Key Takeaways

Cryptocurrency is a decentralized digital asset based on blockchain technology, enabling secure peer-to-peer transactions.

Crypto trading can be conducted via CFDs, also known as Crypto CFD Trading or through centralized exchanges, each offering distinct benefits.

Key concepts include leverage, margin, lot sizes, pips, and spreads.

Effective risk management is essential in crypto trading due to high market volatility.

The Birth of Cryptocurrency

Cryptocurrency originated with the launch of Bitcoin in 2009, following the global financial crisis. In October 2008, an anonymous individual or group under the pseudonym Satoshi Nakamoto published a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System," which introduced the concept of a decentralized digital currency operating without intermediaries like banks.

The first Bitcoin block, known as the "genesis block," was mined on January 3, 2009, marking the official launch of the world'’s first cryptocurrency. Initially, Bitcoin was primarily used by technology enthusiasts and privacy advocates. A notable transaction in 2010 involved purchasing two pizzas for 10,000 Bitcoin (worth billions at today'’s prices).

Following Bitcoin'’s creation, other cryptocurrencies began to emerge:

Figure 1: Illustrates other cryptocurrencies

Litecoin (2011) – Created as a "lighter" alternative to Bitcoin with faster transaction processing times

Ripple (2012) – Developed for institutional payment systems

Ethereum (2015)– Introduced smart contracts and decentralized applications (dApps)

Thousands more have since followed, each with unique features and use cases

Key Characteristics of Cryptocurrencies

Cryptocurrencies are digital assets designed to serve as a medium of exchange without reliance on central authorities such as governments or banks. They operate on decentralized networks and are secured through advanced cryptographic techniques, ensuring security and resistance to counterfeiting. Unlike traditional fiat currencies, cryptocurrencies exist solely in digital form without physical counterparts.

Many cryptocurrencies, including Bitcoin, have a capped supply with a predefined maximum issuance (e.g., Bitcoin’’s limit of 21 million coins), which contributes to scarcity and value appreciation over time.

What is Cryptocurrency Trading?

Cryptocurrency trading involves speculating on price movements of cryptocurrencies via a CFD trading account or buying and selling the underlying tokens through an exchange. This enables traders to capitalize on the inherent volatility of crypto markets and seek potential profits.

Traders employ various strategies based on their objectives and risk tolerance. Day trading targets short-term price fluctuations, with positions opened and closed within the same trading day. Swing trading involves holding positions for several days or weeks to capture larger price movements. Meanwhile, spot trading refers to buying and selling cryptocurrencies at current market prices for direct ownership without leverage. Each method carries distinct risks and benefits, and choosing the appropriate strategy depends on the trader’’s style and market outlook.

Two Main Ways to Trade Crypto

#1 Trade Crypto CFDs with TMGM

Crypto CFDs (Contracts for Difference) are cryptocurrency derivatives that allow you to speculate on price movements without owning the underlying tokens. With TMGM'’s cryptocurrency CFDs:

You can go long ('buy') if you anticipate the cryptocurrency’s value will increase

You can go short ('sell') if you expect the cryptocurrency’s value to decline

Both options utilize leverage, meaning you only need to deposit a fraction—known as margin—to gain full market exposure.

Your profit or loss is calculated based on the total size of your position.

Leverage amplifies both potential gains and losses.

#2 Buying and Selling Cryptocurrencies via Centralized Exchanges

When purchasing cryptocurrencies through an exchange:

You acquire the actual coins

You must create an account on the exchange

You need to provide the full asset value upfront to open a position

You are responsible for securely storing the cryptocurrency tokens in your wallet until you' decide to sell

Trading on exchanges involves challenges:

A steep learning curve to understand the underlying technology

Complexity in interpreting market data

Deposit limits on many platforms

Potentially high account maintenance fees

Security risks related to wallet management

How Do Cryptocurrency Markets Work?

Cryptocurrency markets operate fundamentally differently from traditional financial markets:

Decentralized Network Structure

Cryptocurrency markets are decentralized, meaning they are neither issued nor backed by a central authority such as a government. Instead, they operate across a distributed network of computers. Despite decentralization, cryptocurrencies can be traded on exchanges and stored in 'digital wallets.'

Digital Asset Ownership Records

Unlike fiat currencies, cryptocurrencies exist solely as shared digital ownership records maintained on a blockchain. When a user transfers cryptocurrency units to another user, the transfer is made to that user'’s digital wallet. The transaction is not finalized until it is verified and appended to the blockchain through mining. This process also typically generates new cryptocurrency tokens.

