Trading Styles: Scalping vs Day Trading vs Swing Trading

The world of financial markets is dynamic, with diverse strategies available to traders. Three of the most popular trading styles—scalping, day trading, and swing trading—differ significantly in terms of execution speed, time commitment, and risk tolerance. Each approach presents distinct advantages and challenges, making it crucial for traders to choose a strategy that aligns with their objectives, risk profile, and available time. By comprehending the nuances of each trading style, traders can make better-informed decisions and enhance their potential for success.

Understanding Scalping

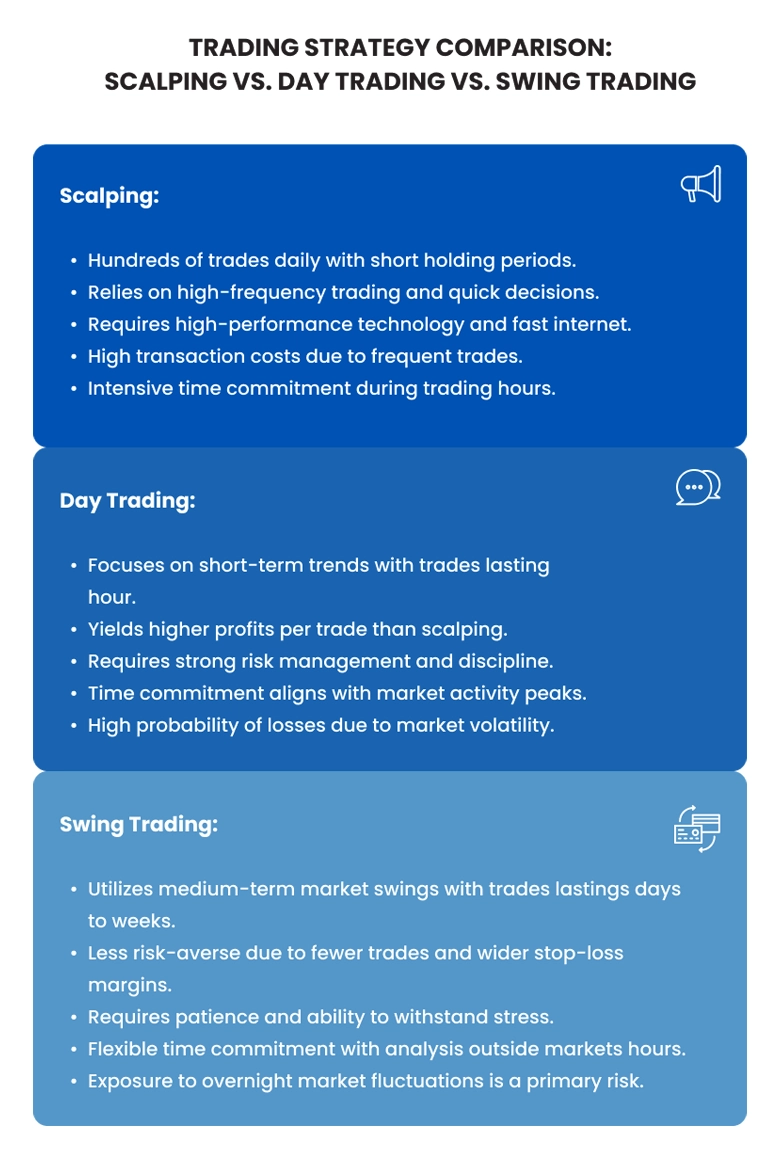

Scalping is one of the most rapid trading strategies. It involves executing high-frequency trades aimed at capturing minor price movements within seconds or minutes. This approach demands precision and heavily depends on technical indicators, chart patterns, and market order flow analysis.

Key Elements of Scalping

Short Timeframes: Scalpers typically utilize 1-minute, 3-minute, or 5-minute charts to execute swift, accurate trades. These charts provide a detailed view of price action, emphasizing micro-movements.

Primary Indicators: Relative Strength Index (RSI), Stochastic Oscillators, and Bollinger Bands are crucial for scalpers to evaluate momentum and overbought/oversold conditions. Moving averages (MAs), especially the Exponential Moving Average (EMA), are also extensively used to identify short-term trends.

