POPULAR ARTICLES

- Hyperliquid trades below the 200-day EMA, with bears targeting the $35 support.

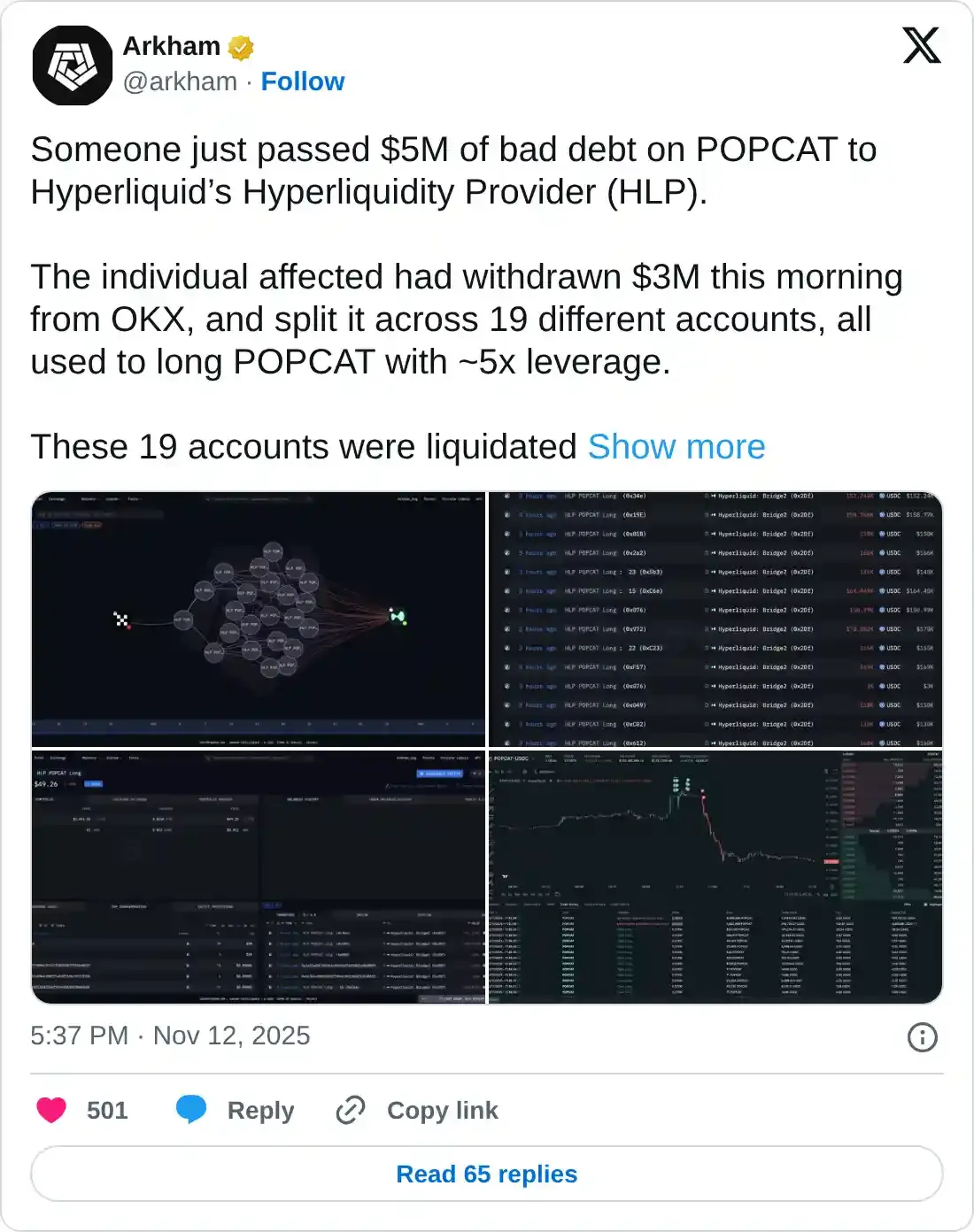

- Hyperliquid Provider absorbed $5 million in bad debt as a trader spoofed the buy wall on Popcat, triggering a pause of its Arbitrum bridge.

