A Comprehensive Guide to Forex Scalping

Forex scalping is a highly dynamic and fast-paced trading strategy in the foreign exchange market. It is designed to capitalize on minute price fluctuations that occur throughout the trading day. This method involves executing a large number of trades, each lasting only a brief period—typically ranging from a few seconds to several minutes—with the ultimate goal of accumulating small profits from each trade that, when combined, can result in substantial gains by the end of the trading session.

What Does Scalping Mean in Forex?

In the complex realm of forex trading, scalping is a technique that capitalizes on the smallest price increments, known as pips (percentage in point). Forex scalpers, traders who utilize this method, generally aim to secure between 5 to 10 pips per trade.

This strategy demands exceptional focus and rapid decision-making. Scalpers must swiftly analyze market conditions and execute trades at high speed to capitalize on transient opportunities.

Key Characteristics of Forex Scalping:

Short Time Frames: Scalping is inherently short-term, with trades often lasting only a few minutes or even seconds. This rapid approach enables scalpers to exploit minimal price fluctuations.

High Trade Frequency: Due to the brief duration of each trade, scalpers execute numerous trades within a single session. This high-frequency trading aims to accumulate small gains that compound over time.

Small Profit Targets: Unlike longer-term strategies targeting larger price moves, scalping focuses on extracting modest profits per trade. Although individual gains are small, the aggregate of many successful trades can yield significant returns.

Intense Concentration: Effective scalping requires sustained focus. The fast-paced nature of this strategy involves continuous price chart monitoring, rapid market analysis, and swift trade execution, which can be mentally and emotionally demanding.

Forex Price Action Scalping

Price action scalping is a specialized subset of scalping that relies exclusively on interpreting price movements without the use of conventional technical indicators. This approach requires a profound understanding of market behavior and the skill to analyze raw price data effectively.

Key Elements of Price Action Scalping:

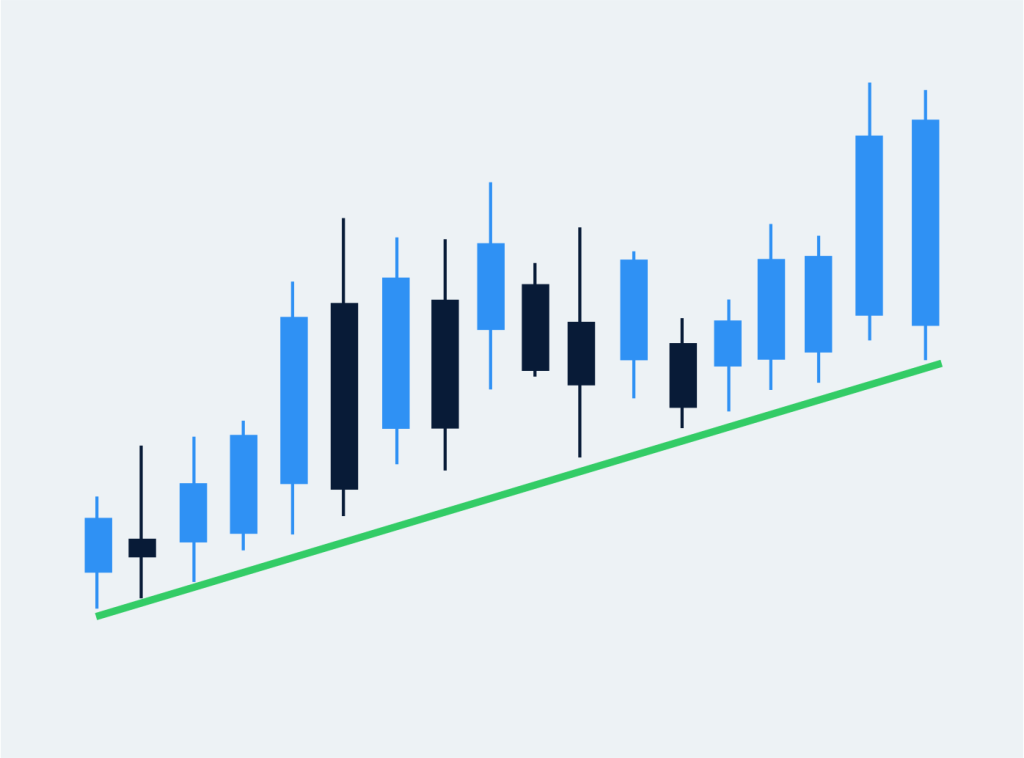

Candlestick Chartsare the primary tool for price action scalpers. These graphical representations of price movements convey market sentiment, including opening and closing prices, as well as highs and lows within a specific timeframe.

