FTSE 100 Macroeconomic Overview

Following the Bank of England’s (BOE) interest rate peak at 2.0% in August 2024, rates have decreased by 0.50 basis points and currently stand at 4.75%.

Recent data from the Office for National Statistics (ONS) indicates inflation increased from 1.7% in September to 3.2% in October, primarily driven by rising energy costs. Despite expectations for easing inflationary pressures, interest rates have remained steady at 4.75 basis points, with the next BOE policy meeting scheduled for 19 December.

Inflationary pressures are anticipated to decline throughout the year. While the UK economy is likely to see interest rate reductions following the recent fiscal budget, future rate cuts are expected to be gradual.

Investing in FTSE 100 dividend-paying equities can be an effective approach to generating income and achieving long-term capital growth. As of January 2025, several FTSE 100 constituents are distinguished by attractive dividend yields and consistent payout records.

Below is a comprehensive guide to the top FTSE 100 dividend stocks for 2025, key investment considerations, and the rationale behind dividend investing as a robust strategy.

Why FTSE 100 Dividend Stocks Are Attractive

Reliable Income Stream

Dividend-paying stocks appeal to investors seeking steady cash flow. The FTSE 100 includes numerous companies with established track records of dividend payments and growth.

Stability and Resilience

FTSE 100 constituents are large-cap firms that typically exhibit lower volatility compared to smaller companies, making them appealing during periods of economic uncertainty.

Dividend Growth Potential

Certain companies prioritize increasing their dividends over time alongside offering attractive yields, making them suitable for long-term investors targeting both income and capital appreciation.

Top FTSE 100 Dividend Stocks to Watch in 2025

#1 Legal & & General Group (LGEN)

Legal & & General Group PLC (LGEN) maintains a consistent dividend payment history, making it an attractive choice for income-focused investors.

• Sector: Financial Services

• Dividend Yield: Approximately 9.8%

Key Highlights:

• A market leader in insurance, retirement solutions, and investment management.

• Consistently delivers a high dividend yield supported by strong cash flow generation.

• Attractive for income investors seeking exposure to the financial sector.

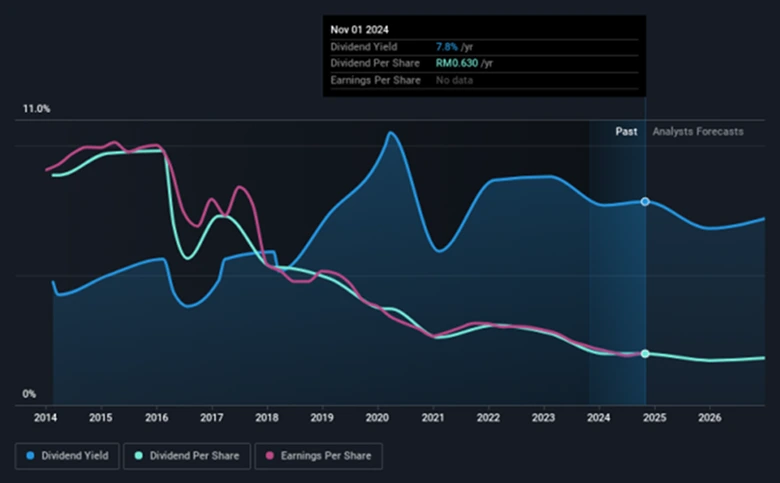

#2 M&G (MNG)

Since 2021, M&G plc has been crediting dividends directly into shareholders’ bank accounts, eliminating cheque issuance. This method enhances security, efficiency, and environmental sustainability.

• Sector: Investment Management

• Dividend Yield: Approximately 13%

Key Highlights:

• Offers one of the highest dividend yields within the FTSE 100.

• Focuses on asset management and long-term wealth creation.

• Suitable for investors seeking strong income despite market volatility.

#3 British American Tobacco (BATS)

British American Tobacco facilitates dividend receipt by crediting payments directly into shareholders’ nominated bank accounts.

• Sector: Tobacco

• Dividend Yield: Approximately 7.9%

Key Highlights:

• A global leader in tobacco products with strong cash flow generation.

• Consistent dividend payments supported by a diversified product portfolio.

• Appeals to income investors despite ethical considerations related to tobacco investments.

#4 Phoenix Group Holdings (PHNX)

Phoenix Group Holdings Plc’s dividends go ex-dividend in three months, with payments typically made about four months later. The company usually issues two dividends annually (excluding special dividends), with a dividend cover ratio near 1.0.

• Sector: Insurance

• Dividend Yield: Approximately 10.2%

Key Highlights:

• Specializes in life insurance and pension products.

• Provides a high and stable dividend, appealing to income-focused portfolios.

• Demonstrates a strong track record of profitability and growth in retirement markets.

#5 B&M European Value Retail (BMEB)

B&M European Value Retail SA is projected to pay a dividend of £0.15, corresponding to a dividend yield of approximately 3.74%.

• Sector: Retail

• Dividend Yield: Approximately 9.7%

Key Highlights:

• Operates as a discount retailer targeting cost-conscious consumers.

• Demonstrates strong performance even in challenging economic conditions.

• High dividend yield reflects consistent profitability.

