POPULAR ARTICLES

- XRP edges higher, targeting a bullish close above $2.50 on Friday.

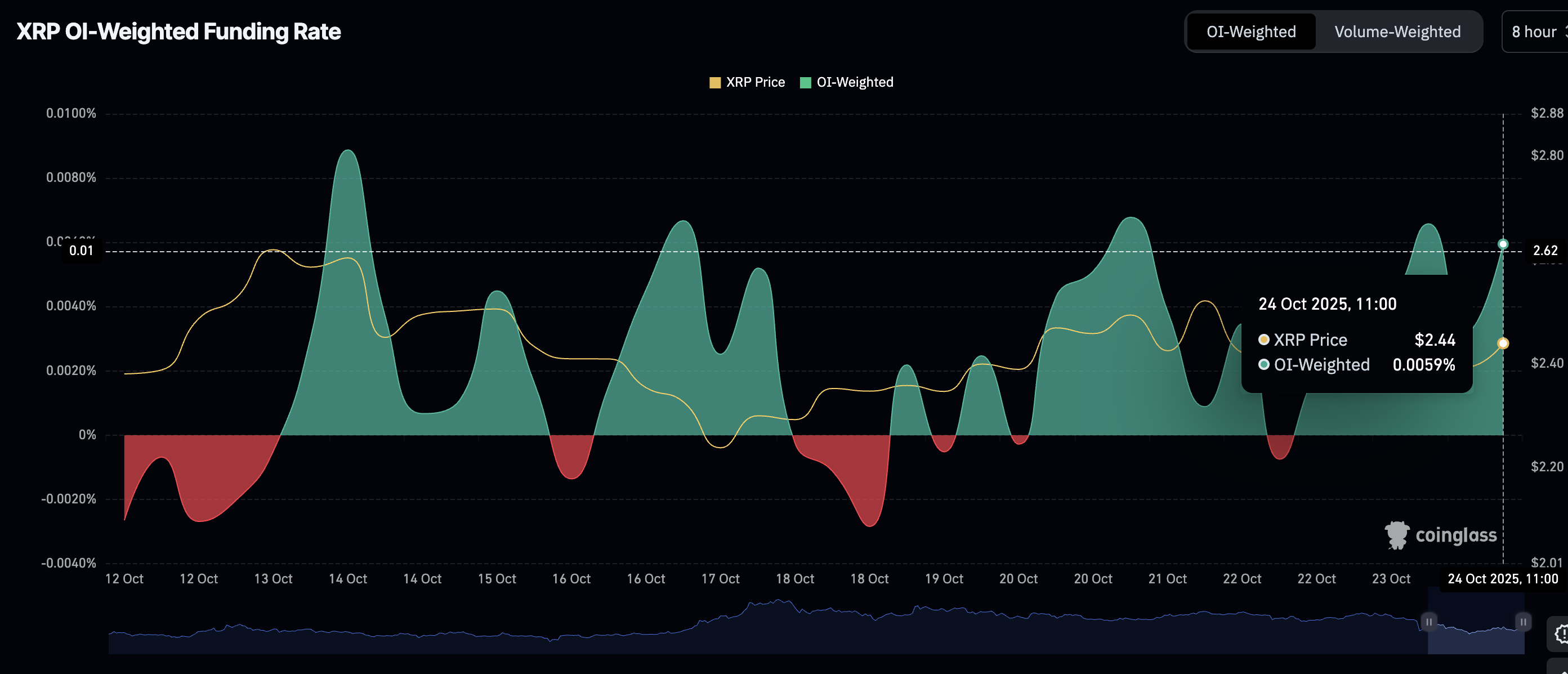

- Retail demand for XRP futures returns as Open Interest weighted sentiment shoots up.

- XRP and micro XRP futures volume hits $27 billion on CME Group five months after launch.

Ripple (XRP) increases in tandem with the broader cryptocurrency market, trading above $2.45 on Friday. Market participants anticipate volatility following the release of the US Consumer Price Index (CPI), which showed that inflation is rising, but at a slightly slower pace than market forecasts.

The US Bureau of Labor Statistics has published the September CPI report, showing that inflation increased to 3% on an annual basis. The Core CPI, which excludes the volatile prices of food and energy, eased slightly to 3% from 3.1% in August.

XRP futures hit $26 billion on CME Group

Demand for regulated XRP products has significantly grown over the past five months, as evidenced by futures contracts on the CME Group. According to the exchange, XRP and micro XRP futures notional volume is near $27 billion five months after their debut.

The world's largest derivatives exchange, CME Group, launched regulated XRP micro and XRP derivatives in April, adding to a growing number of listed digital assets, including Bitcoin (BTC), Ethereum (ETH) and Solana (SOL).

One futures contract is worth 50,000 XRP, with a micro contract representing 2,500 XRP. Both contracts are cash-settled, traded on CME Globex and benchmarked against the CME CF XRP-Dollar Reference Rate.

Meanwhile, XRP has seen a sharp rebound in the OI-weighted funding rate, rising to 0.0059% on Friday from 0.0032% on Wednesday. The OI weighted funding rate tracks the level of trader interest in XRP.

A sustained increase signals that traders are confident about rejoining the market, piling into long positions, which strengthens the token's short-term bullish picture.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Despite the sharp increase in the OI-weighted funding rate, traders should be cautiously optimistic, given that futures Open Interest is lagging. According to CoinGlass data, the notional value of outstanding futures contracts averages $3.67 billion on Friday, down from the October peak of $9 billion. In other words, investors are still on the sidelines, unconvinced that XRP can sustain its recovery in the short term. A steady increase in futures OI is required to support the price increase.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: Can XRP steady its recovery into the weekend?

XRP is trading above $2.45 at the time of writing on Friday, supported by a buy signal from the Moving Average Convergence Divergence (MACD) indicator on the daily chart.

Traders would be inclined to increase exposure if the blue MACD line remains above the red signal line, as the indicator generally rises.

The Relative Strength Index (RSI), which is currently at 44, indicates that bearish momentum is easing heading into the weekend. A breakout above the midline would affirm XRP's bullish outlook.

Moreover, traders will watch for a daily close above $2.50 to ascertain XRP's bullish potential. Other key milestones include the 200-day Exponential Moving Average (EMA) at $2.61, the 50-day EMA at $2.69 and the 100-day EMA at $2.74.

XRP/USDT daily chart

Still, traders must be cautiously optimistic as sentiment remains shaky in the broader cryptocurrency market. Any signs of a weak technical outlook could lead to rushed profit-taking, increasing the odds of a reversal toward support at $2.40 and $2.18, tested over the past week.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.