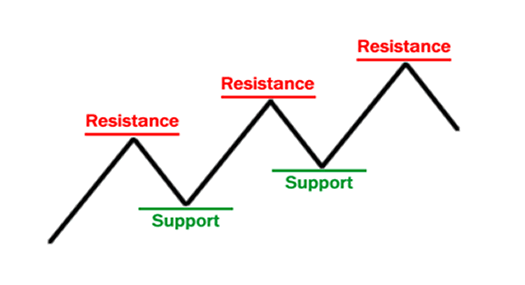

Support and Resistance Levels: These critical price points, where currency pairs historically encounter obstacles moving beyond, are pivotal in price action scalping. Traders monitor these levels closely to determine optimal entry and exit points.

Trendlines: Scalpers map the market’s direction by connecting higher lows in uptrends or lower highs in downtrends using trendlines. These lines assist in identifying potential breakouts or reversals, aiding in timing trade entries and exits.

Risk-Reward Ratio: Price action scalpers carefully evaluate the risk versus reward of each trade before execution, seeking scenarios where potential profits substantially exceed potential losses. This ensures profitability even with a lower win rate.

Price action scalping intentionally excludes fundamental analysis, focusing solely on technical price movements. This concentrated approach allows scalpers to respond swiftly to market shifts without distraction from external factors that may not immediately affect price.

Forex Scalping Signals

In the fast-paced and volatile environment of forex scalping, trading signals are vital for pinpointing potential trade entry and exit points. These signals may be generated by advanced algorithmic software or derived from technical indicators, guiding scalpers through the rapid movements of the forex market.

Types of Forex Scalping Signals:

Technical Indicators: A broad range of technical tools, including Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), can generate scalping signals. These indicators analyze historical price data to forecast future movements, offering scalpers valuable insights for decision-making.

Price Patterns: Skilled scalpers develop the ability to identify specific chart patterns that indicate potential price directions. Patterns such as double tops, head and shoulders, or flags provide clues about possible market reversals or continuations.

Economic Events: Significant economic announcements and data releases can trigger sharp and rapid price movements. Scalpers who monitor these events can position themselves to exploit the ensuing volatility, though this requires precise timing and stringent risk controls.

Indicators for Forex Scalping

Several widely used technical indicators are particularly effective for forex scalping, providing insights into market conditions and trade opportunities:

