POPULAR ARTICLES

- XRP extends its decline to $2.20 on Monday as volatility spikes in the broader crypto market.

- The Crypto Fear & Greed Index is in extreme fear territory amid rising downside risks for XRP.

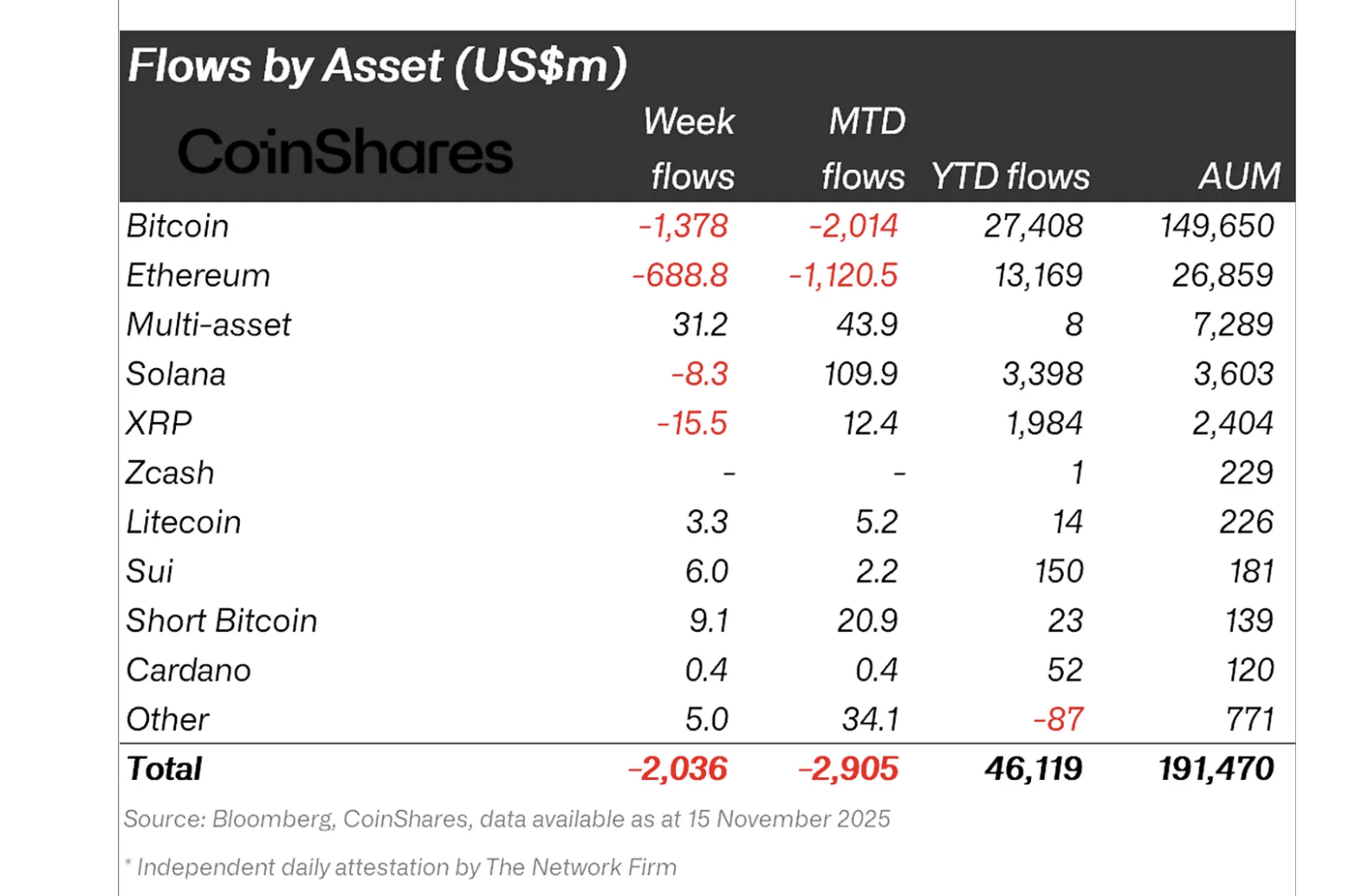

- XRP digital asset products recorded $15.5 million in outflows last week amid a weak retail market.

Ripple (XRP) is sending mixed signals, trading around $2.27 at the time of writing on Monday. The cross-border remittance has faced a series of declines and liquidations, leaving investors counting losses since its record high of $3.66 on July 18.

A flash crash on October 10 liquidated over $19 billion in crypto assets, delaying recovery. This pushed weak hands out of their positions, shrinking retail demand. Institutional demand for XRP has also taken a back foot with steady outflows from related digital asset products.

XRP struggles as institutional and retail investors retreat

XRP-related digital asset products saw outflows of $15.5 million last week amid bearish sentiment across the crypto market. According to CoinShares, monetary policy uncertainty was the primary driver of the outflows.

