What is Bitcoin Halving & When is the Next Halving

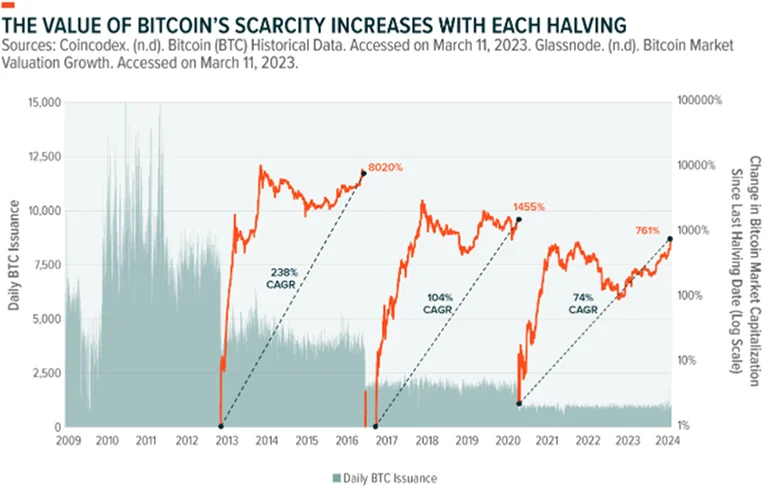

Bitcoin halving is a pre-programmed event within Bitcoin’s protocol that reduces the issuance rate of new bitcoins entering the market. This halving mechanism was designed by Bitcoin’s pseudonymous creator, Satoshi Nakamoto, to manage inflation, increase scarcity, and ensure the phased distribution of Bitcoin over time. Unlike fiat currencies, which central banks can print without limit, Bitcoin operates under a deflationary issuance model. Consequently, each halving represents a pivotal event affecting miners, traders, and the broader cryptocurrency ecosystem. Bitcoin halving takes place approximately every four years, or after every 210,000 blocks are mined, reducing the block reward for miners by 50%. This process will continue until Bitcoin reaches its capped supply of 21 million coins, projected around the year 2140. During this event, miners’ compensation for validating new blocks on the blockchain is halved. This mechanism fulfills several key functions, including inflation control, scarcity simulation, and the controlled release of Bitcoin’s finite supply.

Purpose and Mechanism

Purpose and Mechanism

Controlling Inflation

Unlike traditional fiat currencies, which central banks can print without limit, Bitcoin' operates on a deflationary model. Halving events systematically reduce the rate at which new bitcoins enter circulation, aiming to mitigate inflationary pressures. This controlled supply growth ensures that over time, new bitcoin issuance slows, contrasting sharply with the often unpredictable expansion of fiat money supplies.

Simulating Scarcity

Bitcoin'’s total supply is capped at 21 million coins. The halving mechanism reinforces this scarcity by reducing the influx of new bitcoins, thereby increasing the value of existing coins as demand grows. This scarcity is comparable to precious metals like gold, where limited availability underpins value.

Gradual Supply Distribution

In Bitcoin'’s early phase, miners received substantial block rewards, incentivizing network participation and security. As halvings occur, these rewards decrease, extending the timeline over which the total supply is distributed.

This gradual reduction ensures that most bitcoins are mined over a prolonged period, with the final bitcoin expected to be mined around 2140.

Enhancing Value Proposition

The interaction of reduced supply growth and sustained or increasing demand theoretically supports Bitcoin'’s value appreciation over time. As new issuance declines, if demand remains steady or rises, economic principles suggest upward price pressure, enhancing Bitcoin'’s appeal as a store of value.

Historical Context of Previous Halvings

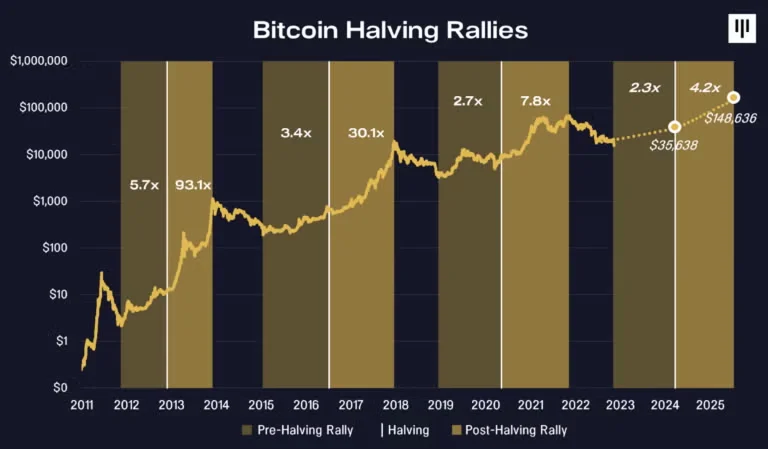

Since its launch, Bitcoin has undergone four halving events, each significantly impacting its market dynamics and valuation.

