Chart Pattern Trading: Top 10 Candle Stick Chart Patterns Indian Traders should Know

The top 10 candlestick chart patterns for trading are the Ascending Triangle Pattern, Descending Triangle Pattern, Symmetrical Triangle Pattern, Flag Pattern, Wedge Pattern, Double Top, Double Bottom, Head and Shoulders, Rounded Top and Rounded Bottom, Cup and Handle. These patterns are widely used for identifying potential trend reversals in financial markets. Right from your first trade on anything like NIFTY or USD/INR chart, chart patterns can help you make sense of price swings instead of guessing. By learning how these patterns form and how to trade them with clear rules, you can plan entries, stops and profit targets more confidently on charts like NSE, BSE and MCX.

What Are Chart Patterns in Trading?

Chart patterns are repeatable shapes formed by price movement on your candlestick chart. Instead of reading every candle one by one, you group swings into structures like triangles, flags, wedges, double tops and other patterns.

For you as an Indian trader, chart patterns are especially useful because they:

Work across different markets & instruments — NIFTY, BANK NIFTY, USD/INR, MCX Gold, MCX Crude, stocks on NSE/BSE

Work on the timeframes you actually trade — 5-minute, 15-minute, hourly, daily

Give a simple framework for planning trades around support, resistance and breakouts

Why Chart Patterns Matter for Traders

Indian markets can move sharply around events like RBI policy, Union Budget, results season or weekly index expiry. Chart patterns help you:

Read market psychology around these events

Spot when price is consolidating before a big move

See when trends in NIFTY or USD/INR are strengthening or weakening

Create IF–THEN rules, such as:

“If NIFTY breaks above this triangle, then I will buy with stop below the pattern low.”

Instead of reacting emotionally to big candles or news, you let chart structures guide your decisions.

Types of Chart Patterns

You will mostly work with three groups of chart patterns.

1. Continuation chart patterns

These suggest the trend is likely to resume after a pause. Examples:

Bullish flag on a strong NIFTY intraday rally

Rising channels or staircases in trending stocks

Triangles and wedges after big moves on MCX metals

2. Reversal chart patterns

These hint that the trend may be ending and could reverse direction:

Double tops after a strong rally in BANK NIFTY

Double bottoms in beaten-down mid-cap stocks

Head and shoulders on a weekly NIFTY 50 chart

3. Ambiguous chart patterns

These can break either way and demand additional confirmation:

Symmetrical triangles on USD/INR daily charts before major macro events

Tight ranges on index futures ahead of expiry

Chart Patterns Popular in Indian Markets

Here’s how chart patterns often show up in Indian instruments:

NIFTY 50 & BANK NIFTY – Flags, triangles and wedges on intraday charts are common during strong trend days. Double tops/bottoms and head & shoulders are more visible on daily/weekly charts.

USD/INR – Symmetrical triangles and channels often form around RBI events or global USD moves, with breakouts leading to sustained trends.

MCX Gold & MCX Crude – Flags, wedges and rounded tops/bottoms are frequent due to international volatility and gap openings.

NSE/BSE stocks – Cup and handle, ascending triangles and rounded bottoms often appear as stocks graduate from accumulation to uptrends.

Essential Chart Patterns for Indian Traders

The core list of chart patterns is the same globally, but below you’ll see them through an Indian lens.

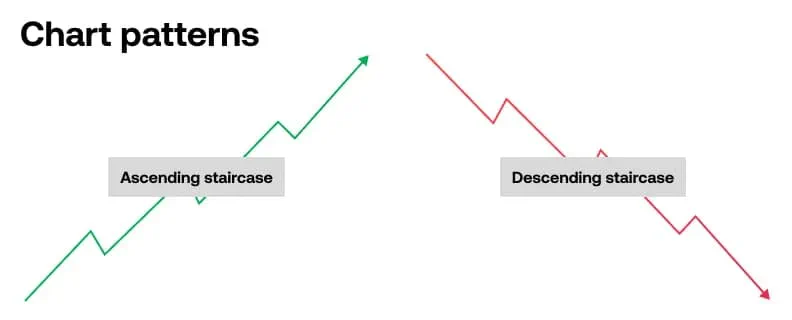

Ascending and Descending Staircases

On a NIFTY 50 uptrend, you’ll often notice price pushing to a new high, then pulling back, but not all the way down. Each correction ends above the previous one. That is your ascending staircase — a series of higher highs and higher lows.

You can use these pullbacks to plan long entries in the direction of the uptrend.

In a falling BANK NIFTY market, the opposite happens: lower highs and lower lows form a descending staircase. Temporary rallies into prior swing highs can act as selling zones.

Ascending Triangle Pattern

An ascending triangle is a bullish continuation pattern. Picture a stock on NSE repeatedly testing resistance near ₹X while forming higher lows each time.

Flat resistance at the top

Rising trendline beneath price

Breakout above resistance, ideally on strong volume, suggests an upside continuation

Indian example: An ascending triangle on NIFTY 50 daily chart just below a key round number before breaking to new highs.

Recommended image: NIFTY daily chart showing an ascending triangle at horizontal resistance.

Alt text: “NIFTY 50 daily chart with ascending triangle pattern and breakout above resistance.”