CoinShares stated in the weekly report that “Bitcoin (BTC) and Ethereum (ETH) led the losses with outflows of $1.38 billion and $689 million, while investors shifted toward multi-asset Exchange Traded Funds (ETPs).”

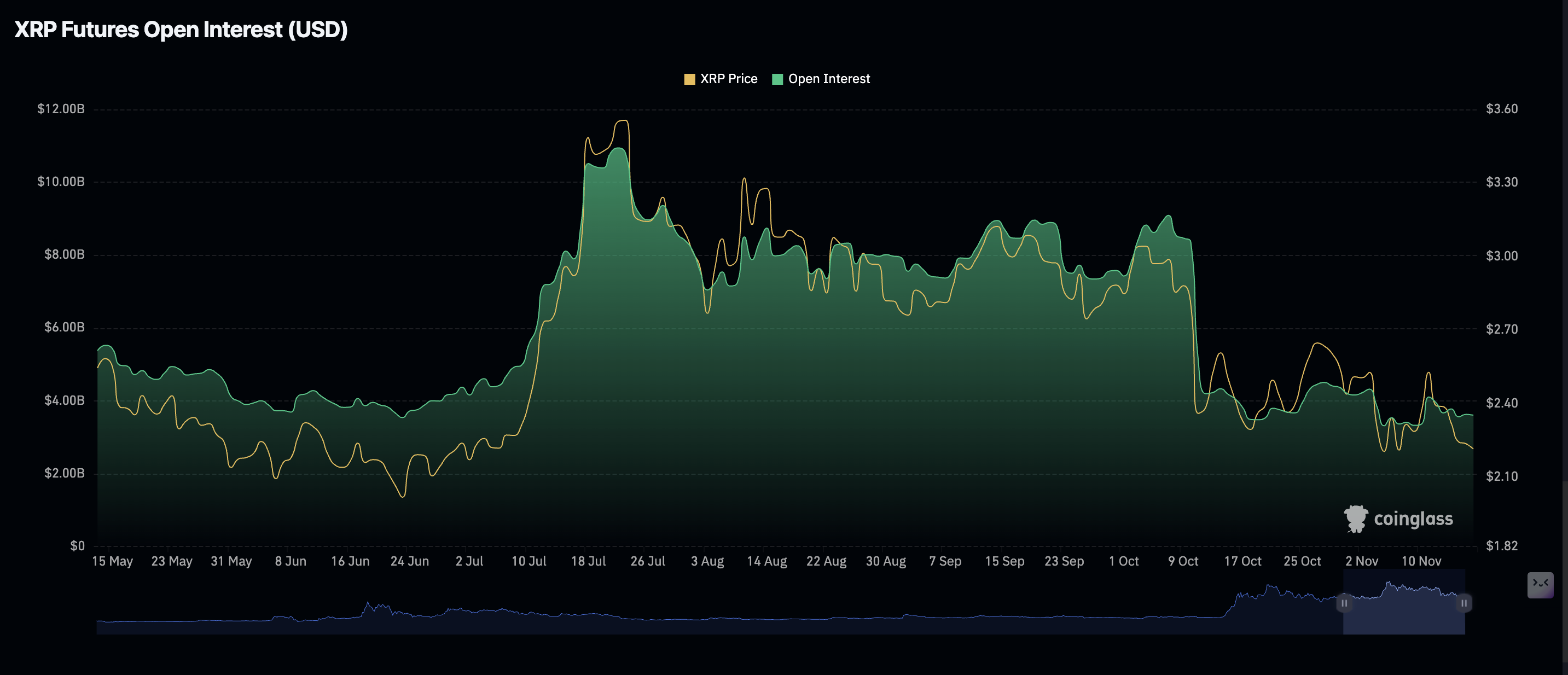

Meanwhile, retail demand for XRP has not recovered since mid-October, characterised by a weak derivatives market. CoinGlass data shows the futures Open Interest (OI) averaging $3.61 billion on Monday, a minor pullback from $3.63 billion the previous day, but significantly down from record highs of $10.94 billion posted on July 22.

The sharp decline in XRP futures OI underscores a weak derivatives market with low retail interest. In other words, traders are not convinced that prevailing market conditions can usher in a short-term bullish trend.

Technical outlook: XRP targets $2.00 as volatility spikes

XRP edges lower alongside other cryptocurrencies on Monday as bears tighten their grip. The Relative Strength Index (RSI) remains steady at 43 indicating that sellers have the upper hand in the short term.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator on the same daily chart is encouraging investors to reduce exposure, which contributes to selling pressure.

XRP is also positioned below key moving averages, including the 50-day Exponential Moving Average (EMA) at $2.49, the 200-day EMA at $2.56 and the 100-day EMA at $2.60, all of which serve as resistance levels.

The 50-day EMA recently crossed below the 200-day EMA on the daily chart, validating a Death Cross pattern. A Death Cross is a bearish pattern that reinforces risk-off sentiment, hence the need to prepare for further downside. Support at $2.07 and $1.90 is in line to absorb potential selling pressure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.