热门文章

- Gold retreats from record highs as President Trump tones down rhetoric on Iran, boosting equities and reducing safe-haven demand.

- Strong US jobless claims and regional manufacturing data reinforce a resilient economic outlook.

- Markets trim Fed easing expectations to 47 bps by year-end, capping bullion upside.

Gold prices retreat on Thursday amid a de-escalation of US President Donald Trump’s rhetoric over Iran. Also, solid jobs data in the US prompted investors to trim Federal Reserve (Fed) rate cut bets. At the time of writing, XAU/USD trades at $4,609.

Bullion eases as easing geopolitical tensions and strong US data lift risk appetite and support the Dollar

Risk appetite improved on Thursday, sponsored by a recovery of global equities, along with Trump’s delaying an attack on Iran after he was briefed by sources “on the other side” that Tehran would stop killing people involved in the protests, reported Bloomberg. When asked about a military action, he said that he would “watch it” and see how the process evolves.

Trump added that he does not plan to fire the Fed Chair Jerome Powell, despite the Department of Justice's (DOJ) investigation over the Fed building renovations.

Economic data proves that the US economy remains solid following the release of jobless claims data for the last week. This, along with solid regional manufacturing surveys revealed by the New York and Philadelphia Fed, reassured the markets that the US economy is in a no-firing, no-hiring environment.

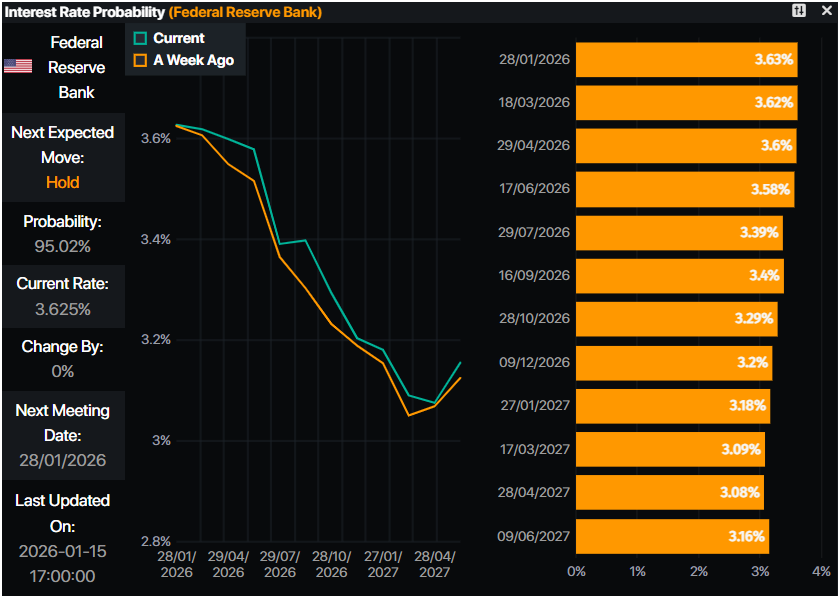

Money markets had priced in 47 basis points of rate cuts by the Fed towards the year’s end, as revealed by the Prime Market Terminal Interest rate probability tool.

Recently, Fed officials crossed the wires, led by Regional Fed Presidents Raphael Bostic and Austan Goolsbee, who spoke earlier in the day.

Ahead, the US economic docket will feature Industrial Production and speeches by Fed Governors Michelle Bowman and Philip Jefferson.

Daily digest market movers: A strong US Dollar weakens Bullion prices

- Initial Jobless Claims for the week ending January 10 were solid, with the number of Americans applying for unemployment insurance dipping from 207K to 198K, below the 215K projected.

- Meanwhile, manufacturing activity is improving according to the New York and Philadelphia Fed Banks. The New York Empire State Manufacturing Index for January improved from -3.7 to 7.7. The Philadelphia Fed Manufacturing Survey for the same period exceeded estimates of -2, jumping sharply by 12.6.

- The Greenback staged a rally after the data release, surging to a new yearly high as depicted by the US Dollar Index (DXY). The DXY, which tracks the performance of the American currency versus six peers, is up 0.33% to 99.38. US Treasury yields are recovering some ground, with the 10-year T-note yield up one and a half basis points to 4.152%.

- Fed officials weighed in. Kansas City Fed Jeffrey Schmid said that monetary policy is not very restrictive and added that there shouldn’t be room for complacency on inflation. San Francisco Fed Mary Daly said that she expects solid growth and that policy is in a good place.

- Richmond Fed Thomas Barkin commented that inflation remains elevated, while the jobs market has shown signs of stabilizing. Earlier, Atlanta Fed President Raphael Bostic said he expects economic growth to run above 2%, but warned that inflation pressures are likely to persist, requiring a restrictive policy stance. Chicago Fed President Austan Goolsbee said the jobless claims data was not surprising, reiterating that the Fed’s primary objective remains bringing inflation back to 2%.

Technical analysis: Gold price retreats towards $4,600

Gold’s uptrend remains intact despite retreating somewhat, providing a respite for bulls, due to the overextended move that began towards the end of 2025 at around $4,300, for a more than $300 run towards all-time highs.

For a bullish continuation, XAU/USD needs to clear Wednesday's record high of $4,643 to confirm the bullish bias, which opens the door to challenge $4,650 and $4,700. Conversely, a drop below the January 13 daily low of $4,569 would expose $4,550, followed by the $4,500 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.