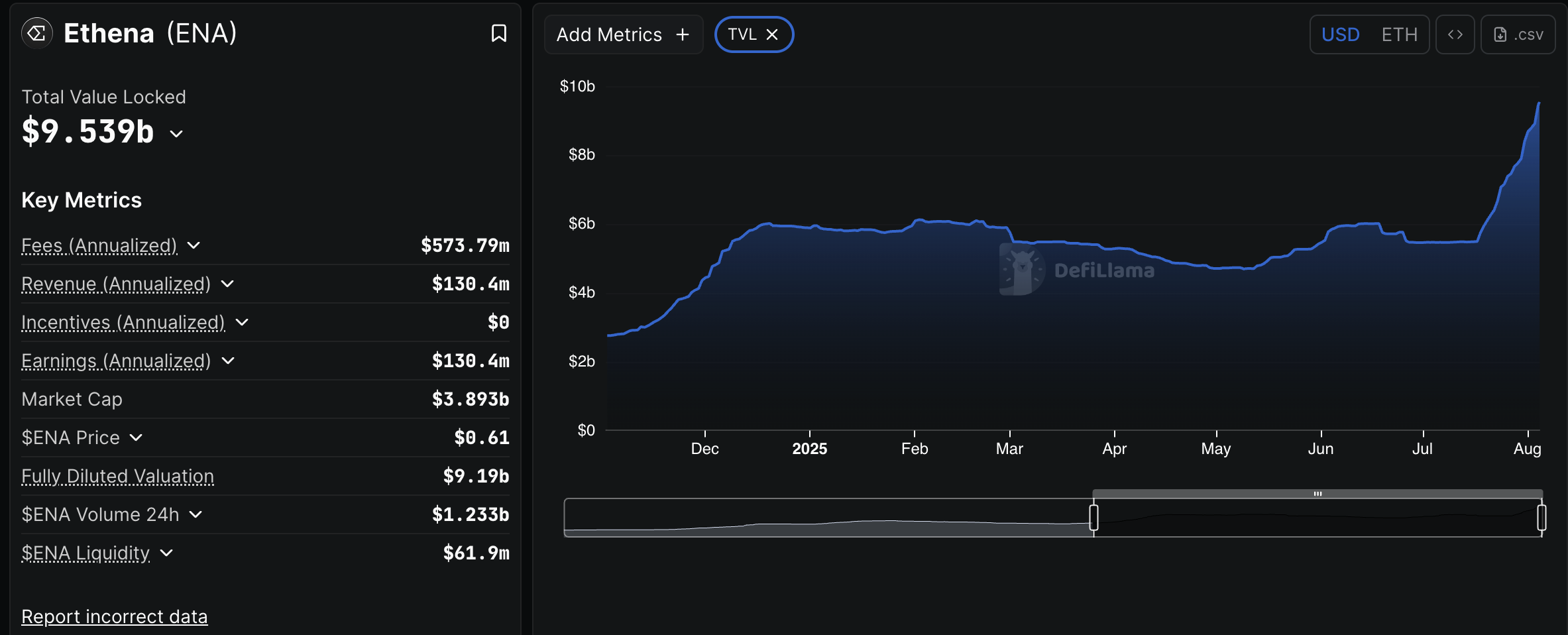

- Ethena’s TVL rises to $9.53 billion, underscoring holder conviction in the ecosystem.

