Day Trading Guide for Beginners: Fundamentals & How to Begin

Day trading is a dynamic trading strategy where traders buy and sell financial instruments within the same trading session, seeking to capitalize on short-term price volatility. For novice traders, grasping the fundamentals of day trading and the initial steps to begin can be complex. This guide offers an introduction to the essentials of day trading and practical advice on how to embark on this trading approach. In contrast to long-term investors, day traders aim to exploit intraday market movements rather than focusing on the underlying intrinsic value of assets. This detailed overview covers the core principles of day trading and provides valuable insights on how to enter this fast-paced segment of the financial markets.

Day Trading Basics: Understanding the Fundamentals

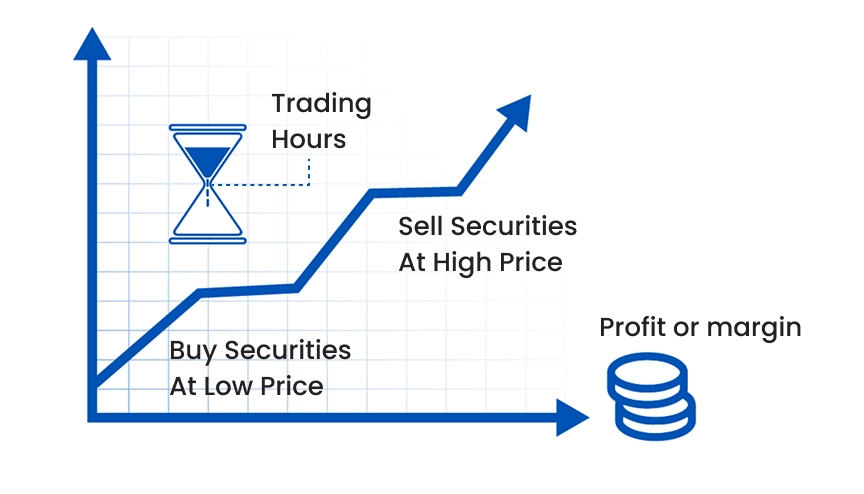

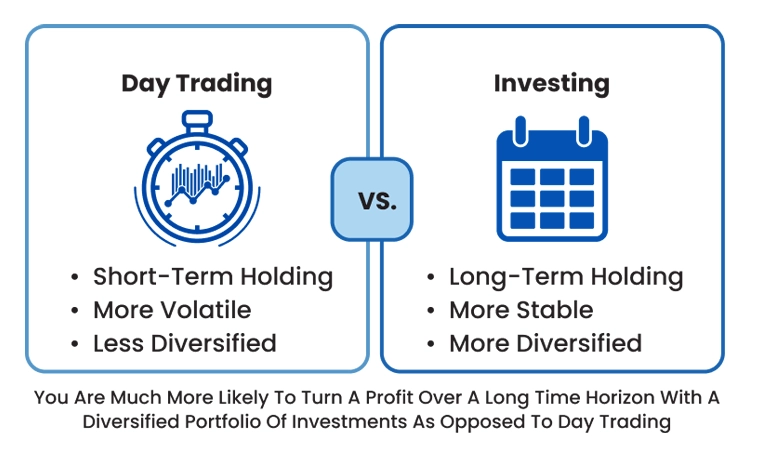

Day trading involves rapidly buying and selling financial instruments — such as equities, options, forex, or futures contracts — within a single trading session. The goal is to capitalize on small price fluctuations to generate profits over time. This method contrasts with traditional "buy-and-hold" investment strategies, where positions are maintained for extended periods to realize value appreciation.

Figure 1: What is Day Trading

Characteristics of Day Trading

Minor And Exotic Pairs

Short-Term Focus: Day traders close all positions before the market closes to avoid overnight risks related to price gaps.

High Trade Frequency: Numerous trades are executed daily to exploit market inefficiencies.

Leverage Usage: Many day traders employ margin to amplify potential returns, which also increases potential losses.

Technical Analysis: Trading decisions rely primarily on technical indicators and chart patterns rather than long-term fundamental analysis.

Figure 1: Day Trading Vs. Investing

Potential Rewards and Risks

The appeal of day trading lies in the potential for significant profits within short timeframes. However, this potential comes with considerable risks:

Market Volatility: Rapid price swings can result in substantial gains or losses in a brief period.

