POPULAR ARTICLES

- XRP reclaims $2.40, mirroring bullish sentiment across the cryptocurrency market.

- Whales buy XRP amid volatility, improving short to medium-term bullish outlook.

- Retail investors eye opportunities in the derivatives market as the XRP Open Interest weighted funding rate rebounds.

Ripple (XRP) shows signs of recovery, trading above $2.40 at the time of writing on Thursday. The current bullish outlook can be attributed to institutional and retail interest, which has gradually increased over the past two weeks despite volatility.

XRP whales increase risk exposure

Large-volume holders of XRP, particularly whales holding between 1 million and 10 million tokens, are piling into the token as the price fluctuates. Santiment data shows that this whale cohort began buying XRP before the October 10 deleveraging event, which liquidated $19 billion in crypto assets. The whales currently hold 12.65% of the total XRP supply, up from 12.16% on October 6.

The next whale cohort, with between 10 million and 100 million tokens, has gradually increased its holdings to 10.07% of the total supply from 9.97% on October 8. Steady demand for XRP is key to sustaining the uptrend, as buying pressure overshadows demand.

[18-1761235856093-1761235856093.17.13, 23 Oct, 2025].png)

XRP Supply Distribution metric | Source: Santiment

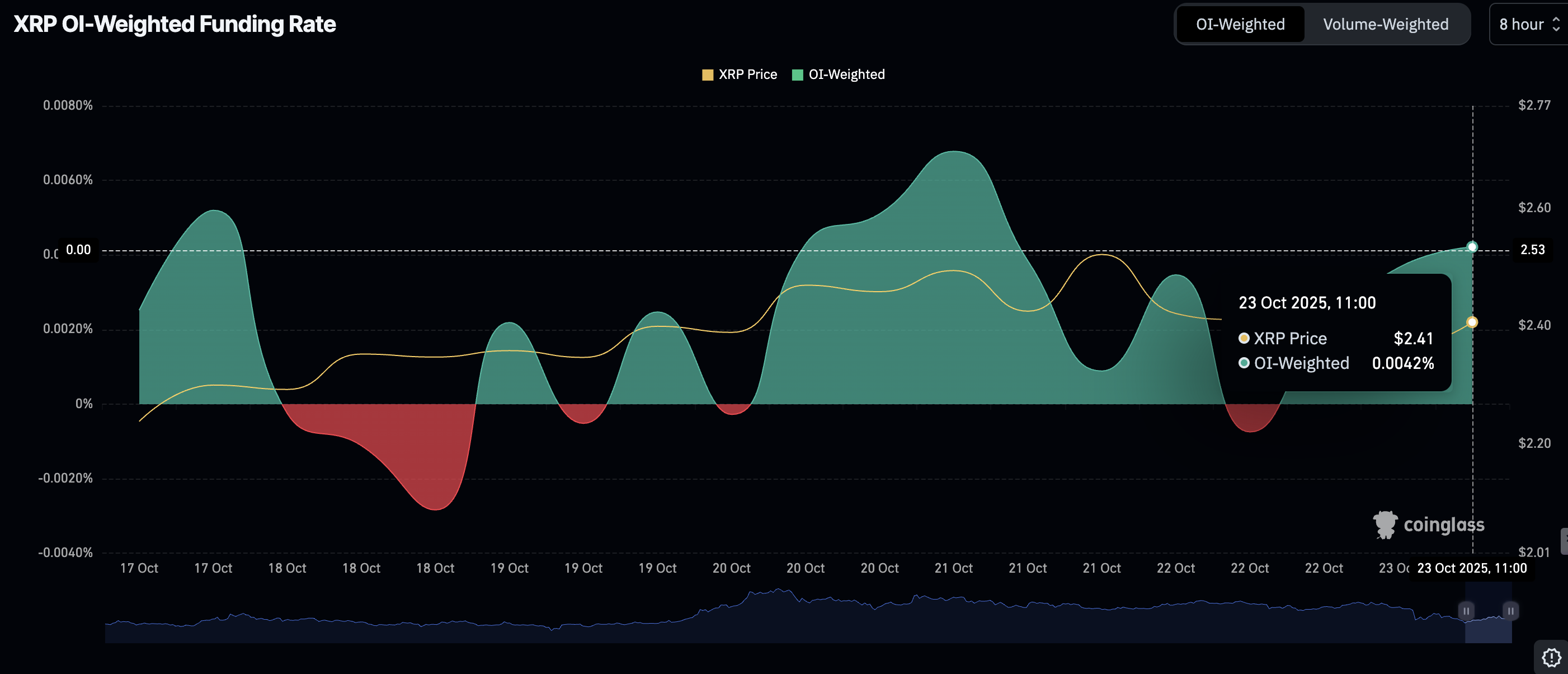

Meanwhile, retail interest in XRP also expanded amidst price fluctuations. CoinGlass data shows that the futures Open Interest (OI)- weighted funding rate stood at 0.0042% on Thursday, up from -0.0007% on Wednesday.

The weighted funding rate plummeted to -0.2040% on October 11, reflecting extreme risk-off sentiment after the sell-off to $1.25 on October 10.

A sustained recovery in the OI Weighted Funding Rate metric suggests that more traders are increasing their risk exposure, piling into long positions.

XRP Futures OI Weighted Funding Rate metric | Source: CoinGlass

Technical outlook: XRP eyes steady recovery

XRP is building on its short-term support at $2.40 as risk-on sentiment improves in the broader cryptocurrency market. An upward-trending Relative Strength Index (RSI) at 40 on the daily chart indicates that bullish momentum is increasing. Traders should monitor the RSI, as a recovery above the midline would indicate strong momentum.

The Moving Average Convergence Divergence (MACD) indicator on the same daily chart is on the verge of validating a buy signal. The blue MACD line must cross and settle above the red signal line as the indicator moves higher, encouraging traders to increase their risk exposure.

XRP/USDT daily chart

Key milestones include a sustained break above $2.50 round-number level, the 200-day Exponential Moving Average (EMA) at $2.61 and the 50-day EMA at $2.70, all of which could signal profit-taking if XRP shows weakness during the uptrend.

The short-term $2.40 support is key to a steady uptrend, likely preventing a reversal to the next demand area at $2.18, which was tested last Friday.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.