Trade Global Indices with

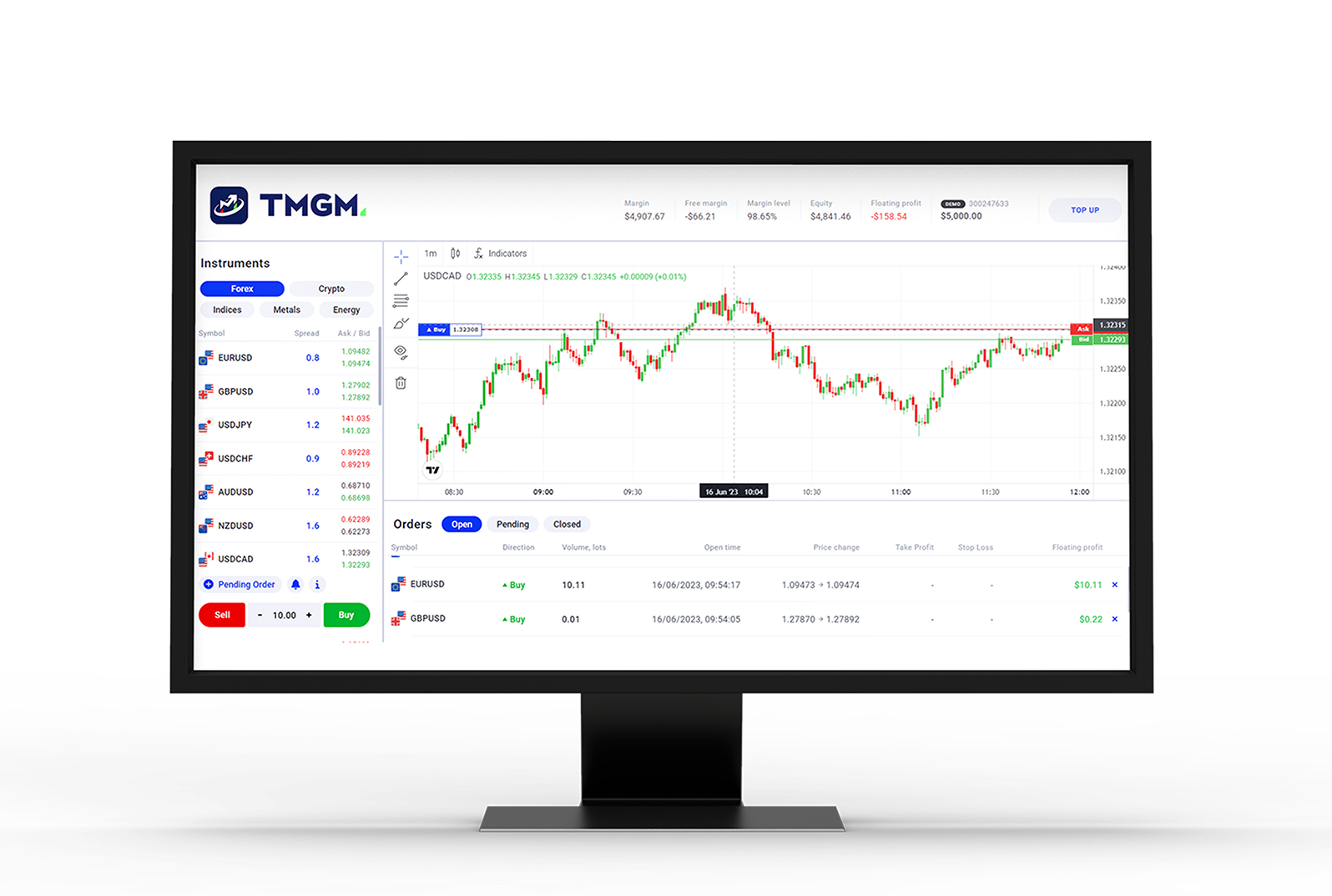

TMGM

Global indices at your fingertips to trade and enjoy zero commission - access leading global markets from your TMGM account. Trading indices like the S&P 500 to the NASDAQ from India has never been easier, with TMGM.

Unlock Your Trading Potential Now!

Why Should You Trade CFDs on Indices?

When you trade CFDs on indices, you gain exposure to international stock market performance, allowing your profits to grow exponentially! It allows you to diversify your portfolio, and gives you versatility whether you're trading in Mumbai or Monaco!

A Global TMGM Account gives you the benefit of:

Ultra-tight spreads and fast execution.

Leverage of up to 1:1000 for maximum flexibility.

Access to powerful trading platforms like MetaTrader 4 and MetaTrader 5.