Emotional Stress: The fast-paced environment of day trading can be mentally demanding, potentially leading to impulsive decisions.

Financial Losses: Without effective risk management, traders may incur losses exceeding their initial capital, especially when using leverage.

Essential Tools and Resources for Day Traders

Navigating the complexities of day trading requires the right tools and resources:

Advanced Trading Platforms

A reliable trading platform offers real-time market data, sophisticated charting tools, and rapid order execution. Features include customizable interfaces, multi-market access, and integration with analytical software.

High-Speed Internet Connection

A stable, high-speed internet connection is essential to ensure timely trade execution and access to live market information, reducing the risk of delays that could affect trading results.

Real-Time Market Data and News Feeds

Access to up-to-the-minute market data and news is critical for informed trading decisions. Subscriptions to reputable financial news services and data providers offer insights into market-moving events.

Analytical Software

Specialized software assists in identifying technical patterns, conducting strategy backtesting, and integrating directly with brokerage platforms for seamless trade execution.

How to Get Started with Day Trading

Starting a day trading career requires thorough preparation and a solid grasp of market dynamics. Here's a step-by-step guide to begin:

Acquire Comprehensive Market Knowledge

Education forms the foundation of successful day trading. Prospective traders should immerse themselves in learning:

Technical Analysis: Mastering chart patterns, indicators, and market trends is essential.

Market Fundamentals: Understanding economic indicators, earnings releases, and other factors influencing price movements.

Risk Management: Learning to safeguard capital through stop-loss orders and appropriate position sizing.

Resources such as books, online courses, webinars, and reputable financial websites provide valuable knowledge. Engaging with trading communities and forums offers practical insights and experience sharing from seasoned traders.

Ensure Adequate Capital

Adequate capital is critical for day trading, not only to comply with regulatory requirements but also to absorb potential losses:

Regulatory Minimums: In the U.S., pattern day traders must maintain a minimum equity of $25,000.

Risk Capital: Trade only with funds you can afford to lose without jeopardizing your financial stability.

Leverage Considerations: While leverage can magnify gains, it also increases losses. Ensure sufficient capital to meet margin requirements and withstand adverse market moves.

Develop and Test a Trading Strategy

A clearly defined trading strategy is vital for consistency and discipline:

Define Your Edge: Identify specific market conditions or setups where your probability of success is higher.

Backtesting: Test your strategy against historical data to assess its viability.

Paper Trading: Practice simulated trades in real time without risking actual capital to refine your approach.

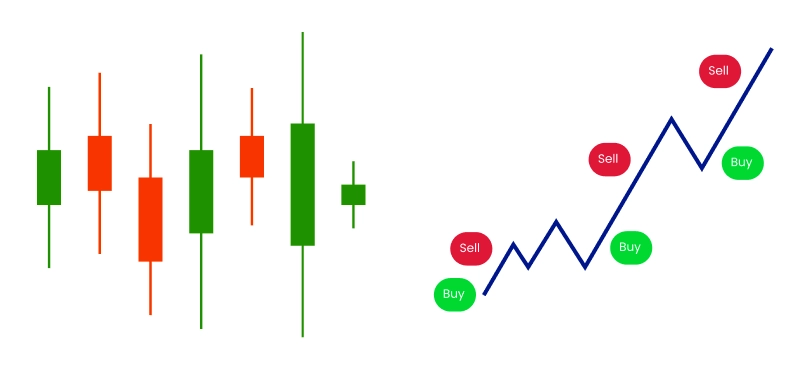

Common day trading strategies include:

Scalping: Targeting numerous small profits from minor intraday price movements.

Momentum Trading: Exploiting strong directional price trends.

Range Trading: Trading based on support and resistance levels.

Figure 2: Day trading strategies

Start Small and Focused

When transitioning to live trading:

Limit Your Scope: Concentrate on one or two instruments to prevent information overload.

Control Position Sizes: Maintain small trade sizes relative to your total capital to manage risk effectively.

Set Realistic Goals: Aim for steady, modest gains rather than large profits initially.

Implement Strict Risk Management

Capital preservation is paramount:

Risk Per Trade: Limit risk to no more than 1-2% of your trading capital on any single trade.

