Introduction to Gold Trading

Gold trading is one of the oldest investment methods, with this precious metal serving as a store of value for millennia. Today, gold remains among the most actively traded commodities globally, offering distinct benefits to traders and investors:

Safe-haven asset during periods of economic uncertainty

Inflation and currency depreciation hedge

Portfolio diversification instrument

Speculative trading vehicle

Many investors consider gold a refuge during market volatility or sharp downturns, making it a key element of a diversified portfolio.

Why Trade Gold?

Liquidity: Gold markets are highly liquid, facilitating easy market entry and exit.

Volatility: Gold prices exhibit volatility, creating trading opportunities.

24-hour Market: Gold is traded around the clock, providing flexibility for traders.

TMGM Advantage: TMGM offers 24/5 access to gold markets, enabling you to trade whenever opportunities arise.

Understanding the Gold Market

Factors Affecting Gold Prices

Economic Indicators:

Inflation rates

Interest rates

GDP growth

Geopolitical Events:

Political instability

Wars and conflicts

Trade disputes

Currency Movements:

US Dollar strength or weakness

Currency devaluations

Market Sentiment:

Risk-on versus risk-off market environments

Investor confidence levels

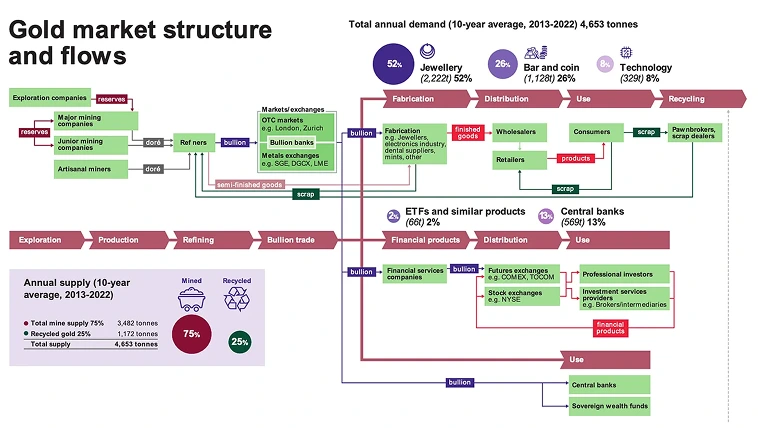

Supply and Demand:

Gold mining output

Central bank buying and selling

Industrial demand

TMGM Tool: Utilize TMGM'’s economic calendar and market analysis to stay updated on these factors.

Gold Price Correlations

Inverse correlation with the US Dollar

Positive correlation with silver prices

Often moves inversely to stock market indices

TMGM Tip: TMGM'’s multi-asset platform enables trading of correlated assets alongside gold for a holistic strategy.

Ways to Trade Gold with TMGM

Gold CFDs (Contracts for Difference)

Definition: A contract to exchange the difference in gold price between opening and closing the position.

Advantages:

Leverage: Control larger positions with less capital

Go long or short: Profit from rising or falling markets

No physical delivery: Simplifies trading logistics

TMGM Offering: TMGM offers Gold CFDs with competitive spreads and leverage up to 1:400.

Gold-backed ETF CFDs

Definition: CFDs that track the price performance of gold ETFs

Advantages:

Diversification: Gain exposure to gold without owning physical metal

Liquidity: Often more liquid than physical gold markets

TMGM Feature: Access a variety of gold-related ETF CFDs via TMGM'’s trading platforms.

Getting Started With TMGM

Account Opening

Visit TMGM'’s website (www.tmgm.com)

Click "Open Live Account" or "Open Demo Account"

Complete your personal details

Verify your identity (for live accounts)

Fund your account (for live accounts)

Selecting Your Trading Platform

TMGM offers the following platform for gold trading:

MetaTrader 4 (MT4):

Intuitive user interface

Advanced charting and analysis tools

Customizable technical indicators

Support for automated trading

TMGM Tip: Begin with MT4 for gold CFDs, as it provides comprehensive tools tailored for commodity trading.

Funding Your Account

TMGM supports multiple funding options:

Bank wire transfer

Credit and debit cards

E-wallets (e.g., Skrill, Neteller)

TMGM Advantage: Fast processing and no deposit fees with TMGM.

