POPULAR ARTICLES

- The Pound bounces up against a weaker Yen and returns to the mid-range of the 202.00s

- BoJ's decision to keep rates on hold disappointed investors and sent the Yen Tumbling.

- The Pound had sold off earlier this week amid fresh concerns about UK's public finances.

The Pound is retracing previous losses against a weaker Japanese Yen on Thursday, as the Bank of Japan (BoJ) met expectations and stood pat on interest rates. The pair has bounced up from three-week lows at 200.57 to reach session highs right above 202.50 at the European session opening times.

The BoJ kept its benchmark interest rate unchanged at 0.5% for the sixth consecutive time and reaffirmed its commitment to continue tightening monetary policies if economic projections are met. Investors, however, have been disappointed, as the number of dissenting votes calling for a rate hike remained at two, and have sent the Yen tumbling across the board.

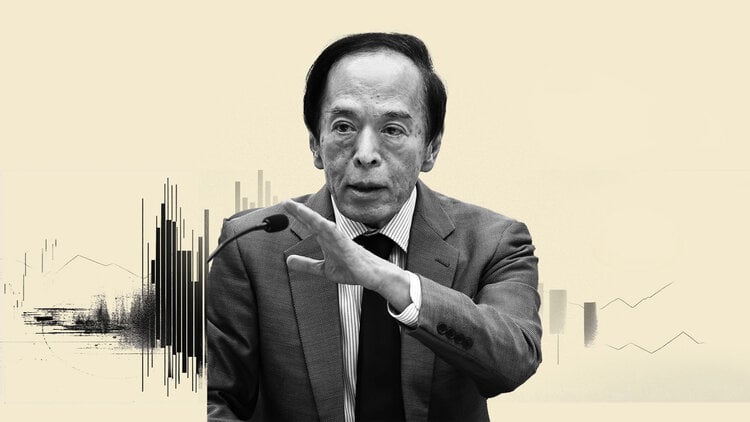

Ueda strikes a dovish note

BoJ Governor Kazuo Ueda's press release has failed to provide any significant support to the Yen. Ueda assessed that economic growth is likely to be modest as trade policies lead to a slowdown in global growth and that underlying inflation will gradually increase, to reach levels in line with the target of price stability in the mid-term.

The outlook on monetary policy, however, has been tilted to the dovish side, as the BoJ Governor played down concerns of falling behind the curve with interest rate hikes and said that he has no present ideas about the timing of the next interest rate hike.

The Sterling was hammered earlier this week after the UK Office for Budget Responsibility (OBR) slashed its productivity growth forecasts for the next five years by 0.3%, which is likely to add a GBP 20 billion hole to the already strained public finances.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.