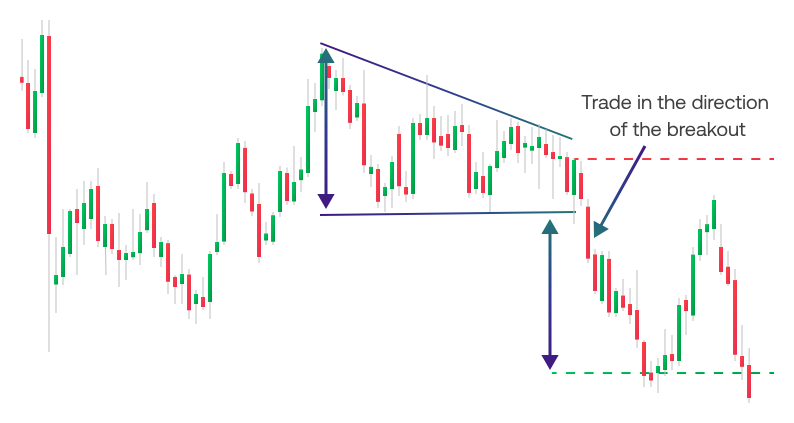

Descending Triangle Pattern

The descending triangle is a bearish pattern often seen in downtrending stocks or indices.

Flat support line at the bottom

Descending resistance line connecting lower highs

Breakdown below support confirms bearish continuation for many traders

Indian example: A descending triangle on BANK NIFTY ahead of a sharp sell-off after weak results or negative sentiment in financials.

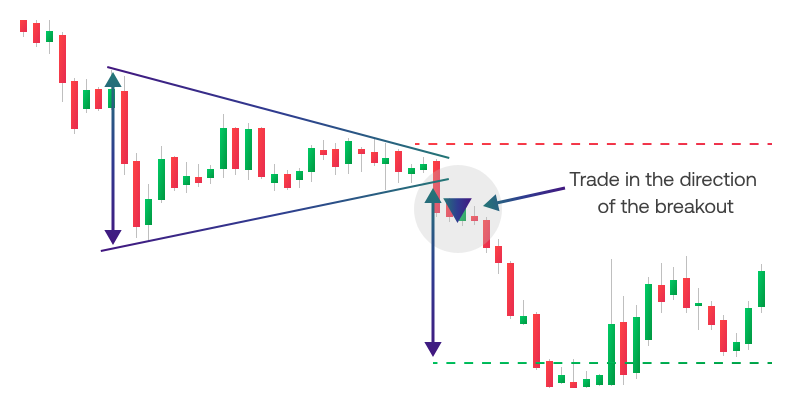

Symmetrical Triangle Pattern

A symmetrical triangle has both support and resistance lines converging. It reflects compression and indecision.

Neither bulls nor bears control the market

Break can happen in either direction — confirmation is critical

Works well on USD/INR or MCX Gold ahead of data releases

Indian example: USD/INR daily chart consolidating in a symmetrical triangle before breaking out after an RBI policy announcement.

Flag Pattern

Flags appear after a sharp move, often on event-driven days.

Bullish flag – Sharp rise (flagpole) followed by a downward-sloping small channel. Breakout higher signals continuation.

Bearish flag – Sharp fall followed by a gentle upward channel. Breakdown lower confirms continuation.

Indian example: MCX Crude rallying after global news, then forming a small bearish or bullish flag before the next leg.