The 2024 Halving: Key Details

Key Bitcoin Halving Events

First Bitcoin Halving (November 28, 2012)

Block Reward Reduction: From 50 BTC to 25 BTC

Pre-Halving Price: Approximately $12

Price One Year Later: Around $1,000

Percentage Increase: Approximately 8,000%

The inaugural halving marked Bitcoin'’s transition from a niche digital asset to broader market recognition. The substantial price surge following the halving highlighted the impact of supply reduction on valuation.

Second Bitcoin Halving (July 9, 2016)

Block Reward Reduction: From 25 BTC to 12.5 BTC

Pre-Halving Price: Approximately $650

Price One Year Later: Around $2,500

Percentage Increase: Approximately 280%

The second halving occurred as Bitcoin gained mainstream traction. While the percentage increase was less dramatic than the first, it reinforced the pattern of post-halving appreciation, albeit with diminishing returns as the market matured.

Third Bitcoin Halving (May 11, 2020)

Block Reward Reduction: From 12.5 BTC to 6.25 BTC

Pre-Halving Price: Approximately $8,800

Price One Year Later: Around $49,500

Percentage Increase: Approximately 460%

The third halving occurred amid growing institutional interest and global economic uncertainty. The significant price increase post-halving underscored Bitcoin'’s emerging role as a hedge against traditional market volatility.

Fourth Bitcoin Halving (April 20, 2024)

The fourth Bitcoin halving occurred on April 20, 2024, at block height 840,000, reducing the block reward from 6.25 BTC to 3.125 BTC. This event has several significant implications for the Bitcoin ecosystem.

Technical Specifications

Current Block Reward: 6.25 BTC

Post-Halving Block Reward: 3.125 BTC

New Bitcoins Created Between Third and Fourth Halvings: 1,312,500 BTC

New Bitcoins to Be Created Between Fourth and Fifth Halvings: 656,250 BTC

This reduction signifies a continued slowdown in new Bitcoin issuance, reinforcing its deflationary characteristic.

Market Implications

Increased Market Maturity

Since the 2020 halving, Bitcoin'’s market has matured considerably. Institutional adoption has surged, with major financial institutions incorporating Bitcoin into their portfolios. Additionally, the emergence of regulated futures markets and exchange-traded funds (ETFs) provides investors with more avenues for exposure, potentially reducing volatility compared to earlier cycles.

Miner Economics

The halving directly impacts miners by halving their block rewards. This necessitates reassessing operational costs, especially for miners with high electricity expenses or less efficient hardware. Potential outcomes include:

Consolidation Among Mining Entities: Smaller or less efficient miners may merge or exit the market.

Increased Reliance on Transaction Fees: As block rewards decline, miners may depend more on transaction fees for revenue.

Geographical Shifts in Mining Operations: Miners might relocate to regions with lower energy costs to maintain profitability.

Supply Shock

Daily new bitcoin issuance will drop from approximately 900 BTC to 450 BTC. Assuming steady or growing demand, this supply reduction could exert upward pressure on Bitcoin'’s price as the market adjusts to reduced new coin availability.

Anticipatory Market Behavior

Historically, Bitcoin'’s price often begins rising months before a halving as market participants anticipate reduced supply. This pre-halving speculation can increase volatility and trading volumes as investors position themselves ahead of the event.

Market Predictions and Analysis

The Bitcoin halving presents a complex scenario for analysts and investors, with multiple factors influencing potential outcomes.

Supply-Demand Dynamics

Fundamentally, the halving reduces the rate at which new bitcoins enter circulation. If demand remains steady or rises, this supply contraction could drive price appreciation. However, market dynamics are influenced by numerous factors, including macroeconomic conditions, regulatory changes, and technological developments.

Stock-to-Flow Model Implications

The Stock-to-Flow (S2F) model, which measures an asset'’s scarcity by comparing existing supply to new production, has been applied to Bitcoin to forecast price trends. Bitcoin'’s S2F ratio will increase post-halving, indicating potential price appreciation. However, critics argue the model oversimplifies complex market dynamics and may not account for external influences on price.

Market Efficiency Considerations

Proponents of the Efficient Market Hypothesis (EMH) argue that since halvings are predictable, their effects should already be priced in. However, the tangible supply reduction and investor psychology often lead to market reactions deviating from purely efficient models.

Maturity and Adoption Factors

Bitcoin market maturation introduces new variables:

Institutional Adoption: Increased institutional participation can enhance liquidity and potentially reduce volatility.

Regulatory Developments: Evolving regulations can either boost confidence and adoption or introduce uncertainty affecting market sentiment.

Technological Innovations: Advances in scalability, security, and usability can strengthen Bitcoin'’s value proposition and attract broader adoption.

Trading Strategies for the Halving Period

Long-Term Accumulation

A common strategy around Bitcoin halvings is long-term accumulation. Historical data suggests buying Bitcoin several months before a halving and holding through the subsequent cycle has yielded substantial returns. This strategy relies on the expectation that reduced supply issuance will drive prices higher over time.

Volatility Trading

Bitcoin halvings typically increase volatility, creating opportunities for short-term traders. Strategies include:

Swing Trading: Buying Bitcoin at perceived lows and selling during price spikes.

Leverage Trading: Using margin or derivatives such as futures and options to amplify gains (with higher risk).

