What is Forex Trading and How Does It Work

Key Takeaways

Forex (FX) is a 24-hour, five-day, over-the-counter market where currencies trade in pairs (e.g., EUR/USD), with daily turnover above $6.6 trillion.

Each quote prices one unit of the base currency in the quote currency, and two-sided prices (bid/ask) create the spread, which is a primary trading cost.

Price changes are measured in pips—0.0001 for most pairs and 0.01 for JPY pairs and lot size determines pip value (for 1 standard lot of EUR/USD, 1 pip ≈ $10).

Traders can go long or short, with profit or loss calculated as (exit − entry) × lot size × number of lots for buys, and the reverse for sells.

Leverage and margin enable larger positions (e.g., 30:1 implies ~3.33% initial margin) but also amplify losses, making position sizing and stop-losses essential.

What is Forex Trading?

Forex trading, also known as foreign exchange or FX trading, means buying one currency and selling another at the same time, hoping to profit from changes in their exchange rates. All forex trades happen in pairs, such as EUR/USD. The forex market is the world’s largest and most liquid, open 24 hours a day, five days a week, across major financial hubs such as London, New York, and Tokyo and with daily trading volume over $6.6 trillion. Unlike stocks, forex lets you trade on both rising and falling prices, making it possible to profit in any market direction.

In this guide, you’ll discover the fundamentals of forex trading, how the forex market operates, strategies, and the benefits of trading with TMGM, a globally recognized forex broker.

How Does Forex Trading Work

Forex trading operates similarly to any financial transaction where one asset is exchanged for another. In this case, forex traders buy one currency while simultaneously selling another. The market price of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

For example, if the GBP/USD pair is priced at 1.2500, it means 1 British pound is equivalent to 1.25 US dollars.

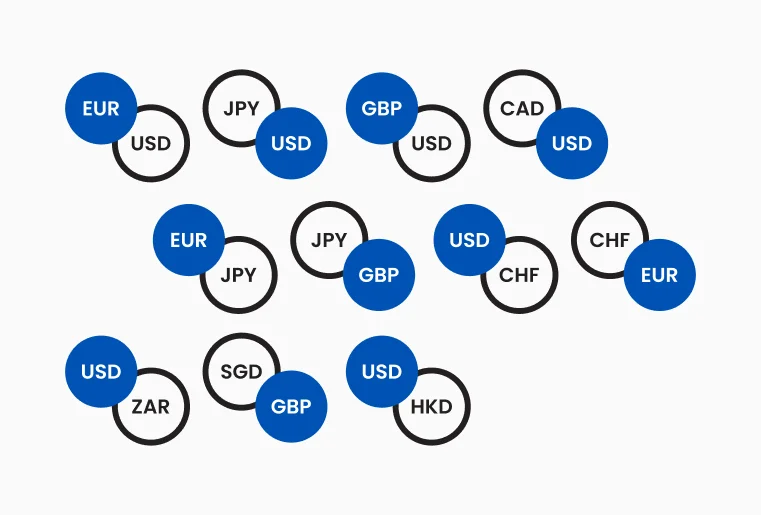

Each currency is identified by a three-letter code, simplifying trade execution. Below are some common currency codes:

- USD – US Dollar

- EUR – Euro

- GBP – British Pound

- JPY – Japanese Yen

- AUD – Australian Dollar

These codes help traders quickly recognize and trade currency pairs efficiently.

Figure 1 : Illustrates different unique currency codes

Forex Trading Fundamentals

Currency Pairs Explained

All forex trading involves buying one currency while selling another, so currencies are quoted in pairs. Each forex pair represents the exchange rate between two currencies.

Major Currency Pairs

Major pairs always include the US dollar (USD) paired with one of seven other major currencies:

Major pairs account for approximately 75% of all forex trading volume, with EUR/USD being the most actively traded pair globally.