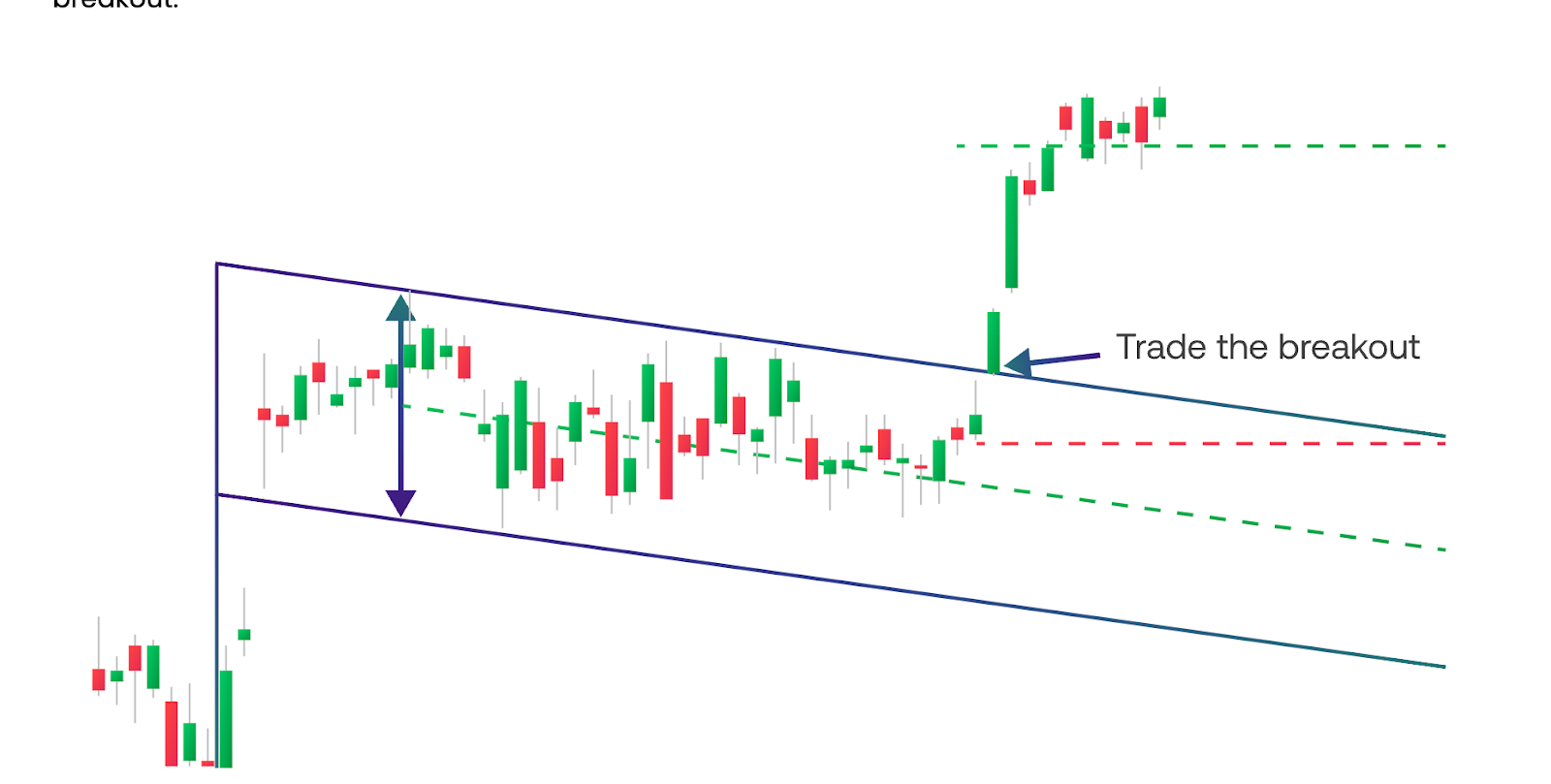

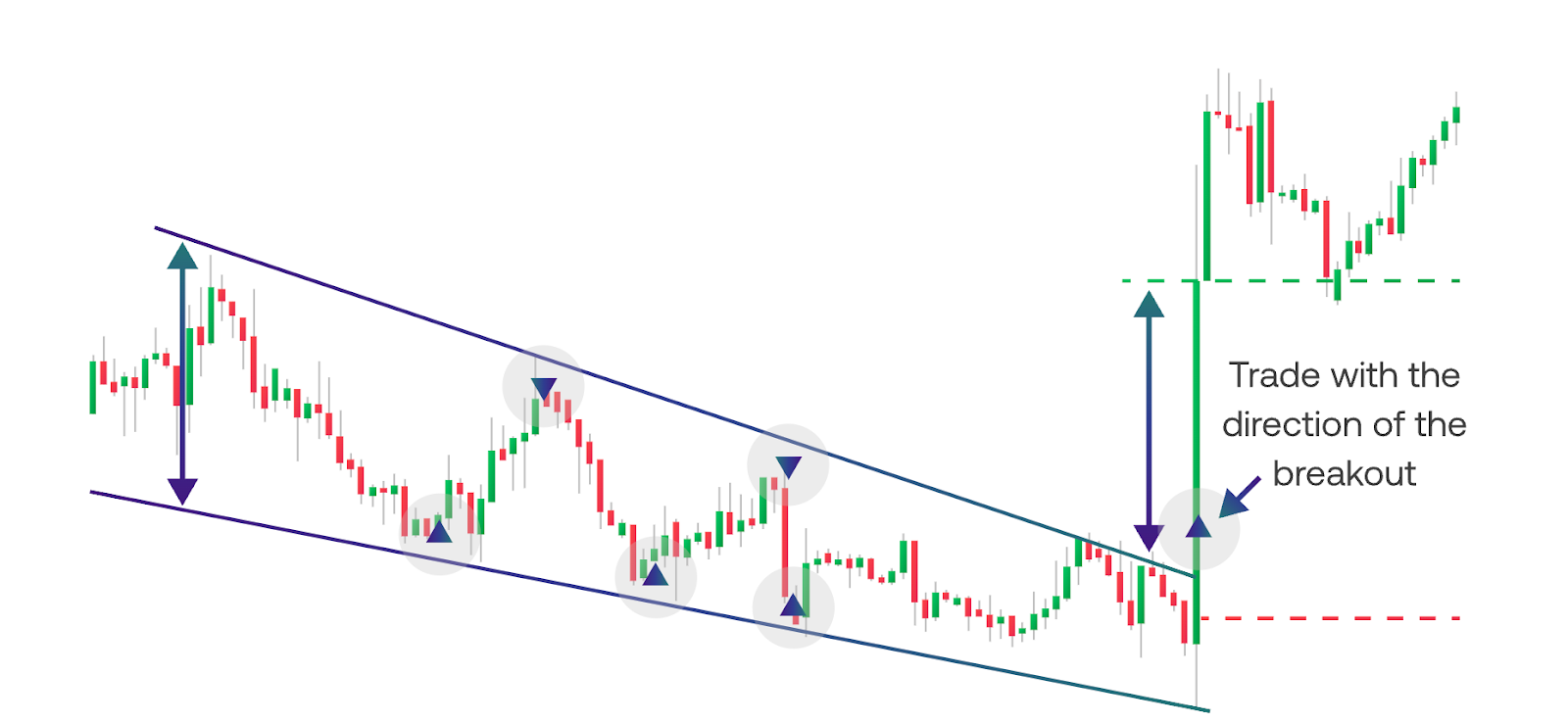

Wedge Pattern

Wedges are like flags but with converging lines.