Use Stop-Loss Orders: Set predetermined stop-loss levels to automatically exit losing trades before losses escalate.

Maintain a Favorable Risk-Reward Ratio: Aim for profits at least twice the size of potential losses (e.g., risking $100 to make $200).

Track Performance: Keep a detailed trading journal to analyze both winning and losing trades, refining your strategy over time.

Understanding the Reality of Day Trading

While the prospect of financial success in day trading is attractive, the reality is that most traders struggle to maintain consistent profitability.

Success Rate and Challenges

Low Long-Term Profitability: Only 10-15% of active day traders consistently generate profits. Many fail due to inadequate risk management, emotional trading, or lack of a defined strategy.

Emotional and Psychological Pressures: Continuous decision-making under market pressure can cause stress, impulsive trades, and burnout.

Hidden Costs: Even profitable traders face erosion of earnings due to transaction fees, software expenses, margin interest, and taxes.

Market Competition: Institutional traders and algorithmic trading systems often have advantages over retail traders due to superior technology, faster execution, and greater capital access.

Figure 3: Day trading

The Day Trading Lifestyle: Is It Right for You?

Successful day traders approach trading as a business, requiring full commitment and discipline. Consider these factors before pursuing day trading as a career:

Time Commitment: Active market monitoring during trading hours is essential. Day trading is not a passive endeavor.

Personality Fit: The ability to remain calm under pressure and make rational, emotion-free decisions is critical.

Continuous Learning: Markets evolve, and strategies effective today may become obsolete. Staying updated with financial news, refining strategies, and adapting to market trends are ongoing necessities.

Practical Example of a Day Trade

To demonstrate how a day trade unfolds, consider this example:’

Market Research: A trader identifies a technology stock with strong pre-market momentum due to positive earnings results.

Entry Point: After confirming a bullish pattern via technical indicators, the trader purchases 500 shares at $100 each.

Risk Management: The trader sets a stop-loss at $98 to limit potential losses to $1,000 and a take-profit target at $105.

Trade Execution: The stock price moves favorably, reaching $105, triggering an automatic sell order.’

Profit Calculation: With a $5 gain per share on 500 shares, the trader realizes a gross profit of $2,500 before fees.

How to Get Started Day Trading: Next Steps

Figure 4: Effective Day Trading Strategy

If you’re ready to begin day trading, follow these structured steps:

1. Education and Preparation

Building a solid knowledge base is essential before trading. Enroll in courses, read authoritative books, and follow market experts to understand strategies, risk management, and market behavior. Use a demo account to gain practical experience without risking real funds.

2. Choose the Right Broker

Select a reputable broker offering low commissions, fast execution, and advanced trading tools to support informed decision-making.

3. Develop a Trading Plan

Success requires discipline and structure. Define your trading strategies, risk limits, and daily profit/loss thresholds before entering the market. A solid plan promotes consistency and curbs emotional trading.

4. Start Small and Scale Gradually

Begin with limited capital and small positions to manage risk effectively. Increase exposure only after achieving consistent profitability, ensuring sustainable growth.

5. Review and Improve

Continuous improvement is key. Maintain a trading journal to track performance, analyze errors, and refine strategies. Regular self-assessment helps adapt to market changes and enhance efficiency.

Mastering day trading basics and getting started requires a structured, disciplined approach. While the potential rewards are attractive, the risks are substantial. Aspiring traders must invest in education, practice in simulated environments, and implement strong risk management before committing significant capital.

Success in day trading’ is not about quick profits — but about continuous learning, adaptation, and effective risk management. With patience and a clear strategy, day trading can be viable for those with the right mindset and dedication.

Master Day Trading with TMGM: Precision, Speed, and Control

Begin your day trading journey with TMGM, a trusted platform providing advanced trading tools, real-time market data, and a seamless trading experience. With competitive spreads, lightning-fast execution, and risk management features, TMGM empowers traders to make informed decisions. Open a demo account today to refine your strategy in a risk-free environment before trading live markets.

Using a demo account like TMGM’’s is an essential step for beginners learning day trading fundamentals and how to get started. It provides a risk-free environment to master strategies, understand market behavior, and build confidence before transitioning to live trading.

Trade Smarter Today

Account

Account

Instantly