Market Liquidity: Scalpers perform best in highly liquid markets where the bid-ask spread is tight, enabling trade execution with minimal slippage. Currency pairs such as EUR/USD or GBP/USD are favored for their liquidity.

Example Strategy: A scalper might initiate a position when the price breaks beyond the upper or lower Bollinger Band (signaling overbought or oversold conditions) and exit with a small profit as the price reverts to the moving average.

Advantages and Disadvantages of Scalping

Advantages:

Frequent Profit Opportunities: The high volume of trades generates numerous opportunities for incremental gains throughout the trading day.

Limited Market Risk Exposure: Positions are held for very short durations, reducing exposure to long-term market risk.

Disadvantages:

Mentally Demanding and Time-Intensive: Scalping requires continuous concentration, which can be mentally taxing.

Technological Requirements: Traders need to invest in advanced trading infrastructure, including high-speed internet connections, to avoid execution delays that could negatively impact profitability.

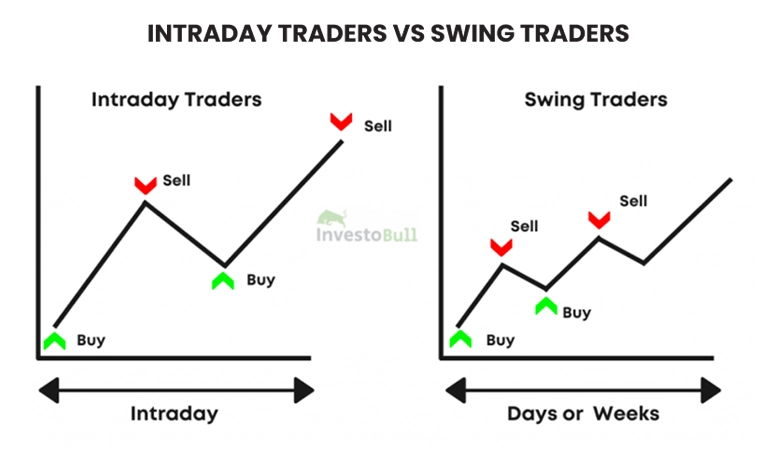

Day Trading Mechanics

Day trading involves opening and closing positions within the same trading session. Unlike scalping, day traders hold positions for minutes to hours, aiming to profit from intraday price fluctuations.

Key Elements of Day Trading

Chart Timeframes: Day traders commonly use 15-minute, 30-minute, and 1-hour charts to monitor intraday price movements. These timeframes balance the micro-focus of scalping with the broader perspective of swing trading.

Indicators and Tools: Day traders utilize a variety of indicators such as Moving Average Convergence Divergence (MACD), Fibonacci retracements, pivot points, and volume analysis to assess momentum, potential reversals, and overall price strength.

Trade Duration: Positions are held longer than in scalping but are closed before market close to avoid overnight risk. Typical target price moves range from 0.5% to 2% during the trading day.

Example Strategy: A day trader may apply Fibonacci retracements to pinpoint potential reversal zones during intraday corrections. This can be combined with moving average crossovers (e.g., 9-period and 21-period EMAs) to identify optimal entry and exit points.

Advantages and Disadvantages of Day Trading

Advantages:

Higher Profit Potential per Trade: With larger intraday price swings, day traders can achieve more significant profits per trade compared to scalpers.

No Overnight Risk: Positions are closed before market close, eliminating exposure to overnight price gaps.

Disadvantages:

Requires Continuous Attention: Day trading demands constant market monitoring, which may be challenging for traders with limited availability.

Psychological Pressure: The fast pace and volatility of intraday trading can induce emotional stress and impulsive decisions without proper psychological discipline.

Exploring Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days to weeks, aiming to profit from market trends lasting longer than those targeted by scalpers or day traders. Swing traders focus on capturing "price swings" within larger trends.

Key Elements of Swing Trading

Chart Timeframes: Swing traders analyze daily, 4-hour, and 1-hour charts to evaluate price action over multiple days. These timeframes provide a broader market perspective compared to scalping and day trading.

