What is Spread in Forex and How to Calculate It

The difference between the ask (buy) price and the bid (sell) price of a currency pair is referred to as the spread. At any moment, every currency pair has two prices: the bid and the ask. The ask price represents the cost to buy the base currency, while the bid price is the amount you receive when selling it. If this seems confusing, don’t worry—you’re not alone. Many novice traders find this concept challenging, but mastering spreads is essential for effective forex trading. Let’s simplify it and explain why it plays a crucial role in your trading experience.

Key Takeaways

The spread is the difference between the ask price and the bid price of a currency pair. It is quoted in pips. Tight spreads indicate lower trading costs and typically occur during periods of high liquidity, whereas wide spreads often reflect low liquidity or increased volatility.

Calculation is straightforward. For example, if GBP/USD is quoted at 1.3089/1.3091, the spread is 0.0002, equivalent to two pips. Most currency pairs use the fourth decimal place to represent one pip, except for JPY pairs, which use the second decimal place.

Spreads can be either variable or fixed. Variable spreads fluctuate with market conditions, while fixed spreads remain constant regardless of short-term price movements.

Spreads tend to widen during periods of high volatility and low liquidity, and narrow during major trading sessions such as London and New York, especially during session overlaps. Major currency pairs usually have tighter spreads compared to exotic pairs.

Managing spread risk is essential. Wider spreads increase trading costs and can lead to margin calls or forced liquidation. It is important to control position size and leverage, utilize tools like spread indicators and economic calendars, and practice trading on a demo account with a regulated broker offering low spreads.

What Is Spread in Forex?

In forex trading, the spread is the difference between the bid price (the price buyers are willing to pay) and the ask price (the price sellers are asking) for a currency pair. It represents the cost of entering a trade and is measured in pips. A tighter spread means lower trading costs and usually occurs during periods of high liquidity, while a wider spread indicates higher costs and may signal low liquidity or increased market volatility. Understanding spreads is crucial for selecting a low-spread forex broker and managing overall trading expenses.

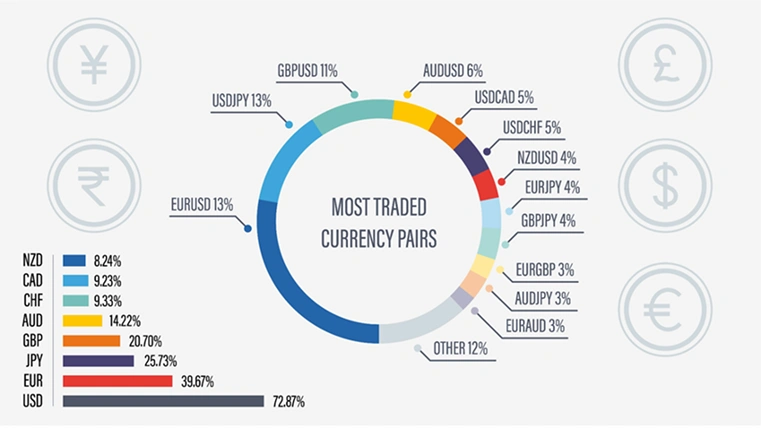

Here is a list of the more popular Forex pairs:

Here is a list of the more popular Forex pairs:

USD/JPY: US Dollar and Japanese Yen

EUR/USD: Euro and US Dollar

USD/CHF: US Dollar and Swiss Franc

GBP/USD: British Pound and US Dollar

Forex Trading Pip Spread

In forex trading, the spread is measured in pips, which represent a minimal price movement in a currency pair, typically the last decimal place in the price quote (0.0001). This applies to most currency pairs, except for Japanese yen pairs, where a pip is measured at the second decimal place (0.01).

A wider spread indicates a larger difference between bid and ask prices, often reflecting low liquidity and high volatility. Conversely, a narrower spread suggests low volatility and high liquidity. Trading currency pairs with tighter spreads results in lower transaction costs, making it more cost-effective for forex traders.

When trading forex, spreads can be variable or fixed. Variable spreads fluctuate with changes in bid and ask prices, while fixed spreads remain constant.

How to Calculate Spread in Forex?

To calculate the spread in forex, subtract the bid price from the ask price. For example, the spread for GBP/USD quoted at 1.3089/1.3091 is 1.3091 minus 1.3089, which equals 0.0002 (2 pips). Spreads can be tight (low) or wide (high); the larger the spread, the greater the pip difference calculated.

Within a price quote, the spread is derived from the most recent bid and ask prices. When trading forex or any other asset via spread betting or CFD trading accounts, you pay the full spread upfront.

In contrast, when trading share CFDs, commissions are charged on both trade entry and exit. As a trader, you benefit from tighter spreads, which reduce trading costs.

Before trading in the forex market, consider practicing with a risk-free demo account funded with virtual capital.

What Causes High Spread in Forex?

Market volatility is a key factor influencing forex spreads and causing fluctuations. Major economic events can strengthen or weaken currency pairs, impacting spreads. In volatile markets, currency pairs may gap or experience reduced liquidity, leading to wider spreads.

Monitoring our economic calendar can help you anticipate periods of wider spreads. Staying informed about events that may reduce liquidity allows you to forecast increased volatility and spread expansion. However, unexpected economic releases or breaking news can still pose challenges.

Lower spreads are typically observed during major forex market sessions, such as London, New York, and Sydney. Spreads tend to tighten further during session overlaps, for example, when the London session ends and the New York session begins. Currency supply and demand dynamics also influence spreads; for instance, strong demand for the euro will increase its value.

Using Spread in Forex Trading Strategies

Forex traders can adopt an event-driven strategy based on macroeconomic indicators to trade during periods of tight spreads and capitalize on favorable market conditions. By monitoring the latest entry and exit points, traders can optimize position timing by following up-to-date market news and economic releases. This approach is known as event-driven trading.

Interested in trading the best currency pairs in the forex market? Explore our recommended currency pairs list here.

Forex Spread Indicator

Using a trading indicator can enhance your forex spread strategy. A forex spread indicator typically displays the spread between bid and ask prices as a curve on a chart. This visualization shows how spreads vary over time, with the most liquid pairs exhibiting tighter spreads and exotic pairs showing wider spreads.

Additionally, currency pairs traded in high volumes, such as major pairs involving the USD, generally have narrower spreads. However, even these pairs can experience spread widening during periods of economic uncertainty.

Forex Spread Changes and Risk Mitigation

A significant widening of the forex spread may trigger a margin call or, in extreme cases, forced liquidation. A margin call occurs when your account equity falls below 100% of the required margin, warning that you may not meet margin requirements. If your equity drops 50% below the margin level, your positions risk being liquidated.

Properly managing your position' size and the leverage employed in forex trading is essential. Since shares are usually traded in smaller increments than forex pairs, monitoring your account balance closely is critical.

Low Spread Forex Broker

The forex spread is the difference between the ask and bid prices of a currency pair, typically expressed in pips. Understanding the factors that cause spreads to widen is important when trading forex.

Exotic currency pairs generally have wider spreads than major pairs due to lower trading volumes. Looking for the best forex broker? Consider registering for a TMGM account now and explore the trading markets.

The forex spread is the difference between the ask and bid prices of a currency pair, typically expressed in pips. Understanding what causes spreads to widen is crucial when trading forex. Exotic currency pairs tend to have wider spreads than major pairs because they are traded in lower volumes. Effective financial and risk management is essential when trading in the forex market.

Trade Smarter Today

Account

Account

Instantly