Technical Analysis for Gold Trading

Key Chart Patterns

Head and Shoulders

Double Tops and Bottoms

Triangles (Ascending, Descending, Symmetrical)

Flags and Pennants

Example: Recognizing a Head and Shoulders pattern on gold

Open the Gold chart (XAUUSD) on MT4

Identify a peak (left shoulder), followed by a higher peak (head), then a lower peak (right shoulder)

Draw a neckline connecting the lows between the shoulders

A break below the neckline indicates a potential downtrend

Essential Indicators for Gold Trading

Moving Averages (MA):

Simple Moving Average (SMA)

Exponential Moving Average (EMA)

Relative Strength Index (RSI)

Moving Average Convergence Divergence (MACD)

Bollinger Bands

TMGM Tool: All these indicators are available on TMGM'’s MT4 platform. Access them via the MT4 menu under "Insert" > >Indicators".

Example: Applying Moving Averages in Gold Trading

Add 50-day and 200-day SMAs to the Gold daily chart

A 50-day SMA crossing above the 200-day SMA (Golden Cross) signals bullish momentum

A 50-day SMA crossing below the 200-day SMA (Death Cross) signals bearish momentum

Fundamental Analysis of Gold Trading

Key Economic Indicators to Monitor

Non-Farm Payrolls (NFP)

Consumer Price Index (CPI)

Federal Reserve interest rate decisions

Gross Domestic Product (GDP)

TMGM Resource: TMGM'’s economic calendar highlights these events and their potential impact on gold prices.

Geopolitical Factors

Political instability in key economies

Trade wars and sanctions

Brexit and other major political events

TMGM Insight: TMGM regularly provides market analysis covering geopolitical developments and their effects on gold.

Gold Trading Strategies

Trend Following Strategy

Use longer-term moving averages (e.g., 50-day and 200-day) to identify trends

Trade in the trend’s direction

Use shorter-term moving averages for entry timing

Example:

If gold is trending upwards (price above 200-day MA)

Wait for a pullback to the 50-day MA

Enter a long position when price rebounds off the 50-day MA

Set stop-loss below the recent swing low

Breakout Trading Strategy

Identify key support and resistance levels

Wait for price to break these levels with increased volume

Enter trades in the breakout direction

Example:

Identify a major resistance level on the gold chart

Place a buy-stop order just above this level

If triggered, set stop-loss below breakout level

Target profit at least twice the risk amount

Gold-Currency Correlation Strategy

Track the correlation between gold and major currencies, especially the USD

Identify divergences between gold and currency movements

Trade gold based on anticipated currency trends

Example:

If the USD weakens but gold has not yet risen

Consider a long gold position anticipating a catch-up move

TMGM Advantage: TMGM'’s multi-asset platform allows seamless monitoring and trading of gold and currency pairs.

Risk Management in Gold Trading

Position Sizing

Limit risk to 1-2% of your account per trade

Use TMGM'’s position size calculator to determine appropriate lot sizes

Stop-Loss Placement

Always implement stop-loss orders

Place stops based on technical support/resistance (e.g., below recent swing lows for longs)

Consider guaranteed stops for high-impact news (may incur extra fees)

Take Profit Strategies

Set realistic profit targets based on chart patterns or support/resistance levels

Use trailing stops to secure profits as the trade moves favorably

Leverage Management

TMGM offers leverage up to 1:400 on gold

Beginners should start with lower leverage (e.g., 1:10 or 1:20)

Increase leverage cautiously as experience grows

TMGM Tip: Practice risk management strategies using TMGM'’s demo account without risking real funds.

Advanced Gold Trading Techniques

Gold Options Trading

Understanding call and put options

Using options to hedge gold positions

Advanced options strategies (e.g., straddles, strangles)

Gold Spread Trading

Trading the price spread between gold and silver

Gold versus gold mining stocks

Algorithmic Trading

Develop and backtest gold trading algorithms

Implement algorithms using TMGM'’s MT4 platform and Expert Advisors (EAs)

TMGM Feature: TMGM'’s MT4 platform supports Expert Advisors for automated gold trading strategies.

Staying Informed and Continuous Learning

TMGM'’s Educational Resources

Webinars on gold trading strategies

Daily market analysis and gold price forecasts

Video tutorials on using MT4 for gold trading

External Resources

World Gold Council reports

Central bank policy statements

Financial news outlets (e.g., Bloomberg, Reuters)

Developing Your Trading Journal

Document all your gold trades

Record entry and exit points, rationale, and emotional state

Regularly review and analyze your trading performance

TMGM Tool: Use MT4'’s integrated journal feature to track your gold trades.

Gold trading offers compelling opportunities for both novice and seasoned traders. TMGM'’s advanced trading platforms, competitive spreads, and extensive educational materials empower you to navigate the gold markets effectively.

Remember to start with small positions, practice consistently, and always prioritize risk management. As your expertise grows, you can explore advanced strategies and expand into other precious metals markets.

Ready to begin your gold trading journey? Open your TMGM account today and apply this knowledge!