Rising wedge – Price moves higher within narrowing boundaries. Often interpreted as a bearish reversal sign in an uptrend.

Falling wedge – Price moves lower within narrowing boundaries, hinting at a bullish breakout.

Indian example: A rising wedge on NIFTY after a long rally, breaking down into a corrective phase; a falling wedge in MCX Gold before a rebound.

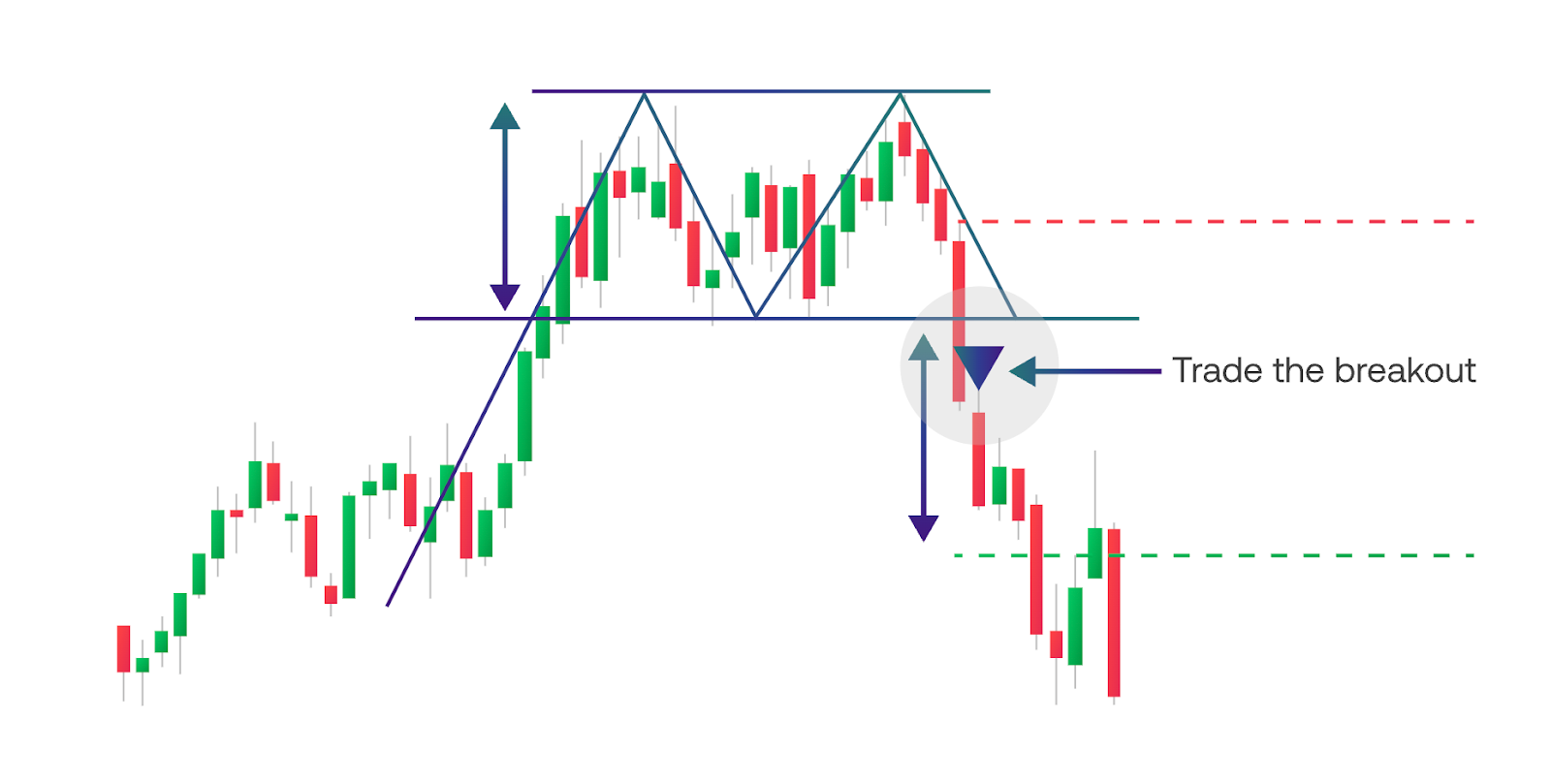

Double Top

The double top often marks the end of a strong uptrend.

Two similar peaks at resistance

Neckline support between them

Break below the neckline confirms the bearish reversal for many traders

Indian example: A double top on BANK NIFTY around a psychological round number just before a deeper correction.

