What is Leverage in Forex?

In forex trading, leverage is the use of borrowed money from a broker to control a larger position with a smaller amount of your own capital. For beginner traders in India, knowing the meaning of leverage is vital because it can quickly magnify both profits and losses when you trade currency pairs such as USD/NR or EUR/USD.

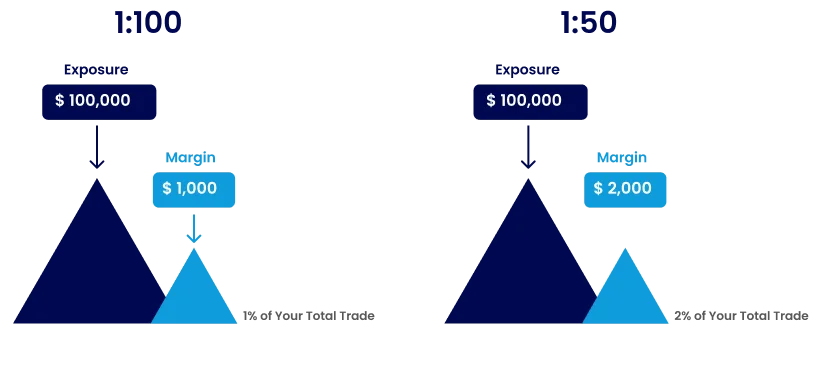

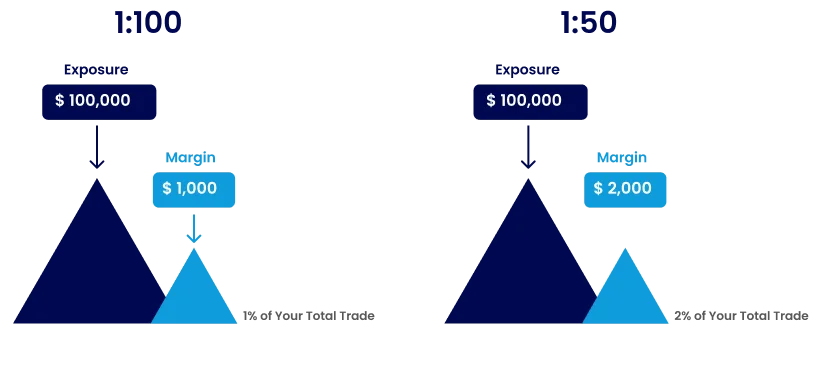

Leverage in forex is usually shown as a ratio that compares your market exposure with the margin you must deposit. For example, with 1:100 leverage a trader can control 100 dollars in the market for every 1 dollar of their own funds.

How Does Forex Leverage Work?

Forex leverage links your margin to a much larger position by combining your deposit with funds lent by the broker. When you open a leveraged trade, you deposit margin, the broker provides the rest, and the total becomes your position value. The leverage ratio, such as 1:10, 1:30, or 1:100, tells you how many times larger the position is than your margin. Because the position is many times bigger than your own money, a small change in the exchange rate creates a much larger percentage gain or loss on your account than it would without leverage in forex.

How to Calculate Forex Leverage?

To calculate leverage in forex, divide the total value of your position by the margin used for the trade. The result shows how many times larger your exposure is than your own capital.

For instance, if you open a 50,000 dollar position and your broker requires 1,000 dollars of margin, your leverage is 50,000 divided by 1,000, which equals 50, so the leverage is 1:50.

You can also reverse the calculation to find the margin requirement by dividing the planned position value by your desired leverage ratio. Knowing how to calculate leverage helps you check whether a planned forex trade fits your risk tolerance before you place the order.

Example of Leverage in Forex Trading

Imagine you have 2,000 dollars in your trading account and choose 100 to 1 leverage. With this leverage, your 2,000 dollar margin controls a 200,000 dollar position in a major currency pair.

If the pair rises by 1 percent, your profit is around 2,000 dollars, which is a 100 percent return on your margin. If the pair falls by 1 percent, your loss is also around 2,000 dollars, which can wipe out your deposit.

This simple scenario shows why forex leverage is powerful and why strict risk control is essential.

What is Leverage in Trading?

Leverage in trading more broadly uses the same idea for other markets such as stocks, indices and commodities. Instead of paying the full value of a position, you deposit an initial margin and borrow the rest from your broker.

For example, with 1:5 leverage a trader who puts down 10,000 dollars can control 50,000 dollars of a stock index. Leverage trading makes it possible to access larger positions and potentially higher returns across many assets, but the same amplified risk that appears in forex leverage also applies here.

What are the Risk of Using Leverage in Forex?

The main risk of leverage in forex is that it increases losses as well as profits. A small adverse move in the exchange rate can cause a large percentage loss on your margin, especially when the leverage ratio is high.

If your account equity falls below the required margin level, your broker may issue a margin call and ask you to deposit more funds or close positions. Larger position sizes and fast swings in profit and loss can also create emotional pressure, which may lead traders to abandon their plan.

On top of that, holding a leveraged position overnight may involve daily interest charges, often called rollover fees or overnight financing costs.

What are the Risk of Using Leverage in Forex?

Before you decide how much leverage to use, think carefully about your risk management, trading style and broker conditions. Set a clear maximum loss per trade and use stop loss orders so that a single position cannot damage your account.

Conservative traders often choose lower leverage and focus on protecting capital, while more aggressive traders sometimes use higher ratios but combine them with tight risk control.

In India and globally, available leverage levels differ between brokers and are shaped by regulatory requirements, so always check the rules that apply to your account. It is also wise to practise on a demo platform first so you can see how leveraged trades behave before risking real money.

Is Leverage Suitable for Beginner Forex Traders in India?

Leverage can be suitable for new traders only when it is applied carefully and at modest levels. Beginners in India may want to start with small position sizes, low forex leverage and a simple trading plan that focuses on discipline rather than fast profits.

As you build experience and understand how leverage affects your account, you can decide whether higher ratios still fit your goals and risk tolerance.

Conclusion

Leverage is a core concept in forex and in trading more generally because it links a small margin deposit to a much larger market position. Understanding how leverage in forex works, how to calculate leverage for each trade, and how leverage in trading affects your risk helps beginner traders in India make better decisions. Used with discipline and sound risk management, leverage can be a useful tool, but without control it can quickly lead to large and sometimes total losses of trading capital.