- The technical outlook remains grim for HYPE as momentum shifts bearish.

Hyperliquid (HYPE) holds above $38 after an 8% drop so far this week, which marks the third consecutive week of losses. The retail interest for HYPE remains low as Hyperliquid’s market maker, Hyperliquid Provider (HLP), suffers a $4.9 million loss in a potential stress test. The technical outlook warns of downside risk if bears fracture the $35 support.

HLP takes $5 million backstop loss as retail demand wanes

Hyperliquid Provider, the market maker system of the 11-person, perpetuals-focused Decentralized Exchange (DEX), reported a $4.9 million loss on Wednesday. The potential stress test occurred as a Popcat (POPCAT) trader distributed $3 million in 19 wallets to place bids near $0.21 before acquiring long positions of nearly $30 million.

However, as the buy wall of bids was canceled or removed, the price fell below the liquidation threshold of long positions, forcing the HLP to take over positions due to thin liquidity in the market and incur $4.90 million in losses to exit at lower prices.

The DEX also paused its Arbitrum bridge, while deposits and withdrawals continue to operate normally.

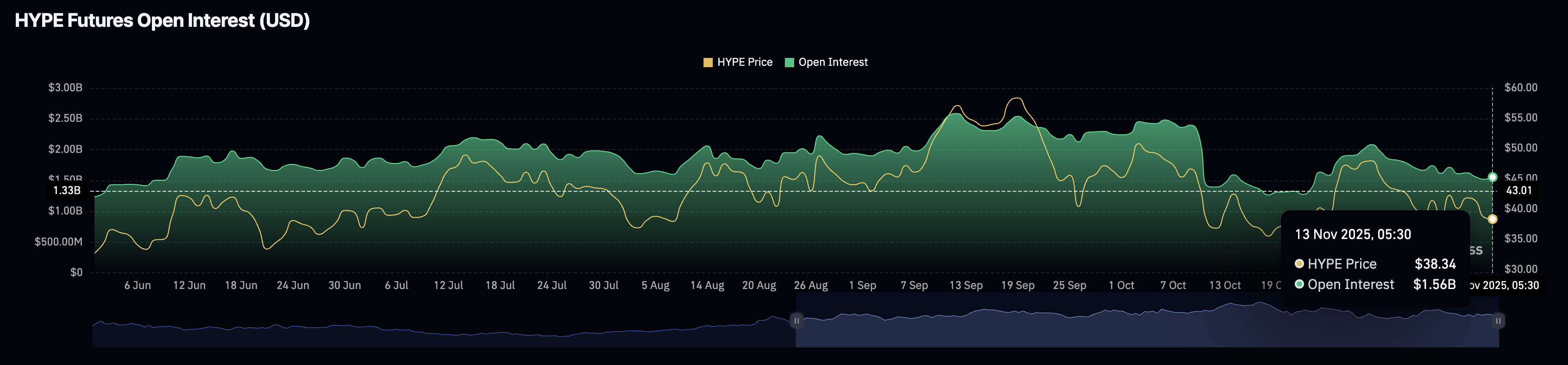

At the same time, the retail demand for HYPE remains low after the nearly $1 billion reduction in futures Open Interest (OI) in early October. A steady decline in futures OI refers to a decrease in the notional value of outstanding future contracts as traders lose risk appetite.

As of Thursday, CoinGlass data shows the HYPE futures OI at $1.56 billion, down from the $2.08 billion peak from October 30.

Hyperliquid’s pullback risks losing $35 support level

Hyperliquid trades below the 200-day Exponential Moving Average (EMA) at nearly $39 after failing to surpass the 50- and 100-day EMAs near $43. The reversal threatens the $35 support previously tested on November 4, as the Moving Average Convergence Divergence (MACD) extends below the signal line, implying a selling opportunity.

Meanwhile, the Relative Strength Index (RSI) at 43 reverts from the midpoint line, signaling a fresh wave of selling pressure. With further room on the downside before reaching the oversold boundary at 30, the indicator warns of strong bearish potential.

A decisive close below the $35 mark could extend the decline to the $30 support, marked by the May 30 low.

On the flipside, a bounce back above $42 could test the $50 psychological level.