Key Takeaways:

Trendlines are diagonal lines drawn through significant highs or lows that serve as dynamic support and resistance across various markets such as forex, cryptocurrencies, metals, equities, and indices. They assist traders of all styles—from day trading to swing trading—in quickly identifying whether price is trending upwards, downwards, or sideways, enabling alignment of CFD trading strategies with the prevailing market momentum.

Trendlines provide clear visualization of price direction in any market, highlight key support and resistance levels for more precise entries and exits, filter out market noise by focusing on critical highs and lows, and help assess volatility and momentum shifts through the formation of chart patterns like triangles, channels, and flags.

To draw effective trendlines, start with a clean chart, use the trendline tool to connect at least two swing highs in a downtrend or swing lows in an uptrend, extend the line forward, and adjust it until it touches three or more significant peaks or troughs, thereby establishing a robust reference for future support, resistance, and trade entries.

Trendlines that connect a minimum of three swing highs or lows are considered validated, and their reliability as support or resistance strengthens with each subsequent price retest.

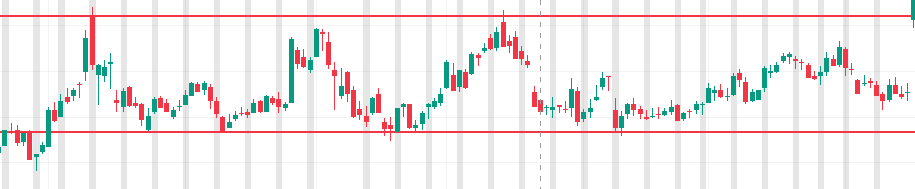

Markets exhibit three primary movements—uptrends (characterized by higher lows), downtrends (marked by lower highs), and sideways ranges—and traders utilize trendlines not only to identify these trends but also to implement strategies such as range trading and trendline breakout setups.

Range trading with parallel trendlines involves buying near the lower boundary and selling near the upper boundary, while breakout trading focuses on strong closes above or below trendlines—often accompanied by increased volume—that signal potent bullish or bearish momentum shifts.

Trendlines are valid only when they naturally connect at least two—ideally three—swing highs or lows, gain strength through repeated price tests, lose reliability if excessively steep, and should always be corroborated with other technical indicators and the broader market context rather than being forcibly applied to erratic price movements.

What is a Trendline in trading?

Trendlines are diagonal lines drawn on price charts by traders to illustrate the general direction of price movement—whether ascending, descending, or lateral. Bullish trendlines are constructed by connecting a series of lows, clearly delineating an upward price trajectory.

Conversely, bearish trendlines link a sequence of highs, indicating a downward price trend. In markets lacking a definitive direction, sideways trendlines connect various highs and lows, signaling a range-bound or consolidating market. A key feature of trendlines is their role as dynamic support and resistance levels, creating zones where prices frequently bounce or break through, making them essential tools for forecasting future price action.

Downward trendlines are drawn from highs sloping downward, indicating bearish sentiment in markets such as forex, energy commodities, or indices.

Upward trendlines connect lows and slope upward, reflecting bullish momentum in cryptocurrencies, equities, or metals.

Whether you trade forex, crypto, metals, indices, or whether you engage in day trading, swing trading or scalping, drawing a simple line through key highs or lows instantly reveals the market’’s true direction—, filtering out noise so you can identify when momentum is accelerating or decelerating.

By assessing whether price respects these trendlines, traders can align CFD strategies on cryptocurrencies, gold, or stock indices with the most likely price trajectory.

Benefits of Using Trendlines in Trading

Trendlines provide several practical advantages across all major asset classes:

Visualize the prevailing price trend: They offer clear visual confirmation of whether prices are generally trending upwards, downwards, or sideways, applicable across all market types.

Identify support and resistance levels: Prices often react around trendlines, providing well-defined zones for entry and exit points.

Reduce market noise: Trendlines filter out minor price fluctuations by focusing solely on significant highs and lows to anticipate future moves, which is especially beneficial for traders impacted by news or extraneous information.

Gauge volatility and momentum shifts: Drawing multiple trendlines (e.g., one above and one below price) can reveal momentum changes through chart patterns such as triangles, channels, and flags, collectively known as ‘Chart Patterns’.