Scalping: Exploiting small price movements throughout the trading day.

Mining Company Investments

Investors seeking indirect Bitcoin exposure may consider publicly traded Bitcoin mining companies. Mining stocks often correlate with Bitcoin price movements, offering alternative risk-reward profiles. Post-halving, profitable miners may consolidate market share, potentially boosting stock prices.

Risk Management Considerations

Regardless of strategy, risk management is essential. Best practices include:

Using Stop-Loss Orders: Protecting capital with predefined exit points.

Diversification: Avoiding overexposure by allocating capital across multiple assets.

Portfolio Sizing: Aligning Bitcoin exposure with individual risk tolerance.

Hedging with Options: Using put options to mitigate downside risk.

Bitcoin Mining Industry Impact

Profitability Challenges

The halving reduces block rewards from 6.25 BTC to 3.125 BTC, significantly impacting miners'’ revenue streams. Profitability depends on:

Electricity Costs: Lower energy costs provide competitive advantages.

Mining Equipment Efficiency: Operators with advanced ASIC miners are more likely to remain profitable.

Bitcoin Price Movements: A rising Bitcoin price post-halving can offset revenue declines.

Network Difficulty Adjustments: If miners exit, the network may lower mining difficulty, reducing competition for remaining miners.

Industry Consolidation

Profitability pressures may cause smaller mining operations to close or merge with larger firms. This consolidation could shift mining dominance to well-capitalized entities with access to cheap energy and efficient hardware.

Technological Innovations

Profitability challenges may drive miners to adopt innovations such as:

More Energy-Efficient Mining Hardware: Lowering power consumption while maintaining high hash rates.

Renewable Energy Mining: Expanding operations in regions with abundant hydro, solar, or wind energy.

Strategic Relocations: Moving to jurisdictions with favorable electricity costs.

Increased Dependence on Transaction Fees

As block rewards decline, transaction fees will become a larger portion of miner revenue. This shift raises concerns about long-term network security and miner incentives, especially as Bitcoin approaches its maximum supply.

Long-Term Implications of the 2024 Halving

Decreasing the Bitcoin Inflation Rate

Bitcoin’’s annual inflation rate will fall to approximately 0.8% post-halving, making it one of the lowest inflationary assets globally. This reinforces Bitcoin’’s potential role as "digital gold," providing a hedge against inflationary fiat currencies.

Security and Network Incentives

Bitcoin’’s security depends on mining incentives. As block rewards decline, network security must increasingly rely on transaction fees. Factors that may sustain security include:

Higher BTC Prices: Higher valuations compensate for reduced block rewards.

Increased Transaction Volumes: More transactions generate higher total fees.

Efficiency Improvements in Mining Technology: Enhancing mining cost-effectiveness.

Bitcoin’’s Path to Monetary Hardness

With each halving, Bitcoin moves closer to its final state as a capped digital asset. By 2024, approximately 94% of all bitcoins have been mined. The remaining supply will be issued at an increasingly slower rate over the next 115+ years. This characteristic enhances Bitcoin’’s appeal as a scarce asset with predictable issuance.

Bitcoin halvings occur approximately every four years, or after 210,000 blocks are mined. This programmed reduction in mining rewards is embedded in Bitcoin’’s protocol to regulate supply issuance and maintain scarcity.

When is the Next Bitcoin Halving?

How is the Next Bitcoin Halving Date Calculated?

The exact date of the next Bitcoin halving depends on the block time, the average time to mine a new block. Bitcoin’’s block time averages around 10 minutes, but mining difficulty adjustments can cause slight variations in the estimated halving date.

Impact of the Next Bitcoin Halving on the Market

The next Bitcoin halving could significantly affect:

Bitcoin’’s Price: Historical data shows Bitcoin prices tend to rise following halvings due to reduced supply issuance.

Mining Profitability: Lower block rewards will challenge mining operations, especially those with high costs.

Investor Sentiment: Increased media attention and speculation may drive heightened interest and volatility before and after the halving.

When is the Bitcoin Halving After 2024?

Based on current block production rates, the next halving is expected in 2028 at block 950,000, reducing block rewards to 1.5625 BTC. This cycle will continue approximately every four years until around 2140 when the final bitcoin is mined.

The Bitcoin halving is a pivotal event in Bitcoin’’s monetary policy, affecting supply dynamics, miner economics, and market behavior. While historical trends show post-halving price increases, Bitcoin’’s maturing market introduces complexities including institutional involvement, regulatory changes, and evolving miner incentives.

Understanding Bitcoin halving nuances is essential for investors and traders. Whether employing long-term accumulation, trading volatility, or investing in mining-related assets, a well-informed approach is crucial for navigating the 2024 halving cycle. As Bitcoin evolves, halvings remain central to its economic framework and broader financial narrative.

Free Crypto Trading Courses and Resources

Success in crypto trading requires knowledge, strategy, and practice. TMGM offers comprehensive free trading courses and webinars tailored for crypto traders.

Gain practical experience with a free demo account funded with US$100,000 in virtual capital. This enables building confidence in a risk-free environment before trading with real funds.

Trade Smarter Today

Account

Account

Instantly