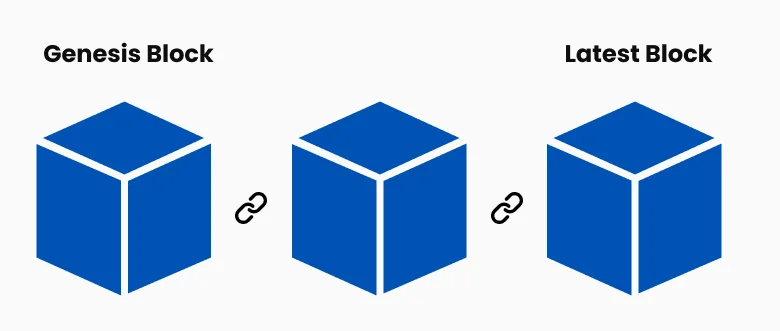

What is Blockchain Technology?

A blockchain is a shared digital ledger of recorded data. For cryptocurrencies, it records the transaction history of every unit, showing changes in ownership over time. Blockchain operates by recording transactions in 'blocks' and appending new blocks sequentially to the chain.

Figure 2: Illustrates Blockchain

Advanced Security Features of Crypto and BlockchainUnique Security Features

Blockchain technology incorporates security features absent in standard computer files:

Consensus Mechanisms in Crypto Networks

A blockchain ledger is stored across multiple computers in a network – rather than centralized in a single location – and is generally accessible to all network participants. This decentralization ensures transparency and makes unauthorized alterations extremely difficult, eliminating single points of failure susceptible to hacks or errors.

Cryptographic Foundations of Crypto

Blocks are cryptographically linked –using complex mathematical algorithms and computer science principles. Any attempt to tamper with data breaks these cryptographic links and is quickly detected as fraudulent by network nodes.

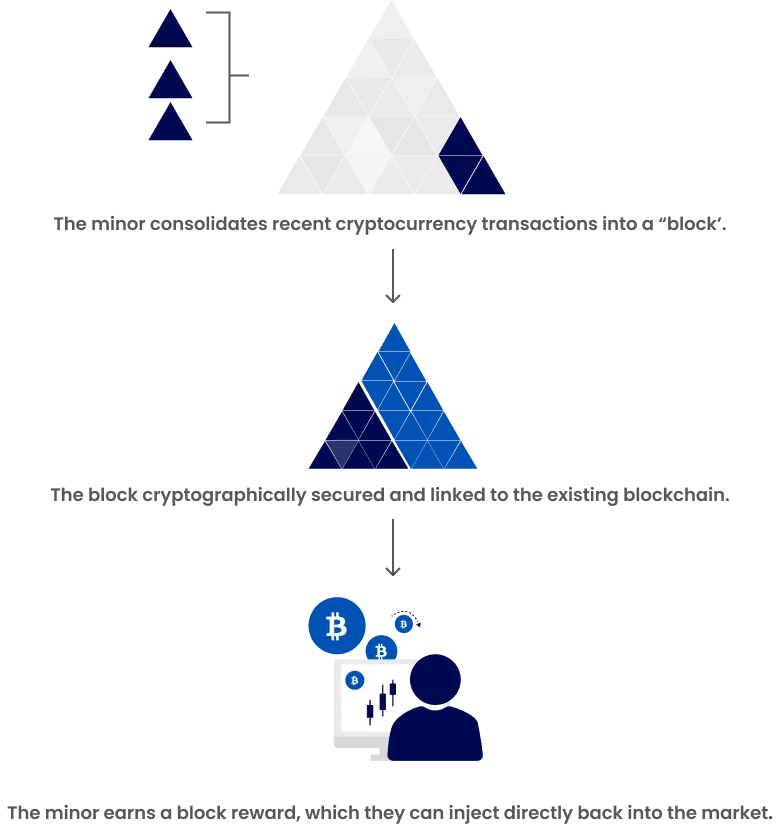

What is Cryptocurrency Mining?

Cryptocurrency mining involves validating recent transactions and adding new blocks to the blockchain.

How Transactions are Verified on the Blockchain

Transaction Verification: Mining nodes select pending transactions from a pool and verify that the sender has sufficient balance to complete the transaction by cross-referencing the blockchain’s transaction history. A secondary verification confirms the sender’s authorization via their private key.

Block Creation: Mining nodes aggregate validated transactions into a new block and attempt to solve a complex cryptographic puzzle to link it to the previous block. Upon success, the block is added to their local copy of the blockchain and the update is broadcast across the network.

Figure 3: Illustrates Cryptocurrency Mining

What Drives Cryptocurrency Markets?

Cryptocurrency markets are driven by supply and demand dynamics. However, their decentralized nature means they are less influenced by many economic and political factors affecting traditional fiat currencies.

