What Is the ‘Dogs of the Dow’ Strategy?

The "Dogs of the Dow" strategy involves selecting the 10 highest dividend-yielding stocks from the Dow Jones Industrial Average at the start of each year. These stocks are typically viewed as undervalued and may provide enhanced returns through potential capital appreciation combined with consistent dividend income.

Key Features of the Strategy

Focus on Value: Targets stocks with high dividend yields, often signaling undervaluation.

Dividend Income: Generates steady income streams from established blue-chip companies.

Simplicity: Requires minimal active management, making it accessible for retail investors.

2025 Dogs of the Dow List

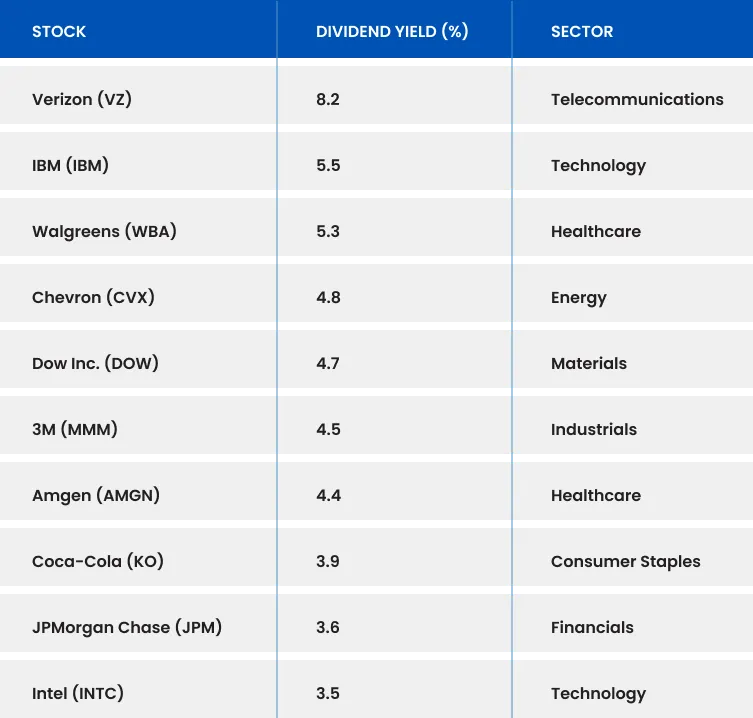

Below are the top 10 highest-yielding Dow stocks comprising the 2025 Dogs of the Dow portfolio (as of January 1, 2025):

Does the Strategy Still Work?

The performance of the Dogs of the Dow strategy varies with market cycles and investor goals. Historically, it has delivered competitive returns and has outperformed the broader market in certain periods.

Pros:

Stable Dividends: Focuses on companies with robust cash flows and reliable dividend distributions.

Undervalued Opportunities: Targets stocks with potential for price recovery.

Low Volatility: Primarily includes blue-chip equities, which tend to exhibit lower volatility compared to smaller-cap stocks.

Cons:

Sector Concentration: May lead to overexposure in certain sectors such as healthcare or technology.

Market Underperformance: Can underperform during bull markets dominated by growth stocks.

Dividend Cuts: Elevated yields might sometimes reflect financial distress or dividend reductions.

How to Invest in the Dogs of the Dow

1. Direct Stock Investment

Investors can acquire shares of each of the 10 Dogs of the Dow individually. This method offers portfolio customization and control but requires ongoing monitoring of each stock’s performance.

2. ETFs and Mutual Funds

Several exchange-traded funds (ETFs) and mutual funds replicate the Dogs of the Dow strategy, providing diversification and ease of management. Examples include:

ALPS Sector Dividend Dogs ETF (SDOG)

ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

3. Dividend Reinvestment Plans (DRIPs)

Utilize DRIPs to automatically reinvest dividends into additional shares, enabling compounding growth over time.

4. Combine with Other Strategies

Integrate the Dogs of the Dow approach with other investment strategies, such as growth investing or international equity diversification, to mitigate risk and enhance portfolio returns.

Conclusion

The Dogs of the Dow strategy remains a viable option for investors seeking reliable income and exposure to undervalued blue-chip equities. While annual performance may fluctuate, its emphasis on dividend yield and long-term value supports a conservative investment approach.

Ready to Invest?

Access the tools and insights you need with TMGM. Whether deploying the Dogs of the Dow strategy or exploring alternative approaches, TMGM offers advanced trading platforms and expert resources to support your success. Start trading today.