POPULAR ARTICLES

Ethereum price today: $4,105

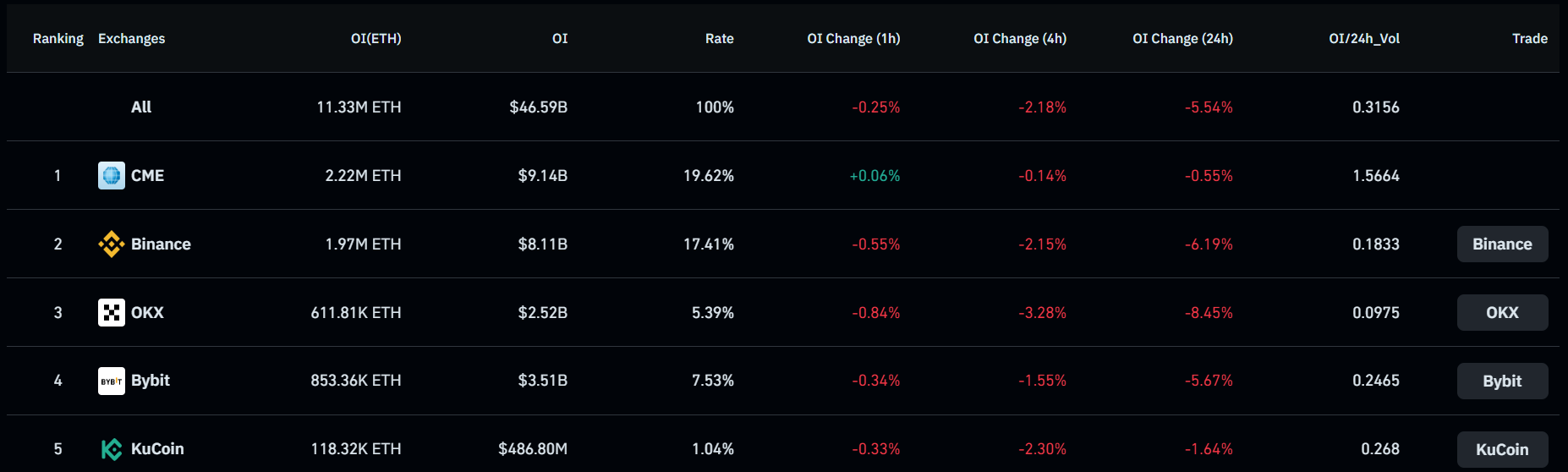

- Ethereum open interest has declined to 11.59 million ETH, a level last seen in May.

- The CME's open interest surpassed that of Binance, making the platform Ethereum's largest derivatives market.

- ETH is struggling to hold the $4,100 support after seeing a rejection at $4,270.

Ethereum (ETH) is down 3% on Tuesday following a decline in open interest and rising profit realization among investors.

Ethereum open interest falls, CME traders lead recovery

Ethereum's open interest has declined to its lowest level since May, following the crypto leverage flush last Friday.

Historically, increased cautious sentiment and price consolidation in the short term often accompany a deep drawdown in leverage.

The top altcoin's open interest plunged to 11.04 million ETH on Saturday before mildly rising to 11.59 million ETH on Tuesday. Open interest is the total value of unsettled contracts in a derivatives market.

The slight recovery in OI was largely spearheaded by traders on the Chicago Mercantile Exchange (CME), with the platform's open interest flipping that of Binance to become the largest ETH derivatives market.

ETH Open Interest. Source: Coinglass

The CME dominance, combined with the growing amount of ETH held in US spot Ethereum ETFs — 6.79 million ETH, which is about 5.7% of its circulating supply, shows the growing influence of US traders over the top altcoin.

Meanwhile, ETH saw a spike in profit realization, with investors booking more than $800 million in profits over the past 24 hours. Despite the rise in profit realization, whales held steady, growing their holdings by over 110,000 ETH.

[21-1760477750541-1760477750542.58.55, 14 Oct, 2025].png)

ETH Network Realized Profit/Loss. Source: Santiment

Ethereum Price Forecast: ETH sees rejection at $4,270, battles to hold key support

Ethereum saw $240.9 million in futures liquidations over the past 24 hours, comprising $150 million and $90.9 million in long and short liquidations.

After seeing a rejection at $4,270 and bouncing off a rising trendline, ETH is looking to recover the $4,100 support level, strengthened by the 100-day Simple Moving Average (SMA).

ETH/USDT daily chart

On the upside, ETH has to overcome the $4,270 resistance to stage a potential move toward $4,500. On the downside, ETH could decline to the $3,470 key level if it loses the rising trendline support.

The Relative Strength Index (RSI) saw a rejection near its moving average and neutral level, indicating a failure for bulls to regain dominance. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram bar remains below its neutral level.