Why a Crypto Trading Strategy is Essential in a Volatile Market

Cryptocurrencies are traded on decentralized markets, meaning they are not issued or regulated by a central authority such as a government. Instead, they operate on blockchain networks. While this decentralization removes some traditional financial constraints, cryptocurrencies remain highly volatile, influenced by:

Supply and demand dynamics

Media coverage and market sentiment

Adoption trends and institutional interest

Macroeconomic events and regulatory developments

This volatility highlights the necessity of a disciplined trading strategy. A well-structured approach enables traders to manage risk effectively and make informed decisions, whether using leveraged products like CFDs or by directly acquiring crypto assets through an exchange.

Mastering Crypto Strategy: Essential Trading Techniques

Successful crypto trading requires a strategic framework. Here are five key strategies that traders commonly employ:

1. Moving Average Crossovers

Moving averages (MAs) are lagging indicators that help traders identify market trends by smoothing price fluctuations over a defined period. A crossover occurs when a short-term moving average crosses above or below a long-term moving average, signaling potential trend reversals:

Golden Cross: When a short-term MA crosses above a long-term MA, it indicates a bullish trend—often interpreted as a buy signal.

Death Cross: When a short-term MA crosses below a long-term MA, it signals a bearish trend—typically a sell signal.

Traders can leverage these signals to time entries and exits strategically. With TMGM’’s advanced charting tools, applying moving average strategies to crypto markets is straightforward.

Best For: Trend traders seeking confirmation of bullish or bearish momentum.

TMGM Advantage: TMGM’’s sophisticated charting platform enables seamless implementation of moving average crossover strategies in crypto trading.

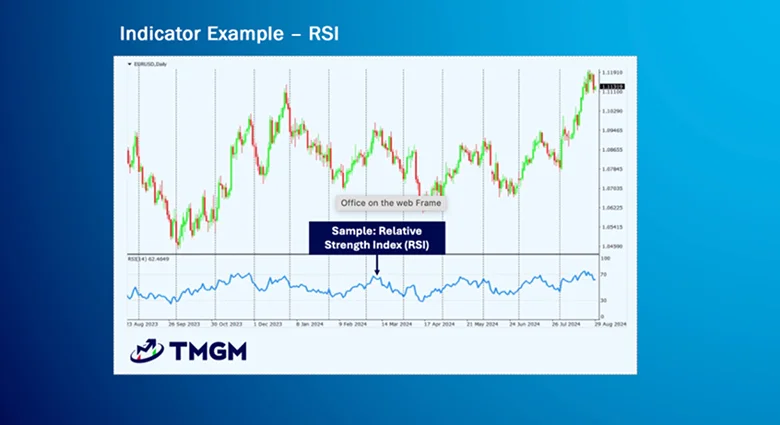

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that helps traders evaluate whether a cryptocurrency is overbought or oversold:

Above 70: The asset is overbought—indicating a potential sell opportunity.

Below 30: The asset is oversold—suggesting a potential buy opportunity.

By analyzing trend strength and divergences, traders can use RSI to optimize entry and exit timing. TMGM’’s trading platform offers real-time RSI indicators to enhance your trading decisions.

Best For: Traders aiming to detect trend reversals and momentum shifts.

TMGM Advantage: TMGM’’s platform delivers live RSI analytics to support your trading strategy.

3. Event-Driven Trading

Market-moving events—such as regulatory updates, strategic partnerships, or protocol upgrades—can significantly influence cryptocurrency valuations. Event-driven trading capitalizes on these developments by:

Buying on positive news releases

Short selling when negative news surfaces

This approach requires vigilant market monitoring, which TMGM facilitates through live news feeds and comprehensive market analysis.

Best For: Traders who actively track news cycles and respond promptly to market events.

TMGM Advantage: Stay updated with TMGM’’s real-time market news and in-depth analytical resources.

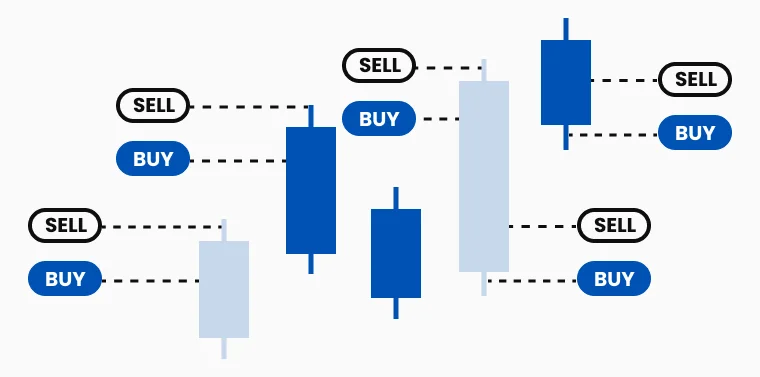

4. Scalping

Scalping is a high-frequency trading technique where traders open and close positions multiple times within short timeframes to capitalize on minor price fluctuations. This strategy suits volatile markets and requires:

Rapid order execution

Strict risk controls

Constant monitoring of real-time price movements

TMGM’’s ultra-fast execution speeds and low-latency infrastructure empower scalpers to trade efficiently without slippage.

Best For: Active traders seeking multiple rapid trades within a single session.

TMGM Advantage: TMGM’’s lightning-fast trade execution and robust infrastructure support efficient scalping strategies.

5. Dollar Cost Averaging (DCA)

Dollar Cost Averaging is a long-term investment technique where traders allocate a fixed amount into cryptocurrency at regular intervals, irrespective of market price fluctuations. This approach mitigates the impact of volatility by averaging the purchase price over time.

For instance, instead of investing $10,000 in Bitcoin all at once, you could spread the investment over six months by allocating $1,667 monthly. This strategy reduces the risk of entering the market at an unfavorable price point.

Best For: Investors aiming to minimize risk and pursue a long-term growth strategy.

TMGM Advantage: TMGM provides seamless access to crypto CFD trading, supported by structured strategies to optimize your investment approach.

How to Apply Your Crypto Strategy with TMGM

Now that you have an understanding of core crypto trading strategies , it'’s time to put them into practice. Here’’s how you can start trading crypto CFDs with TMGM:

Open an Account—Register with TMGM or open a demo account to access a professional-grade trading platform.

Explore the Markets – Analyze price trends, news developments, and technical indicators.

Develop a Strategy – Select a trading approach aligned with your risk profile and objectives.

Use TMGM’’s Tools – Utilize advanced charting, real-time market data, and expert insights.

Trade with Confidence – Execute trades efficiently with TMGM’’s competitive spreads and rapid execution speeds.