#6 Shell (SHEL)

• Sector: Energy

• Dividend Yield: Approximately 4.6%

Key Highlights:

• A leading integrated oil, gas, and renewable energy company.

• Reliable dividend payments supported by strong cash flow from diversified operations.

• Attractive for investors seeking energy sector exposure with a focus on sustainability.

#7 HSBC Holdings (HSBA)

• Sector: Banking

• Dividend Yield: Approximately 6.7%

Key Highlights:

• A global banking leader with significant operations across Asia and Europe.

• Regular dividend distributions supported by strong financial results and global diversification.

• An excellent choice for investors seeking exposure to the financial sector.

#8 Unilever (ULVR)

• Sector: Consumer Goods

• Dividend Yield: Approximately 3.6%

Key Highlights:

• Manufactures essential products in food, home care, and personal care sectors.

• Recognized for its defensive qualities and dependable dividend payments.

• A stable option for income investors seeking low-risk exposure to consumer goods.

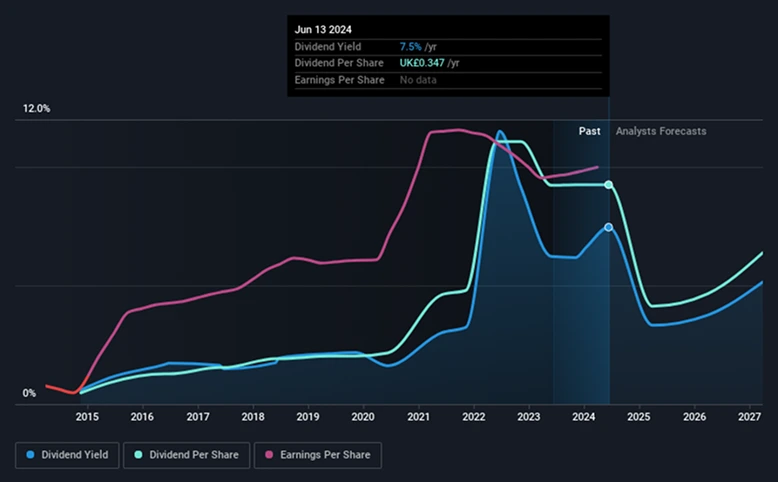

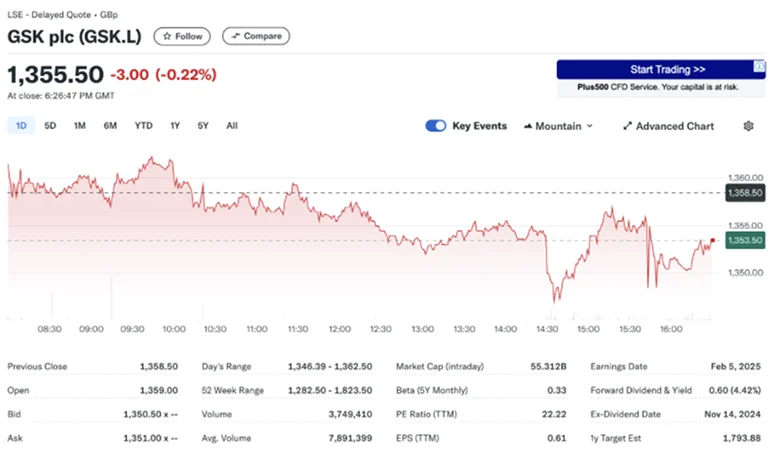

#9 GlaxoSmithKline (GSK)

• Sector: Pharmaceuticals

• Dividend Yield: Approximately 4.9%

Key Highlights:

• Specializes in vaccines, pharmaceuticals, and healthcare innovation.

• Consistent dividend payments supported by a strong product pipeline.

• Provides stability in a defensive sector, especially during volatile market conditions.

#10 Diageo (DGE)

• Sector: Beverages

• Dividend Yield: Approximately 3.7%

Key Highlights:

• A leader in premium alcoholic beverages with iconic brands such as Johnnie Walker and Guinness.

• Generates consistent cash flow supporting stable dividend growth.

• Attractive for investors seeking income from consumer staples.

Summary

Key Considerations for Dividend Investors

Dividend Sustainability

While high yields are attractive, not all dividends are sustainable. Evaluate payout ratios, cash flow generation, and debt levels to confirm a company’s ability to maintain dividend payments.

Sector Diversification

Avoid concentration risk by diversifying across sectors such as energy, financials, and consumer goods to mitigate portfolio volatility.

Economic and Market Conditions

Economic downturns can adversely affect corporate earnings and dividend payouts. Prioritize companies with resilient business models and strong balance sheets.

Dividend Growth vs. High Yield

Decide whether your investment focus is on high current income or consistent dividend growth. Historically, dividend growth stocks tend to outperform over the long term.

Why Dividend Investing Is Effective

Dividend investing balances income generation with long-term capital appreciation. Reinvesting dividends can compound returns, while steady dividend payments provide downside protection during market volatility.

By focusing on reliable dividend payers within the FTSE 100, investors can build a portfolio aligned with their income objectives and risk tolerance, benefiting from the stability of well-established companies.

Investing in FTSE 100 dividend stocks remains a proven strategy for wealth accumulation and securing a sustainable income stream.

Seeking a reliable Forex broker? Why not open a TMGM account today and explore the trading opportunities?