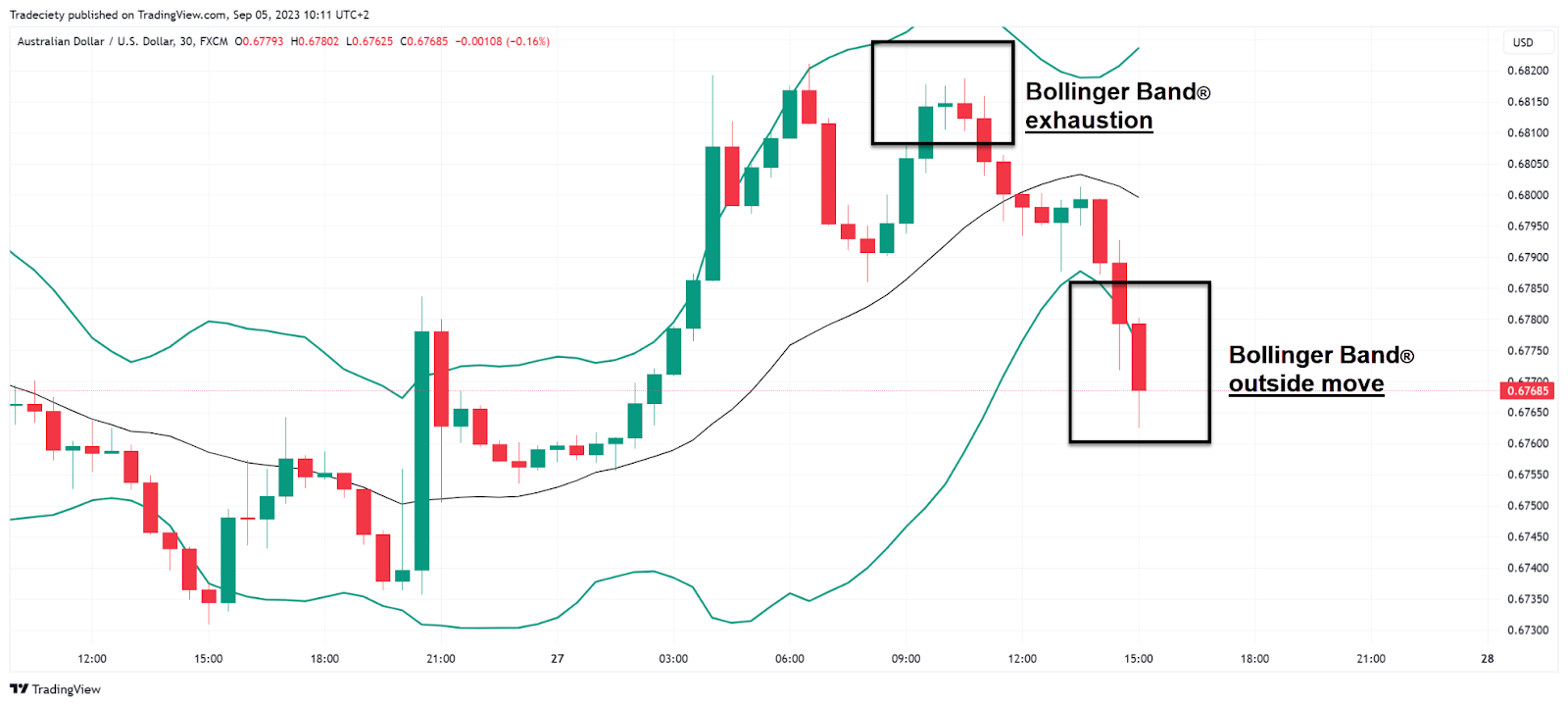

Bollinger Bands: This versatile indicator features a central moving average line flanked by upper and lower bands, effectively illustrating market volatility. The bands’ expansion and contraction can signal potential breakouts or reversals, making it invaluable for scalpers. Bollinger Bands are especially suited to currency pairs with tight spreads, which tend to be less volatile but offer multiple profit opportunities when trades are timed correctly. Common pairs for this strategy include majors and minors such as EUR/USD, GBP/USD, and EUR/JPY.

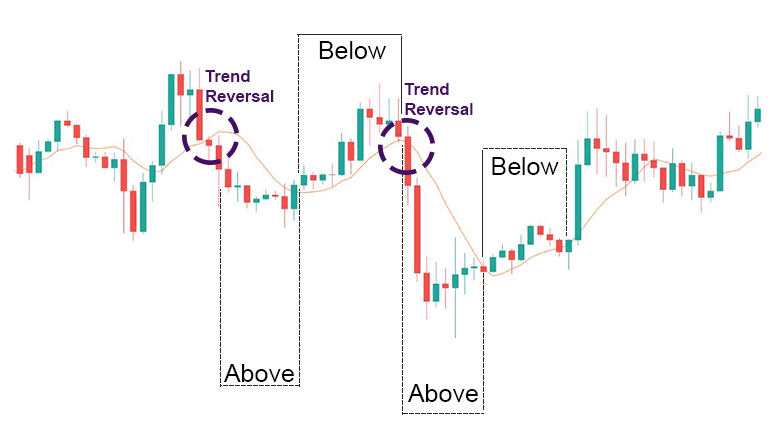

Moving Averages: Both Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are extensively used by scalpers to detect short-term trends and reversal points. These indicators smooth price data over defined periods, helping traders filter out noise and focus on the underlying trend. The EMA, which weights recent prices more heavily, is favored for its responsiveness to price changes. Scalpers often employ multiple moving averages with varying periods to identify entry and exit signals when these averages cross.

Relative Strength Index (RSI): This momentum oscillator measures the velocity and magnitude of price changes, making it a favorite among scalpers. The RSI helps identify overbought or oversold conditions, signaling potential reversals. Scalpers often customize RSI settings to very short timeframes, sometimes as brief as 1-5 minutes, enabling them to adapt strategies to current market momentum, whether trending or ranging.

Forex Scalping Tips

To enhance success in forex scalping, traders should consider these best practices:

Concentrate on a single currency pair or position at a time to maintain optimal focus and avoid diluting attention. This approach enables a deeper understanding of the pair’s specific market behavior.