Figure 2: Illustrates major currency pairs

Minor and Exotic Pairs

- Minor pairs: Combinations of major currencies that don't include USD (e.g., EUR/GBP, GBP/JPY)

- Exotic pairs: Combinations of a major currency with the currency of an emerging or smaller economy (e.g., USD/TRY, EUR/ZAR)

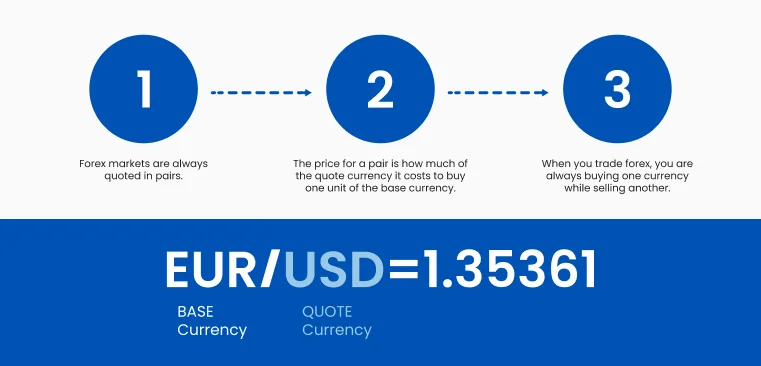

Understanding Currency Pair Quotes

Every currency pair quote includes two prices:

- Bid price: The price at which you can sell the base currency

- Ask price: The price at which you can buy the base currency

The difference between these prices is known as the spread, and it represents one of the primary transaction costs in forex trading.

Base and Quote Currencies

Figure 3: Illustrates Base and Quote Currencies

In the currency pair EUR/USD:

- EUR is the base currency

- USD is the quote currency

The exchange rate indicates how much-quoted currency (USD) is needed to purchase one unit of base currency (EUR). For example, if EUR/USD is quoted at 1.2000, 1 euro can be exchanged for 1.20 US dollars.

Understanding Pips and Lots in Forex Trading

Figure 4: Illustrates One Pip

What is a Pip in Forex?

A forex pip (percentage in point) is the smallest standardized price movement in forex trading:

- For most currency pairs: a 0.0001 change in price (fourth decimal place)

- For pairs involving Japanese yen: a 0.01 change in price (second decimal place)

For example, if EUR/USD moves from 1.2000 to 1.2001, it has moved one pip. Pipettes (or fractional pips) represent a 1/10 of a pip and are shown as the fifth decimal place in most currency pairs.

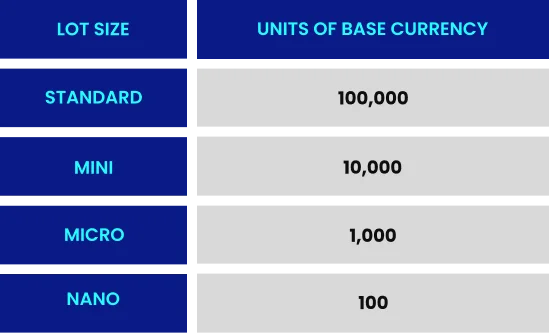

What is a Lot in Forex Trading?

Figure 5: Illustrates One Lot

In forex trading, a "lot" refers to the standardized unit of measurement for trade size, with one standard lot equal to 100,000 units of the base currency. The size of the lot directly impacts the value of a pip. For a standard lot of EUR/USD, each pip movement represents a $10 change in value.

Calculating Profit and Loss

To calculate potential profit or loss in forex trading:For a long position (buying): Profit/Loss = (Closing Price - Opening Price) × Lot Size × Number of Lots

For a short position (selling): Profit/Loss = (Opening Price - Closing Price) × Lot Size × Number of Lots

Example Calculation

Trading scenario:

Currency pair: EUR/USD

Opening position: Buy 1 standard lot (100,000 units) at 1.2000

Closing position: Sell at 1.2050

Calculation: (1.2050 - 1.2000) × 100,000 = $500 profit

What is Leverage and Margin in Forex Trading?

What is Leverage in Forex?

Leverage allows forex traders to control a large position with a relatively small capital. It is expressed as a ratio, such as 30:1, which means you can maintain a position 30 times larger than your invested capital.