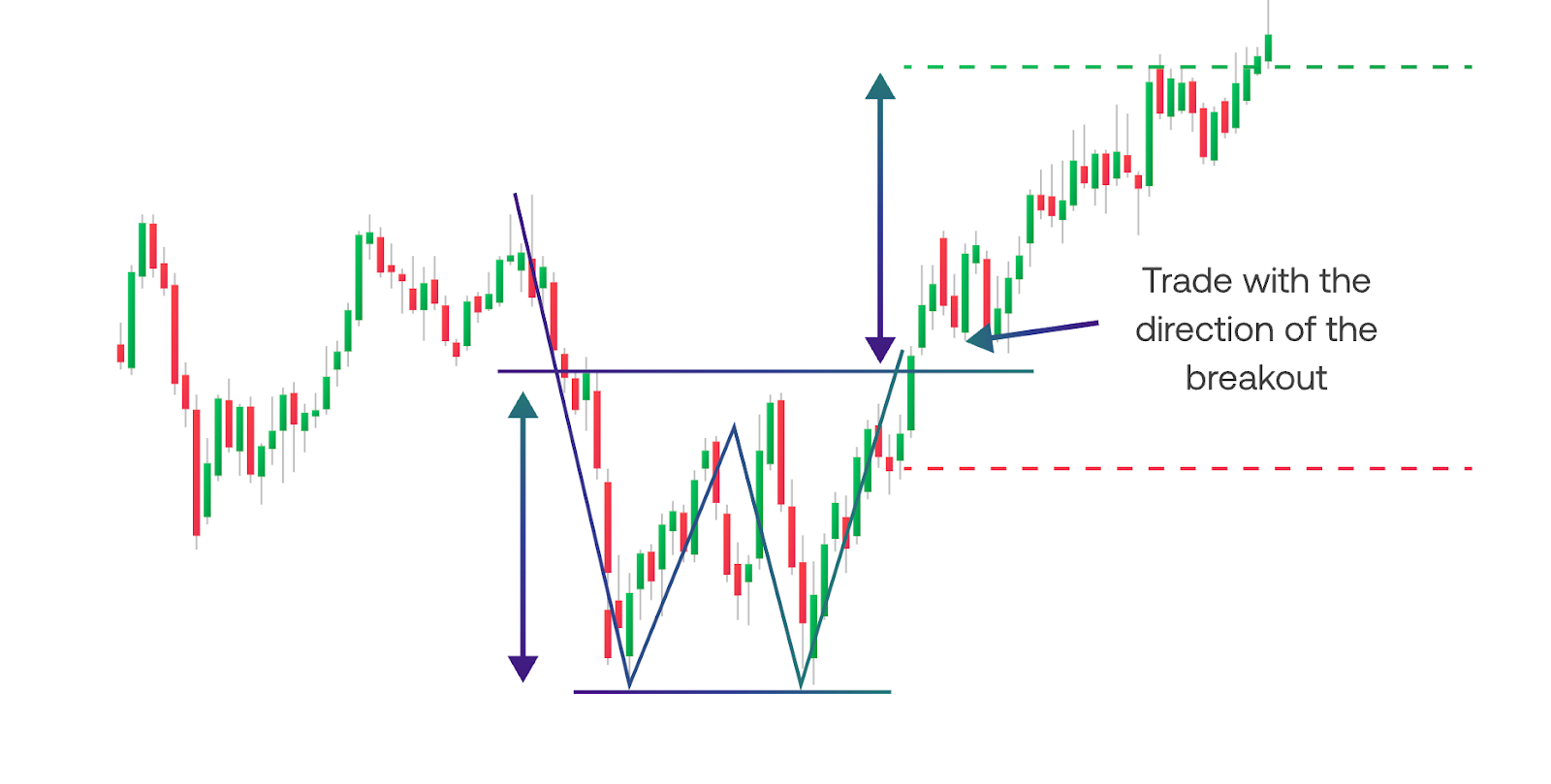

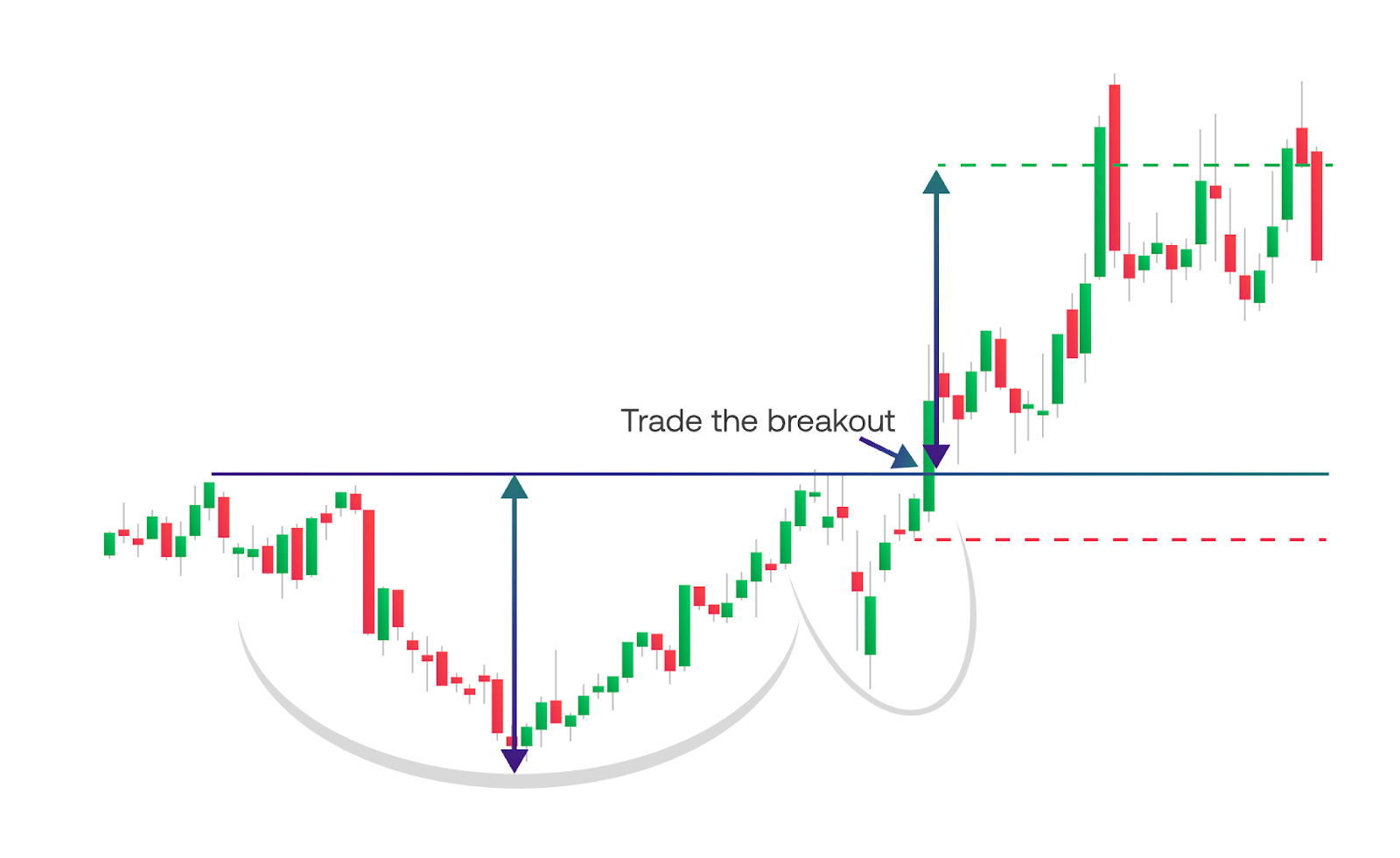

Double Bottom

The double bottom is the bullish mirror image.

Two troughs at or near the same support zone

Neckline acting as resistance between them

Break above neckline signals potential trend reversal higher

Indian example: Double bottom in a beaten-down mid-cap NSE stock, followed by a move back into an uptrend once neckline resistance breaks.