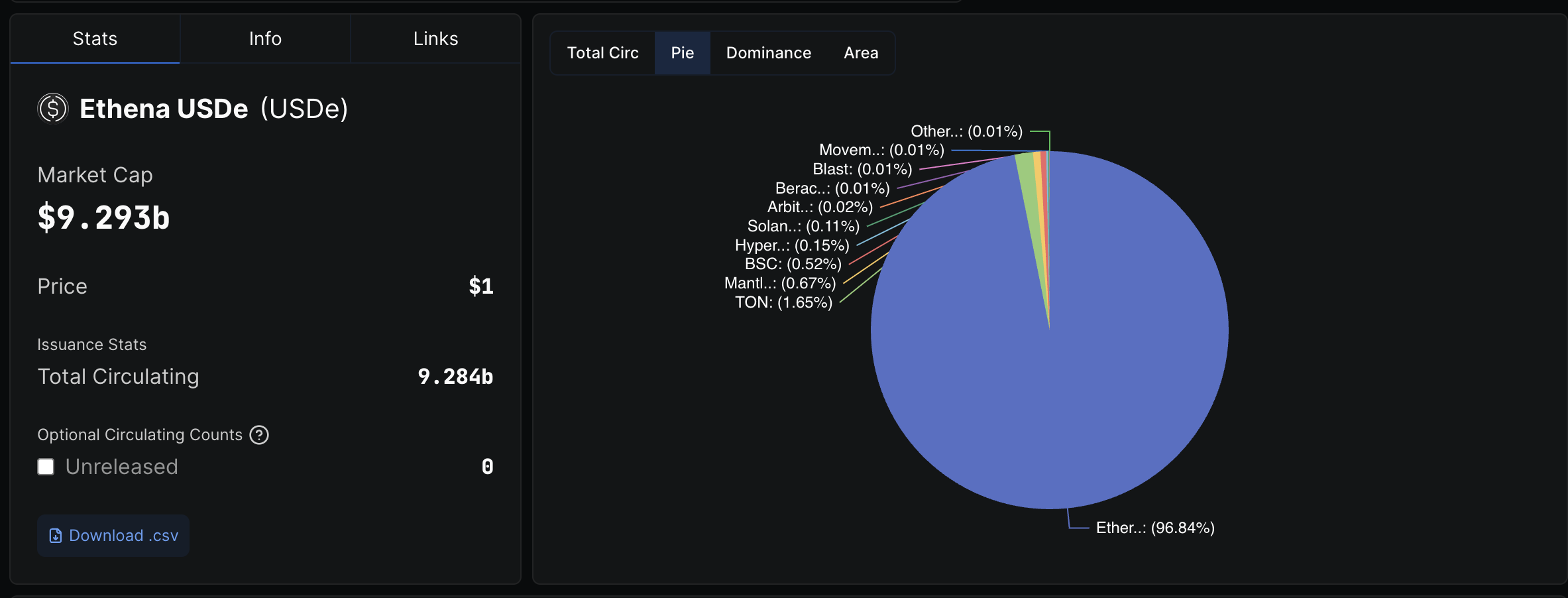

- Ethena’s USDe stablecoin surpasses FSUSD, becoming the third-largest stablecoin by market capitalization.

Ethena (ENA) price posts one of the strongest rebounds among major cryptocurrencies on Monday, underpinned by a strong Decentralized Finance (DeFi) ecosystem and steady retail demand. After correcting to $0.51 support on Saturday, ENA increased 24% to $0.63 before retracing to exchange hands at around $0.61 at the time of writing.

A daily close above the short-term $0.60 support would affirm the bullish grip, increasing the probability of Ethena tagging key resistance levels at $0.70, $0.75 and $1.00.

Ethena flaunts a bullish DeFi ecosystem

Ethena’s DeFi ecosystem has steadied its growth over the last few months, with its Total Value Locked (TVL) peaking at around $9.54 billion from the $4.72 billion recorded on May 4.

TVL refers to the sum of the value of all coins locked in all the smart contracts across the protocol. Holders often prefer to lock their tokens in smart contracts when intending to hold long-term.

Staking allows investors to participate in securing the network while earning rewards. Such a steady rise in TVL indicates high investor conviction in the ecosystem. At the same time, it reduces ENA’s circulating and potential selling pressure, paving the way for a price increase.

Ethena DeFi TVL data | Source: DefiLlama

Ethena’s USDe stablecoin has also experienced significant growth this year, reaching $9.23 billion in market capitalization, according to DefiLlama data. USDe saw the largest growth rate, of over 75%, in the last 30 days, becoming the third-largest stablecoin after Tether’s USDT.