US500

S&P 500

Bid

0

Ask

0

Spread

0.0

Leverage

Up to 1:500

Buy

Sell

US30

Dow Jones 30

Bid

0

Ask

0

Spread

0.0

Leverage

Up to 1:500

Buy

Sell

GER40

DAX

Bid

0

Ask

0

Spread

0.0

Leverage

Up to 1:500

Buy

Sell

UK100

FTSE 100

Bid

0

Ask

0

Spread

0.0

Leverage

Up to 1:500

Buy

Sell

JPN225

Nikkei

Bid

0

Ask

0

Spread

0.0

Leverage

Up to 1:500

Buy

Sell

Click here to view the Indices' Dividends

How Does Indices Trading Work with TMGM

Indices trading gives Indian traders the opportunity to speculate on the performance of a group of stocks within a specific index, such as the S&P 500 or the FTSE 100. Instead of focusing on individual companies, indices trading allows you to gain exposure to the broader market movements of an entire country or sector, making it a popular choice for those starting their journey in online trading.

One of the biggest advantages of indices trading is the ability to trade using leverage, where you can control larger positions with a smaller initial margin. With TMGM, traders in India can access leading global indices such as the Dow Jones (US30), DAX (GER40), and Nikkei (JPN225), all through a secure online trading environment. This approach not only helps in diversifying your portfolio but also provides exposure to some of the most actively traded markets worldwide.

At TMGM, leverage on indices trading can go up to 1:500, creating opportunities for traders to amplify their exposure in global markets. While this level of access enhances profit potential, it is important to remember that leveraged CFD trading also carries risks. TMGM supports Indian traders with a safe and transparent platform, ensuring that you can explore CFD opportunities with confidence while practicing responsible risk management.

Why Trade Indices with TMGM?

Over 15+ Indices CFDs

Access global indices from the US, EU, UK, Australia, and Asia in one platform.

Up to 1:500 Leverage

Trade indices CFDs with leverage of up to 1:500 for maximum market exposure.

0 Commission

Enjoy zero commission on all indices of CFD trading.

Spreads from 0.1 Pips

Take advantage of tight spreads powered by TMGM's proprietary Aggregation Engine for optimal pricing.

10+ Tier 1 Liquidity Providers

Benefit from deep liquidity and reliable execution with top-tier liquidity providers.

NY4 Servers

Experience lightning-fast execution with TMGM's strategically located NY4 servers.

All Strategies Allowed

Whether you're a scalper, news trader, or EA trader, TMGM provides the ideal environment for your trading strategy.

No Requotes

Trade confidently with zero requotes, thanks to our robust pricing and liquidity infrastructure.

Trusted & Regulated Broker

With ASIC, VFSC, FSA and FSC licenses, TMGM ensures a safe and secure trading experience.

Transparent Spreads

Trading with TMGM is Confidence

At TMGM, we are the best in tight and transparent spreads, and help you Trade the top indices at the most competitive rates.

Bid

Ask

US500

0

0

US30

0

0

GER30

0

0

UK100

0

0

JPN225

0

0

AUS200

0

0

EUSTX50

0

0

FRA40

0

0

GER40

0

0

NAS100

0

0

SGCSGD

0

0

HK50

0

0

US500

Bid

0

Ask

0

US30

Bid

0

Ask

0

GER30

Bid

0

Ask

0

UK100

Bid

0

Ask

0

JPN225

Bid

0

Ask

0

AUS200

Bid

0

Ask

0

EUSTX50

Bid

0

Ask

0

FRA40

Bid

0

Ask

0

GER40

Bid

0

Ask

0

NAS100

Bid

0

Ask

0

SGCSGD

Bid

0

Ask

0

HK50

Bid

0

Ask

0

Explore more about Indices with TMGM

Please note that these are indicative rates only and are subject to change pending the final executed rate at midnight MT4 Server time. Dividends will be settled in your account balance and you will see the corresponding comment 'CFD Dividend'. We always recommend before trading such assets, that you monitor for any updates relevant to your trades.

How do Dividends work? If you hold an open position from the day before the ex-dividend date, then you will receive the dividend payment on a buy position and be charged on a sell position.

Symbol ▲ ▼ | Symbol ▲ ▼ | Long Amount ▲ ▼ | Short Amount ▲ ▼ | Currency ▲ ▼ | Effective Date ▲ ▼ |

|---|---|---|---|---|---|

| USD | |||||

| USD | |||||

| USD | |||||

| USD | |||||

| USD |

Indices FAQs – Your Questions Answered

What are the benefits of trading CFD indices in India?

+

What factors impact the price of indices?

+

Are TMGM's indices based on future or spot prices?

+