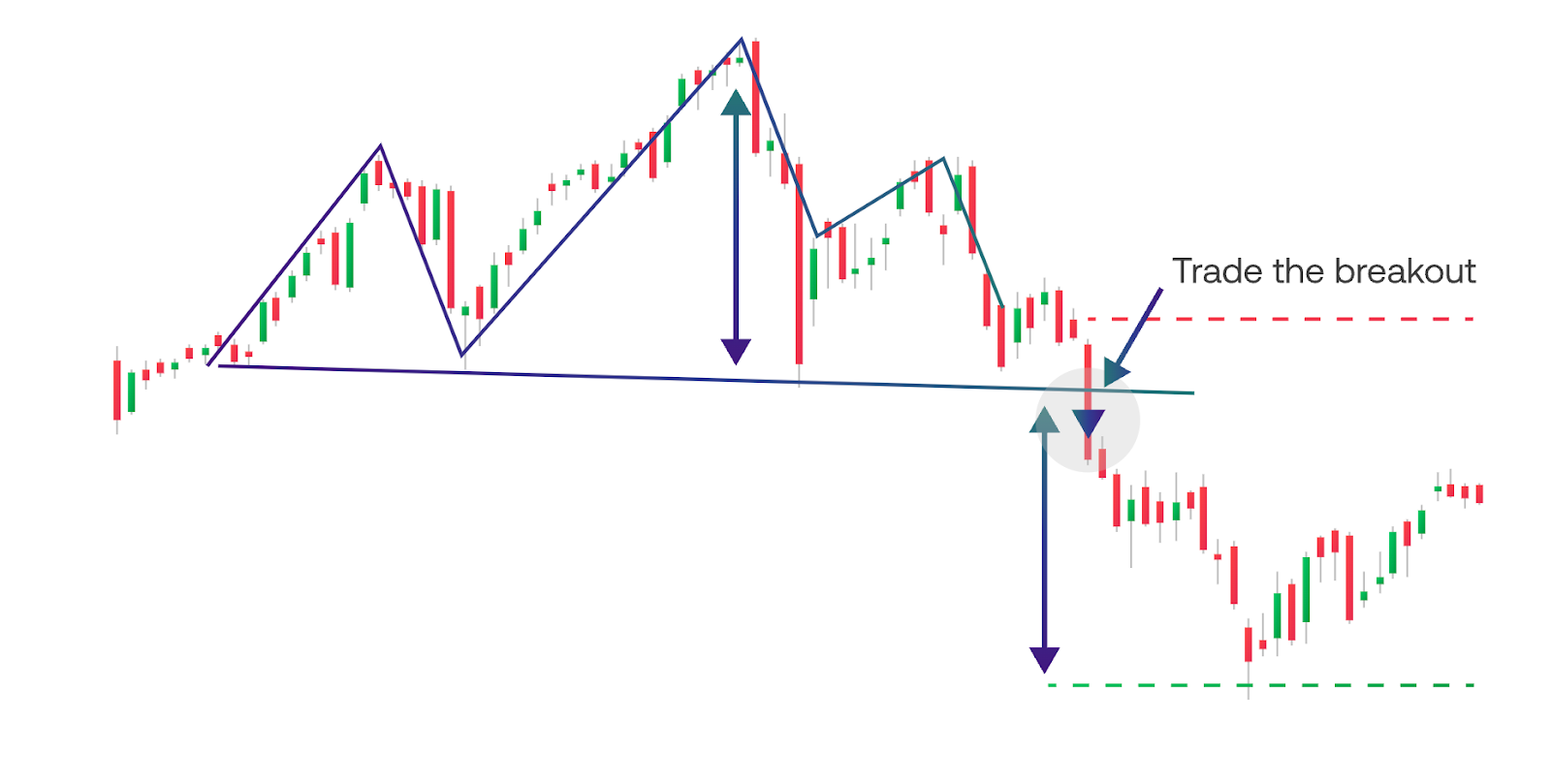

Head and Shoulders

The head and shoulders is a classic bearish reversal pattern:

Left shoulder – rally and pullback

Head – higher high and deeper pullback

Right shoulder – lower high

Neckline – support connecting the two pullback lows

Breakdown below the neckline signals downside potential.