Trading platforms like MetaTrader 4 and MT5 allow manual or automatic drawing of trendlines connecting highs and lows across markets including gold, forex, cryptocurrencies, or equities, facilitating step-by-step mastery of trendline analysis.

How do you draw Trendlines?

To draw trendlines, identify at least two "swing points" (highs for downtrends or lows for uptrends) on a price chart, then connect them with a straight line. A stronger trendline is established by connecting more points without price piercing the line, and the line should be extended forward to anticipate potential support or resistance zones.

Using trendlines in trading often improves outcomes across markets such as gold, forex, cryptocurrencies, commodities, and equities.

Follow these steps to draw accurate trendlines and enhance your trendline trading skills:

Open a clean chart without indicators on your trading platform.

Identify the highest or lowest price points on the chart. For example, if planning a long (buy) position, focus on the lowest points to draw a trendline that acts as a support level to guide your entry.

Locate the trendline tool in your charting software, typically represented by a diagonal line icon and labeled as ‘Trendline’.

Adjust the trendline until it touches at least two significant swing highs or lows—with a minimum of three points for stronger trendlines .

Important Note:

Trendlines drawn through multiple consecutive highs or lows are considered ‘tested multiple times’. Such trendlines gain ‘confirmation’ status, as price tends to revisit them, enhancing their reliability as support or resistance levels.

Therefore, a valid trendline on any price chart and market—be it gold, forex, crypto CFDs, or other asset classes—should ideally connect at least three swing points. The greater the number of touchpoints, the stronger the trendline signal.

How to Use/Trade with Trendlines

Types of Trends

There are three primary trend types:

Uptrend (characterized by higher lows)

Downtrend (characterized by lower highs)

Sideways trend (ranging)

Beyond identifying uptrends and downtrends, professional traders also employ trendline-based strategies such as Range Trading and Trendline Breakout setups.

Range Trading Using Trendlines

Range trading with trendlines involves creating parallel trendlines to form a channel, where you can:

Enter long positions near the lower trendline when bullish confirmations arise.

Enter short positions near the upper trendline when bearish signals occur.

This approach is effective across gold, silver, energy commodities, and cryptocurrencies when trading CFDs, illustrating the versatility of trendline strategies.

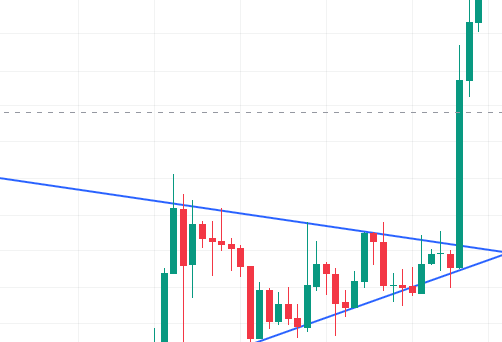

Trendline Breakout Strategies

Breakouts through trendlines can trigger significant price moves:

A close above the upper trendline—often accompanied by increased trading volume—signals a bullish breakout.

A close below the lower trendline typically indicates a bearish breakout.

Traders can open long or short CFD positions on energy commodities or cryptocurrencies accordingly, using trendlines to time entries effectively.

Important Considerations & Cautions for Trend Trading

Limitations

Markets move in irregular swings, so a trendline alone does not guarantee trend direction and may merely reflect counter-trend moves or consolidation phases.

Always confirm trendlines with supporting technical indicators and broader market context across indices, forex, or commodities before executing trades.

Considerations

A valid trendline requires at least two swing highs or lows to be drawn, but typically three touches are needed for confirmation.

The steeper the trendline, the less reliable it tends to be and the higher the probability of a breakout.

Similar to horizontal support and resistance levels, a trendline’s significance increases with the number of times price tests it.

Most importantly, never force a trendline to fit the market; if it does not naturally align with price action, it should not be considered valid.

Applying Trendlines Across Different Markets

Trendlines can be applied effectively in virtually any market:

Indices (e.g., S&P 500, NASDAQ)

Forex majors and minors

Energy commodities (e.g., crude oil, natural gas)

Equities (CFDs on global stocks)

Metals (gold, silver, platinum)

Cryptocurrencies (Bitcoin, Ethereum, altcoins)

Trendline techniques are universal: the same principles apply to trendlines on cryptocurrency, metal, or equity charts.