Leverage is a double-edged sword:

- It magnifies potential profits from favorable market movements

- It equally magnifies potential losses from adverse market movements

What is Margin in Forex Trading?

Margin in forex is the deposit required to open and maintain a leveraged position. It acts as collateral for the leveraged portion of the trading exposure.

Types of Margin

- Initial Margin: The percentage of the full trade value required to open a position. For example, with 30:1 leverage, the initial margin requirement would be 3.33% of the total position value.

- Maintenance Margin: The minimum account balance required to keep a position open. If your account equity falls below this level due to losses, you may receive a margin call requiring additional funds, or your positions may be automatically closed (stopped out).

How to Calculate Margin in Forex Trading

For a EUR/USD trade with:

- Position size: 1 standard lot (100,000 EUR)

- Current exchange rate: 1.2000

- Position value in USD: 120,000

- Leverage: 30:1

- Initial margin requirement: 120,000 ÷ 30 = $4,000

You need at least $4,000 in your account to open this position.

Risk Management with Leverage

Leverage in trading can amplify potential gains and losses, making risk management a crucial component of a sustainable strategy.

- Position Sizing: To mitigate excessive exposure, limit each trade to a small percentage of your total capital. A commonly recommended approach is risking no more than 1-2% per trade.

- Stop-Loss Orders: Always use stop-loss orders to define the maximum acceptable loss for each trade, ensuring that sudden market movements do not lead to significant capital drawdowns.

- Risk-Reward Ratio: Prioritize trades with a favorable risk-reward ratio, typically aiming for at least 1:2. This ensures that successful trades can offset potential losses over time.

- Leverage Reduction: While brokers may offer high leverage, consider using less than the maximum available to reduce risk exposure and prevent unnecessary liquidation.

- Stress Testing: Assess how different market conditions, including high volatility, may impact leveraged positions. This helps forex traders prepare for unexpected price fluctuations and adjust strategies accordingly.

Effective leverage management ensures controlled risk exposure and long-term sustainability in trading.

What is a Forex Market

Forex trading is decentralized and operates over the counter (OTC). Instead of a central exchange, transactions occur electronically between banks, brokers, institutions, and retail traders.

Figure 6: Illustrates the forex transactions each day

The Evolution of Forex Trading

The modern forex market has undergone significant transformation since its origins:

Pre-1970s: Fixed exchange rates under the Bretton Woods Agreement

1971: Transition to floating exchange rates following the collapse of Bretton Woods

1980s-1990s: Introduction of electronic trading platforms and expanded institutional access

Early 2000s: Proliferation of online retail forex brokers, democratizing access for individual traders

Present day: Advanced algorithmic trading, mobile platforms, and integration with other asset classes

Today's forex market represents a sophisticated ecosystem where central banks, commercial banks, investment firms, corporations, and retail traders interact continuously across global markets.

What Moves the Forex Market?

Economic Factors

Central Bank Policies

Central banks are crucial in shaping monetary policy, directly influencing currency values. Interest rates are a primary tool—higher rates generally strengthen a currency by attracting foreign investment seeking better returns. Quantitative easing (QE) expands the money supply, potentially weakening a currency, while quantitative tightening (QT) reduces liquidity, often leading to currency appreciation. Additionally, forward guidance, or central bank communication about future policy decisions, can significantly impact market expectations and exchange rate movements.

Major central banks that influence global currency markets include the Federal Reserve (Fed), European Central Bank (ECB), Bank of Japan (BOJ), Bank of England (BOE), and Swiss National Bank (SNB). Traders closely monitor their decisions and statements to anticipate shifts in market trends.

