Netflix Stock Investment Guide: How to Buy, and Who Owns Netflix

Investing in major corporations and their equities is a prevalent strategy in the trading sector. These large-cap companies typically have substantial market capitalization, indicating a generally lower risk profile for equity investments. As the leading streaming service provider, Netflix represents a compelling investment opportunity. Traders can acquire shares outright or engage in contracts for difference (CFDs) to speculate on price fluctuations. Given the recent upward trend in Netflix's share price, is now an opportune moment to invest in this stock?

Netflix’’s Stock Market Evolution

Founded in 1997, Netflix initially began with DVD rentals, operating in a competitive market as most consumers were unfamiliar with streaming digital content.

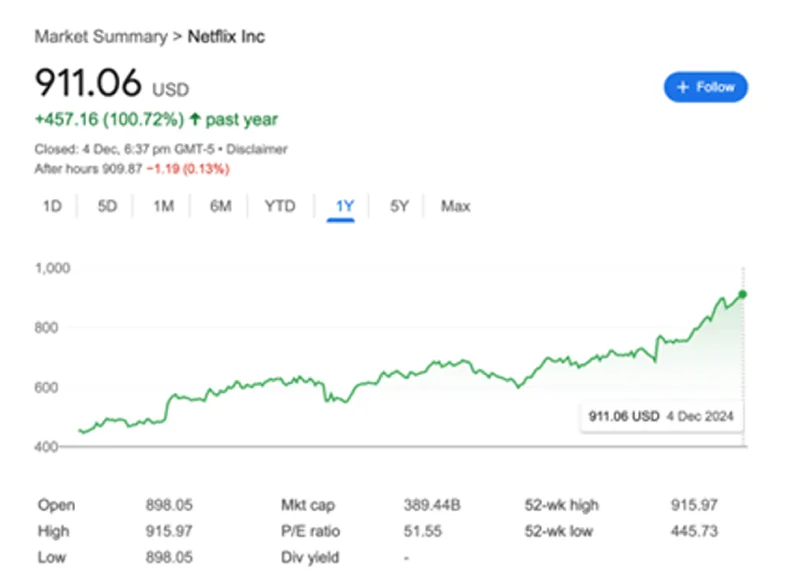

After facing financial challenges and rejected proposals, Netflix went public on the stock exchange under the ticker symbol NFLX in 2002 to enhance market liquidity. Netflix’s share price steadily increased until October 2021, reaching $678, before declining sharply to $182 in June 2022. Despite these setbacks, Netflix’s stock price surged to an all-time high of $911.06 in December 2024.

This raises the question: is now an opportune moment to invest in Netflix?

Who Owns Netflix?

Institutional investors collectively hold the majority of Netflix’s shares. Their ownership mainly stems from passive index funds, reflecting Netflix’s inclusion in major indices such as the S&P 500.

- The Vanguard Group, Inc.: The largest single shareholder, owning over 9% of Netflix’s outstanding shares.

- BlackRock, Inc.: The second-largest shareholder, holding approximately 8%.

- FMR LLC (Fidelity Investments): Holds the third-largest stake, exceeding 5%.

- State Street Corporation: Another major institutional investor, owning over 4% of shares.

- Capital Research and Management Company: One of the leading active asset managers, holding more than 4% of Netflix’s shares.

In addition to institutional investors, individual shareholders—primarily current and former executives—are significant stakeholders.

- Reed Hastings: Co-founder and former CEO, Hastings transitioned to Executive Chairman in early 2023. He remains a key individual shareholder with a stake slightly above 1%.

- Ted Sarandos: Co-CEO since 2020, Sarandos is a notable individual shareholder.

- Greg Peters: Co-CEO since 2023, Peters also holds a significant individual stake.

- Jay Hoag: A long-standing member of Netflix’s board of directors and one of the top individual shareholders.

How to Invest in Netflix?

There are two primary ways to invest in Netflix shares: purchasing the stock outright or trading Contracts for Difference (CFDs). For CFDs, there are two approaches:

Trading Netflix CFDs enables investors to speculate on both upward and downward movements in the stock price. If anticipating a decline, traders can open short positions to potentially profit from falling prices.

Alternatively, investors can purchase Netflix shares directly.

Netflix Stock Performance to Date

Netflix’s stock performance has exhibited significant volatility historically. Annual returns were 11% in 2021, 51% in 2022, and 65% in 2023. For 2024, Netflix’s share price has been on an upward trajectory, likely driven by subscriber growth and enforcement of password-sharing restrictions. Year-to-date, the stock has appreciated nearly 72%, compared to a 5% gain for competitor Disney+ over the same period.

Between January 2023 and September 2024, Netflix added over 50 million new subscribers. The company’s revenue is projected to increase approximately 15%, approaching $39 billion.

Dividends Paid by Netflix Per Share

Netflix does not currently pay dividends to shareholders. This policy was reasonable during the company’s early growth phase around 2010. Despite recent stock price gains, Netflix has no plans to initiate dividend payments or increase leverage for share buybacks. CFO Spencer Neumann emphasizes that the company prioritizes “profitable growth through reinvestment in our business”.

Technical Analysis

Investors considering Netflix should monitor the upcoming 2024 earnings report. The company is expected to report earnings per share (EPS) of $4.20, representing a 99% increase compared to the same quarter last year. Analysts interpret Netflix’s upward earnings revisions as a positive signal for its business outlook.

Netflix shares have entered a bullish trend, supported by optimistic year-end earnings forecasts. This presents an attractive opportunity for investors. Continued subscriber growth is also anticipated to drive revenue expansion.

Traders can consider long-term investment in Netflix shares, expecting further price appreciation, or engage in CFD trading to capitalize on price volatility. However, it is essential for investors to thoroughly understand the company’s fundamentals before making investment decisions.

Trade Smarter Today

Account

Account

Instantly