Prioritize currency pairs with high liquidity and substantial trading volume. These features facilitate swift entries and exits with minimal slippage, essential for scalping.

Develop a temperament suited to scalping’s demands, including sharp concentration, analytical skills, and patience to carefully assess rapid market movements.

Best Pairs for Scalping Forex:

For beginners or those refining their scalping approach, consider these pairs known for liquidity and tight spreads:

Major pairs: EUR/USD, GBP/USD, AUD/USD

Minor pairs: AUD/GBP

These pairs typically feature high volume and narrow spreads, minimizing potential losses and enabling faster trade execution.

Best Times for Scalping Forex:

Timing is critical in scalping, with certain periods offering optimal conditions:

For GBP-based pairs: The first hour of the London session often presents heightened volatility and liquidity, ideal for scalpers.

For major pairs: The overlap between London and New York sessions, especially the initial hours of New York trading, typically delivers the highest volume and volatility.

Some experienced scalpers prefer early morning trading when volatility peaks. However, this is recommended primarily for professionals due to increased risk.

Is Forex Scalping Profitable?

Forex scalping can be profitable but involves significant risks that require careful management:

Market Volatility: Sudden price swings in forex can cause substantial losses if a scalper is positioned unfavorably. These rapid changes can quickly erode gains, necessitating constant vigilance and swift reactions.

Timing Challenges: Scalping success depends heavily on precise entry and exit timing. Delays of even seconds can impact profitability due to the small price targets. This pressure can lead to stress and potential errors.

Leverage Risks: Scalpers often employ high leverage to amplify gains from minor price moves. While this can increase profits, it also escalates the risk of significant losses from small adverse price shifts.

Risk Management in Forex Scalping:

To mitigate risks and enhance long-term profitability, scalpers should adopt robust risk management practices:

Stop-Loss Orders: Automated stop-loss orders are vital to limit losses on each trade. Setting predefined exit points helps protect against sudden market moves that could cause severe losses.

Position Sizing: Managing trade size relative to account equity is essential. Scalpers should risk only a small fraction of their capital per trade to avoid rapid account depletion from consecutive losses.

Risk-Reward Ratio: Trades should have a favorable risk-reward ratio, where potential profits significantly exceed potential losses. This strategy supports profitability even with a win rate below 50%.

Forex Scalping with TMGM

TMGM provides a robust trading environment tailored to support forex scalpers. Here’s how TMGM facilitates scalping strategies:

Advanced Trading Platforms

TMGM offers access to MetaTrader 4 and MetaTrader 5 platforms, favored by scalpers for their rapid execution and advanced charting capabilities. Features include:

Real-time price feeds with minimal latency, essential for split-second trade decisions.

A comprehensive suite of technical indicators and drawing tools for detailed market analysis.

Competitive Spreads and Low Commissions

In scalping, every pip matters. TMGM provides competitive spreads across numerous currency pairs, enhancing scalping profitability. Their low commission fees further reduce trading costs, crucial given the high trade frequency in scalping.

Fast Execution Speeds

TMGM'’s advanced infrastructure ensures rapid order execution, critical for scalpers needing to quickly enter and exit positions to exploit small price changes.

Wide Range of Currency Pairs

With over 60 currency pairs available, TMGM offers scalpers ample opportunities to identify and capitalize on short-term price inefficiencies across diverse markets.

Risk Management Tools

TMGM provides essential risk management features such as stop-loss and take-profit orders, enabling scalpers to control risk effectively in volatile markets.

Educational Resources

Although scalping requires skill and experience, TMGM offers educational content and market analysis to help traders develop and refine their scalping techniques.

24/5 Customer Support

Given the rapid pace of scalping, access to responsive customer support is vital. TMGM provides 24/5 assistance to resolve platform or account issues promptly during trading hours.

Demo Account for Practice

Before live scalping, traders can utilize TMGM'’s demo account to practice strategies risk-free, hone skills, and optimize their approach.

It' is important to remember that while TMGM offers tools and services supportive of forex scalping, this strategy carries inherent risks. Traders should fully understand these risks and establish a comprehensive trading plan before engaging in scalping. Always practice responsible trading and never risk more than you can afford to lose.

For more information on how TMGM can support your forex scalping strategies, visit here or contact their customer support team.

Trade Smarter Today

Account

Account

Instantly