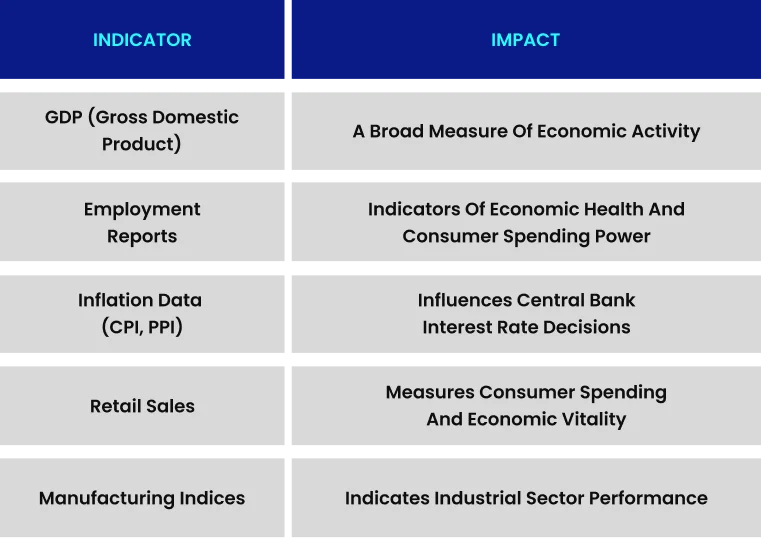

Economic Indicators

Key economic releases that influence forex markets:

Geopolitical Events

- Elections: Political transitions can signal policy changes affecting currencies

- Trade Agreements/Disputes: Impact economic relationships between countries

- Regional Conflicts: Create uncertainty and risk aversion in markets

- Regulatory Changes: New financial regulations can affect capital flows

Market Psychology

Market Sentiment

Market sentiment reflects traders' overall attitude, influencing price movements beyond fundamental data. It plays a crucial role in short-term trends and momentum-driven markets.

- Risk-On vs. Risk-Off: In a risk-on environment, traders favor higher-yielding or riskier assets, leading to stronger demand for currencies tied to growth, such as AUD and NZD. Investors seek safety in stable currencies like USD, JPY, and CHF in risk-off periods, often causing capital flows into these assets.

- Technical Levels: Key price levels, such as support and resistance, can become self-fulfilling prophecies as traders react to them similarly. When many market participants watch the same levels, breakouts or reversals often follow.

- Positioning Reports: Data such as the Commitment of Traders (COT) report can provide insights into extreme positioning. When traders are overwhelmingly positioned in one direction, it may indicate that a reversal is possible, as markets tend to correct from overextended moves.

Understanding market sentiment allows traders to align their strategies with prevailing biases and anticipate potential shifts in market direction.

Trade Forex with TMGM

TMGM is a leading forex broker offering exceptional trading conditions, advanced technology, and comprehensive support for traders of all levels.

Why Choose TMGM for Forex Trading

TMGM is a leading forex broker offering exceptional trading conditions, advanced technology, and comprehensive support for traders of all levels.

TMGM offers tight spreads starting from 0.0 pips on major currency pairs with competitive commission rates. Traders can access leverage up to 1:1000, benefiting from deep liquidity sourced from multiple tier-1 providers for efficient trade execution. The platform provides fast execution speeds, averaging under 30 milliseconds, minimizing slippage, and improving trading efficiency.

TMGM supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on pc, mac, tablet and mobile devices, catering to various trading preferences. The broker provides educational resources, including a Trading Academy, live webinars, daily market analysis, trading guides and a real-time economic calendar to keep traders informed. Clients also receive multilingual support, dedicated account managers, and efficient withdrawal processing, ensuring a seamless trading experience.

Free Forex Trading Courses and Resources

Becoming a successful Forex trader takes skill, knowledge, and practice. TMGM offers everything you need to get there, with a wealth of free forex trading courses and webinars. It also offers a free demo account with US$100,000 in virtual funds to help build your confidence in a risk-free environment.

We also provide trading strategy insights, market analysis, and news articles for all experience levels-so whether you're a complete newcomer or a seasoned trader, TMGM has something for you. Sign up for an account today!

Trade Smarter Today

Frequently Asked Questions

What Does Forex (FX) Trading mean?

Is there a difference between forex trading and currency trading?

How can I make money from forex trading?

How can I get started trading forex?

What costs and fees do you have to pay when trading forex?

Account

Account

Instantly