Indian example: NIFTY 50 weekly chart forming a head and shoulders after a multiyear bull run.

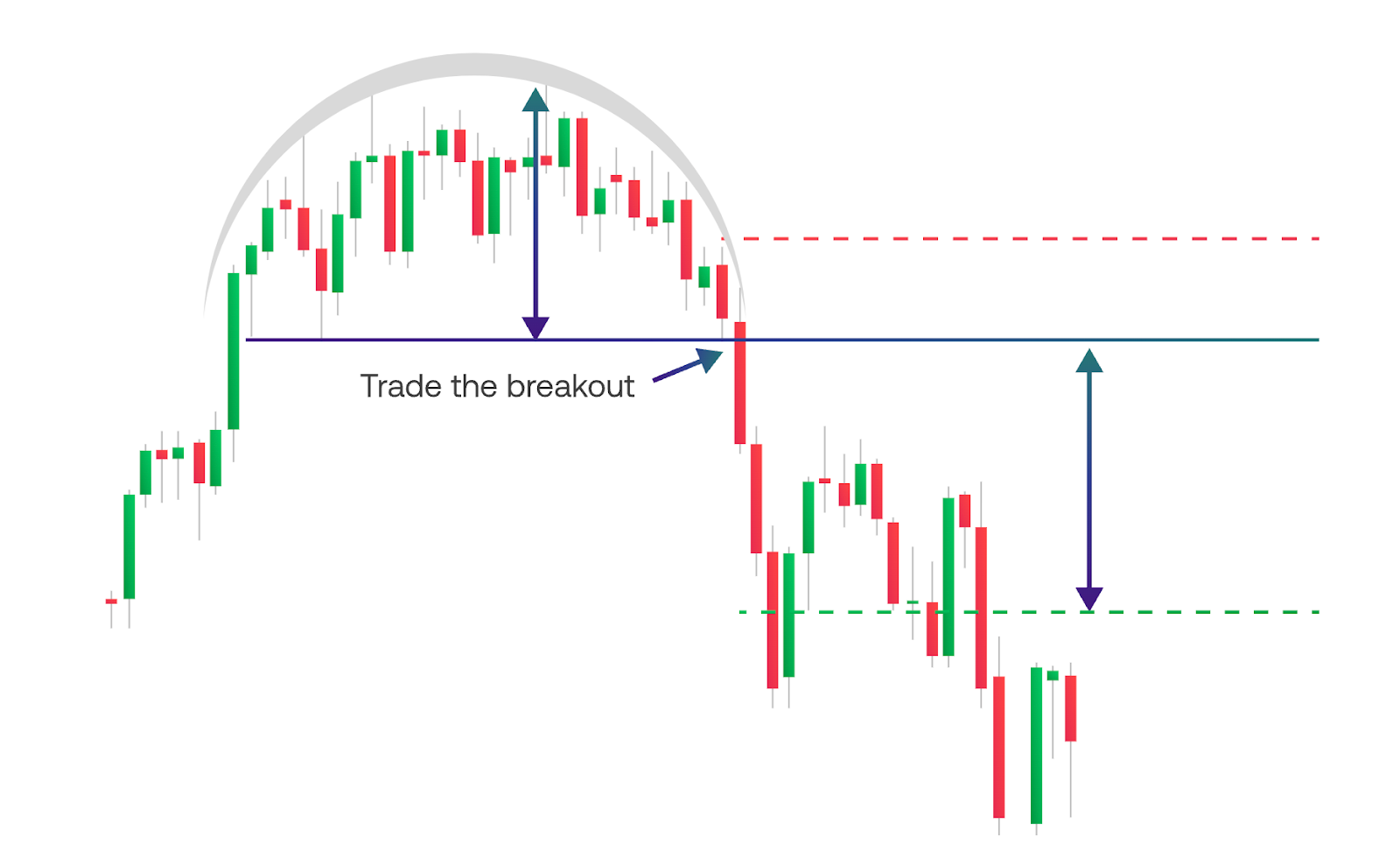

Rounded Top and Rounded Bottom

Rounded patterns reflect slow, steady sentiment shifts.

Rounded top – Gradual topping in an uptrend, leading to a downtrend.

