Why Are Gold Pips Important?

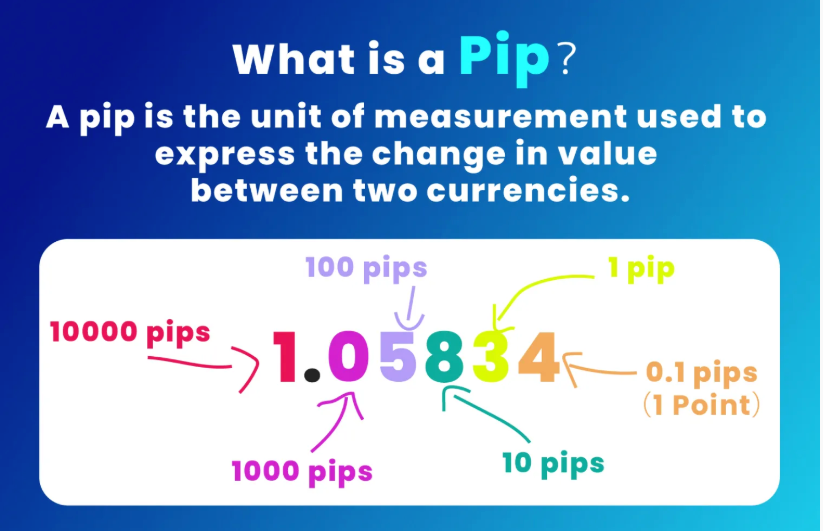

Understanding Gold Pips: In gold trading, a pip denotes the smallest incremental price change, typically at the fourth decimal place, though this can vary based on broker specifications.

Introduction to Calculating Gold Pips

Price Point Fundamentals: Gold is generally quoted in USD, with a standard contract size of 100 troy ounces.

Understanding Contract Sizes: Most forex brokers use standard lots for gold trading, where one lot equals 100 troy ounces.

Broker Platform Variations: The decimal precision for pip calculation differs among brokers, impacting the pip value accordingly.

Calculating the Pip Value for Gold

Pip Value Formula: The standard calculation is:

Pip Value = (One Pip / Current Price) × Lot Size × Contract Size

For example, if gold is priced at $1,800 per ounce, a 0.01 price movement on a 100-ounce lot corresponds to a pip value of $1.

Leverage Considerations: Many traders utilize leverage to increase their exposure, amplifying both potential profits and losses.

Effective Tips for Monitoring Gold Pips

Real-Time Monitoring: Gold prices are highly volatile throughout the trading session.

Set Alert Notifications: Many trading platforms offer pip alert features for timely responses.

Utilize Technical Analysis Tools: Gold traders often employ RSI and Fibonacci retracement tools to identify pip movements and trend signals.

Key Drivers of Gold Pip Fluctuations

Economic Indicators: Gold prices respond to inflation data, interest rate changes, and Federal Reserve policies.

Market Sentiment: As a safe-haven asset, demand for gold increases during periods of market uncertainty.

Currency Strength: Since gold is priced in USD, fluctuations in the US dollar impact pip values.

Gold Pip Trading Strategies

Scalping for Incremental Profits: Short-term traders, known as scalpers, capitalize on small pip movements. This approach involves executing numerous trades throughout the day to capture minor pip fluctuations.

Swing Trading for Market Trends: Swing traders focus on identifying and trading broader price trends.

Long-Term Investment: Some investors hold gold positions over extended periods, guided by pip analysis.

Common Pitfalls in Gold Pip Counting

Neglecting Broker-Specific Details: Pip definitions can vary between brokers.

Ignoring Contract Size: Always confirm the lot size involved in your trade.

Overlooking Risk Management: Disregarding risk-reward ratios may result in significant losses.

Final Thoughts on Mastering Gold Pips

Accurate pip counting is essential for successful gold trading. By applying precise calculations and continuous monitoring, traders can manage their positions effectively.

Ready to deepen your expertise? Visit TMGM’’s Trading Calculator to calculate gold pip values and better assess your trade impact.