Key Factors Influencing Crypto Prices

Despite ongoing uncertainty, the following factors significantly impact cryptocurrency valuations:

Supply: Total coin supply and the rate of issuance, destruction, or loss

Market Capitalization: Aggregate value of all coins in circulation and market sentiment regarding future growth

Media Coverage: Media portrayal and the extent of coverage a cryptocurrency receives

Integration: Degree to which the cryptocurrency integrates with existing infrastructure, such as e-commerce payment systems

Key Events: Significant occurrences including regulatory changes, security incidents, and economic disruptions

How Crypto Trading Works with TMGM

With TMGM, you can trade cryptocurrencies through a CFD account – derivative instruments that allow speculation on whether a cryptocurrency’s price will rise or fall. Prices are quoted in fiat currencies like the US dollar, and you do not take ownership of the underlying cryptocurrency.

CFDs are leveraged products, meaning you can open a position by depositing only a fraction of the trade'’s full value. While leverage can amplify profits, it also increases potential losses if the market moves against your position.

Key Terms in Crypto Trading

Understanding Crypto CFD Spreads

The spread represents the difference between the bid and ask prices quoted for a cryptocurrency. As with many financial instruments, when opening a position on a cryptocurrency market, you'’ll see two prices:

To open a long position, you transact at the ask price, which is slightly above the market price

To open a short position, you transact at the bid price, which is slightly below the market price

What are Lots in Crypto Trading?

Cryptocurrencies are typically traded in lots – standardized batches of tokens used to define trade sizes. Due to high volatility, lots are generally small, often consisting of a single unit of the base cryptocurrency. However, some cryptocurrencies are traded in larger lot sizes.

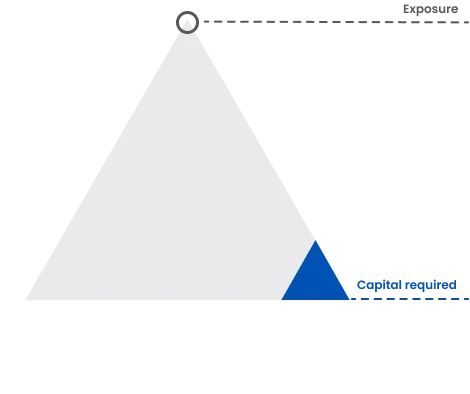

How Leverage Works in Crypto Trading

Leverage allows traders to gain exposure to large cryptocurrency positions without paying the full trade value upfront. Instead, a margin deposit is required. Upon closing a leveraged position, profit or loss is calculated on the full trade size.

While leverage can enhance profits, it also increases the risk of amplified losses—, potentially exceeding your margin on a single trade. Therefore, mastering risk management in leveraged trading is critical.

Figure 3: Illustrates Leverage

Crypto Margin Explained

Margin is the initial deposit required to open and maintain a leveraged position. Margin requirements vary by broker and trade size when trading cryptocurrencies on margin.

Margin is typically expressed as a percentage of the total position size. For example, a Bitcoin (BTC) trade might require a 10% margin, meaning instead of depositing $5,000, you' would only need to deposit $500.

Measuring Crypto Price Movement with Pips

Pips quantify price changes in cryptocurrencies and represent a one-digit movement at a specific price level. Generally, major cryptocurrencies trade at the 'dollar' level, so a price move from $190.00 to $191.00 equals one pip. Some lower-value cryptocurrencies trade on different scales, where a pip may correspond to a cent or smaller fraction.

Before trading, it'’s important to review TMGM'’s platform details to understand the pip measurement for each cryptocurrency.

Getting Started with TMGM'’s Crypto CFD Trading

Open an Account: Register with TMGM and complete account verification

Deposit Funds: Fund your account using secure payment options

Choose a Cryptocurrency: Select from available crypto CFDs

Analyze the Market: Utilize TMGM'’s analytical tools to identify trading opportunities

Set Your Position Size: Determine leverage and margin requirements

Implement Risk Management: Set stop-loss and take-profit orders

Execute Your Trade: Go long or short based on your market analysis

Monitor and Close: Track your position and close it when appropriate

Risk Management for Crypto Trading

Due to the high volatility of cryptocurrency markets, risk management is critical:

Use stop-loss orders to limit potential losses

Consider guaranteed stop orders for added protection during major market events

Maintain reasonable leverage levels to avoid excessive exposure

Diversify across various cryptocurrencies and asset classes

Never risk more than you can afford to lose

Stay updated on market developments and news

Free Crypto Trading Courses and Learning Tools

Becoming a successful trader requires skill, knowledge, and experience. TMGM provides comprehensive free trading courses and webinars. It also offers a free demo account with US$100,000 in virtual funds to practice trading in a risk-free environment.

Additionally, TMGM delivers trading strategy insights, market analysis, and news articles suitable for all experience levels—, ensuring that whether you’ are a beginner or an experienced trader, TMGM offers valuable resources for your trading journey.