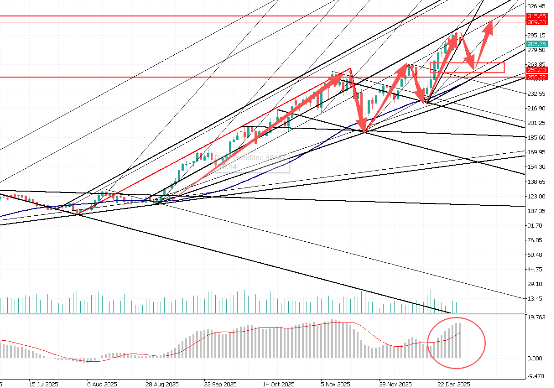

Since the beginning of this year, memory chip giant Micron Technology has taken advantage of the dividends from a multi-year cloud supercomputing cycle. Its HBM3E/HBM4 products have secured strong orders from hyperscale data-centre customers, refreshing its growth outlook and driving its share price to surge more than 250%.

Even so, taking into account the company’s improved pricing power, the currently tight supply–demand balance in the market, and its capacity-expansion plans that run through to 2030, Micron—although clearly facing the pressure that comes with AI-driven success—still trades in what can be seen as a value pocket from a valuation perspective.

By year-end, Micron’s rapid rally had yet to come to a halt, with the stock continuing to set fresh all-time highs this Monday. By contrast, some other semiconductor and memory peers fell into a correction in November after the AI theme cooled, dragged down by stretched valuations and rising debt risks.

A core driver behind Micron’s strong share-price performance lies in the fact that its valuation had previously been seriously depressed. As market style rotated, funds flowed aggressively into deeply undervalued names such as Micron.

More importantly, Micron has successfully seized the opportunity presented by the cloud supercomputing cycle. Its HBM3E/HBM4 products have won favour from hyperscale customers, not only putting a definitive end to the slump in memory demand and elevated inventories seen since 2022, but also opening up an entirely new growth runway.

The overall HBM market is expanding rapidly. It is expected to grow from 35 billion USD in 2025 to 100 billion USD by 2028, implying a three-year compound annual growth rate of 41.9%. This target is not considered aggressive. Against the backdrop of the cloud supercomputing cycle, Micron has built a close partnership with NVIDIA and is rapidly advancing product qualifications with multiple hyperscale data-centre customers. AI workloads require massive memory support; compared with consumer-grade devices, AI servers and enterprise-level application scenarios demand exponentially higher memory capacity per system.

The explosive growth in memory demand is already visible in several dimensions: inventory levels continue to decline, product prices have risen sharply, contract pricing has shifted from annual to monthly, and long-term order volumes have increased significantly. This all suggests that, until the tight supply situation is eased, Micron will retain very strong pricing power.

Market commentary:

Despite the sharp rally in its share price, Micron still looks highly attractive from a valuation perspective. In other words, even after the stock has more than tripled, supported by strong demand for its HBM3E/HBM4 products, a high-growth and high-profitability business outlook, and the prospect of maintaining robust free cash flow despite heavy capital expenditure through 2030, Micron’s valuation remains within a reasonable range.