Rounded bottom – Long accumulation phase, then transition into an uptrend.

Indian example: Rounded bottom in MCX Gold on the weekly chart before a long bullish phase.

Cup and Handle

A popular bullish continuation pattern, especially in stocks:

Cup – Smooth U-shaped pullback from a resistance area

Handle – Short-term consolidation or dip after the cup

Breakout above the cup’s resistance confirms the pattern for many traders

Indian example: Cup and handle in a strong NSE growth stock before a fresh breakout to new highs.

Step-by-Step: How to Trade Chart Patterns in India

Here is a simple workflow you can adapt for NIFTY, BANK NIFTY, USD/INR or MCX charts.

Step 1: Choose the right timeframe

Intraday (5-minute, 15-minute): Suitable for day trading NIFTY/BANK NIFTY or liquid stocks.

Swing (hourly, daily): Better for positional trades and avoiding noise.

Start by marking chart patterns on a higher timeframe (daily or hourly), then refine entries on a lower timeframe if needed.

Step 2: Mark the pattern correctly

Draw support and resistance lines (triangle boundaries, flag channel, neckline, etc.).

Confirm that the structure really matches a valid chart pattern, not just random candles.

For wedges and triangles, check that price is touching each boundary at least twice.

Step 3: Plan your entry

Typical approaches Indian traders use:

Breakout entry – Enter when price closes outside the pattern (above resistance for bullish, below support for bearish).

Retest entry – Wait for price to break out, then retest the broken level before entering, which can give tighter stops.

Avoid chasing price if the candle is already far from the pattern boundary.

Step 4: Place a stop-loss

Common rules:

For bullish trades, place your stop below the most recent swing low or below pattern support.

For bearish trades, place stops above the recent swing high or above pattern resistance.

Always size your position so that a stop-out on NIFTY, USD/INR or MCX does not breach your per-trade risk limit (for example, 1–2% of your trading capital).

Step 5: Set realistic profit targets

Popular methods:

Measure the height of the pattern (triangle, flag, head and shoulders) and project it from the breakout point.

Use fixed risk-reward ratios like 1:2 or 1:3 to avoid taking big risks for small potential gains.

Consider partial profit-taking at intermediate levels (prior swing highs/lows, daily levels, etc.).

Common Mistakes Indian Traders Make with Chart Patterns

Indian traders often run into the same chart-pattern issues:

Only trading ultra-low timeframes (1-minute, 3-minute) on NIFTY/BANK NIFTY without any higher-timeframe context.

Ignoring gaps on indices and stocks, especially after news — gaps can distort patterns if not interpreted carefully.

Over-relying on a single pattern without checking volume, trend direction or broader market sentiment.

Entering before confirmation, just because a structure “looks like” a pattern.

Risking too much per trade and trying to recover losses quickly, which can lead to emotional decision-making.

Addressing these errors — especially timeframe selection and risk management — often improves results more than learning a new exotic pattern.

Regulations and Risk Considerations for Indian Traders

When using chart patterns in India, you must also think about rules and risk:

Trade through SEBI-regulated intermediaries – For equity, equity derivatives and some commodities, this means using SEBI-registered brokers and trading only on approved exchanges such as NSE, BSE, MCX, NCDEX, MSEI and India INX.

Respect RBI rules – Especially for currency products involving INR.

Understand product risk – Derivatives and leveraged products can lead to losses exceeding your initial margin if not controlled.

Separate learning from live risk – It’s sensible to practise chart pattern strategies in a demo or low-risk environment before committing meaningful capital.

Chart pattern education is not investment advice. You should always consider your financial situation, objectives and risk tolerance, and seek independent advice if needed.

Advanced Chart Pattern Techniques for Indian Markets

Once you’re comfortable with basic chart patterns, you can refine how you use them on Indian markets:

Multi-timeframe confluence – For example, a head and shoulders on the NIFTY daily chart combined with a smaller rising wedge on the 1-hour chart.

Combine with Fibonacci tools – Use Fibonacci retracements and extensions to validate targets from chart patterns.

Volume confirmation – Look for rising volume on breakouts from triangles and flags, especially in NSE stocks and index futures.

Event awareness – Be cautious around RBI policy days, Union Budget, major global data and weekly/monthly expiry, where patterns can break but slippage and whipsaws are common.

The goal is not to make charts more complicated, but to increase the quality of your setups.

Trading Chart Patterns Summary

Learn and Practise Chart Patterns with TMGM

Before risking significant capital on NSE, BSE or MCX, it makes sense to practise chart pattern trading in a controlled environment.

With TMGM you can:

Study chart patterns on multiple markets – Explore forex, indices, metals and more to see how the same structures behave in different environments.

Use MetaTrader 4 and 5 platforms – Draw chart patterns with trendlines, channels and other tools, and combine them with indicators like RSI or moving averages.

TMGM’s focus on education and practice can complement your on-exchange trading in India, helping you build discipline and a rule-based approach to chart patterns.

Trade Smarter Today

Frequently Asked Questions (FAQ): Chart Patterns for Indian Traders

How do I use chart patterns on USD/INR?

Do chart patterns work on lower timeframes on Indian Market intraday?

Which timeframe should I use for chart patterns?

Can I rely only on chart patterns to trade Indian markets?

Are chart patterns useful for MCX commodities like Gold and Crude?

Account

Account

Instantly