Ethena’s USDe stablecoin market cap | Source: DefiLlama

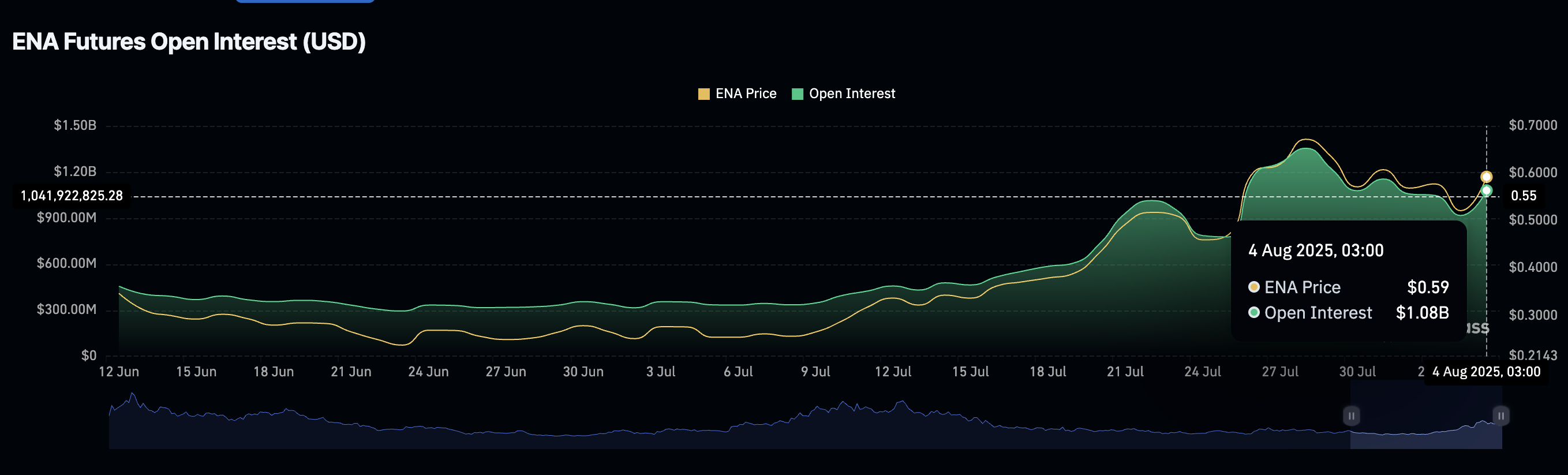

Investor interest in Ethena is edging higher. According to CoinGlass data, the futures Open Interest (OI) is back above the $1 billion mark following a drop to $916 million recorded on Sunday.

OI, which refers to the notional value of all futures or options contracts, peaked at $1.35 billion in July as traders increasingly bet on the price of Ethena rising.

Ethena Futures Open Interest | Source | CoinGlass

Technical outlook: Ethena reclaims key support

Ethena price holds above support at $0.60 at the time of writing, backed by a robust DeFi ecosystem and rising retail interest. The token also sits above key moving averages, including the 50-day Exponential Moving Average (EMA) currently at $0.57, the 100-period EMA at $0.53 and the 200-period EMA at $0.46. In case last week’s decline resumes, these levels would serve as tentative support to prevent ENA from dropping toward $0.40.

The Relative Strength Index (RSI) had recovered slightly above 60 before reversing to 58, suggesting possible profit-taking and a shaky risk-on sentiment in the broader cryptocurrency market.

ENA/USDT daily chart

Traders should monitor the RSI for a continued drop toward the midline, which could mean a reduction in buying pressure. However, if the RSI resumes the uptrend toward overbought territory, the path of least resistance would remain upward, increasing the chances of ENA extending gains toward the $0.70 and $0.75 levels, respectively.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.