Indicators and Tools: Commonly used indicators include trend-following tools such as the 50-day moving average, RSI, Bollinger Bands, and MACD to identify trends and entry points.

Risk Management: Swing traders typically apply wider stop-loss orders to allow the market room to "consolidate" or retrace, offering more flexibility than scalping or day trading.

Example Strategy: A swing trader may enter a position when the price rebounds from a significant support level or when signs of a new trend emerge. Exits may occur near resistance levels or upon reaching predefined profit targets.

Advantages and Disadvantages of Swing Trading

Advantages:

Potential for Larger Gains per Trade: Swing trading enables capturing more substantial price moves, potentially resulting in higher profits compared to scalping or day trading.

Less Time-Consuming: Since positions are held over days or weeks, swing traders are not required to monitor the markets continuously.

Disadvantages:

Exposure to Overnight Risk: Holding positions through market closures exposes swing traders to overnight price risks.

Capital Requirements: Longer holding periods often necessitate higher capital to manage positions and absorb adverse price movements.

Selecting the Appropriate Trading Style

Choosing the right trading approach depends on several factors:

Time Commitment: Scalping requires full-day attention, day trading demands focus during market hours, while swing trading offers more flexibility with less frequent monitoring.

Risk Appetite: Scalping and day trading involve higher volatility exposure, whereas swing trading allows for more strategic adjustments.

Personality and Psychological Considerations: Scalpers require strong discipline and focus, day traders may face increased stress from constant market changes, and swing traders need patience to let trades develop over time.

Essential Tips for Trading Success

Scalping Tips

Prioritize Speed: High-frequency trading demands low-latency execution. Opt for platforms offering direct market access (DMA) to minimize slippage.

Master Technical Patterns: Scalpers should be proficient in candlestick patterns, price action setups, and short-term chart formations such as double tops and head-and-shoulders.

Risk Management: Given the high trade volume, it is critical to apply tight stop-loss orders and maintain a favorable risk-to-reward ratio on each trade.

Day Trading Tips

Utilize Multiple Indicators: Combining technical indicators like MACD with fundamental analysis (e.g., earnings releases and economic data) enables informed decision-making.

Develop a Comprehensive Trading Plan: Include stop-loss levels, take-profit targets, and entry criteria to minimize emotional trading.

Maintain Discipline: Avoid impulsive trades driven by short-term market noise. Adhere strictly to your strategy and avoid chasing the market.

Swing Trading Tips

Identify Strong Trends: Use moving averages to detect long-term trends and enter trades on pullbacks to key levels within the trend.

Manage Risk Effectively: Implement trailing stops to lock in profits and limit losses as the market moves favorably.

Exercise Patience: Wait for clear directional signals before entering trades, which may involve holding cash positions for extended periods.

Each trading style—— scalping, day trading, and swing trading ——has distinct advantages and challenges. By thoroughly understanding these approaches, traders can select strategies aligned with their individual goals and resources.

Success in trading requires mastering both technical analysis and psychological discipline, alongside a robust risk management framework. The optimal approach depends on a trader’’s financial objectives, risk tolerance, and time availability.

Regardless of style, achieving trading success demands thorough research, disciplined execution, and a well-structured risk management plan. Understanding market dynamics and continuously refining trading skills can significantly improve profitability.

Trading with TMGM: The Ideal Platform for Scalpers, Day Traders, and Swing Traders

Whether you’ prefer the rapid pace of scalping, the dynamic swings of swing trading, or the strategic flow of day trading, TMGM offers a powerful trading environment for all styles. With access to advanced tools on MetaTrader 4 and MetaTrader 5, TMGM provides competitive spreads, high leverage options, and fast order execution to facilitate efficient entries and exits.

Start Trading with TMGM Today! Maximize your trading potential with TMGM’’s state-of-the-art platform, tight spreads, and advanced risk management features. Whether scalping, day trading, or swing trading, TMGM equips you with the tools and support necessary for success in global markets. Register now and elevate your trading to the next level!

Trade Smarter Today

Account

Account

Instantly